Sony Becomes AMD's Largest Customer on Booming PS5 Sales

Gaming was AMD's largest business in 2022.

Sony became AMD's largest customer last year, accounting for 16% of the company's revenue as its PlayStation 5 increased its lead over competitors. Sravan Kundojjala, a semiconductor industry analyst, noted that if Xilinx results are excluded, Sony accounts for 20% of AMD's revenue, probably making it the company's largest customer in recent history.

Indeed, the gaming business unit was AMD's largest revenue generator, which indicates that sales of system-on-chips for Microsoft's Xbox Series X|S consoles were also strong. AMD sold Sony some $3.776 billion worth of chips for PlayStation 5 game consoles in 2022, which accounted for 16% of the company's revenue for the year, according to the company's filing with the SEC.

Sony confirmed at CES that it had sold over 30 million PlayStation 5 game consoles. VGChartz estimates that by now, life-to-date sales of PS5 exceeded 31.77 million units. Microsoft’s Xbox Series X|S consoles are by far not as successful as Sony’s systems, with LTD shipments of around 20.68 million units, according to VGChartz.

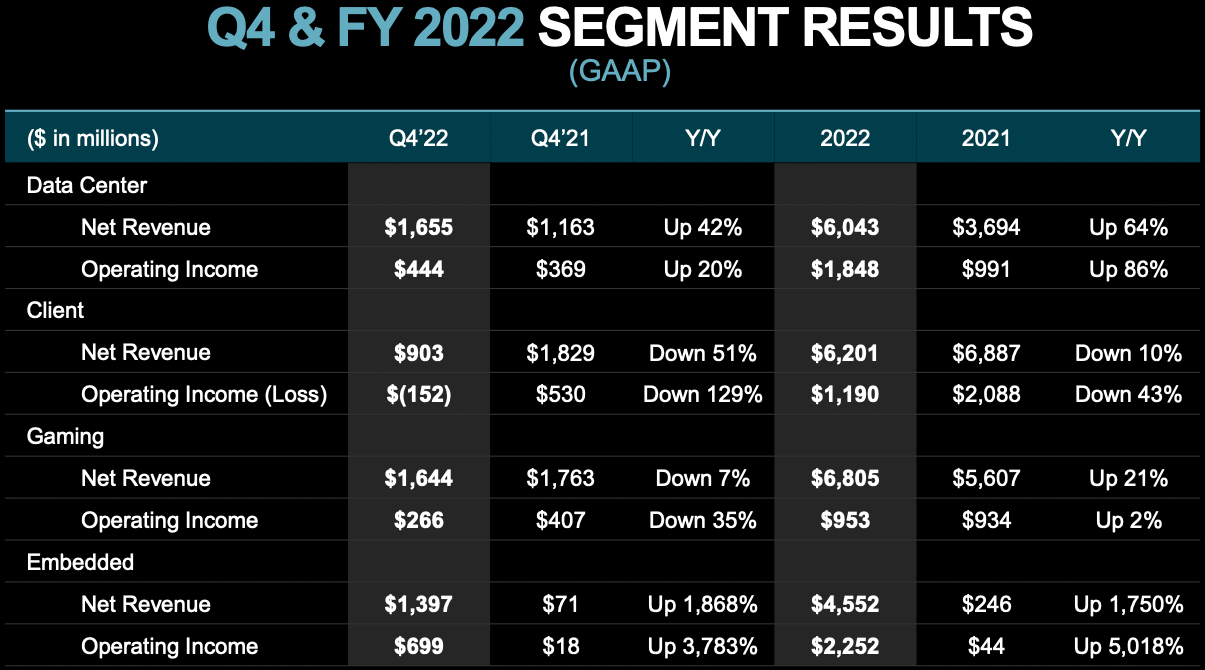

In fact, AMD's gaming business unit — which sells discrete graphics processors for desktop graphics cards and notebooks as well as SoCs for game consoles — earned $6.805 billion in earnings and $953 million in profits last year and was the company's main source of revenue. Keeping in mind that in recent quarters the unit sales of AMD's standalone GPUs have declined (based on data from Jon Peddie Research), consoles SoCs accounted for the lion's share of AMD's gaming business unit revenue.

"Gaming revenue declined 7% year-over-year to $1.6 billion [in Q4 2022] as lower gaming graphics sales more than offset higher semi-custom revenue," said Lisa Su, chief executive of AMD, at the company's most recent earnings call (via SeekingAlpha). "Semi-custom SoC revenue grew year-over-year as demand for game consoles remained strong during the holidays. Gaming graphics revenue declined year-over-year as we further reduced desktop GPU downstream channel inventory."

But AMD's earnings from PlayStation 5 and Xbox Series S|X SoCs will likely decline in 2023 and onwards since sales of consoles usually peak in their third year and platform holders tend to renegotiate components pricing after that. Therefore, AMD's gaming revenue is set to drop in 2023 compared to 2022.

"Given where we are in the cycle, we would expect gaming to be down on a year-over-year basis," said Su.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Analysts and investors tend to praise AMD's data center EPYC processors as they have been the company's key profit driver for about six years now. In 2022, AMD's data center unit earned $6.043 billion in revenue and was behind the company's gaming unit ($6.805 billion) as well as client computing group ($6.201 billion). Yet, based on softening demand for the PC and game console cycle, it looks like AMD's data center business will become the company's main source of revenue in 2023.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Elusive Ruse Been having a blast with my PSVR 2, Horizon is glorious and I was never interested in the previous Horizon entries. RE Village VR and Pavlov are as incredible! I just hope Sony brings 3D and 360 video play feature soon.Reply -

brandonjclark I wanted a PS5 for awhile, but it's been a long time since launch and since I'm not willing to pay scalper prices due to availability issues, I think that ship has sailed.Reply

I really just need games like Demons Souls and other exclusives to come to PC, eventually. I don't care if I have to wait two years, that's fine. -

drivinfast247 Reply

Not sure what country you live in but they've been available for some time now at MSRP. You could've done as I did and entered the queue at direct.playstation. Took about a month to receive mine.brandonjclark said:I wanted a PS5 for awhile, but it's been a long time since launch and since I'm not willing to pay scalper prices due to availability issues, I think that ship has sailed.

I really just need games like Demons Souls and other exclusives to come to PC, eventually. I don't care if I have to wait two years, that's fine. -

watzupken This boom is not going to last for long. The reason for the surge is mostly because the supply of PS5 is so limited over the 3 years, and thus, the pent up demand. I guess consoles may be the go to option for people tired of having to pay top dollars for PC gaming graphic solution.Reply -

Yep, that was me. I gave up PC gaming. Only console. The graphics are good enough now and they don’t even have to get any better than they are. Plenty good enough. They look and perform beautiful on OLED screens as well so you can have your giant TV with brilliant picture and colors and pure blackReply

-

bit_user Reply"Given where we are in the cycle, we would expect gaming to be down on a year-over-year basis," said Su.

I've seen bundle deals on Amazon and Newegg for a while, but Amazon still has a waiting list for the bare PS5 console.

...and, for the first time ever, I see it in-stock @ Newegg, for the $499 list price. So, maybe she's right and supply finally is catching up with demand. -

thestryker I'm not sure how good of a thing this is for AMD, because the margins on console chips are generally a lot lower than CPUs/GPUs. If you take the dollar figures here and Sony's target for fiscal 2022 sales figures as a rough estimate you're looking at about $210/chip. So while it may be making up a big chunk of revenue I'd be surprised if it even made up half as much percentage wise in profits.Reply -

TerryLaze Reply

Yeah, that's why AMD wouldn't supply them with enough CPUs the last three years, but now that the CPU market is down it's a good thing that they have a shackled customer that has to buy from them.thestryker said:I'm not sure how good of a thing this is for AMD, because the margins on console chips are generally a lot lower than CPUs/GPUs.