Jabil to Acquire Intel's Silicon Photonics Business

Intel makes another strategic shift to focus on CPUs.

Jabil has announced that it would acquire the silicon photonics connector business from Intel for an undisclosed sum. Under the terms of the agreement, Jabil will obtain current silicon photonics-based pluggable optical transceiver product families and will continue to develop these product lines in the future.

The deal will strengthen Jabil's position in the lucrative data center connectivity market and enable it to compete for clients in different verticals, including AI cloud data centers and hyperscale cloud service providers. By contrast, Intel will focus on the development and manufacturing of its key products: processors and compute platforms. Meanwhile, Intel will not completely exit I/O solutions, the company said.

"In addition, in Q3, we decided to divest the pluggable module portion of our silicon photonics business, allowing us to focus on the higher-value component business and optical I/O solutions to enable AI infrastructure scaling," said Pat Gelsinger, chief executive officer, in prepared remarks for the company's earnings call. "This marks the 10th business we have exited in the last two-and-a-half years, generating $1.8 billion in annual savings and a testament to our efforts to optimize our portfolio and drive long-term value creation."

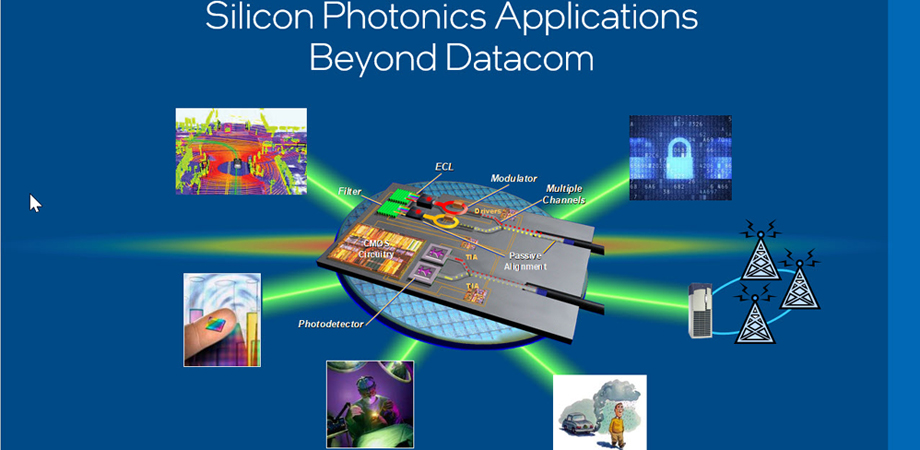

After absorbing Intel's silicon photonics business, Jabil promises to simplify the complexities typically associated with optical networking solutions by offering comprehensive photonics services such as component design, system assembly, and efficient supply chain management. Jabil expects that such an approach will help it expand the addressable market for its silicon photonics components.

"This deal better positions Jabil to cater to the needs of our valued customers in the data center industry, including hyperscale, next-wave clouds, and AI cloud data centers," said Matt Crowley, Senior Vice President of Cloud and Enterprise Infrastructure at Jabil. "These complex environments present unique challenges, and we are committed to tackling them head-on and delivering innovative solutions to support the evolving demands of the data center ecosystem. This deal enables Jabil to expand its presence in the data center value chain."

Intel has been getting rid of non-key businesses in the last couple of years under the leadership of Pat Gelsinger. The company opted to exit multiple ventures, including 3D NAND memory production and conventional SSD business, the Optane SSD business, notebook modem activities, the Barefoot switching, servers, and NUC desktops. These decisions are part of Intel's broader strategy to focus more on its primary businesses to boost profitability.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Albert.Thomas "These decisions are part of Intel's broader strategy to focus more on its primary businesses to boost profitability."Reply

I understand most of them, but the axing of the NUC division still boggles my mind if profitability is Intel's goal. -

cyrusfox Reply

NUC was a low margins/low volume business that required 3+ years of extended driver/system support(NUC was not an insanely profitable segment of their business).Albert.Thomas said:I understand most of them, but the axing of the NUC division still boggles my mind if profitability is Intel's goal.

Furthermore NUC was directly competing against their own internal customers, making the project open sourced(available to all) while Asus took over support makes a lot of business sense.

Intel held all of these forward thinking interfaces in house, One would think so they could accelerate integration (FPGA, Emerging memory, photonics, AI, etc...) and eke out a competitive advantage. Not sure that ever materialized, but they completely lost manufacturing advantage as well as largely floundered on these efforts, the business case to divest makes sense although may prove to be myopic.

Zen 5 is delayed (per MLID leak), and Intel is laser focused on its core business, next 18 months should be interesting. -

Albert.Thomas Reply

From what I've been told, the NUC division had good numbers and was one of the more profitable divisions.cyrusfox said:NUC was a low margins/low volume business that required 3+ years of extended driver/system support(NUC was not an insanely profitable segment of their business).

MLID can be right at times, but he's unreliable to the point that I can't take anything from him seriously.cyrusfox said:Zen 5 is delayed (per MLID leak), and Intel is laser focused on its core business, next 18 months should be interesting. -

scottslayer Reply

Unfortunately that is what happens when most of your "leaks" come from Twitter and cold calling staff at manufacturers or BestBuy/MicroCenterAlbert.Thomas said:MLID can be right at times, but he's unreliable to the point that I can't take anything from him seriously.