Windows 8, Tablets Driving Growth for Chip Industry in 2012

Growing demand for communications semiconductors is bailing out the chip industry from a potentially catastrophic 2012. IDC said that it expects global chip sales to climb by 4.6 percent to $315 million.

The research firm projects negative growth for memory makers and just 1.5 percent growth for the computer industry overall, which is largely driven by the introduction of Windows 8. However, there are bright spots, such as semiconductors for mobile PCs, which are forecast to gain 5.9 percent year over year.

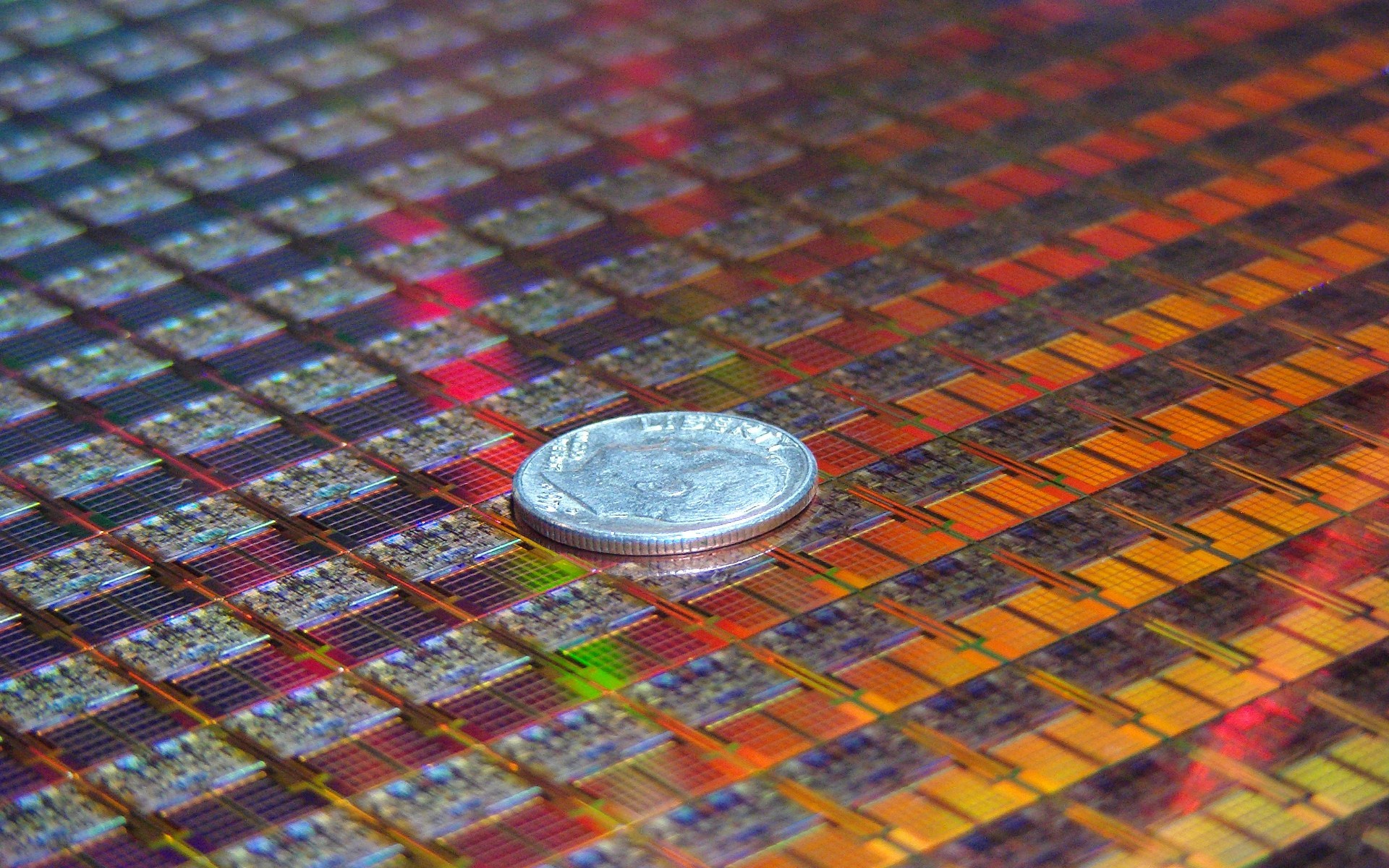

"As we forecasted earlier this year, the cyclical semiconductor downturn that started in the middle of last year reached bottom in the second quarter of 2012," said Mali Venkatesan, research manager for Semiconductors at IDC. "Supply constraints on semiconductor products, such as smartphone applications processors and PC discrete graphics processors, based on the most advanced process technologies are easing as foundries are bringing more capacity online."

Conclusively, the biggest opportunities appear to be in the communications and automotive segments. IDC estimates that the Communications industry segment will grow 7.2 percent year over year in 2012, while semiconductor revenues for 4G phones will experience year-over-year growth of 579 percent. Chips for the automotive will increase sales by 9.7 percent, IDC said.

Somewhat surprising may be the note that chips for media tablets, e-Readers, HD receivers, and LED/LCD TVs will grow at a much more moderate pace of 4.4 percent.

"The semiconductor industry has recovered from the flooding in Thailand that held back the supply of hard drives and PCs. Leading-edge 22nm at Intel is ramping fast now, while foundries and memory companies are getting ready to move to 20nm technology node," Venkatesan said. However, he believes that near term growth will be slower than that of past semiconductor cycles due to "macroeconomic weakness."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Douglas Perry was a freelance writer for Tom's Hardware covering semiconductors, storage technology, quantum computing, and processor power delivery. He has authored several books and is currently an editor for The Oregonian/OregonLive.

-

Microsoft managed to increase Skype usage by 50 percentReply

http://www.techatron.net/2012/07/microsoft-managed-to-increase-skype.html -

killerclick Negative growth... love that PR-speak.Reply

As for Windows 8 driving chip sales, I'd like to see what they're basing that on. -

back_by_demand Now that these Thailand based companies have spent all their extra money they fleeced from us with hard drive prices on large quantities of sandbags, it's about time they got back to pumping out large quantities of cheap, high quality techReply

...

Stack it high and sell it cheap, we need something to kickstart this recession and buying techie shiney things sound like a good idea -

DRosencraft These "researchers" don't seem to have a good sense of what to expect from Win8. Every other week it seems like one is saying Win8 will bomb, and another one says it's going "save" the PC industry. Why can't they just admit they don't really know? Anyway, what I think can be said with some confidence, is that unless macroeconomic factors improve worldwide, any potential any sector has for growth will be diminished. The average person just does not have enough money or confidence that they will still be economically secure even six months from now to just jump at everything that is being thrown out by companies.Reply -

ceh4702 I think for instance that the hard drives manufacturers are over-inflating the prices of hard drives. If the sales of tablets are up, who wants all these hard drives?Reply -

freggo ceh4702I think for instance that the hard drives manufacturers are over-inflating the prices of hard drives. If the sales of tablets are up, who wants all these hard drives?Reply

Upgrades....

I just upgraded several 500GB internals to 2TBs.

And they will fill up fast too... :)

Who will have the first 10TB drive ?

-

ojas Well obviously, more tablets + phones based on win 8 (in addition to all the stuff that exists) will mean more chip sales. For desktops, however, it's a very generalized statement. New computers with windows 8 will mean new chips. replace windows 8 with any other OS and the statement still stands.Reply -

eddieroolz There may be growth, but the issue is that tablet, smartphone and other embedded chips don't command the same prices a full-fledged desktop chips do. So even when sales grow, profits don't grow proportionally.Reply