AMD Posts Record Quarterly Revenue and Notebook Sales, Zen 3 and RDNA 2 On Track

Show me the money

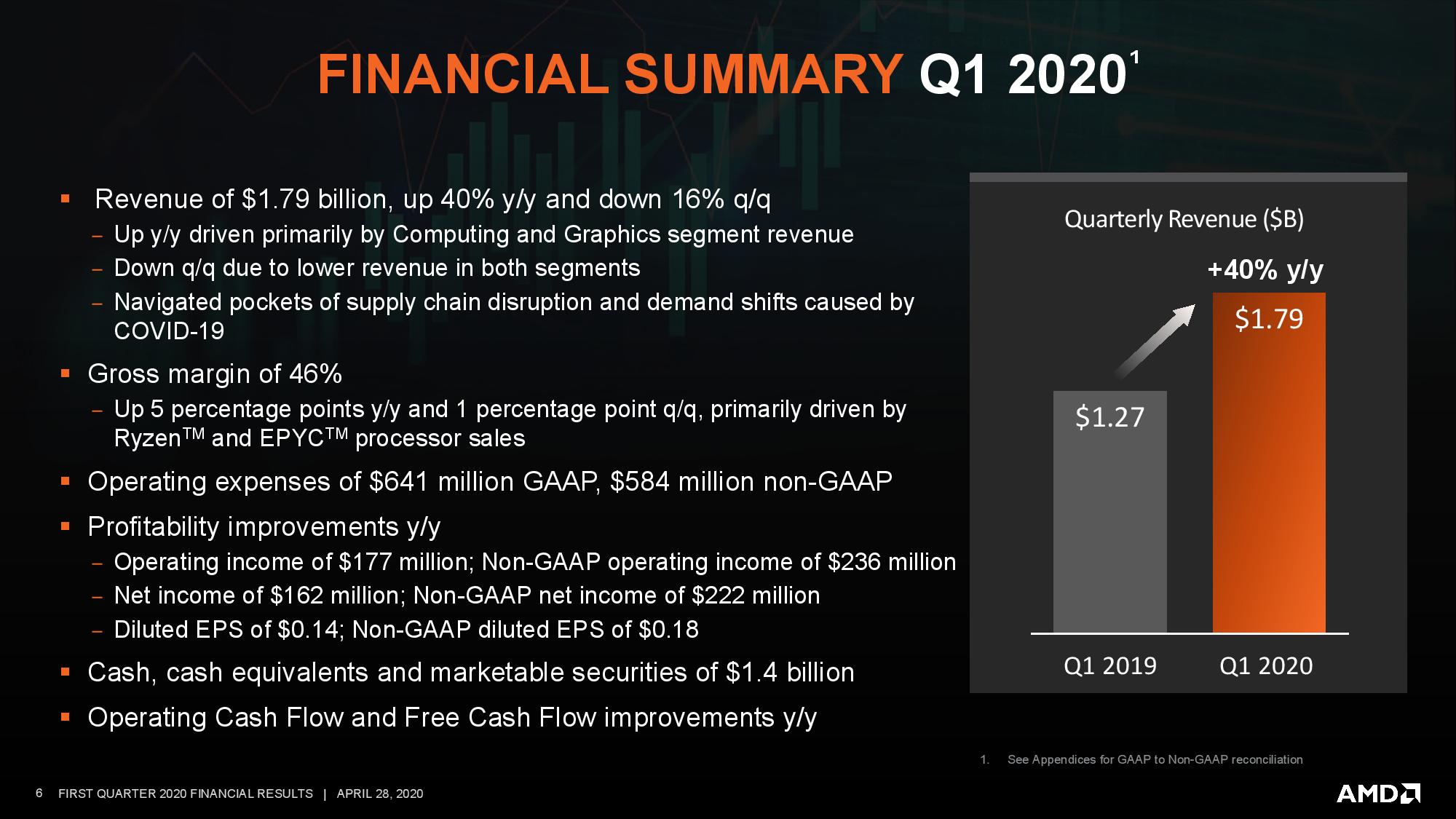

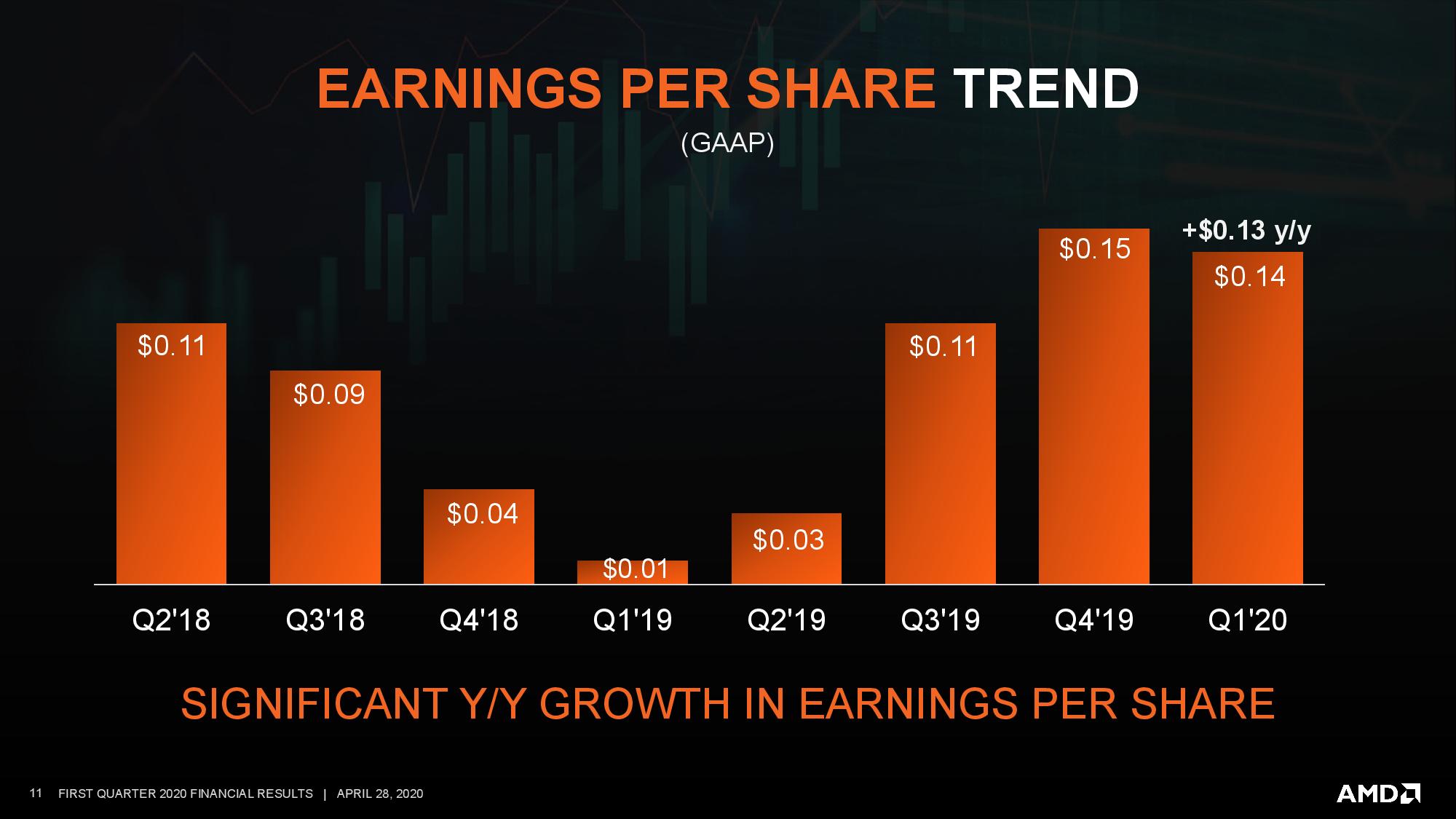

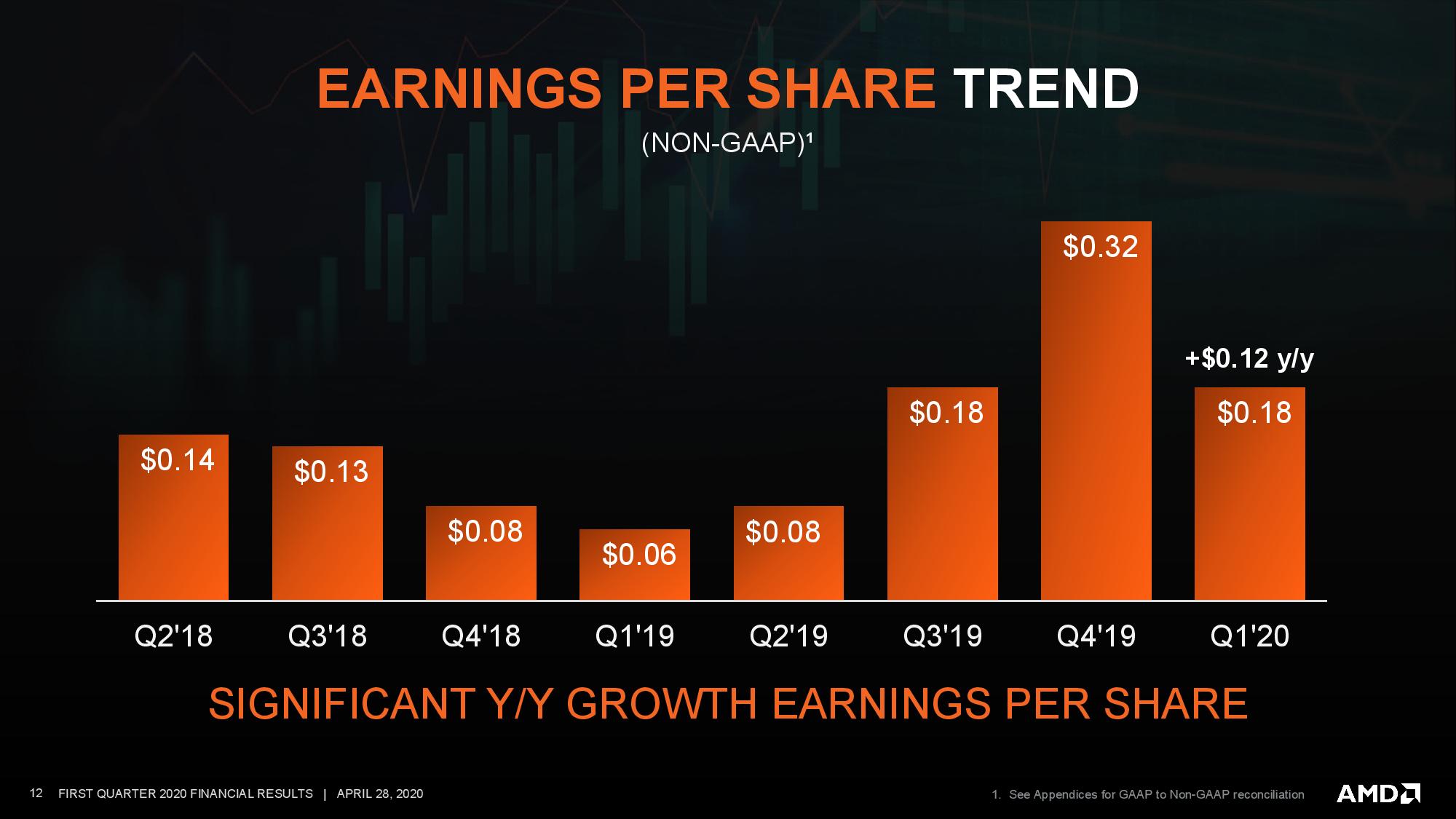

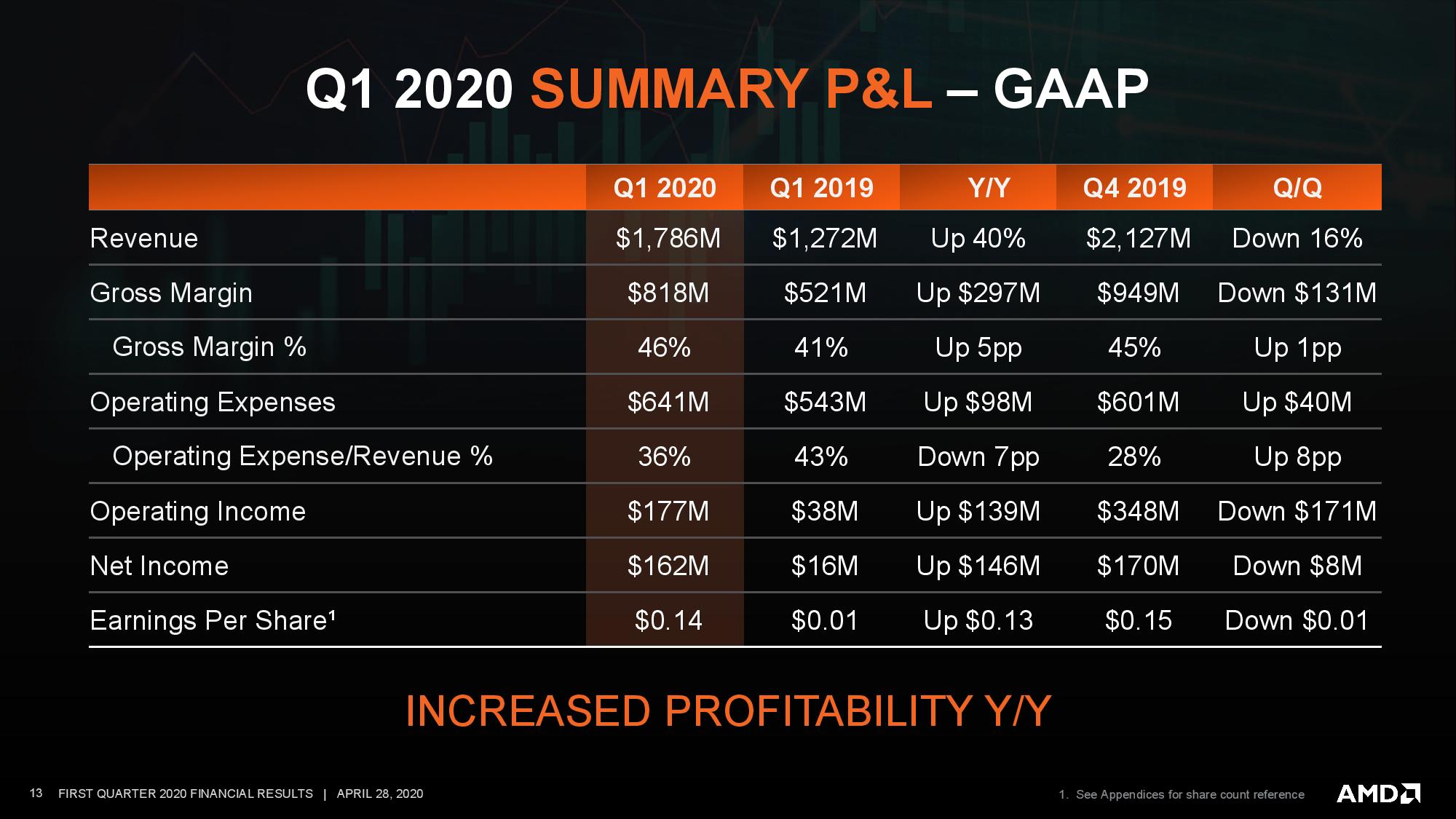

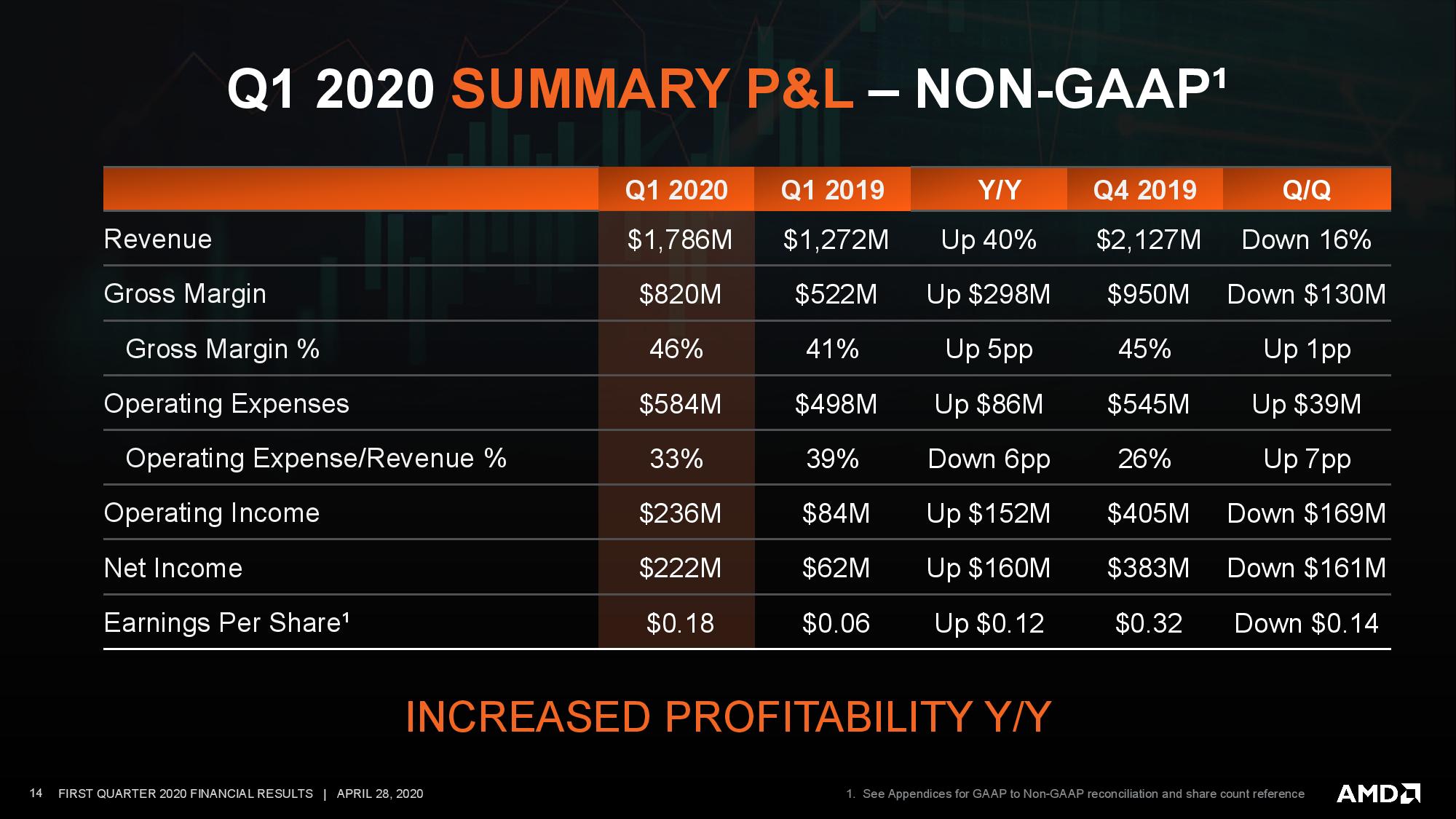

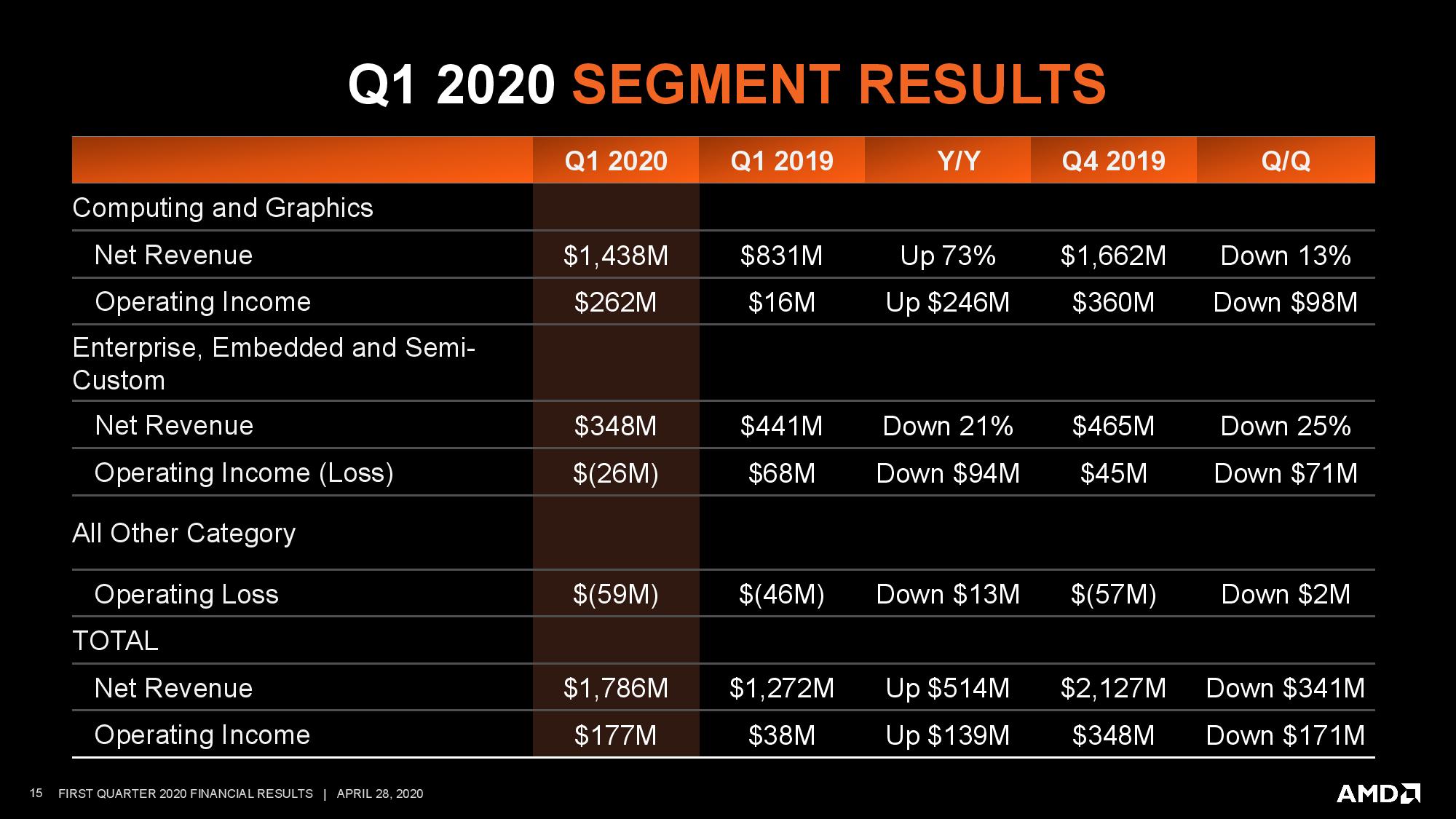

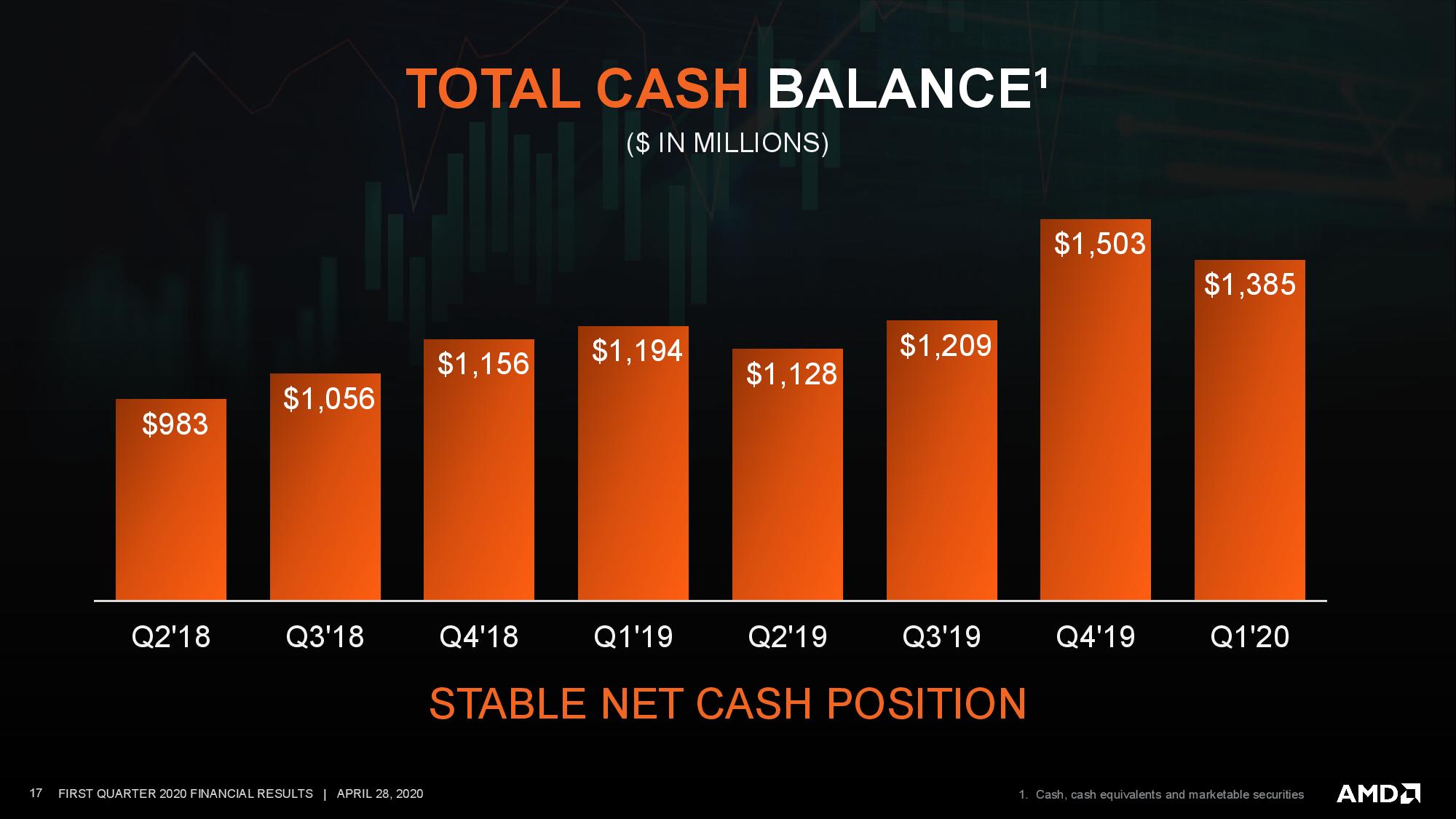

Amidst the turbulent waters of the coronavirus pandemic, AMD posted record first-quarter 2020 revenue as the company raked in $1.79B in revenue, a 40% year-over-year increase, but 16% decline from the prior quarter. The company posted record notebook chip sales driven by the new Ryzen 4000 series processors, a key growth segment that comprises more than two-thirds of the addressable consumer market.

AMD also says it remains on track for the Zen 3 and RDNA 2 GPUs in late 2020, with the latter offering a 50% performance-per-watt increase over current-gen AMD GPUs. AMD CEO Lisa Su also said the company had gained more share in the desktop PC market for the tenth straight quarter.

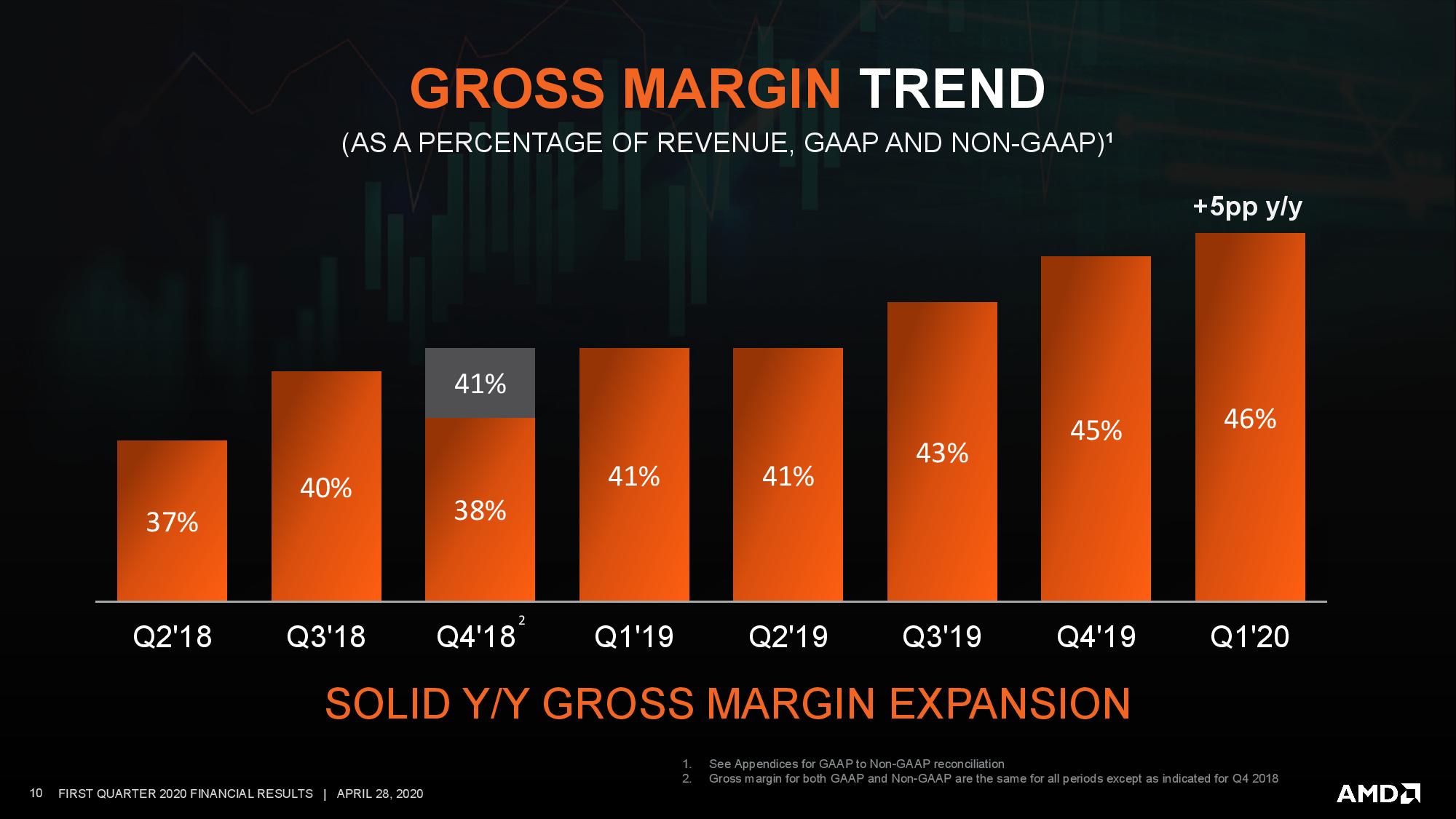

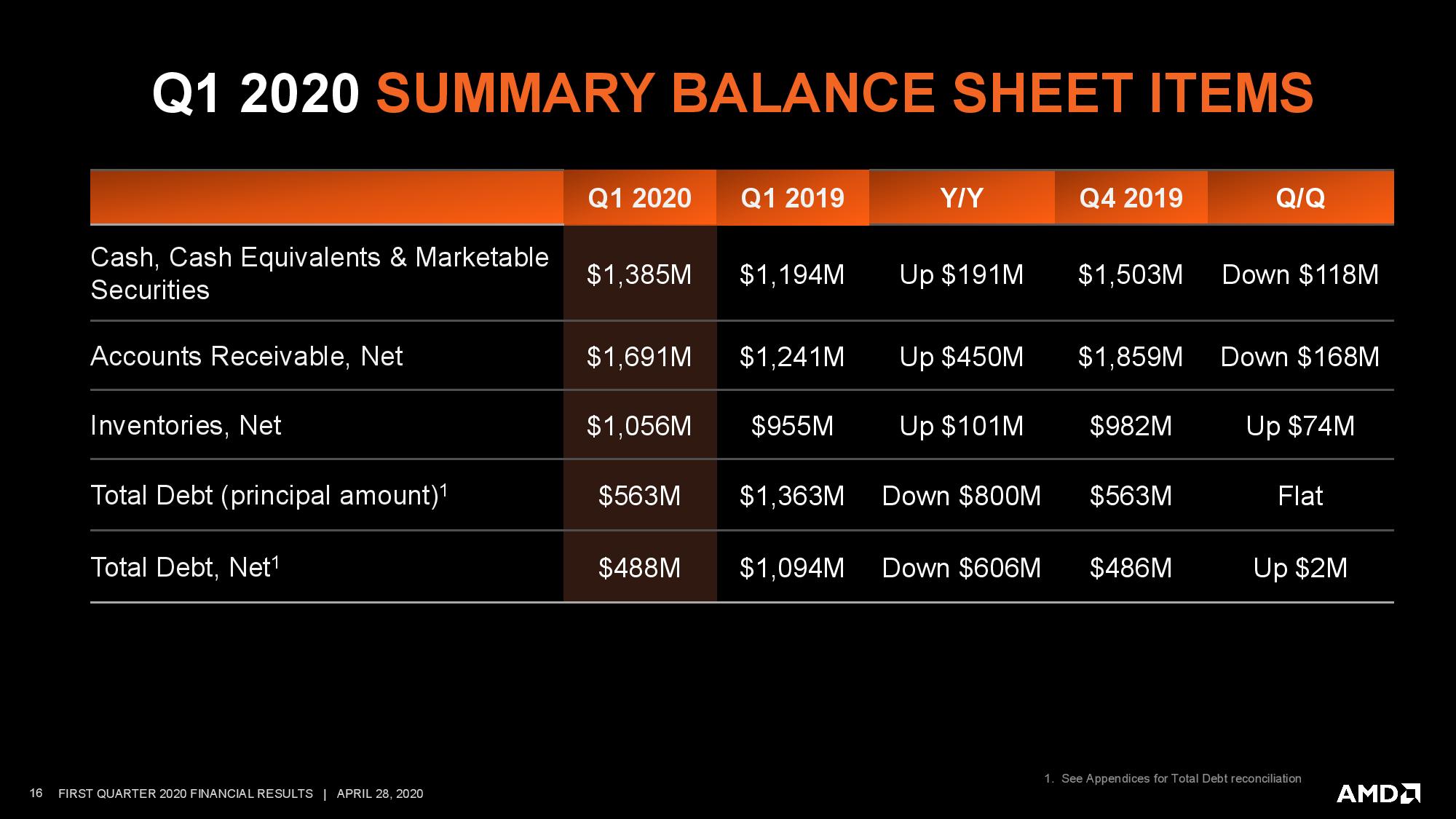

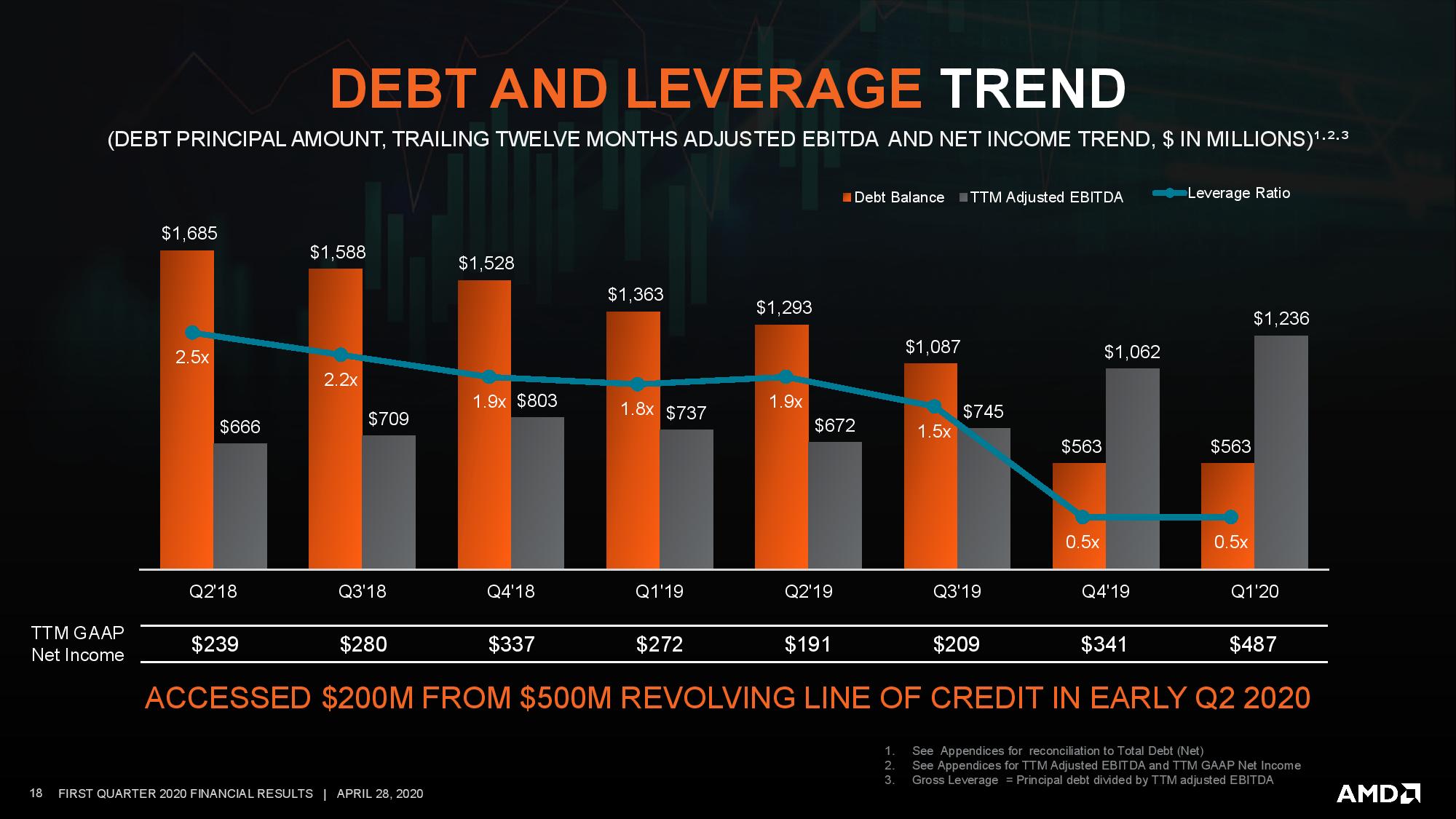

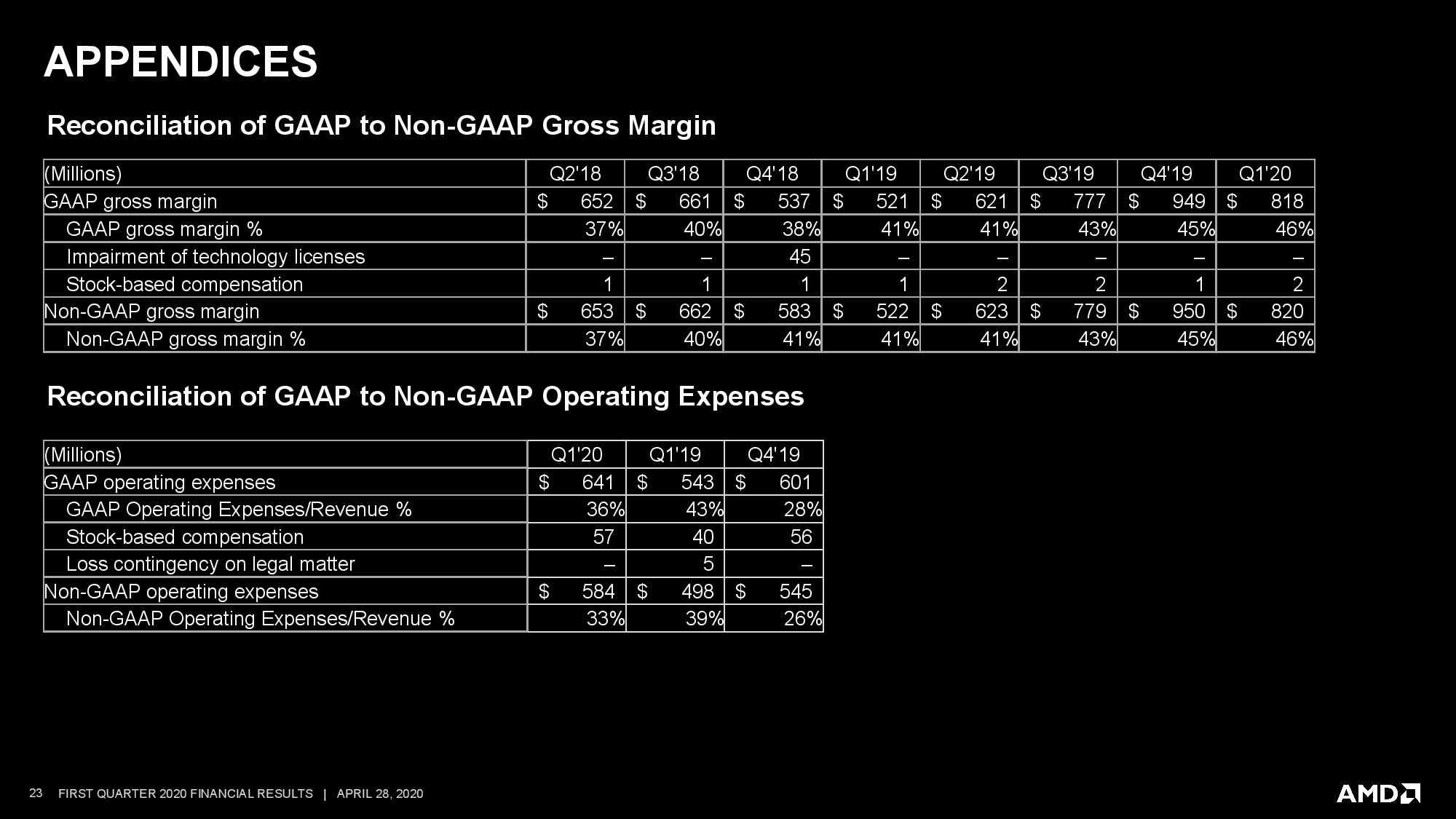

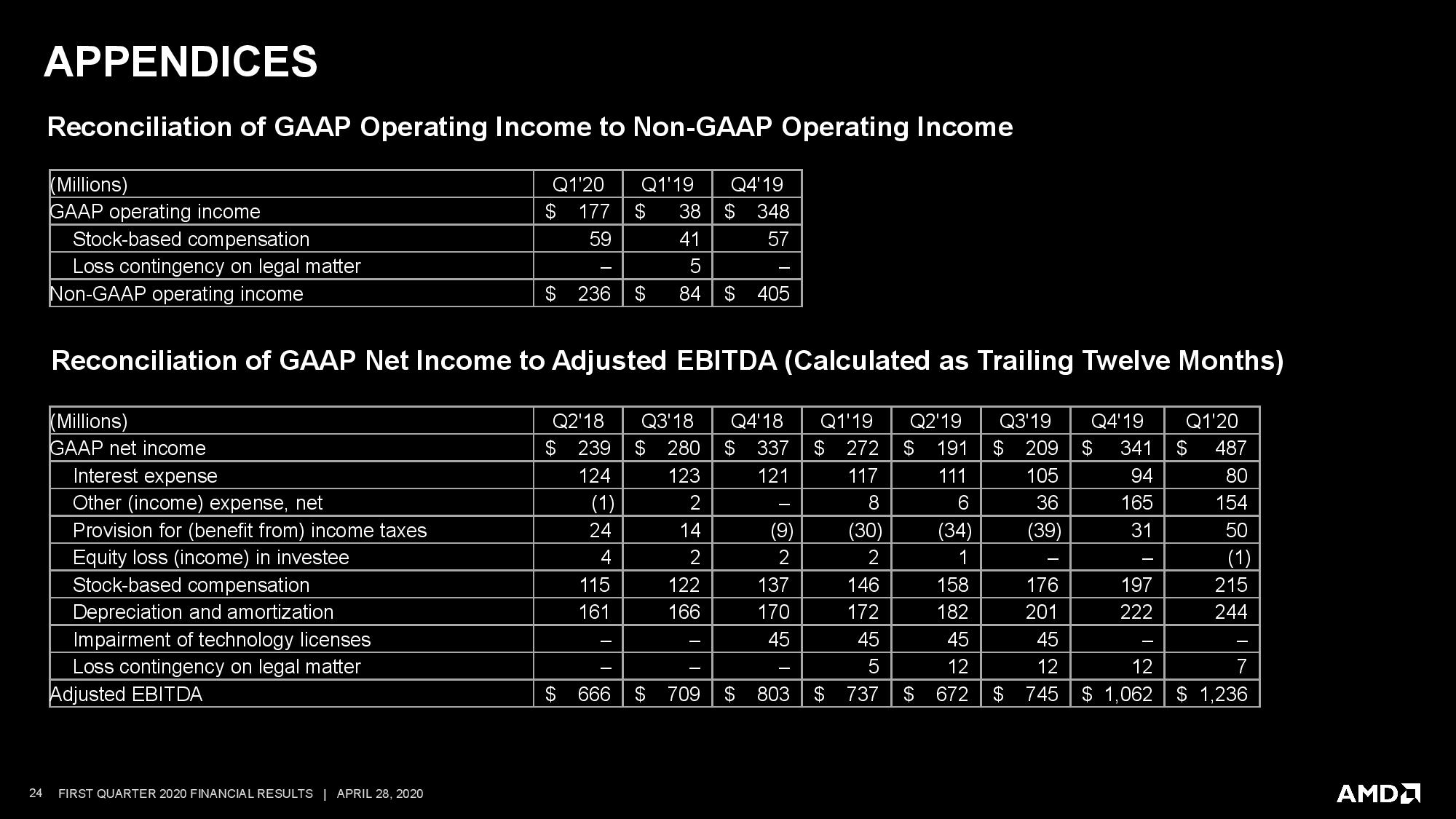

AMD also expanded its gross margins to 46%, the twelfth straight quarter of growth (and the highest mark in eight years). That equated to profits of $222 million in the quarter, a $160 million increase from the year prior, but a $161 quarterly decline.

AMD cited robust sales of its Ryzen and EPYC processors as key drivers for its increased margins, while graphics cards and custom silicon sales for consoles dragged on revenue.

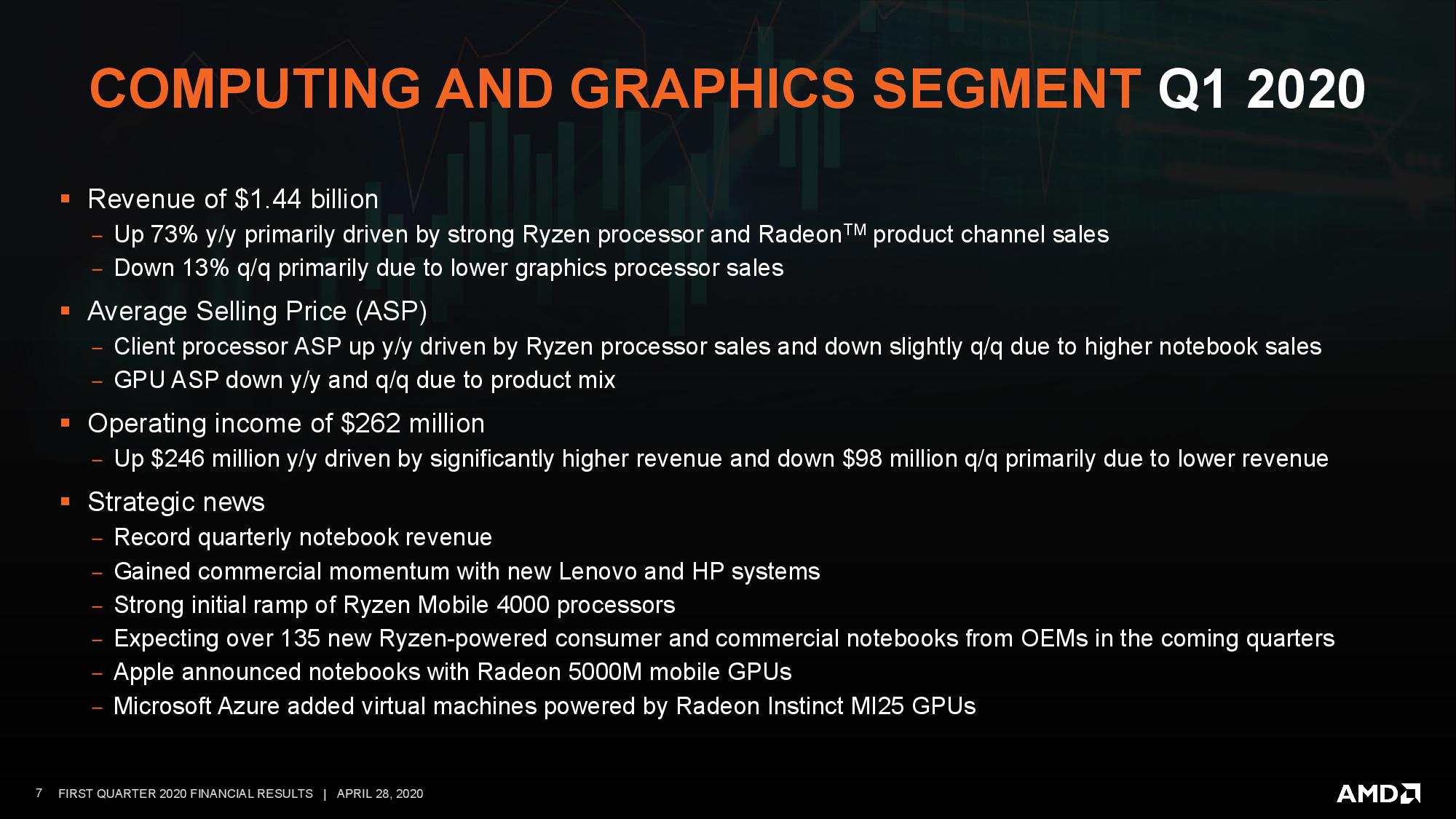

AMD's computing and graphics segment, which includes revenue for both consumer CPUs and GPUs, weighed in at $1.44 billion, a 73% year-over-year increase but 13% decline on the quarter. AMD cited lower graphics sales and lower GPU average selling prices (ASPs) due to a shifting product mix.

Su cited weakness in China during the quarter due to closed retail shops, saying "PC demand in the rest of the world was strong, offsetting the softness in China. Client processor revenue grew significantly year-over-year as strong Ryzen processor demand resulted in significant double-digit percentage increases in unit shipments and ASP. As a result, we believe we gained client unit market share for the tenth straight quarter."

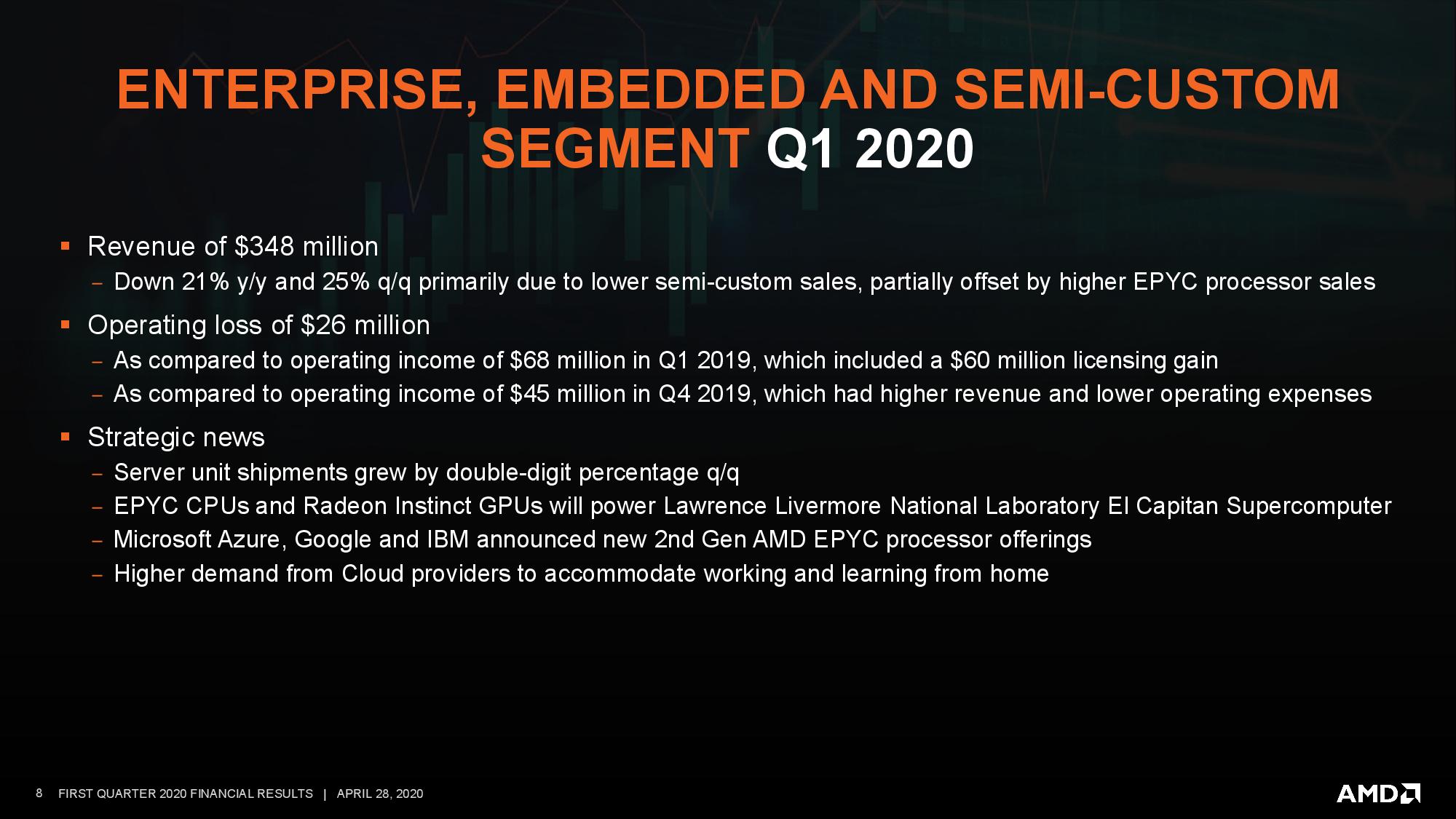

AMD's Enterprise, Embedded and Semi-Custom segment, responsible for both the EPYC server and console chips, generated $1.44 billion, a 21% year-over-year decline. AMD chalked this up to lower sales into the console market, but Su said that increased EPYC Rome sales reduced the impact.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

In either case, the market's bullish prospects for AMD's EPYC Rome processors might be blunted by the lower revenue generation in this key segment. The unit posted a $26 million operating loss compared to an operating income of $45 million in the fourth quarter of 2019. AMD cited lower EPYC ASPs due to heightened cloud spending, but Intel's aggressive strategy of slashing pricing on its competing Cascade Lake Refresh processors might come into play. Intel's server unit (DCG) also recently posted a 42.7% year-over-year sales increase due to coronavirus-spurred demand.

However, AMD cited a double-digit sequential increase in EPYC server chip sales for a 3x year-over-year improvement, and Su maintained the company's position that it will reach double-digit market share by next quarter. AMD also expects its semi-custom revenue (i.e., console chip sales) to improve as it ramps for the PlayStation 5 and Xbox Series X launches later this year.

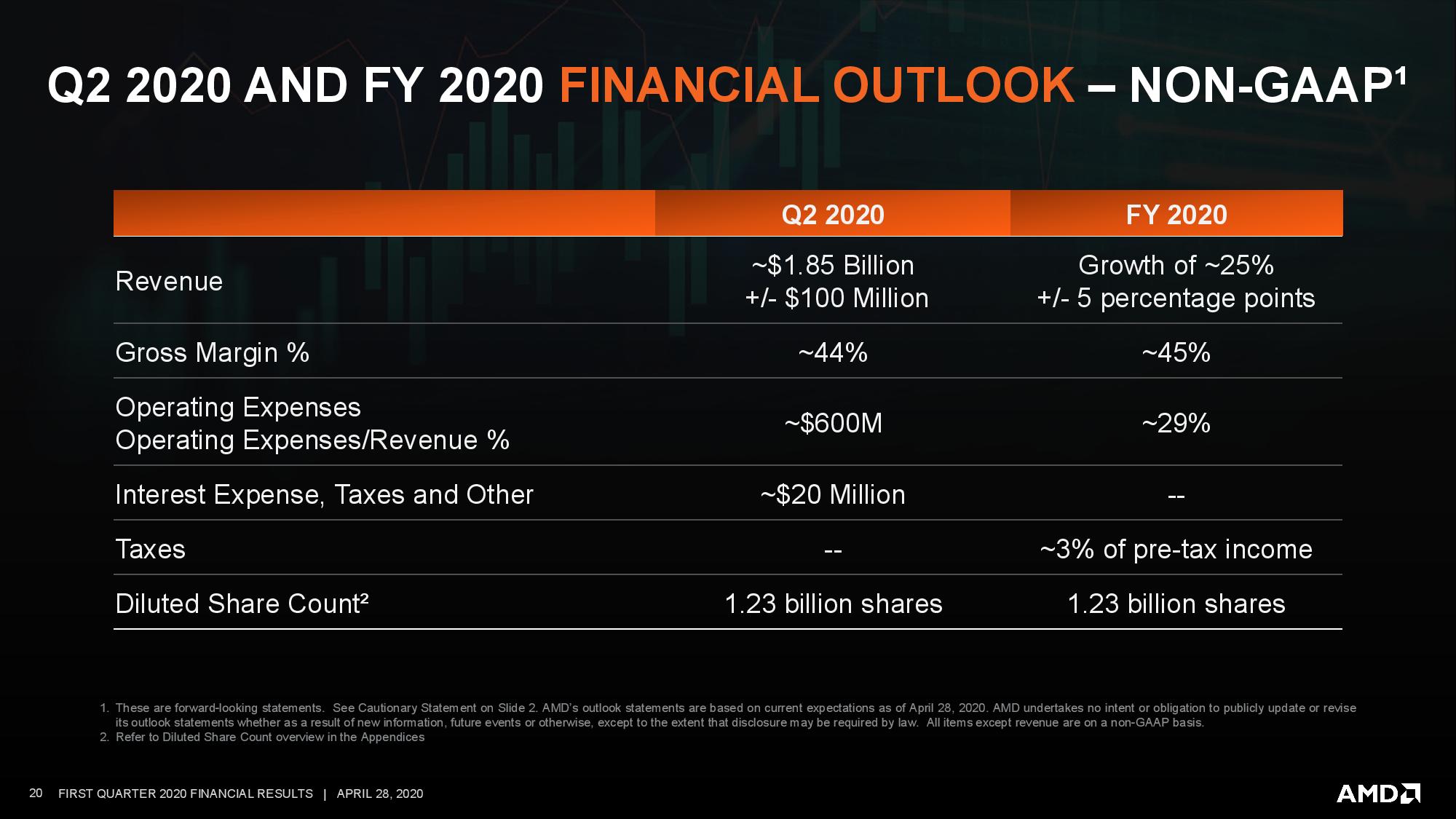

Unlike countless other companies this earnings season, AMD did guide for both next quarter and the remainder of the year, albeit with cautionary statements about uncertain demand during the coronavirus pandemic.

AMD predicts second-quarter revenue at $1.85B (plus or minus $100 million), a 21% YoY increase driven by Ryzen and EPYC sales, with a reduction in gross margin to 44%. For the full year, AMD projects YoY revenue growth of 25%, plus or minus 5% points. That's a slight reduction (~5%) compared to the company's previous projections, which it attributes to uncertain demand due to the pandemic. AMD's gross margin projections for the full year remain unchanged at 44%.

"While demand indicators across commercial, education and data center infrastructure markets are strong, we expect some softness in consumer demand in the second half of the year depending on how overall macro-economic conditions evolve." "We remain on track to launch our next-generation "Zen 3" CPUs and RDNA 2 GPUs in late 2020, and believe we can deliver another year of strong revenue growth and margin expansion based on the strength of our product portfolio and the diversity of markets we serve," Su said in her prepared remarks.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

refillable Can someone explain why gross margin is down? Are PS5/X1X chips selling really cheaply? I can only see client CPUs going up in margins with Renoir.Reply -

escksu Replyrefillable said:Can someone explain why gross margin is down? Are PS5/X1X chips selling really cheaply? I can only see client CPUs going up in margins with Renoir.

You saw the part about Intel slashing prices?? Yup. That also forces AMD to lower their prices which in turn lower gross margin.

AMD's market share for server is less than 10%. ITs not that easy to gain market share. Having a superior product alone is not enough. Most companies are still buying Intel servers today. Lots of reasons for this happening. -

vaughn2k The driver was really the capability of TSMC to go into smaller nodes from 14nm, now its 7nm. This made AMD went to top.Reply

If this happens 6 years ago, that TSMC's manufacturing process is on par with Intel, AMD would have made more better CPUs. -

refillable Reply

That's quite contradictory. Semi custom/server division only accounts for less than 20% of AMD's revenue, and that is still divided across the console, embedded and server revenue. Most of the money is still coming from the client segment, and I can only see margins going up there.escksu said:You saw the part about Intel slashing prices?? Yup. That also forces AMD to lower their prices which in turn lower gross margin.

AMD's market share for server is less than 10%. ITs not that easy to gain market share. Having a superior product alone is not enough. Most companies are still buying Intel servers today. Lots of reasons for this happening. -

TerryLaze Is Record Quarterly Revenue a euphemism for something?Reply

Revenue is down from last quarter so how is that a record?

Compared to the last year's 1st quarter revenue is way up but how does that translate into record,is it the best 1st quarter of any year that AMD had?That would be a record at least. -

mitch074 Reply

Probably the increased cost of 7nm over 14/12 nm and the impact the end of crypto mining had on GPU demand.refillable said:That's quite contradictory. Semi custom/server division only accounts for less than 20% of AMD's revenue, and that is still divided across the console, embedded and server revenue. Most of the money is still coming from the client segment, and I can only see margins going up there. -

st379 Amd cpu are great but I am reading a lot of complains about their gpu drivers.Reply

Maybe it hurts their sale numbers.

Nvidia prices and performence are pretty close.

I chose ryzen 5 3600 with gtx 1660 ti.

I am not a beta tester. -

thGe17 Replyrefillable said:Can someone explain why gross margin is down? Are PS5/X1X chips selling really cheaply? I can only see client CPUs going up in margins with Renoir.

Why is gross marging going down? It has increased constantly from 1Q19 to 1Q20 from 41 % to now 46 % (over all).

Additionally the new console SoCs are currently not within balance sheets. AMD said last year, that (only a small portion) will be seen as of 2Q20 and major revenue (generated by these SoCs) will affect financial numbers starting as of 3Q20.

Currently, still declining old SoC production/requirements are reducing the Enterprise, Embedded and Semi-Custom segment. The interesting part here is, that AMD says, that "lower semi-custom sales " are "partially offset by higher EPYC processor sales", which means, that their over-all Epyc sales are still quiet small. -

King_V ReplyTerryLaze said:Is Record Quarterly Revenue a euphemism for something?

Revenue is down from last quarter so how is that a record?

Compared to the last year's 1st quarter revenue is way up but how does that translate into record,is it the best 1st quarter of any year that AMD had?That would be a record at least.

You clearly HAD to have read the first sentence, and not just the headline. So, did you mentally tune out certain parts of the first sentence just to be able to make your post?

Amidst the turbulent waters of the coronavirus pandemic, AMD posted record first-quarter 2020 revenue as the company raked in $1.79B in revenue, a 40% year-over-year increase, but 16% decline from the prior quarter.

Points that make it clear are emphasized. -

TerryLaze Reply

You only made my point even clearer, it's not a record quarter it's a record first quarter of the year...clickbait to withhold that part.King_V said:You clearly HAD to have read the first sentence, and not just the headline. So, did you mentally tune out certain parts of the first sentence just to be able to make your post?

Points that make it clear are emphasized.