Surging AI demand sees Nvidia full-year revenue hit $60.9 billion in 2023

Quarterly revenue up 22% from Q3, full-year 126%

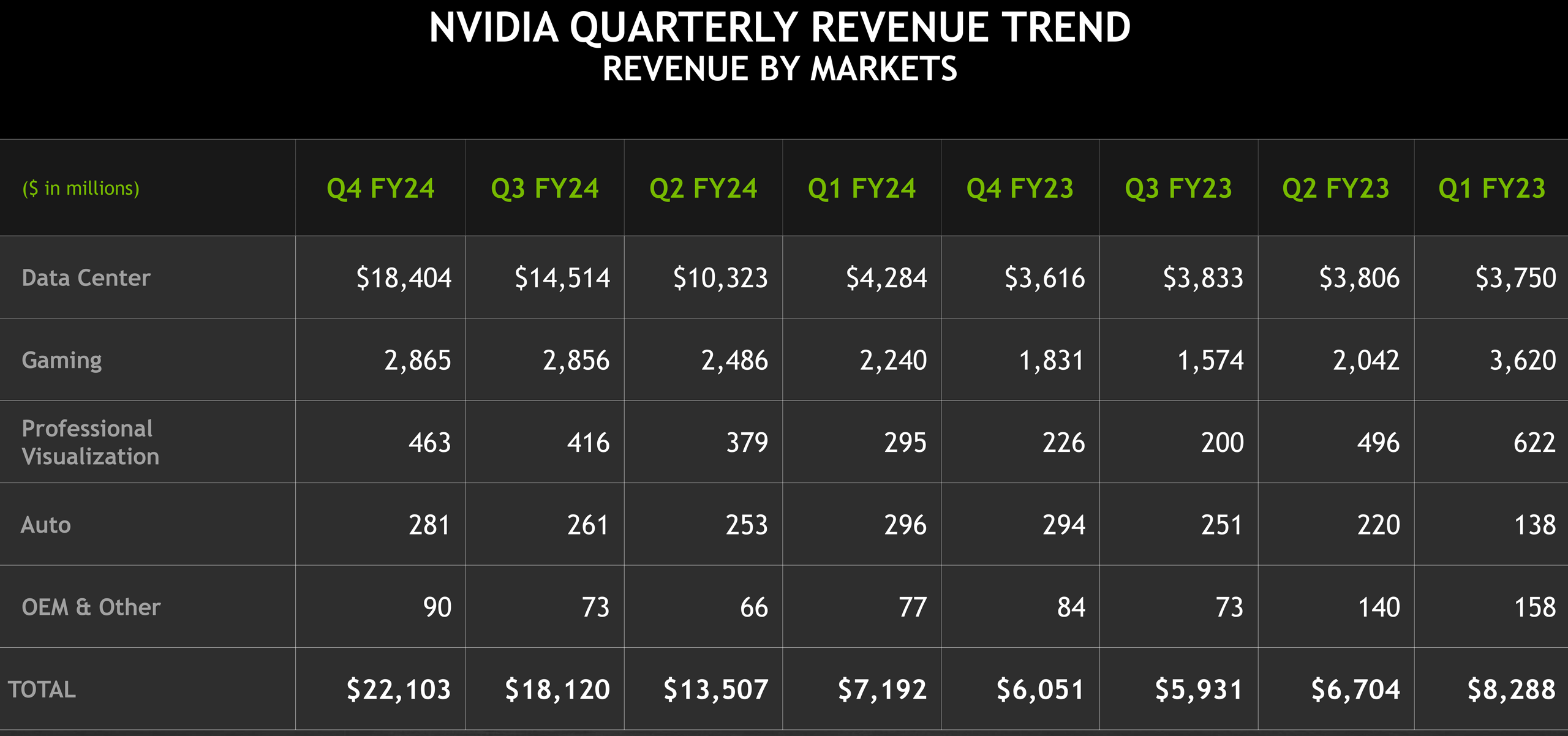

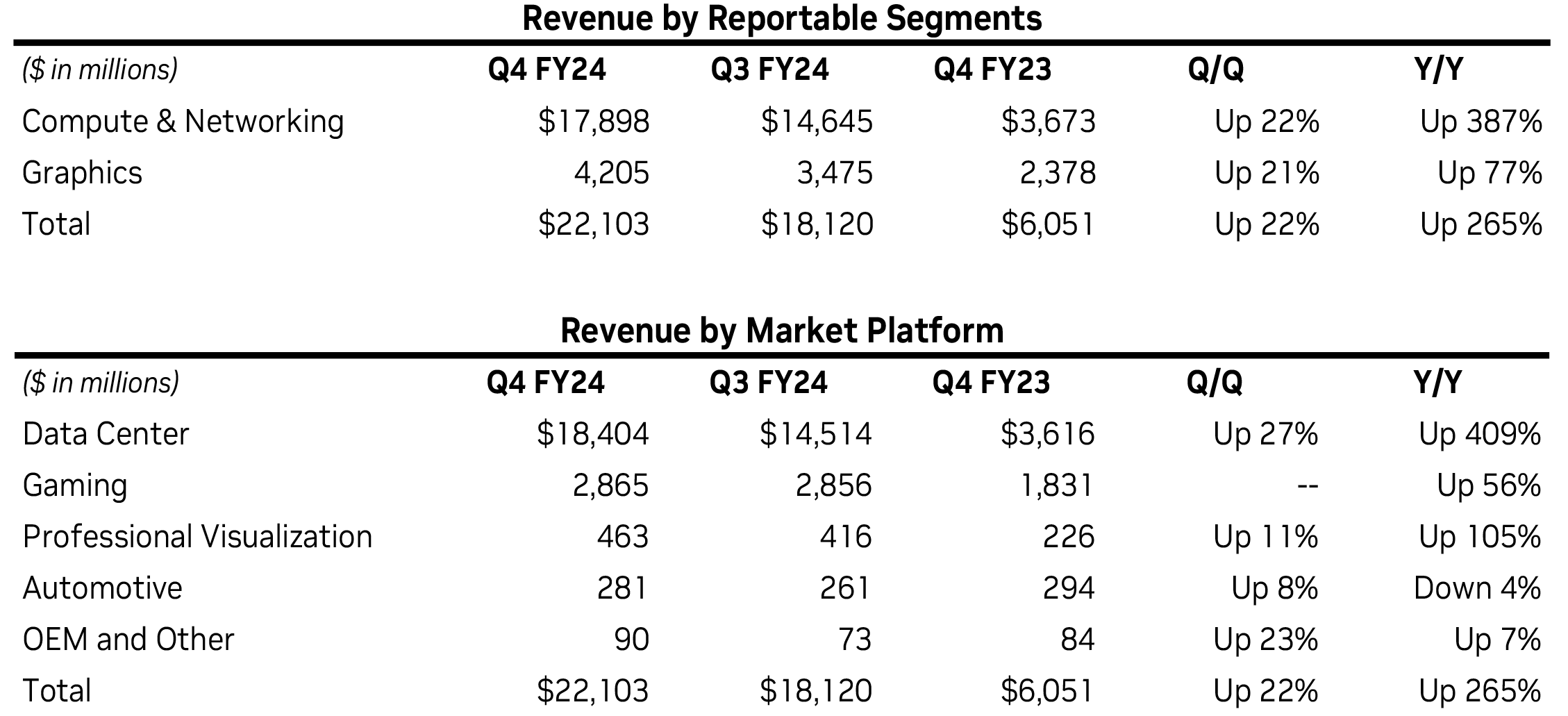

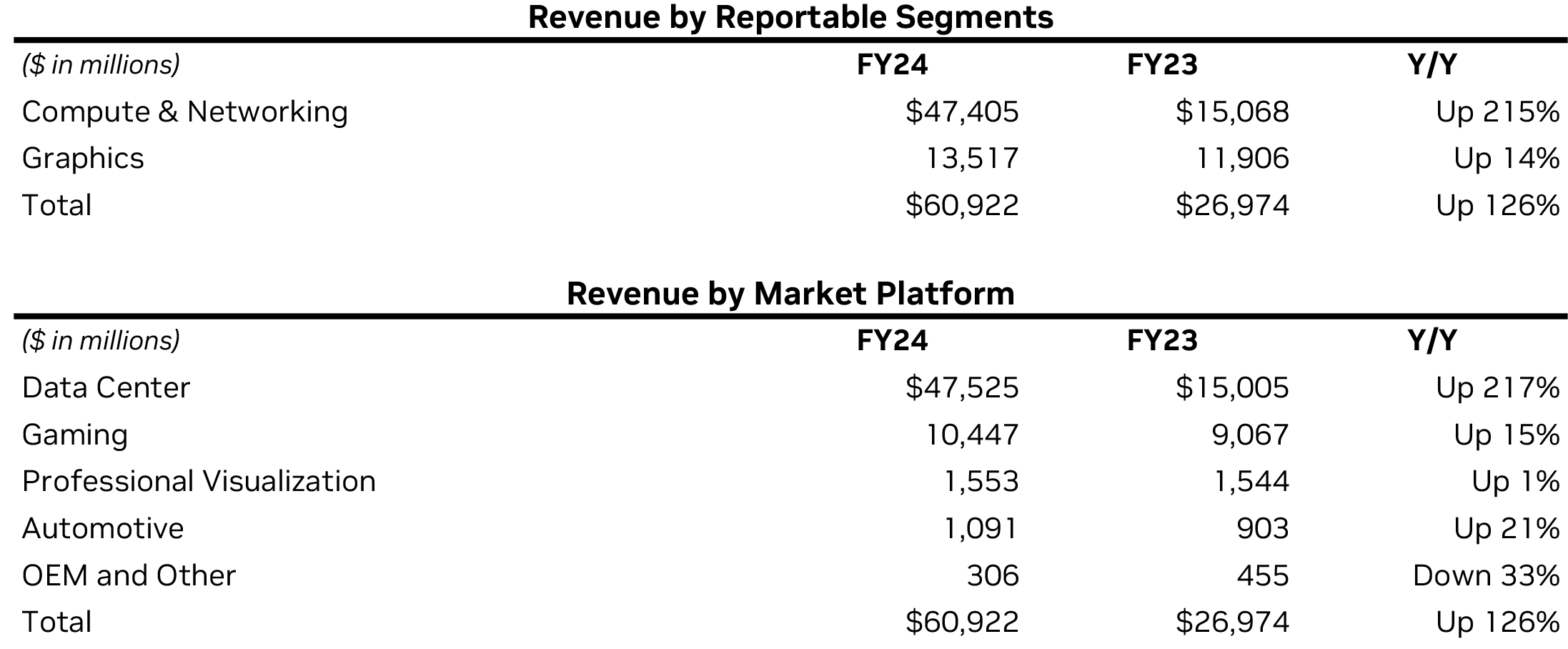

On Wednesday, Nvidia announced its financial results for the fourth quarter of fiscal 2024 and for the whole year, which concluded on January 28, 2024. The company reported quarterly earnings of $22.1 billion and per-annum sales of $60.9 billion, marking two new all-time records as demand for its products for artificial intelligence (AI), high-performance computing (HPC), and gaming was unprecedented.

"Accelerated computing and generative AI have hit the tipping point," said Jensen Huang, founder and chief executive of Nvidia. "Demand is surging worldwide across companies, industries and nations."

Record Results

Nvidia's revenue for the fourth quarter of fiscal year 2024 rose to $22.103 billion, marking a whopping 265% increase from the same quarter of the previous year. The company's net income reached $12.285 billion, and the gross margin also saw an improvement, rising to 76% from 63.3% in the fourth quarter of fiscal year 2022. As for the whole fiscal year 2024, Nvidia reported total revenue of $60.922 billion, a 126% inrease from $26.974 billion in FY 2024. The company's net income for the year saw a significant uptick to $29.760 billion, up from $10.02 billion in 2022.

"Our Data Center platform is powered by increasingly diverse drivers — demand for data processing, training and inference from large cloud-service providers and GPU-specialized ones, as well as from enterprise software and consumer internet companies," said Huang. "Vertical industries — led by auto, financial services and healthcare — are now at a multibillion-dollar level."

Datacenter

Nvidia has been selling large numbers of Datacenter hardware for years now, but in fiscal 2024 it essentially became a datacenter company a sales of its AI and HPC GPUs as well as networking gear overshadowed everything else.

The green company's datacenter revenue for the fourth quarter of fiscal 2024 totaled $18.404 billion, up from $14.514 billion sequentially and up from $3.616 billion in the same quarter a year before. For the whole FY2024, Nvidia earned $47.525 billion on datacenter hardware, up 217% year-over-year from $15 billion in FY2023.

"These increases reflect higher shipments of the Nvidia Hopper GPU computing platform used for the training and inference of large language models, recommendation engines, and generative AI applications, along with InfiniBand end-to-end solutions," said Colette Kress, chief financial officer of Nvidia.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

It is noteworthy that datacenter sales to China declined significantly in Q4 FY2024 due to U.S. government licensing requirements, which essentially banned sales of high-performance AI and HPC GPUs to China. If in FY2023 around 19% of Nvidia's datacenter revenue came from the People's Republic, in FY2024, the share of China in Nvidia's datacenter sales dropped to 14%, according to the company.

China continues to be a significant customer for Nvidia and sales to Chinese companies are expected to account 14% in Q1 FY2025, the company said.

Graphics

While not reaching historical peaks, Nvidia's Gaming Business unit reported revenue of $2.865 billion, which represents a slight increase quarter-over-quarter and a 56% rise year-over-year. For the whole year the company earned $10.447 billion on gaming hardware, up 15% year-over-year.

"The year-on-year increases for the quarter and fiscal year reflect higher sell-in to partners following the normalization of channel inventory levels and growing demand," said Kress. "The launch of our GeForce RTX 40 Super-series family of GPUs also contributed to revenue in the quarter."

As for Professional Visualization, Nvidia earned $463 million in Q4 FY2023 (up 105% YoY) and $1.553 billion for the whole year, which is flat compared to fiscal 2023.

"The sequential increase was primarily due to the ramp of desktop workstations based on the Ada Lovelace GPU architecture," explained the CFO.

It is noteworthy that sales of graphics products totaled $13.517 billion in the fiscal 2024, up 14% year-over-year.

Automotive, OEM, Other

While Nvidia's datacenter business is growing rapidly, whereas gaming and ProViz business are thriving, we cannot say the same about other businesses of the company. Nvidia's automotive business brought the company $281 million in Q4 FY2024, down from $294 million in the same quarter a year before, whereas revenue of OEM and other businesses reached $90 million. Automotive revenue for the whole year totaled $1.091 billion, up 21% from the year before, whereas sales to OEMs dropped 33% to $306 million year-over-year.

Q1 Guidance

Since demand for Nvidia's Hopper-based AI and HPC platforms continues to be strong and the company can barely meet demand, it expects revenue for the first quarter of its fiscal 2025 to reach $24 billion ± 2%. GAAP gross margin is forecasted to be 76.3%.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

gg83 Is there any other business that operates at a 76% profit margin? That can't be common at all.Reply -

domih In the NYTimes report on the subject (https://www.nytimes.com/2024/02/21/technology/nvidia-earnings.html) there is this notable excerpts:Reply

<<In an interview later Wednesday, Mr. Huang said much more growth for the company lay ahead. “We are one year into generative A.I.,” he said. “My guess is we are literally into the first year of a 10-year cycle of spreading this technology into every single industry.”>>

Indeed the rise of generative AI is based on real technological advances. It's an entirely different situation compared to the cryptocurrency minting fads from a few years ago. Generative AI is here to stay and grow.

After the keyboard + mouse interface, touch and gestures were added. The next wave is to have your computers and phones listening, seeing, doing and talking, with the appearance of understanding you and your surroundings (not really but very good enough). -

hannibal Nice to see that Nvidia is not suffering from bad gaming GPU demand...Reply

:ROFLMAO:

This will just get better next year! The AI demand i just starting to rice even higher! -

Giroro I thought I had invested a few thousand dollars into Nvidia a couple years ago.Reply

Turns out I had sold it and bought Intel instead. which has lost like 30% of it's value.

Bummer.