Intel Q4 2021: Strong Competition Hurts Intel's Results

2021 is the company's best year ever.

Intel on Wednesday reported its fourth-quarter and full-year 2021 financial results. Fueled by strong demand for CPUs aimed at PCs and servers, the company reported its highest quarterly and full-year revenue ever. Yet, there are some alarming signs, too, as Intel's PC platform volumes continued to drop in terms of units due to supply chain issues, but surged in terms of dollars.

Strong Results, Cautious Outlook

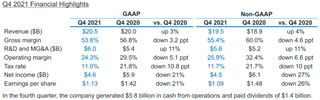

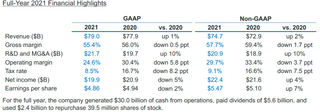

Intel earned $20.5 billion in the fourth quarter of 2021, exceeding its guidance by $1.3 billion and up 3% year-over-year (YoY). Intel's revenue totaled $79 billion for the whole year, up from $77.9 billion in the prior year (GAAP data). One thing to keep in mind is that Intel no longer includes the results of its NAND division in its reports.

As far as the gross margin is concerned, it was 53.6% in Q4 2021 (down 3.2% YoY) and reached 55.4% for the full year (down 0.6% from 2020). Intel has warned that since its 10nm-class process technologies are significantly more complex than its 14nm-class nodes, this generation of manufacturing processes will not allow it to reach gross margin levels of around 60% that were common in recent years.

As for profits, Intel's net income in Q4 totaled $4.6 billion, down significantly from $5.9 billion in Q4 2020. As for the whole year, Intel's net income for 2021 decreased to $19.9 billion from $20.9 billion in 2020.

"Q4 represented a great finish to a great year," said Pat Gelsinger, Intel CEO. "We exceeded top-line quarterly guidance by over $1 billion and delivered the best quarterly and full-year revenue in the company's history. Our disciplined focus on execution across technology development, manufacturing, and our traditional and emerging businesses is reflected in our results. We remain committed to driving long-term, sustainable growth as we relentlessly execute our IDM 2.0 strategy."

Intel expects to earn $18.3 billion in revenue in the first quarter, which will be in line with Q1 2021. However, since the ongoing quarter includes an additional week due to 2022 being a 53-week year, it looks like the company expects its sales to be lower than in the same period in the prior year. Furthermore, the company's gross margin will drop to 49% (down from 52% in Q1 2021 and down from its 51% ~ 53% guidance for the upcoming years) due to new product ramp-ups, higher costs, and possibly pre-payments for upcoming products.

Client Computing Group: Volumes Down, Prices Up, Again

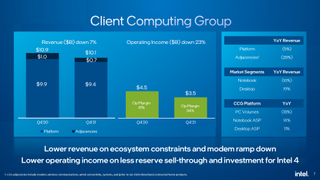

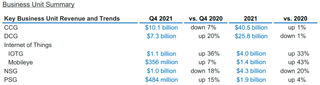

Intel's Client Computing Group (CCG), the main cash cow, earned $10.1 billion in Q4 2021, down 7% year-over-year when platform adjacencies are considered, which is unusual for a world that suffers from an undersupply of chips amid growing demand for PCs.

Intel's notebook components volumes dropped by 16% YoY (which is more than what one would expect from Apple's transition to its own SoC and subsequent drop of Intel's sales because of that), but unit sales of desktop components increased 19% compared to the same period a year ago. Because demand for PCs in general and premium systems, in particular, is high, Intel's notebook average selling prices (ASPs) were up 14%, whereas the company's desktop ASPs increased by 11% YoY, which somewhat offset Intel's lower client volumes in Q4.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

During the fourth quarter, Intel shipped over 30 million premium Tiger Lake CPUs for notebooks as well as began shipments of its 12th-Gen 'Alder Lake' processors for desktops and laptops. Since all companies tend to ship more expensive SKUs first, the majority of ADL chips Intel sold were probably higher-end models, which naturally drove its ASPs.

"We are extending our leadership position further with products like our 12th-Gen 'Alder lake,' the fastest client processor ever, which is now shipping to over 140 customers in 30 countries around the world," said Gelsinger.

Furthermore, the company started shipping its Arc 'Alchemist' discrete GPUs, a product category that barely existed at Intel in Q4 2020. Unfortunately, Intel didn't give details about its discrete GPU volumes and ASPs.

As for the whole year 2021, Intel's CCG's revenue reached $40.5 billion, up 1% from 2020, which is surprisingly low growth amid the ongoing PC boom.

Datacenter Group: Growth Is Back, ASPs Moderately Up

While Intel's CCG is the company's cash cow, its Datacenter Group (DCG) is without any doubt its profit generator due to very high ASPs. While the competition from AMD is strong, Intel's DCG continues to perform very well due to the growing demand for servers.

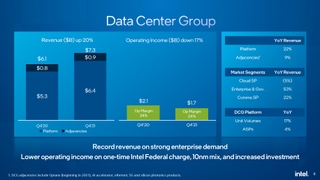

"We had a record quarter for DCG, where we grew 20% year and year and where we continue to be the partner of choice for cloud and datacenter customers," said Gelsinger.

In Q4, Intel's DCG sales increased to $7.3 billion (excluding Optane, AI accelerator, Ethernet, and silicon photonics products), up from $6.1B in the same period a year ago. Intel says that DCG's shipments to enterprises and governments skyrocketed by 53% YoY nand sales to telco companies surged by 22%, but supplies to hyperscale cloud service provided decreased by 5%. In general, unit volumes were up 17%, whereas ASPs were up 4%.

All of these organizations primarily bought Intel's 3rd Generation Xeon Scalable 'Ice Lake' processor made using the company's second-generation 10nm technology. Because this particular node brings lower profitability than its predecessors and because of very strong competition from AMD, Intel has to adjust the pricing of its mainstream and higher-end server products. To that end, DCG's operating margin dropped from 34% in Q4 2020 to 24% in Q4 2021, whereas operating profit fell from $2.1 billion to $1.7 billion.

While Intel continues to control the lion's share of servers made and deployed these days, AMD is gaining share, so Intel chose to reemphasize its position in a rather unusual way.

"We expect that our Xeon shipments in December alone exceeded the total server CPU shipments by any single competitor for all of 2021," said the head of Intel, implying that AMD's unit share in the server market is still less than 10%.

But mentioning the whole year might not be a particularly good idea as DCG's earnings for the whole of 2021 totaled $25.8 billion, down 1% year-over-year, a clear indicator that the competition is getting stronger.

Summary

Intel continues to increase revenues and remain profitable as it transits from one business model to another (IDM 2.0) in a bid to regain undisputed leadership in the semiconductor market. For 2021, the company earned $79 billion in revenue (up 1.4% YoY) and posted a $19.9 billion net profit.

Intel continues to have competitive products in its lineup, but its growth is slowing. Intel's client computer group's revenue for 2021 totaled $40.5 billion, up 1% from 2020, whereas its datacenter group earned $25.8 billion, down 1% year-over-year. The company's profit margins also suffered because of higher 10nm costs, investments in next-generation nodes, outsourcing of some products, and strong competition.

Despite temporary difficulties, Intel remains optimistic about its long-term growth as it invests heavily in product R&D as well as next-generation process technologies. In the coming weeks, the company will host its Investors Day, where it intends to outline its future plans.

"As we look back on 2021, we have made tremendous progress across all areas that we have laid out," said Gelsinger. "We still do have a lot of work to do, but we are focused, energized, and our momentum is building. I look forward to sharing our progress with you as we continue on this amazing journey. Our Investor Day is coming up, we are going to lay out the strategy, we got a lot to say."

Anton Shilov is a Freelance News Writer at Tom’s Hardware US. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

watzupken While Intel registered strong growth for the year, their competitors probably logged even stronger growth. In a time when anything sells, it should not come as a surprise that they are in the money. But the fact is that both ARM and AMD are chipping away at their firm grip of the industry. This is especially the case for ARM since many big companies are switching to custom ARM SOCs, as oppose to buying them from the likes of Intel and AMD. This hurts Intel more since they have the lion's share in the data center market.Reply

Most Popular