Litecoin Leads Crypto Rebound On News That LitePay Is Coming Feb 26

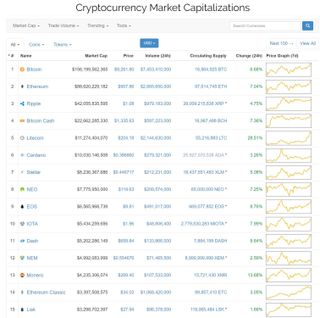

In sharp contrast to early February’s dramatic crash, the cryptocurrency markets are on the rise again. Nearly every top-100 cryptocurrency is in the green today, and Litecoin is soaring with 30% gains in the last day because LitePay is just around the corner.

Early this month, news broke that authorities in several countries were about to slam the hammer down on cryptocurrency trading, which triggered a panicked sell-off of digital assets. The price of every top-100 cryptocurrency dropped dramatically, including a more than 50% crash of Bitcoin’s value and market cap, and more than 40% from Ethereum’s all-time-high trading price.

Following the crash, the perceived tone from regulatory bodies has shifted from a heavy-handed stance to a hands-off approach. On February 7, the chairman of the Commodity Futures Trading Commission (CFTC) and the chairman of the SEC testified in front of Congress, and their view on cryptocurrencies was positive.

CFTC chairman Christopher Giancarlo said that “We owe it to this new generation to respect their enthusiasm for virtual currencies, with a thoughtful and balanced response, and not a dismissive one.”

Following the statements from Giancarlo, and SEC chairman Jay Clayton, the crypto-markets began to stabilize. However, the values remained relatively flat because there were fears that Europe’s central banks would crack down on cryptocurrency purchases.

On February 6, CNBC reported that Augustin Carstens, the general manager of the Bank of International Settlements, called Bitcoin a “ponzi scheme,” and called upon authorities to regulate cryptocurrencies to prevent tax evasion, money laundering, and other criminal activity.

Indeed, the world’s most prominent financial leaders are set to discuss the merits and concerns of the cryptocurrency market. Officials from the central banks of France and Germany recently revealed that they intend to introduce a bitcoin regulation proposal at the next G20 summit.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Despite the worries of a regulatory crackdown, cryptocurrency advocates in Europe have something to cheer about today, which no doubt contributed to the overall surge in the crypto-markets. Yesterday, Mario Draghi, the president of the European Central Bank, declared that “it’s not the ECB’s responsibility” to regulate the cryptocurrency market.

Litecoin Breaks Away From The Crowd

The overall health of the crypto-currency market appears to be on the rise again. But Litecoin is surging harder than the rest of the market, with a 30% jump from yesterday’s trading price.

Litecoin’s recent rise could be in anticipation of an upcoming service called LitePay, which will enable businesses to accept Litecoin for goods and services. LitePay is a Visa-compatible system that converts Litecoin to dollars, which would enable you to use Litecoin anywhere Visa is accepted.

On Monday, LitePay tweeted that the service would commence on February 26. In theory, a service like LitePay would make Litecoin much more useful, and therefore more valuable. Speculative investors are probably buying Litecoin now in hopes of a quick return at the end of the month.

Kevin Carbotte is a contributing writer for Tom's Hardware who primarily covers VR and AR hardware. He has been writing for us for more than four years.

-

berezini.2013 this was anticipated but this wont last long again, it will crash and again us gov will shell out to keep it going.. and again and again.. it has to succeed because it was fortold thousands of years ago. its in the bible if you read between the lines.Reply -

redgarl People that think this is a fad, need to think again. Yes, some currencies are going to crash, but others are going to take over. It is unfortunately just the beginning.Reply

The technology is promising, but the medium is temporary. -

Co BIY Although clearly electronic currency will continue into the future I am pretty sure that the pozi scheme design that requires continuous escalation of computing power to perform simple transactions will not last.Reply

A useful digital currency will maintain a steady value over time rather than continual increase or decrease (or both).

Most Popular