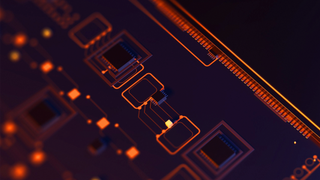

Samsung Significantly Reduces Memory Production Amid Low Market Demand

This could be the last hurrah for low DDR4 prices

According to DigiTimes, Samsung announced severe cuts to its memory chip production due to decreased market demand. As a result, DDR4 prices are expected to stay low temporarily as Samsung cuts NAND and memory output to reduce inventory overhead and match market demand. However, DDR4 prices are expected to rebound once the overloaded inventory is depleted.

Samsung did not confirm whether its memory production cuts are related to DDR4; however, according to DigiTimes, most market observers believe the cuts will focus on DDR4. Either way, it will affect Samsung's memory output significantly. For perspective, this is the first production reduction announcement Samsung has made in 27 years.

Sources with IC testing houses said Samsung saw a whopping 30% drop in orders in just the first quarter of this year. At the same time, DRAM inventory has exploded, exceeding demand by 21 weeks.

Market sources confirm that Samsung's memory shipment issues are primarily caused by its customers focusing on inventory depletion, combined with added price cuts from Samsung's competitors (increasing market sales from the competition). Other issues stem from significant DRAM contract and NAND flash price reductions by 25 to 30% and a fall of 24 and 16%, respectively.

Samsung is the final memory manufacturer to announce official production cuts amid the reduced worldwide demand for NAND flash and memory ICs. The demand reduction has been significant enough to impact every single manufacturer in the market today. This has favorably impacted consumers, leading to low DDR4 pricing and significantly reduced SSD prices.

This trend is not expected to last forever. With Samsung now on board, NAND flash and memory IC inventory is expected to equalize very soon, with some reports suspecting equalization could happen as soon as Q3 2023. Once the excess supply is sold off, memory and SSD prices are expected to rebound.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Aaron Klotz is a freelance writer for Tom’s Hardware US, covering news topics related to computer hardware such as CPUs, and graphics cards.

-

PlaneInTheSky Reuters reported today that PC sales took another massive hit.Reply

Memory sales are down too, so are GPU sales. This is quickly eroding Samsung's profits.

Nvidia and AMD are bluffing with GPU prices, no one is buying PC parts at these prices.

Hardware prices need radical cuts if they don't want PC sales to plummet futher.

South Korea reported the biggest trade deficit in history, US$24.13 billion.

South Korea is a banana republic, but instead of bananas, it is chips. Over half South Korea's exports are chips or tech related products.

20% of South Korea's GDP is Samsung.

https://i.postimg.cc/508xpx2b/dzsfsfsfsf.jpg -

InvalidError "This could be the last huzzah for cheap DDR4 prices."Reply

As has been the case with almost every DRAM generation before it: new generation comes in, production shifts to new stuff over the span of 2-3 years, economic slowdown causes DRAM prices tp crash from over-supply, at least one DRAM manufacturer goes bankrupt, DRAM prices go sky-high (~5X low or ~3X pre-crash pricing) for the better part of two years and the older stuff becomes just about unobtainable at least on the new market. -

JTWrenn Hoping this will finally start the push to larger drives and lower NAND prices. It's been promised forever but we just keep getting faster drives. Maybe we will finally see a push to get into the size space that HDDs have dominated for so long.Reply

Most Popular