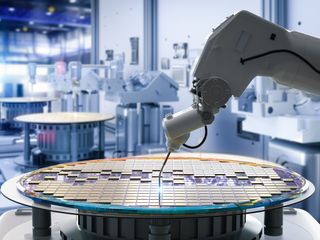

Largest chip toolmaker receives multiple subpoenas from U.S government over China shipments — Applied Materials under the govt's microscope

U.S. government gets serious over shipments to Chinese chipmakers.

Applied Materials, the largest producer of chipmaking equipment in the U.S., said in a filing with the U.S. Security and Exchange Commission that it had received multiple subpoenas from various government agencies over shipments of its products to certain customers in China. At least one subpoena could be related to shipments to SMIC, a major China-based foundry that is blacklisted by the U.S. government.

"We have received multiple subpoenas from government authorities requesting information relating to certain China customer shipments," the filing by Applied Materials reads. "In August 2022 and February 2024, we received subpoenas from the U.S. Attorney’s Office for the District of Massachusetts; in November 2023, we received a subpoena from the U.S. Commerce Department’s Bureau of Industry and Security; and in February 2024, we received a subpoena from the U.S. Securities and Exchange Commission. […] We are cooperating fully with the government in these matters. These matters are subject to uncertainties, and we cannot predict the outcome, nor reasonably estimate a range of loss or penalties, if any, relating to these matters.

* Feb. 2024: ASML dethroned Applied Materials, becoming the world's largest fab tool maker.

* Nov. 2023: During an earnings call, Applied Materials reveals a U.S. criminal investigation over shipments to SMIC.

* Oct. 2022: The U.S. introduces export controls limiting shipments to China. Chip companies lost $240 billion in value.

At least one U.S. Justice Department investigation is focused on allegations that Applied Materials circumvented necessary U.S. export licenses by routing some of its tools, valued in the hundreds of millions of dollars, to SMIC through South Korea. The shipment was allegedly made following the U.S. Commerce Department's decision to place SMIC on its Entity List in December 2020 due to national security concerns. The specific WFE types and the exact timing of these shipments to SMIC remain undisclosed at this point.

Back in October 2022, Applied Materials confirmed receiving a subpoena from the Massachusetts U.S. Attorney's Office, which requested details regarding its shipments to certain customers in China. Since then, the company received several more subpoenas as various government agencies are looking into Applied Materials business with Chinese entities.

In October 2023, the U.S. government, citing national security, introduced stringent export controls on shipments of high-performance processors and cutting-edge semiconductor manufacturing equipment to China. Specifically, manufacturers of U.S. fab tools are required to obtain a license to export equipment capable of producing FinFET logic chips with 14nm/16nm technology or more advanced, to Chinese firms.

Meanwhile, even without the latest U.S. export rules, SMIC, the only contract maker of chips in China capable of manufacturing 14nm-class chips, has been on the U.S. Department of Commerce's Entity List for some time, which is why Applied and other American makers of fab tools must secure an export license for any dealings with the Chinese chip giant.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Anton Shilov is a Freelance News Writer at Tom’s Hardware US. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

HaninTH Unregulated capitalism at it's finest! There are no moral/ethical issues when profits are to be had. This is not exclusive to any industry. Even extraordinarily low margin business are subject to ruthless profit seeking.Reply

Make money however you can and at any cost. Let others deal with any of the ramifications. -

digitalgriffin I predict this:Reply

Net profits: 100,000,000

Gov't Penalty: 100,000 and slap on wrist.

You do the math

Damages to national security should be TRIPLE the amount of any sales. -

tooltalk Reply

What unregulated capitalism? The Dept of Commerce allowed over $100+B worth of export licenses to China, 1/3 to those blacklisted, in 2022.HaninTH said:Unregulated capitalism at it's finest! There are no moral/ethical issues when profits are to be had. This is not exclusive to any industry. Even extraordinarily low margin business are subject to ruthless profit seeking.

Make money however you can and at any cost. Let others deal with any of the ramifications.

Most Popular