EVGA's Manufacturing, Consumer Policies Minimized GPU Profits, Report

Igor says EVGA's problems don't just come from Nvidia. They're at least somewhat self-inflicted.

EVGA shocked the gamer and enthusiast world last week when it announced its departure from the graphics card industry entirely, due to conflicts with Nvidia as its "tyrannical" partner. Today, Igor of Igor's Lab published his thoughts on EVGA's departure, deeming most of EVGA's problems self-inflicted.

According to Igor, EVGA as an add-in-noard (AIB) manufacturer, operates very differently compared to Nvidia's other AIB partners. EVGA relies completely on third parties to create the circuit boards and the coolers, with engineering being the only part of the process EVGA covers directly.

As a result, EVGA's GPU margins are exceptionally low for an AIB partner, since much of its resources have to be fed back to the third parties responsible for manufacturing the actual graphics cards. Igor asked several competitors about margins, and found worst-case scenarios — which includes EVGA's strategy — account for around 5% in margin profits.

This is a significant difference compared to the 10% profit margins allotted to other AIB partners who do all the manufacturing in-house, allowing these companies to be a lot more efficient to gain those higher margins.

To make matters worse, EVGA is also operating on a volumetric loss compared to its other AIB partners, with far fewer GPU shipments overall. This is probably related to EVGA's sales coverage of primarily America (and Europe), compared to its AIB competitors who manufacture and ship GPUs worldwide. According to Igor, shipment volume is a big deal when you're only making 5% to 10% profit margins.

At the same time, EVGA has also tried to stand out by offering longer warranty periods, and a step-up program, both things no other competitor in the GPU industry offers. While this strategy does provide EVGA with a stellar track record for customer satisfaction, it is a "suicidal strategy" according to EVGA's competitors. One anonymous source at a competitor told Igor, "If it were profitable, we would have done it long ago."

Weighing Up Nvidia's Blame

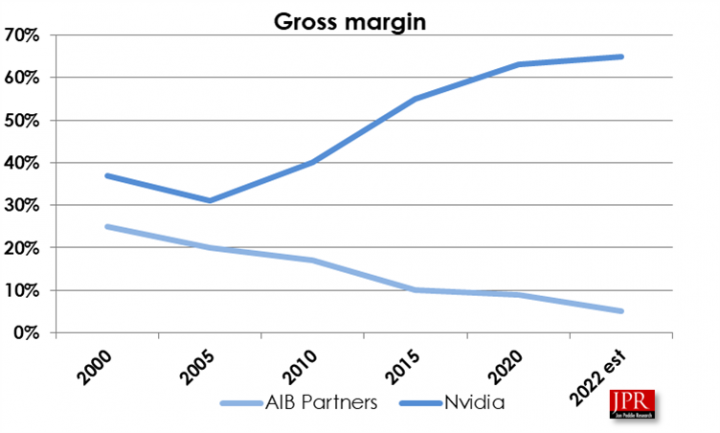

There is no denying that Nvidia has strict guidelines for its AIB partners, including what to do or not do with each graphics card design. Nvidia also goes the extra mile to compete with its AIB partners directly with its Founders Edition GPU models. Recent stats from JPR indicates Nvidia's gross margins have grown fairly steadily since 2005, while the margins of its AIB partners have fallen since 2000.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

We don't doubt EVGA's professed reasons for leaving Nvidia are true, including Nvidia withholding MSRP information until GPUs are announced on stage, and forcing AIB partners to set GPU prices to specific categories on specific models. But, it is interesting to see this new information come to light, indicating EVGA has one of the lowest profit margins compared to the rest of Nvidia's AIB partners.

It's clear we don't know the full details of the situation. And with Nvidia and its partners seemingly uninterested or unable to go on the record and be candid about sales, profits and other stats, we may never know much more than we do today. But it would not be surprising to hear EVGA left the GPU market due to issues originating from Nvidia directly, as well as from self-inflicted financial problems combined.

Still, take all this with a grain of salt. Igor is a respected, well-connected individual in the PC industry, but we may still learn more, given we're just a few days past EVGA's bombshell announcement.

Aaron Klotz is a contributing writer for Tom’s Hardware, covering news related to computer hardware such as CPUs, and graphics cards.

-

hotaru251 evga prolly does have some effect on outcome, but i mean its not anything new that nvidia is an overbearing and controlling partner.Reply

multiple partners have stated that for over a decade.

and having a rep (in the GN video) say Jensen sees AIB's as (basically) leeches shows their future is to ditch AIB entirely (like apple did) and thats harmful to AIB's and not soemthing they can bounce back from while nvidia has literally no downside to it. (as they know ppl will buy as their brand is quality gpu's)

AIB's will never be able to rival Nvidia's prices as nvidia makes the things w/o any 3rd party fees.

also i'd argue that EVGA's step-up, long warrenty, etc are beneficial to EVGA.

it creates loyal trusting customers. which means they are likely to come back to you in future.

step up specifically gets them new sales and they can sell the old gpu as B stock. -

peachpuff Reply

Nvidia wants that 5%-10% too if they could.thisisaname said:5% or 10% meanwhile Nvidia makes do with 65%. -

-Fran- So, in order to be able to make a sightly less than minuscule profit with nVidia, its AIB partners need to be scummy and offer the bare minimum the law states for consumers while accepting nVidia itself is competing with them having stupid unfair advantages.Reply

Gotcha.

Regards. -

Glenlivet81 What a terrible take. EVGA prioritized gamers over miners and this is what you promote? Trash by Igor and trash article. How sad.Reply -

criticaloftom I love it when people take the exact same data and try and spin it in the complete opposite direction.Reply

I mean they failed, but it's amusing.

Of course a high volume seller is saying why on earth would you sell low volume add value; that they couldn't imagine it working?!

It's not like outsourcing the manufacturing can't be a profitable thing in itself as getting away from specific industries like GPU's having your manufacturing in a low labor cost area is capital efficient and not having the manufacturing yourself would allow a company tight quality assurance control as they can simply throw back what doesn't make the measure or even stop dealing with a specific company all of a sudden if product standards drop.

Sounds like something that would be costly and actually have to be fixed if it was manufacturing in house under similar circumstance.

Also the article doesn't post any details on if this was a more recent change (cost saving measure) to do with shrinking margins. -

10tacle Replycriticaloftom said:Also the article doesn't post any details on if this was a more recent change (cost saving measure) to do with shrinking margins.

Well you let us know who has that information then...we'll wait.

Meanwhile back on topic, this is a big sting for me. I've been an exclusive EVGA GPU buyer since the GTX 275/285 days. I chose them due to their renown customer experience when things go south, and things only went south for me once: a dead GTX 970, one of two I had in SLI. They gave me a voucher for the cost since they no longer had the card as the RTX 10xx series was out. It was a zero brainer to sell that second GTX 970 and put all that money to their RTX 1080 Ti SC2 Gaming - a card still used in an old backup gaming rig.

Something is amiss in serious order when a CEO decides to pull the plug on a market segment that comprises 80% of the sales of the company. Is EVGA the canary in a coal mine of all AIB board partners for Nvidia? We'll find out I suppose... -

thestryker Yeah citing customer positive things as bad because they're not profitable is big business 101. If it doesn't have a measurable link to profits it's bad no matter if it means customer loyalty.Reply

I think we'll all find out with the 40 series whether this is a sign of AIB dying or not by who steps in to fill the gaping hole in the NA market. -

btmedic04 Evgas warranty, step up and customer support is the reason why I've been buying their gpus since the geforce 7800 gt I bought in 2005.Reply

This whole article comes off as deflection and damage control.