1,000 Cryptocurrency Tokens Met Their Demise in 2022

De-bloating the blockchain from zombie coins.

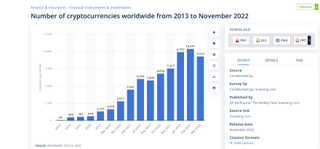

The world of cryptocurrencies has seemingly gone on a massive diet through this bear market, as the number of active tokens has decreased by almost 1,000 - the biggest-ever annual decline, according to Statista. The reduction brought the number of active cryptocurrencies from its 2021 high of 10,397 down to a (still) overwhelming 9,310. Of course, there's more to the cryptocurrency world than Ethereum and Bitcoin; but that doesn't mean all projects are worthy of attention.

2022 has been a challenging year for the cryptocurrency space. The entire market has been shaken to its core following the high-profile implosion of FTX (whose pieces are still being picked up) in a year of severe economic uncertainty. As a result, fear, uncertainty and doubt regarding the space are at an all-time high. This led the crypto market's capitalization to shrink by an astonishing 72% decline from its November 2021 high of $3 trillion to today's $850 billion.

It's interesting to note the explosion in the number of tradeable tokens from November 2021 through January 2022, which saw a jump of around 2,400 up to its 10,397 maximum. When the grass is green, everyone wants to set camp; the bull market exacerbated confidence and greed flourished. It's no coincidence that so many tokens, each with their own "project," launched while cryptocurrency prices were at their all-time highs. The decline in the number of tokens can mainly be attributed to one of two things: the token project failed to survive the crypto winter, following a marked reduction in investment volume from both users and entities; or it was merely a scam/rug pull coin that never meant to bridge any gaps between today and tomorrow.

Coingecko, which uses a different analysis method than Statista's source (CoinMarketCap), paints a much more explosive picture. It estimates 8,000 launched tokens throughout 2021, with only 59% of them carrying on to this day.

Advocates of crypto are quick to compare cryptocurrency's cycles to that of other high-impact technologies, such as the events surrounding the dot-com bubble. Unfortunately, the potential for profits also led to frauds, scams, and economic blowouts during that time. The argument is that this is what's happening in crypto, with bull markets attracting all kinds of bad actors whose only objective is profit. However, the reverse is also true: bear markets reduce people's willingness to part with their money, which means there are fewer chances of these "projects" actually taking off. The macroeconomic picture and rocketing cost of living only amplify this effect, and, likely, advances in law enforcement's actions against blockchain-yielding criminals and chain analysis should give bad actors some sleepless nights.

Whether the future of crypto will only leave space for a few high-impact cryptocurrencies or a veritable field remains to be seen. For now, it seems that a culling is in effect. Hopefully, the blockchain space is up for rehabilitation.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

Co BIY The boom and bust of "new coins" shows the real weakness of the crypto schemes. Because they are "nothing" they can be easily replaced by anyone else who wants to create money from "nothing" which is basically everybody. No barriers to entry in the market because there is no there there.Reply

Many of the greater fools are now at least somewhat wiser. -

trance77 ReplyCo BIY said:The boom and bust of "new coins" shows the real weakness of the crypto schemes. Because they are "nothing" they can be easily replaced by anyone else who wants to create money from "nothing" which is basically everybody. No barriers to entry in the market because there is no there there.

Many of the greater fools are now at least somewhat wiser.

Except the top coins have stayed the same and have not been replaced. Which is why I am only holding Bitcoin and Ethereum, could become worthless yes but then I always saw it as a gamble so that is ok. -

InvalidError I bet it is only a matter of time before Binance gets taken down by a scandal just like so many others before it and effectively ends crypto coins.Reply -

cyrusfox Reply

Before Binance was Mt Gox(Which handled 70% of transactions at the time), there will always be a new exchange, crypto was around before binance and will exist after.InvalidError said:I bet it is only a matter of time before Binance gets taken down by a scandal just like so many others before it and effectively ends crypto coins. -

InvalidError Reply

Crypto wants to be perceived with the same or greater legitimacy as banks. The countless crypto bankruptcies and scandals show that crypto is nowhere near as stable due to lack of regulations and consumer protections. If Binance goes under and takes most of its stakeholders' remaining money down with it, it would likely be the killing blow for any chance of crypto establishing itself as legitimate and likely prompt regulators worldwide to make sure there won't be another to take its place.cyrusfox said:Before Binance was Mt Gox(Which handled 70% of transactions at the time), there will always be a new exchange, crypto was around before binance and will exist after. -

Sleepy_Hollowed Cryptocurrency should just crash already, it's a worthless pump and dump, pyramid scheme that can't go away soon enough.Reply -

Co BIY Replytrance77 said:Except the top coins have stayed the same and have not been replaced. Which is why I am only holding Bitcoin and Ethereum, could become worthless yes but then I always saw it as a gamble so that is ok.

Bitcoin and Ethereum do at least have name recognition which gives them some "brand value". -

Arbie A great video for those not real familiar with crypto and NFTs is Dan Olson's doco "The Line Goes Up - The Problem With NFTs". In the first part he explains cryptocurrencies in a way that I found more understandable than elsewhere. Then he shows how NFTs use the same base blockchain tech. It was interesting from start to finish.Reply -

Kamen Rider Blade CryptoCurrency needs to be Outlawed on a Global scale via laws/regulation/legislation.Reply

It's hot garbage designed as a Ponzi Scheme.

Most Popular