Nvidia posts record $44 billion revenue, H20 export ban bites as gaming rises

Raking in more cash.

Nvidia on Wednesday disclosed its financial results for the first quarter of its fiscal 2026, posting revenue of $44.062 billion — its best quarter ever.

The company's sales increased almost across the board both in terms of quarter-over-quarter and year-over-year comparisons. As the company ramped up its Blackwell GPUs, it also set revenue records both for gaming and datacenter revenues. But the recent shipments ban of H20 GPUs to China hurt Nvidia's margins quite significantly.

Record quarter

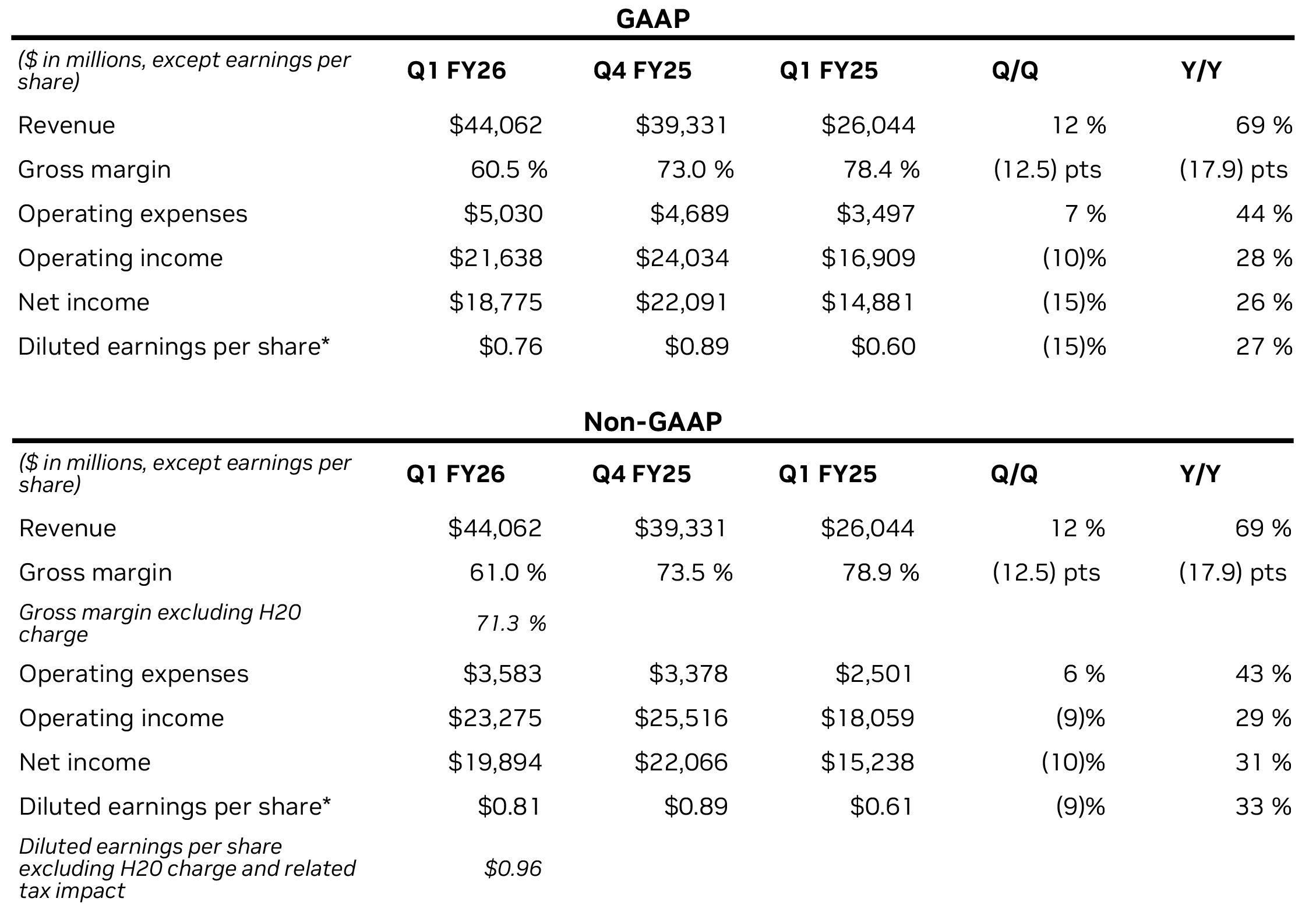

For the first quarter of fiscal 2026, Nvida reported GAAP revenue of $44.062 billion, marking a 12% rise quarter-over-quarter (QoQ) and a 69% increase year-over-year (YoY). The company's gross margin fell sharply to 60.5%, primarily due to a $4.5 billion charge related to writing down of H20 inventory due to the latest U.S. export restrictions imposed in early April.

Without the charge, Nvidia's non-GAAP margin would have been 71.3%, still considerably lower than 78.9% in Q1 FY2025 or 73.5% in Q4 FY2025. Nvidia's operating income was $21.6 billion, down 10% from the prior quarter but up 28% year-over-year, as for net income, it reached $18.8 billion, a 15% sequential decline but a 26% increase from the same period a year ago.

Driven by AI and gaming

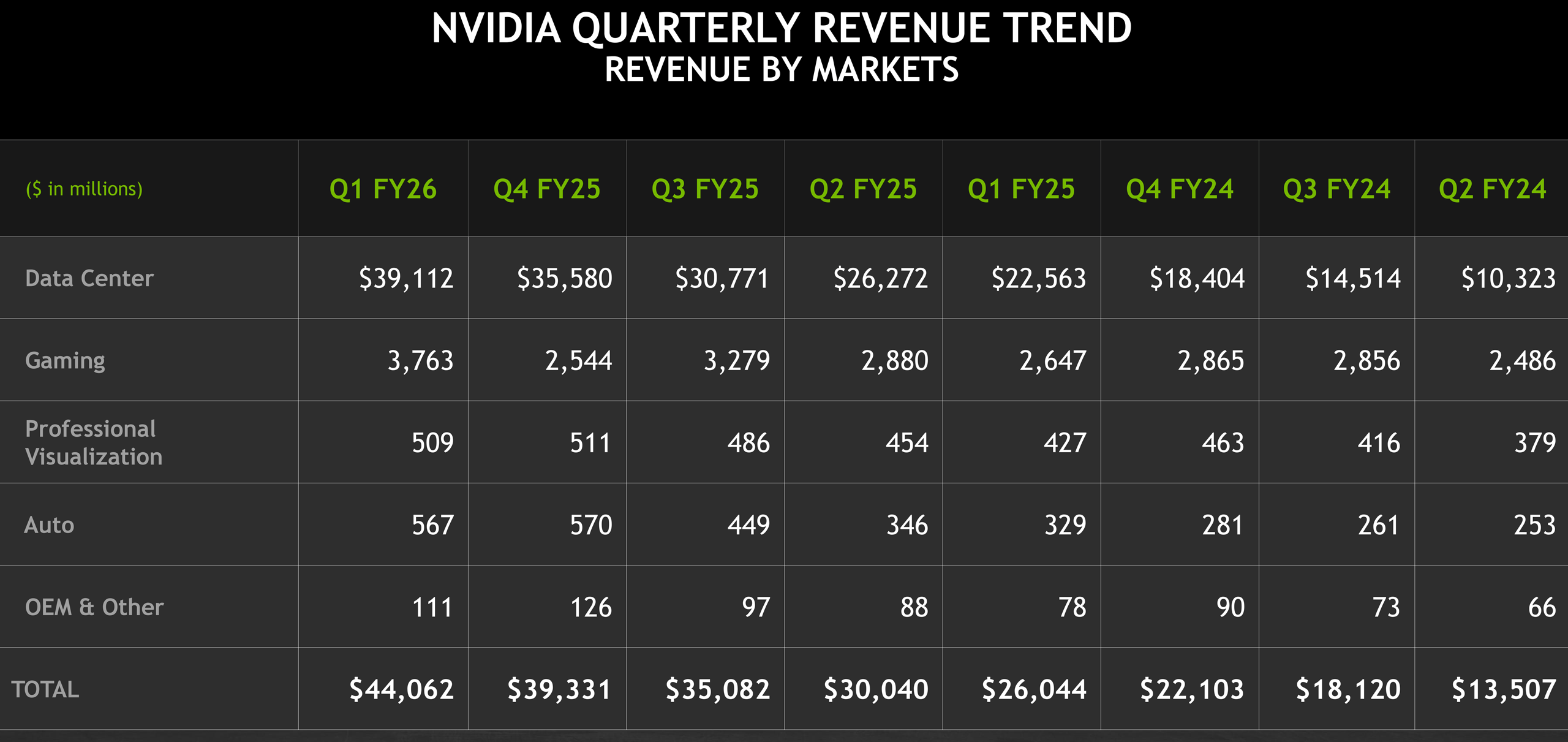

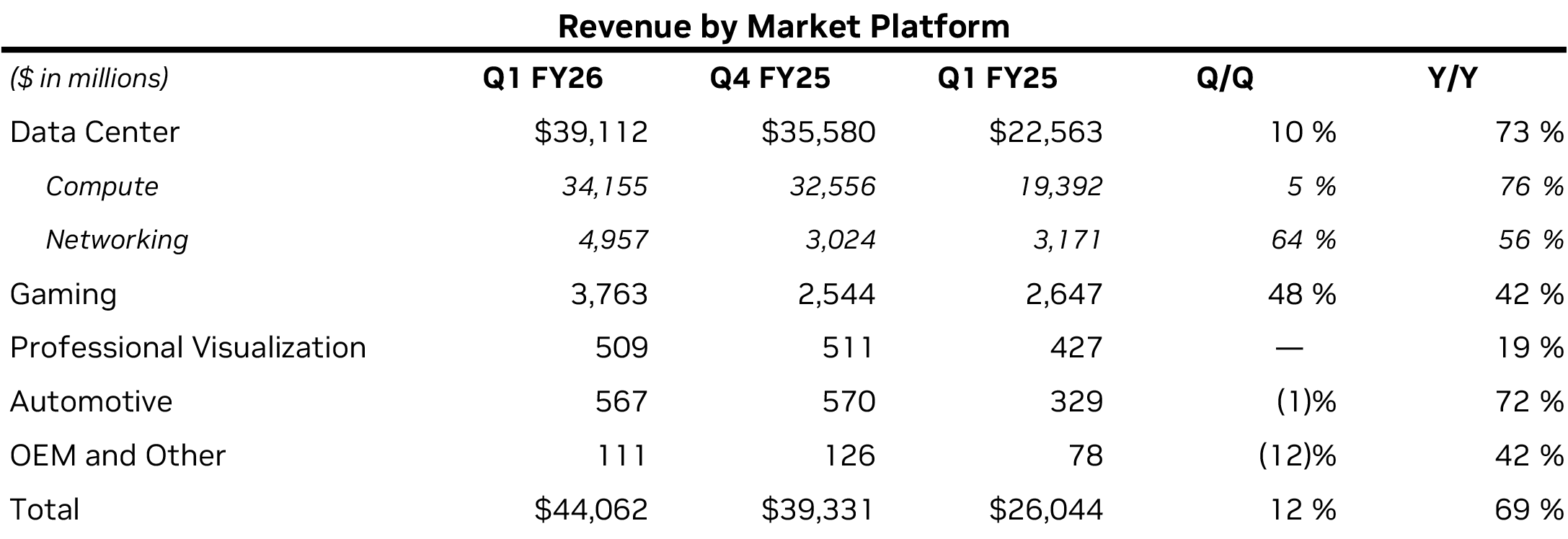

Nvidia's data center revenue set a new record $39.112 billion, comprising of $34.155 billion compute revenue and $4.957 billion networking revenue. The result represented a 10% quarter-over-quarter growth and 73% year-over-year growth, driven by surging global demand for AI infrastructure.

Nvidia does not provide the split between sales of Blackwell and Hopper AI GPUs as well as Blackwell and Hopper systems, but it said that transition to Blackwell is almost complete. This means that while there are still some customers interested in Hopper processors, the vast majority of its clients now want Blackwell products. In addition, the company highlighted strong momentum in Blackwell-based systems as NVL72 GB200 machines ramped to full-scale production during the quarter.

"Our breakthrough Blackwell NVL72 AI supercomputer — a 'thinking machine' designed for reasoning — is now in full-scale production across system makers and cloud service providers," said Jensen Huang, founder and CEO of Nvidia. "Global demand for Nvidia's AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Nvidia's gaming products also achieved record-breaking revenue of $3.8 billion — a 48% increase from the previous quarter and a 42% rise YoY — in the first quarter of FY2025. This growth was driven by multiple factors, including insufficient gaming GPU shipments in the previous quarter as well as launch of Nvidia's mainstream GeForce RTX 5070 and 5060-series products based on the Blackwell architecture. As for OEM and other segment, it generated $111 million, down 12% sequentially but up 42% year-over-year.

Nvidia's professional vizualization (ProViz) business reported revenue of $509 million, down from $511 million QoQ, but up 19% from $427 million in the same quarter a year go. Such results may indicate that workstation makers continued to purchase Ada Lovelace-based professional graphics cards despite the imminent release of Blackwell-based RTX Pro graphics boards in May, perhaps because of uncertainities with the U.S. tariffs.

It is noteworthy that sales of Nvidia's client and professional GPUs — which are reported under gaming, ProViz, OEMs, and other monikers — totaled $4.42 billion, which is lower than sales of Nvidia's networking gear.

Nvidia's automotive and robotics segment earned $567 million, down from $570 million in the previous quarter, but up a whopping 72% from $329 million in Q1 FY2025.

Impressive outlook

For the second quarter of fiscal 2026, Nvidia expects revenue of approximately $45.0 billion ± 2%. The company's Q2 revenue outlook could have been $8.0 billion higher if there was no H20 export restrictions. However, the company projects GAAP gross margins of 71.8% and Nvidia's goal is to reach mid-70% gross margins later in the year. This recovery reflects improving product mix and normalization after the Q1 inventory charge related to unsellable H20 units.

Operating expenses in Q2 FY2026 are projected to be around $5.7 billion on a GAAP basis. The vast majority of that sum will be used for research and development (R&D).

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

A Stoner They must be selling more cards than I expected they were for gaming to get record sales on them. I guess demand is just that high!Reply -

btmedic04 Reply

More than likely these numbers are inflated due to 5090s being purloined for AI cards, at $3000 a piece.A Stoner said:They must be selling more cards than I expected they were for gaming to get record sales on them. I guess demand is just that high! -

nitrium nVidia remains the "industry standard" in so far as that term can be used in GPUs. If you look at the latest Steam Hardware survey it is still absolutely dominated by nVidia (~75% of all GPUs), and people tend to stick to brands that they trust (= brands they are currently using).Reply -

-Fran- I'll have to update my internal numbers for when talking "consumer" market to ~$4BN instead of my "just" $2BN :DReply

Regards. -

A Stoner Reply

Probably true, but it still indicates they are selling much more gaming GPUs than supply seems to indicate. This could certainly be the cause. But it makes NVidia look better, since they are in fact creating supply, we are just screwed if we are not making money off our video cards since it makes them price prohibitive to us.btmedic04 said:More than likely these numbers are inflated due to 5090s being purloined for AI cards, at $3000 a piece.