HPE gets approval for $14B acquisition of Juniper, to defend AI networking edge against China's Huawei — White House stepped in after agencies flagged national security concerns

The fight for AI continues.

When Hewlett Packard Enterprise (HPE) announced its intent to acquire Juniper Networks for $14 billion back in January of 2024, it sparked the usual buzz around consolidation in enterprise tech. But what looked at first like a classic case of portfolio expansion—HPE growing its edge-to-cloud stack by folding in Juniper’s networking business—may have had far higher strategic stakes behind the scenes.

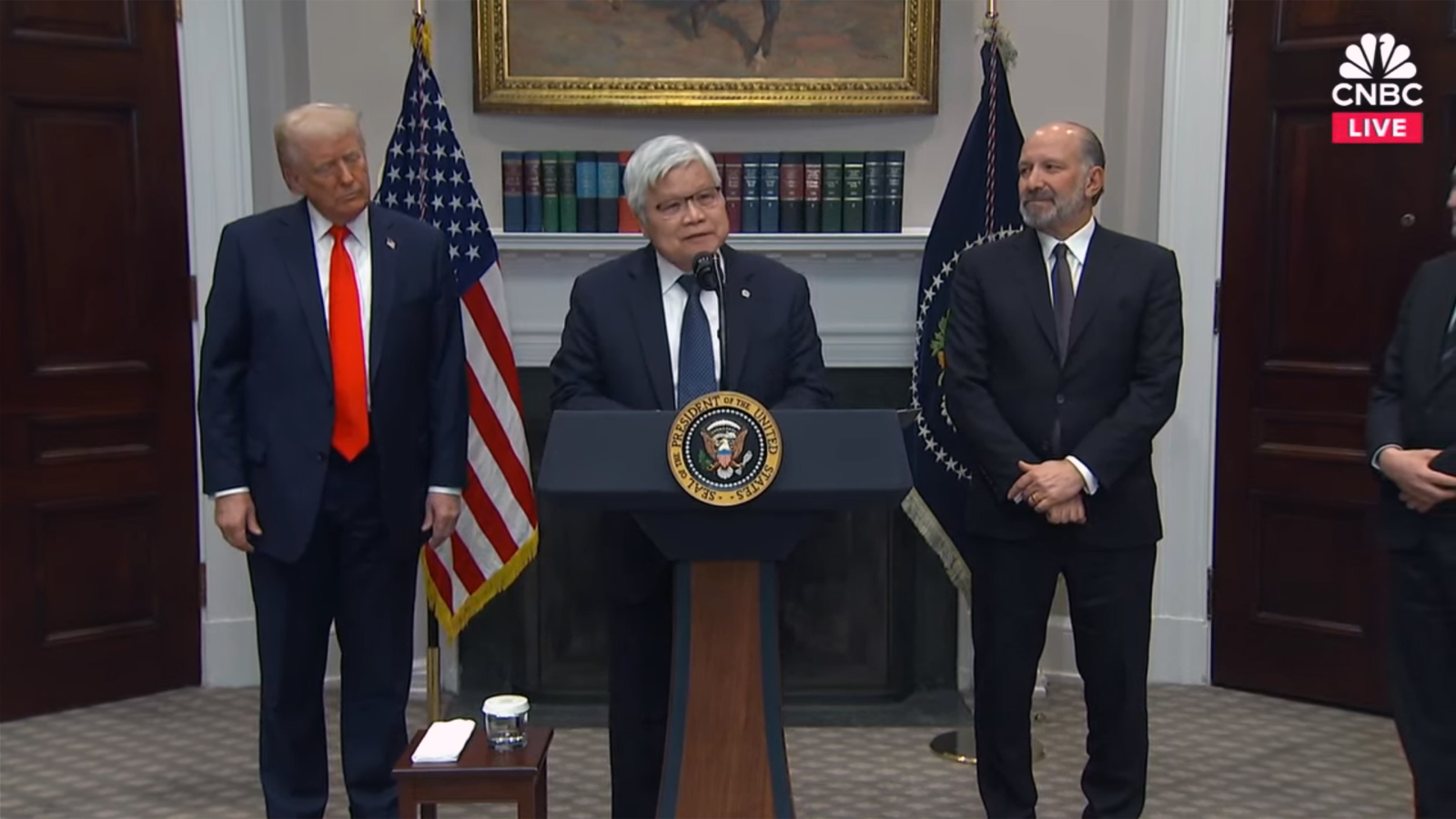

New reporting from Axios reveals that the U.S. Department of Justice (DOJ) actually had internal conflict over whether to block the deal, with multiple officials arguing it posed competitive concerns. What changed? According to sources close to the matter, senior White House and intelligence officials intervened, emphasizing that national security interests overrode any antitrust objections.

That intervention seems to have tipped the scales. Just last week, the DOJ formally signed off on the deal, allowing it to proceed with no major conditions. But according to Axios, at least two DOJ staffers who raised red flags about the merger were pushed out during internal disputes, adding weight to speculation that this wasn’t just a regulatory approval, but a calculated strategic move.

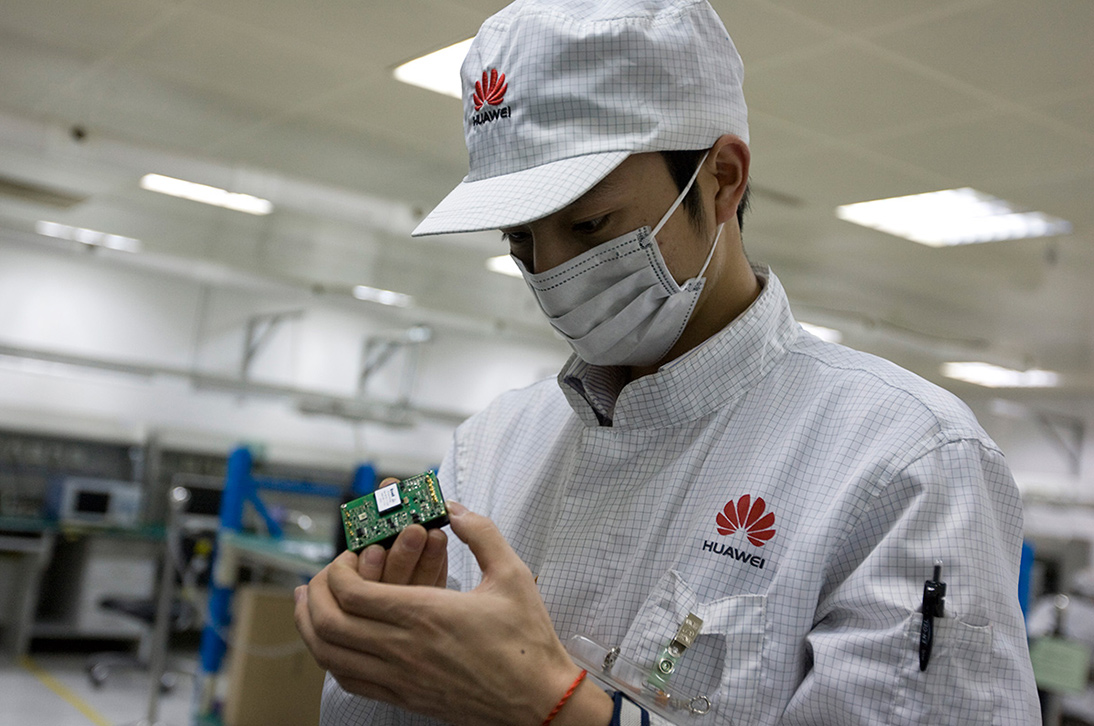

The deal itself isn't just another high-value acquisition between two legacy tech firms. While HPE and Juniper overlap in networking, the merger is more about aligning U.S. infrastructure players against what national security officials see as an encroaching threat from Chinese-designed networking stacks. In internal meetings, U.S. intelligence officials reportedly argued that Huawei’s dominance in global infrastructure isn’t just a trade issue, but rather a strategic vulnerability.

For many developing countries, Huawei’s tightly integrated ecosystem offering networking hardware, cloud services, and AI-backed management software comes at a fraction of the cost of its Western rivals. The concern from Washington was that if U.S. vendors kept competing independently, they'd fail to match Huawei’s scale, and American influence in digital infrastructure would continue to erode.

That’s where the HPE-Juniper combination comes in. Juniper’s strength in carrier-grade routing and Mist AI network automation complements HPE’s enterprise footprint and GreenLake’s growing cloud presence. Together, the merged company could offer a vertically integrated stack—not unlike Huawei’s—targeted toward U.S. allies and sectors with sensitive data flows. It’s no coincidence that the deal was finalized just as the U.S. has been urging partner nations to diversify away from Chinese tech across telecom and cloud.

Internally, the Justice Department didn’t reach this decision lightly. According to Axios, the department’s antitrust division initially had reservations, fearing that the consolidation could reduce competition in enterprise networking and edge infrastructure. But after meetings with the intelligence community and senior White House staff, the narrative shifted. National security, not market concentration, became the dominant concern.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Two DOJ officials who pushed back on the decision were reportedly dismissed during the process, underscoring the weight of the political and strategic considerations in play. The message from the executive branch was clear: regulatory friction shouldn’t get in the way of countering Huawei’s lead in global digital infrastructure.

That shift in tone is reflective of a broader trend where traditional antitrust arguments are increasingly being sidelined in favor of geopolitical strategy. It's a pattern we’ve seen take shape in semiconductors with the CHIPS Act, and now it's reaching into networking. The HPE-Juniper merger isn’t being sold as a growth story or a revenue synergy play as much as it’s being framed as a necessity. A way to ensure that Western tech firms don’t just survive but remain relevant in a world where infrastructure dominance is increasingly tied to soft power and national leverage.

If executed well, the merger could give the U.S. a more credible alternative to Huawei’s offerings, especially in friendly but vulnerable markets like Southeast Asia and Eastern Europe. Ultimately, the success hinges on more than just consolidation. HPE and Juniper still have to unify their roadmaps, streamline overlapping products, and make the combined stack attractive not just on paper, but in cost, performance, and manageability. That’s a tall order—but in this case, Washington seems to have decided that not trying would be riskier.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Hassam Nasir is a die-hard hardware enthusiast with years of experience as a tech editor and writer, focusing on detailed CPU comparisons and general hardware news. When he’s not working, you’ll find him bending tubes for his ever-evolving custom water-loop gaming rig or benchmarking the latest CPUs and GPUs just for fun.

-

hotaru251 Reply

and that can of worms is now opened.

emphasizing that national security interests overrode any antitrust objections.

can't wait for any big tech merger in future to use that :| -

gblack Why is there zero mention of Cisco anywhere in this article? It's like they don't exist? Cisco is a much better Huawei competitor than Juniper or HPE either one.Reply

But yes, I'm sure others in big tech will try to exploit this for mergers.