US Lawmakers Ask Facebook to Suspend Libra Cryptocurrency

A number of U.S. Congress people, including Congresswoman Maxine Waters (D-CA), the Chairwoman of the House Financial Services Committee, yesterday sent Facebook’s top executives a letter requesting the immediate suspension of Facebook’s development of its Libra blockchain digital currency, which Facebook announced in June.

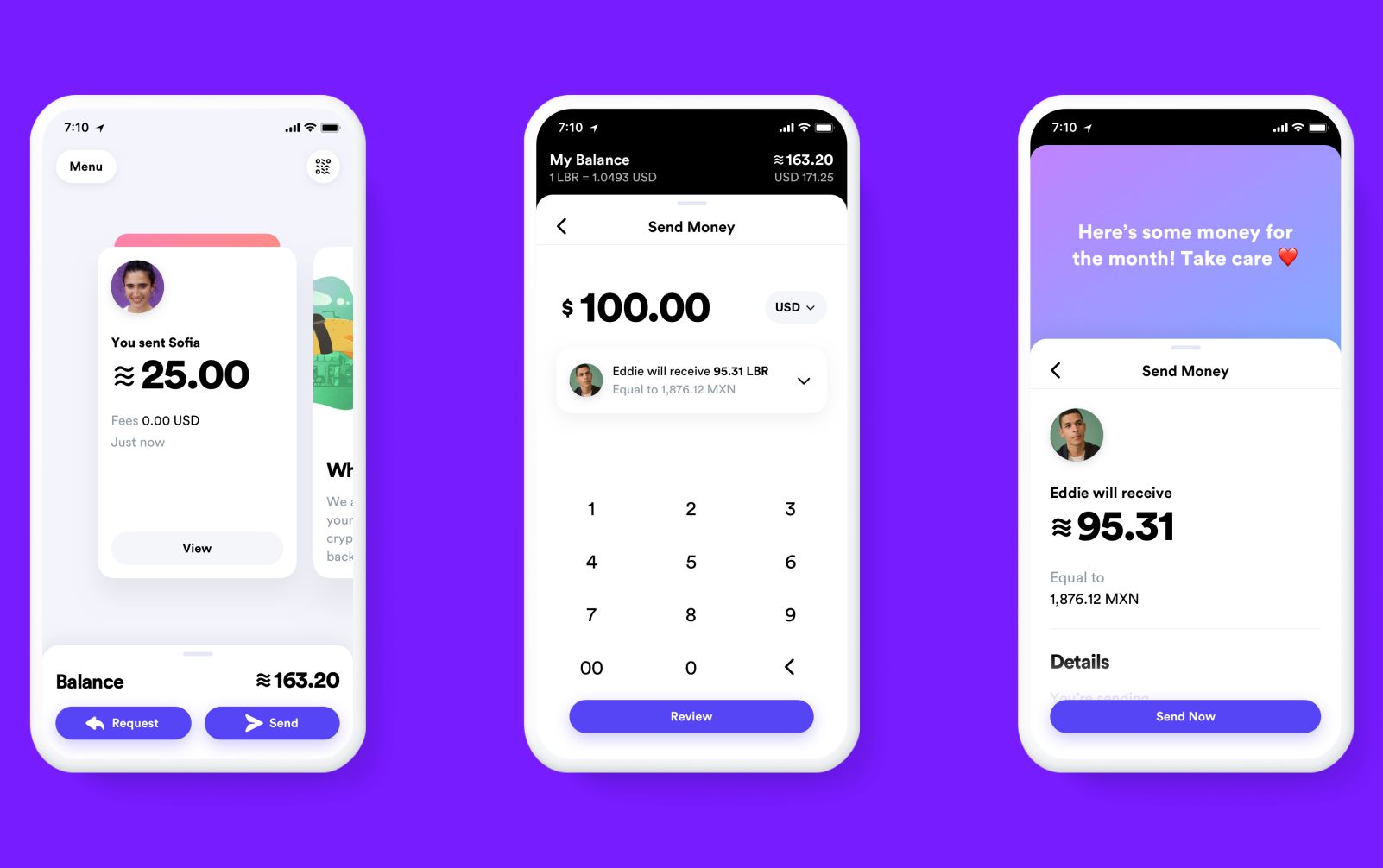

So far, Facebook has only released some basic and experimental code for Libra, with the full release being planned for 2020.

The letter states:

“Because Facebook is already in the hands of over a quarter of the world’s population, it is imperative that Facebook and its partners immediately cease implementation plans until regulators and Congress have an opportunity to examine these issues and take action. During this moratorium, we intend to hold public hearings on the risks and benefits of cryptocurrency-based activities and explore legislative solutions. Failure to cease implementation before we can do so, risks a new Swiss-based financial system that is too big to fail.”

The rest of the letter focuses primarily on Facebook’s Libra currency being a risk both to the U.S. financial system (more specifically a risk to the U.S. dollar) and other global markets. The letter points to Libra potentially increasing the risk of people or businesses losing all of their money to hackers. The lawmakers reminded everyone that last year, hackers stole a total of $1 billion worth of cryptocurrency from online exchanges.

Yet another concern was that Libra will provide an “under-regulated” platform for illicit activity.

The letter argued that these risks need to be emphasized even more because Facebook hasn’t always kept user’s data safe, and, in fact, has often exchanged it with third-party developers or smartphone manufacturers. In other words, why should Facebook be trusted with people’s money when it couldn’t even be trusted with their text messages and photos?

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

As fallout from the Cambridge Analytica scandal, Facebook is expected to pay $5 billion in fines to the Federal Trade Commission (FTC, responsible for protecting U.S. consumers) and remains under an FTC consent order over previous privacy violations and misleading statements to its users from the company.

Facebook has also recently been sued by civil rights groups and the U.S. Department of Housing and Urban Development for violating fair housing laws on its advertising platform and through its ad delivery algorithms.

Even though Facebook intends to create a separate entity in Switzerland to handle everything related to Libra, which in theory means it should be bound only by Swiss laws, the U.S. government can still go after Facebook’s core advertising business and social media platform at home. The U.S. feds could make Facebook pay even bigger fines for actions it deems illegal, or by creating new privacy-friendly laws that could severely cripple Facebook’s advertising business model.

Facebook has yet to respond to the letter.

Lucian Armasu is a Contributing Writer for Tom's Hardware US. He covers software news and the issues surrounding privacy and security.

-

bit_user ReplyEven though Facebook intends to create a separate entity in Switzerland to handle everything related to Libra, which in theory means it should be bound only by Swiss laws

US lawmakers can restrict and regulate the use of Libra in the US, no matter where it's based. Running it out of Switzerland only protects foreign use of Libra from US regulators. -

ElectrO_90 Congress wants to talk about it... What does Congress know? They can't even agree on helping people who are sick.Reply -

f0xnewz During the height of the 2008 fiscal crisis, Waters helped arrange a meeting between the Treasury Department and top executives of a bank where her husband was a shareholder. Using her post on the House Financial Committee as leverage, she called Treasury Secretary Henry Paulson personally, asking him to meet with minority-owned banks.Reply

When Treasury followed through, there was only one financial institution present: OneUnited. Had that bank gone under, the New York Times reported, Waters' husband would've lost as much as $350,000. Luckily for the Waters family, OneUnited received a cool $12 million in bailout funds. -

sykozis Reply

One side claims to want to help sick people while the other side claims to be helping sick people by trying to limit or remove access to health care for those sick people.... Congress, needs to be replaced. Too many have loyalty to money or large corporations. It doesn't matter what they know, or understand. What matters is their loyalty. Cryptocurrency has the potential to change the entire economic landscape. Unless it's regulated by Gov'ts, the change it has the potential to cause, is contrary to what is desired by those in power. With crypto-currencies having a limited number of "coins" available, the potential for a financial collapse is actually higher than under our current systems.ElectrO_90 said:Congress wants to talk about it... What does Congress know? They can't even agree on helping people who are sick. -

bit_user Reply

What's the point of this?f0xnewz said:During the height of the 2008 fiscal crisis,

First, you supplied no sources. Second, I don't see what it has to do with this story.