Intel Earnings: 10nm+ Tiger Lake Arrives Mid-Year, Company Withdraws Guidance

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

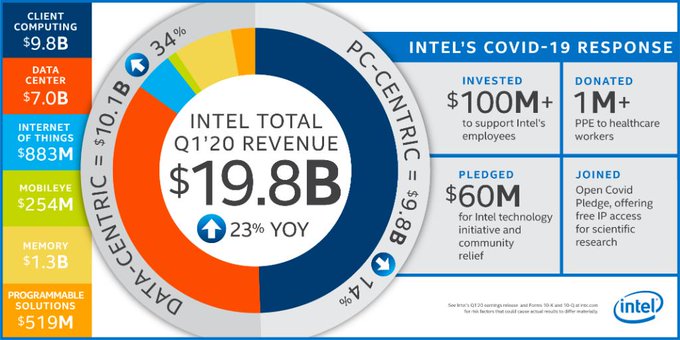

Intel released its quarterly earnings today with an unexpected bit of good news for the chipmaker: It plans to release its 10nm+ Tiger Lake chips in the middle of 2020. The company also weathered the opening stages of the coronavirus pandemic with surprisingly robust results as it notched another blowout quarter.

The world truly needs silicon more now than ever. In fact, that's one of the few certainties as a large portion of the global population remains sequestered and adjusts to the realities of remote work during an unprecedented pandemic. Given that Intel claims its silicon runs 95% of the world's internet communications and governmental infrastructure, we'd expect the massive societal shift to benefit the chipmaker, at least in the short term.

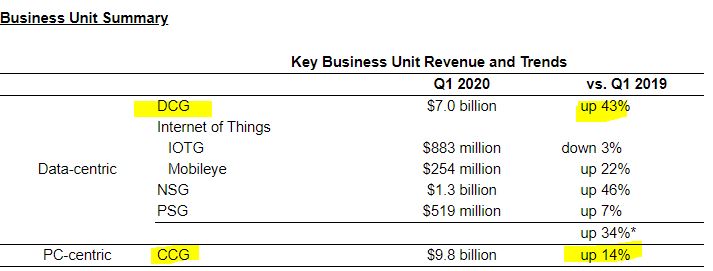

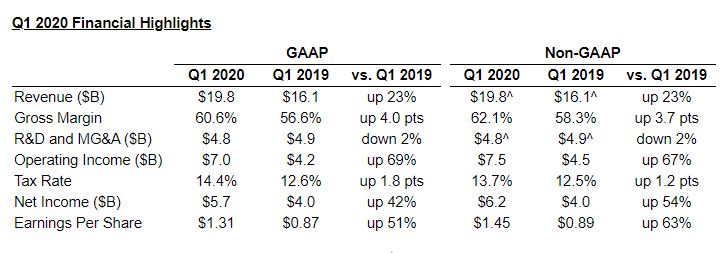

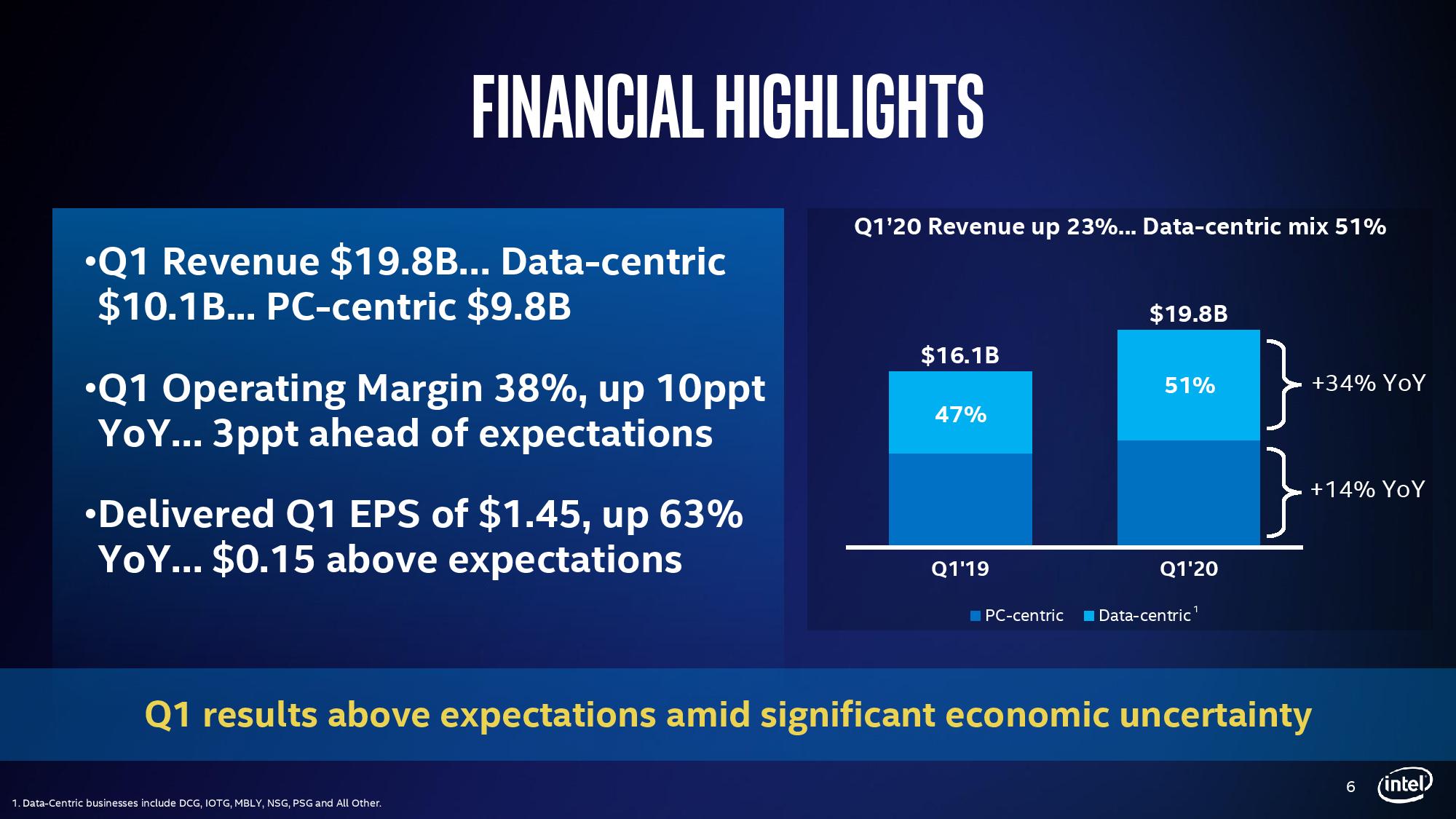

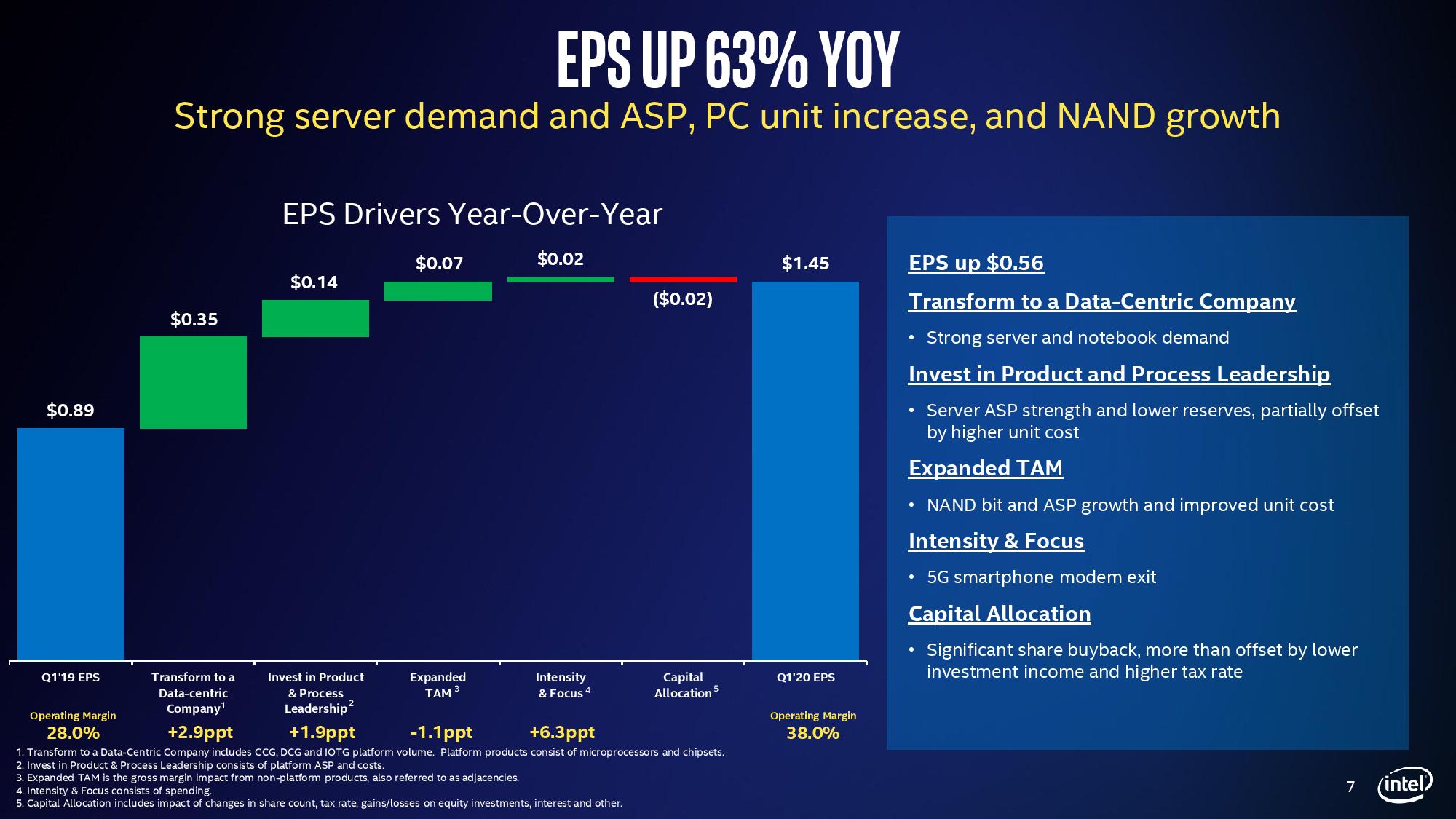

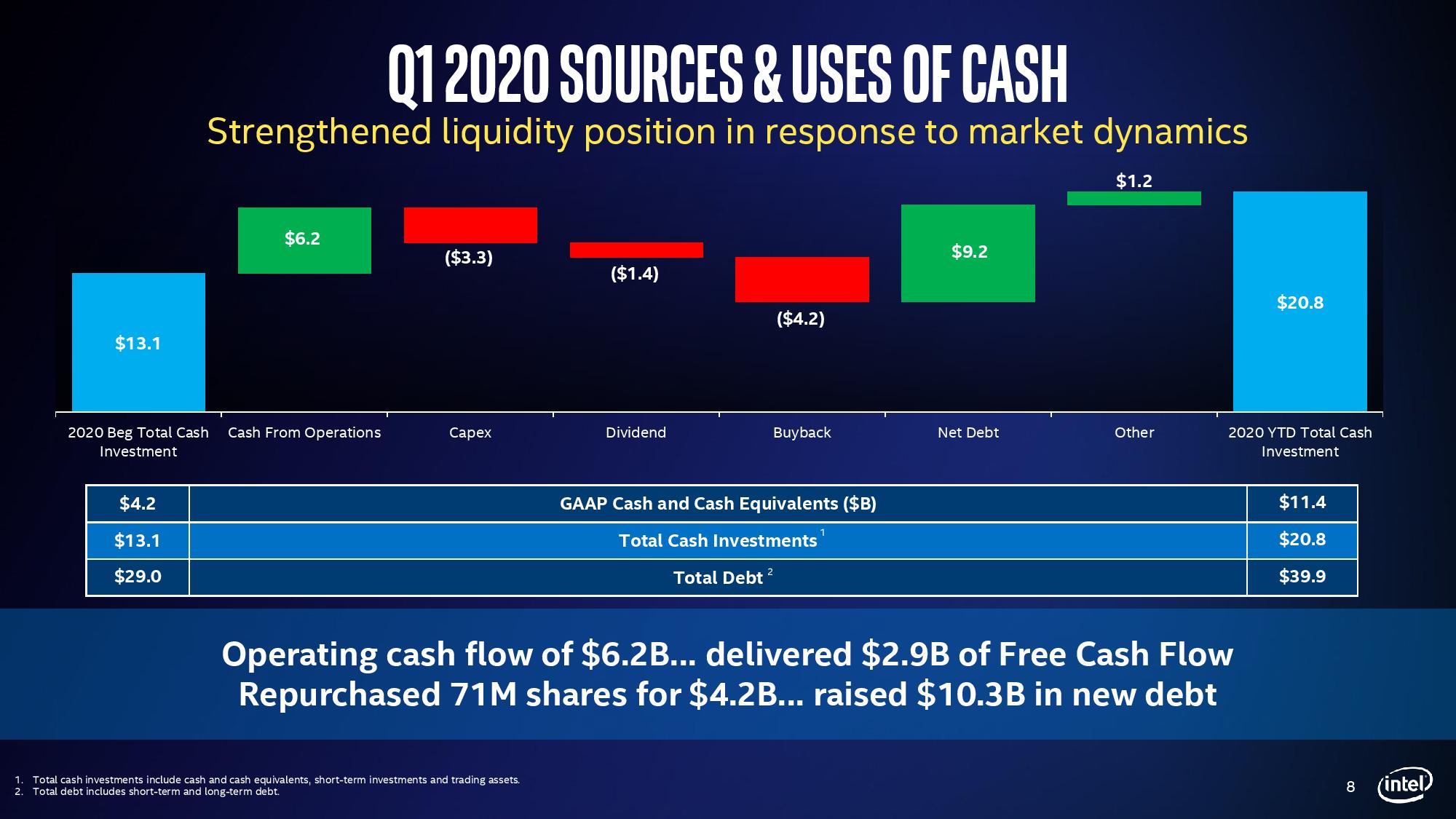

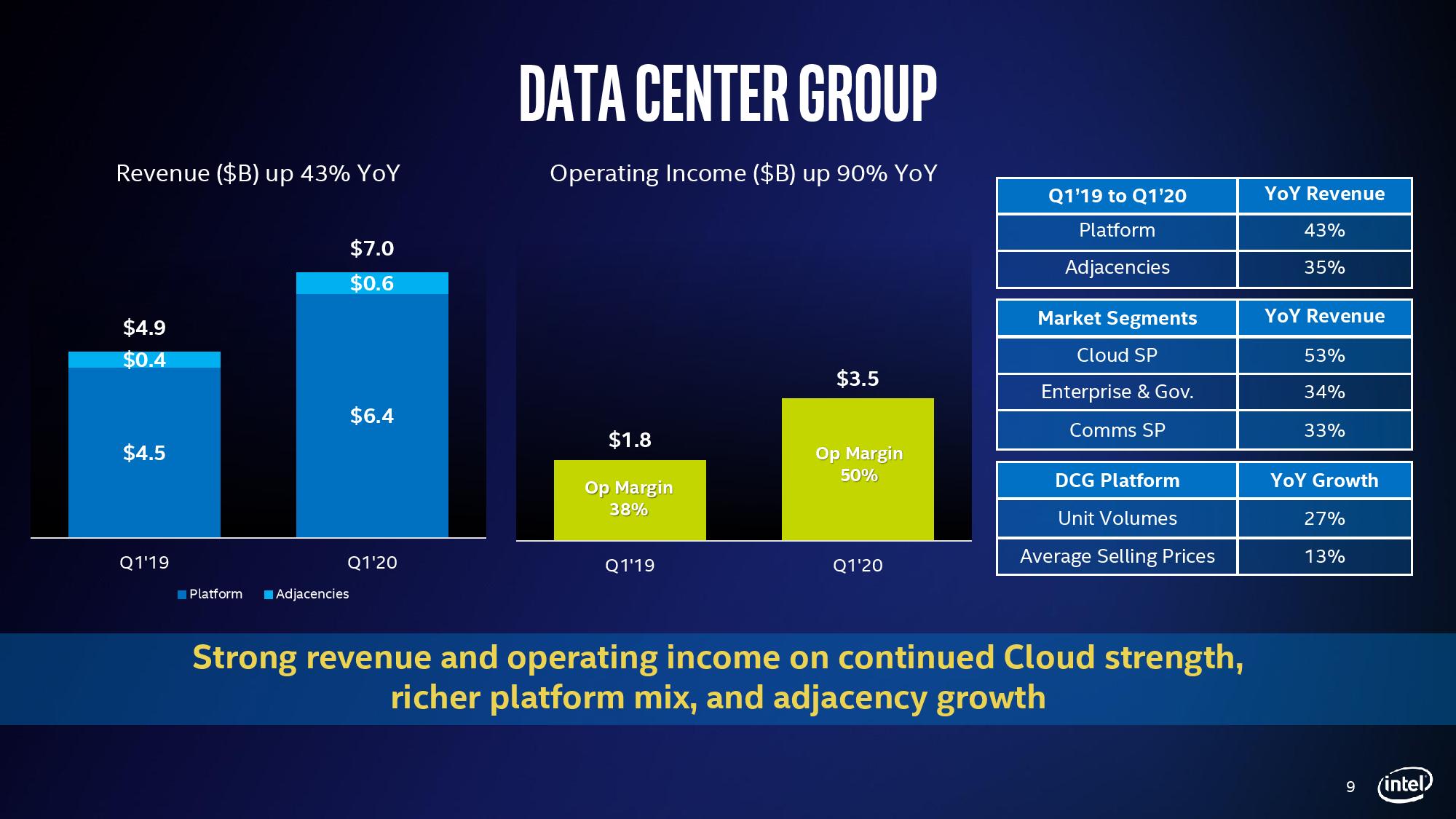

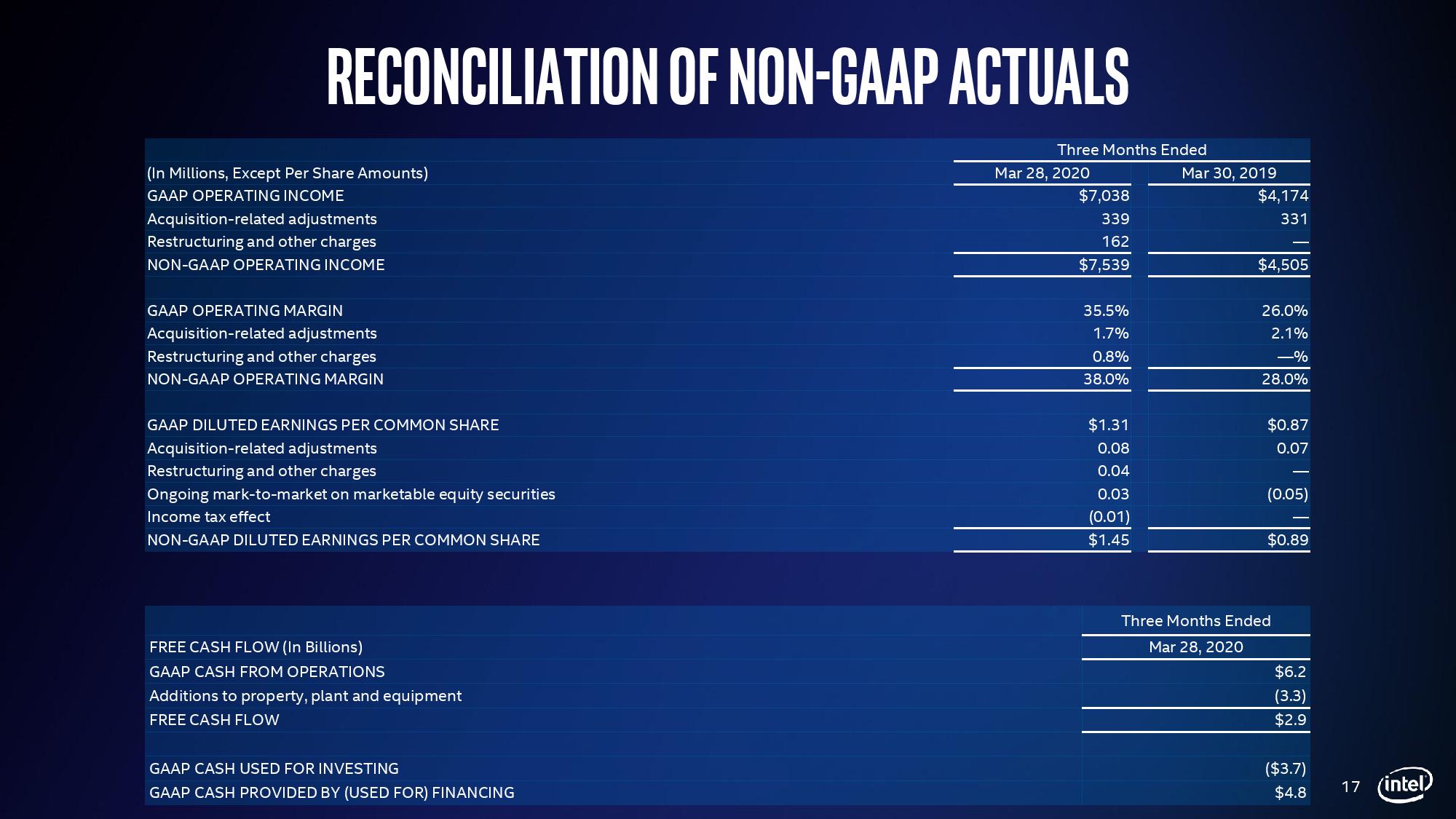

According to the company's first-quarter 2020 financial results, the pandemic did just that. Intel raked in $5.7 billion in Q1 profit, a whopping 42% year-over-year increase propelled by a 23% quarterly revenue increase to $19.3B. As expected, Intel's cloud and communications businesses benefited the most with huge gains of 50% and 30% year-over-year, respectively. Intel's PC sales also registered a 15% uptick, largely driven by a 13% YoY increase in notebook sales. Intel expects the notebook momentum to carry over into the next quarter, too.

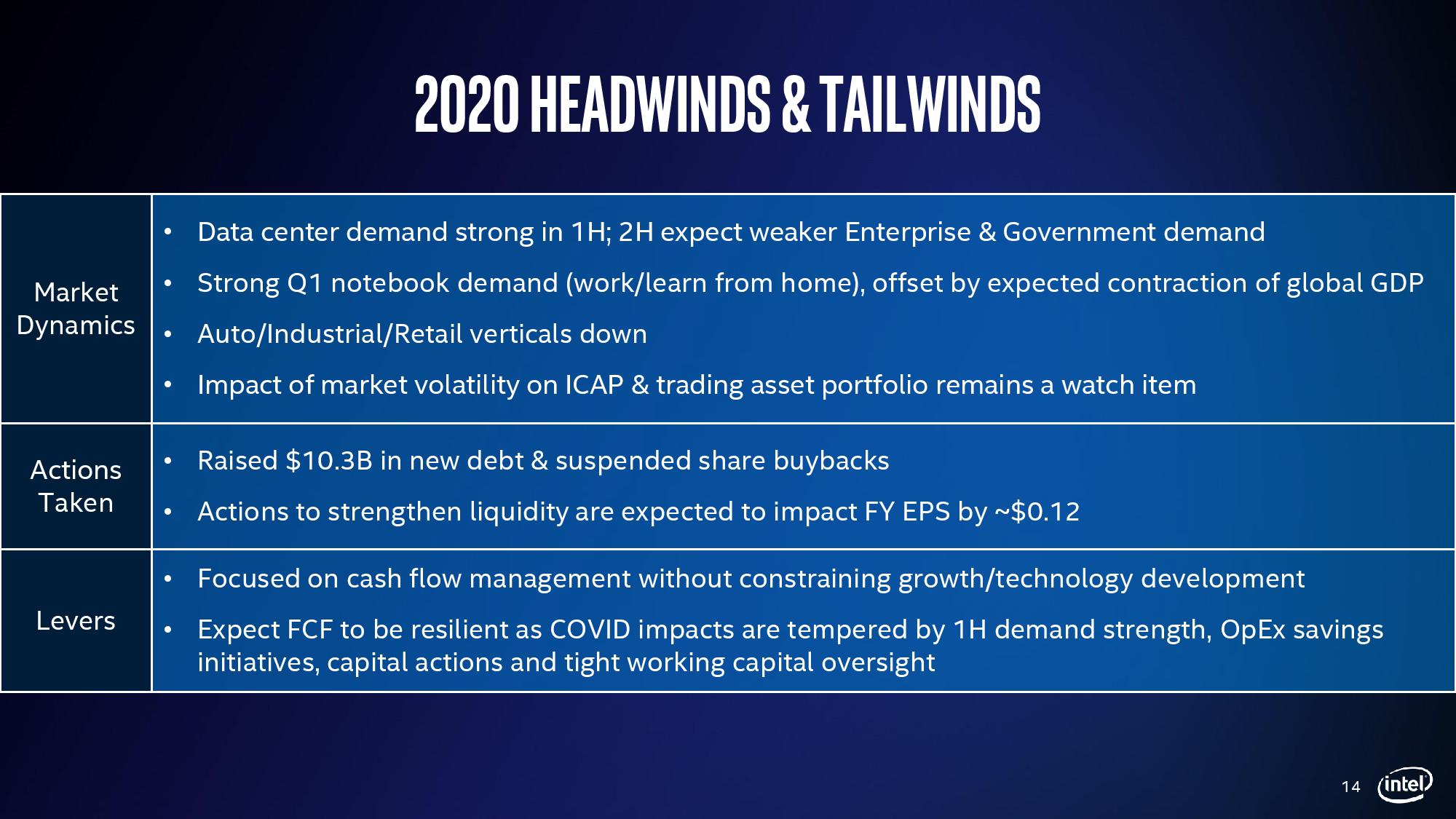

But the uncertainty of these times weighs heavy as, like countless other companies, Intel's decision to effectively withdraw its full-year guidance portends potential disruptions to its business as the pandemic deepens. Bloomberg's explosive report today that Apple will shift to producing its own 5nm chips for laptops also hung thick in the air, with both factors contributing to Intel's stock taking a 5% hit in after-hours trading.

However, amid these uncertain times, another certainty remains: Forward progress is paramount. For Intel, as with any other semiconductor manufacturer, that means moving down to the next, smaller process node.

Intel's woes moving to the 10nm node have caused it considerable pain over the last several years, but the company announced it would release its 10nm+ Tiger Lake processors in the middle of this year. Intel CEO Bob Swan pointed out that the company sees early signs of rapid uptake with OEMs as they prepare more than 50 Tiger Lake-based designs for the holiday season. That number pales in comparison to AMD's projections for 150 designs this year based on its disruptive 7nm Renoir chips. In either case, the Tiger Lake lineup will likely serve to bolster Intel's already-expansive portfolio of Comet Lake systems, so it's hard to make a direct comparison.

Tellingly, Intel cited that its Tiger Lake roster of designs is already 40% larger than its previous-gen Ice Lake platform at the same point in the rollout. Compared to the Ice Lake launch, the company has also amassed twice the number of Tiger Lake pre-qualification chips in reserve as it braces for robust demand from OEMs. Intel also said its 10nm Ice Lake server chips are already sampling and remain on track for release in the second half of 2020.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Intel says its 7nm chips remain on the starting blocks for the fourth quarter of 2021. Despite the Tiger Lake and Ice Lake rollouts, the company doesn't foresee its 10nm production overtaking its 14nm output this year, and even stated that 14nm would remain its dominant node throughout 2021, which isn't surprising given its earlier statements. That means that the 10nm node could go down in the annals of Intel history as its least productive node.

Intel noted that it continues to have a 90% on-time delivery rate, in part due to planning from its seasoned Pandemic Team. Although there have been "some" construction delays due to coronavirus quarantines, it doesn't expect significant disruptions to its roadmaps.

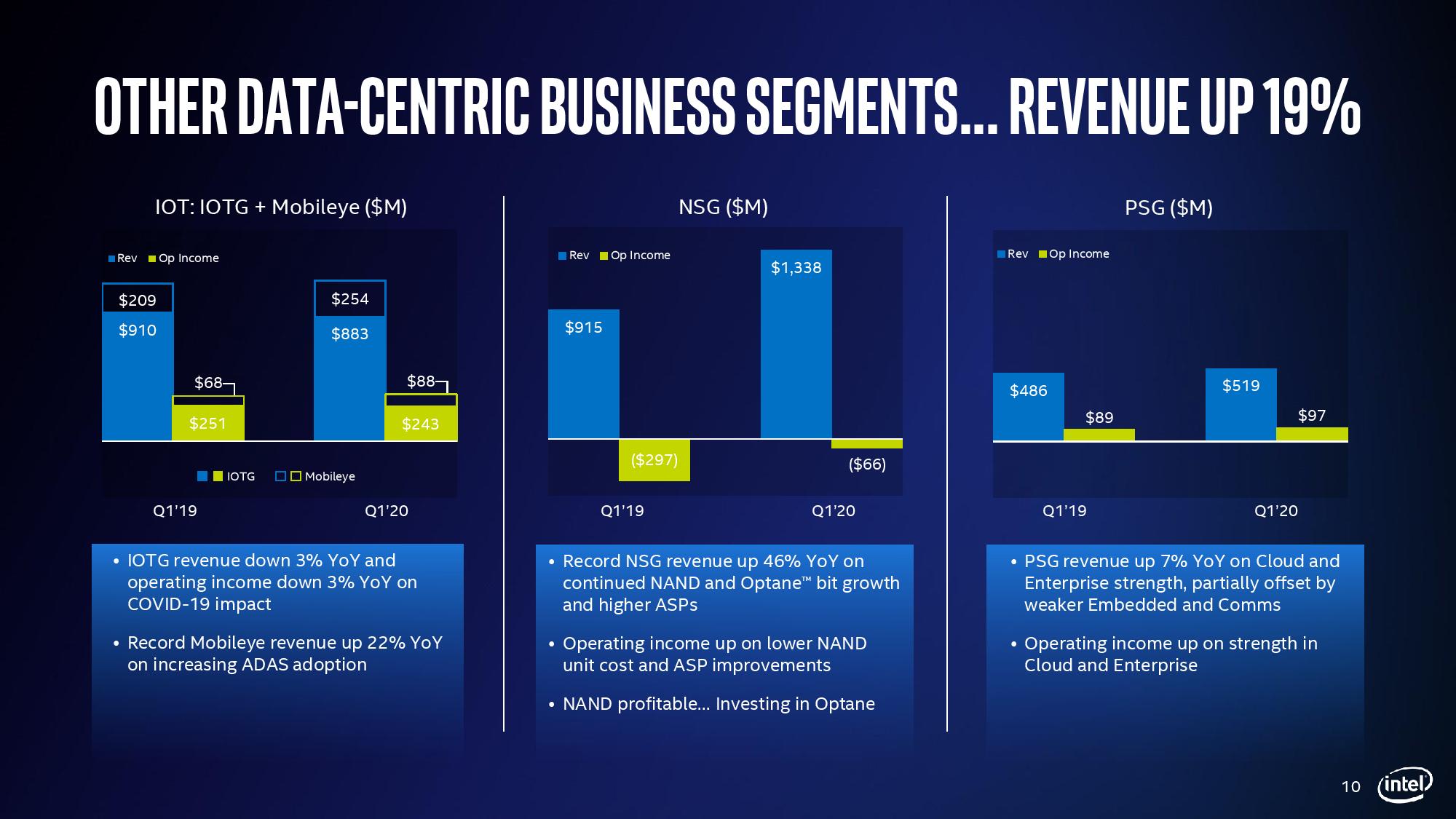

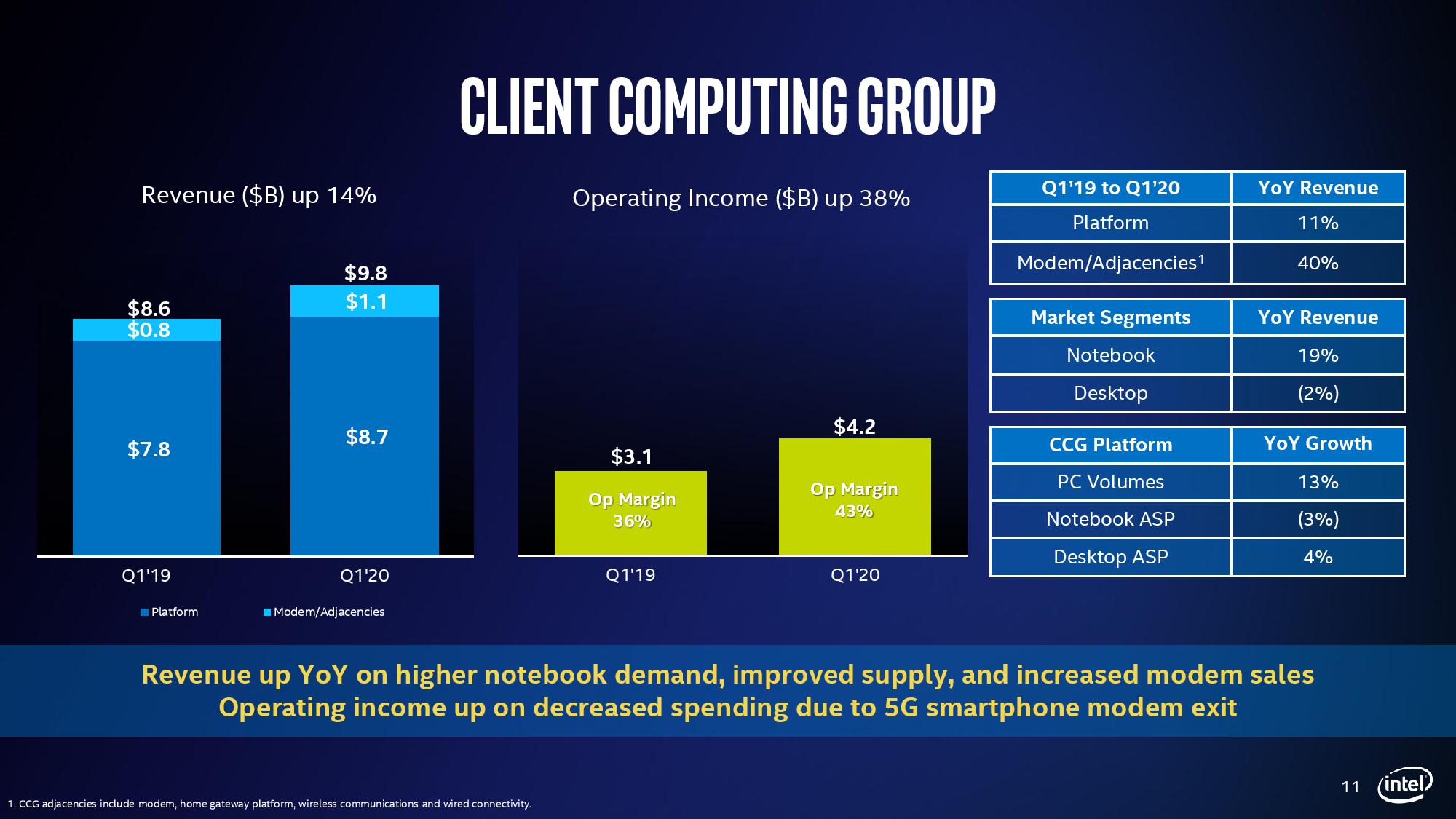

For the quarter, Intel's PC business (CCG) notched $9.8 billion in revenue, a 14% YoY increase. Its data center group (DCG) also put up strong performance with $6.99 billion in revenue, a whopping 42.7% YoY increase, and its storage and memory arm (NSG) jumped 46% to $1.38 billion. Gross margins also came in unexpectedly high at 62%.

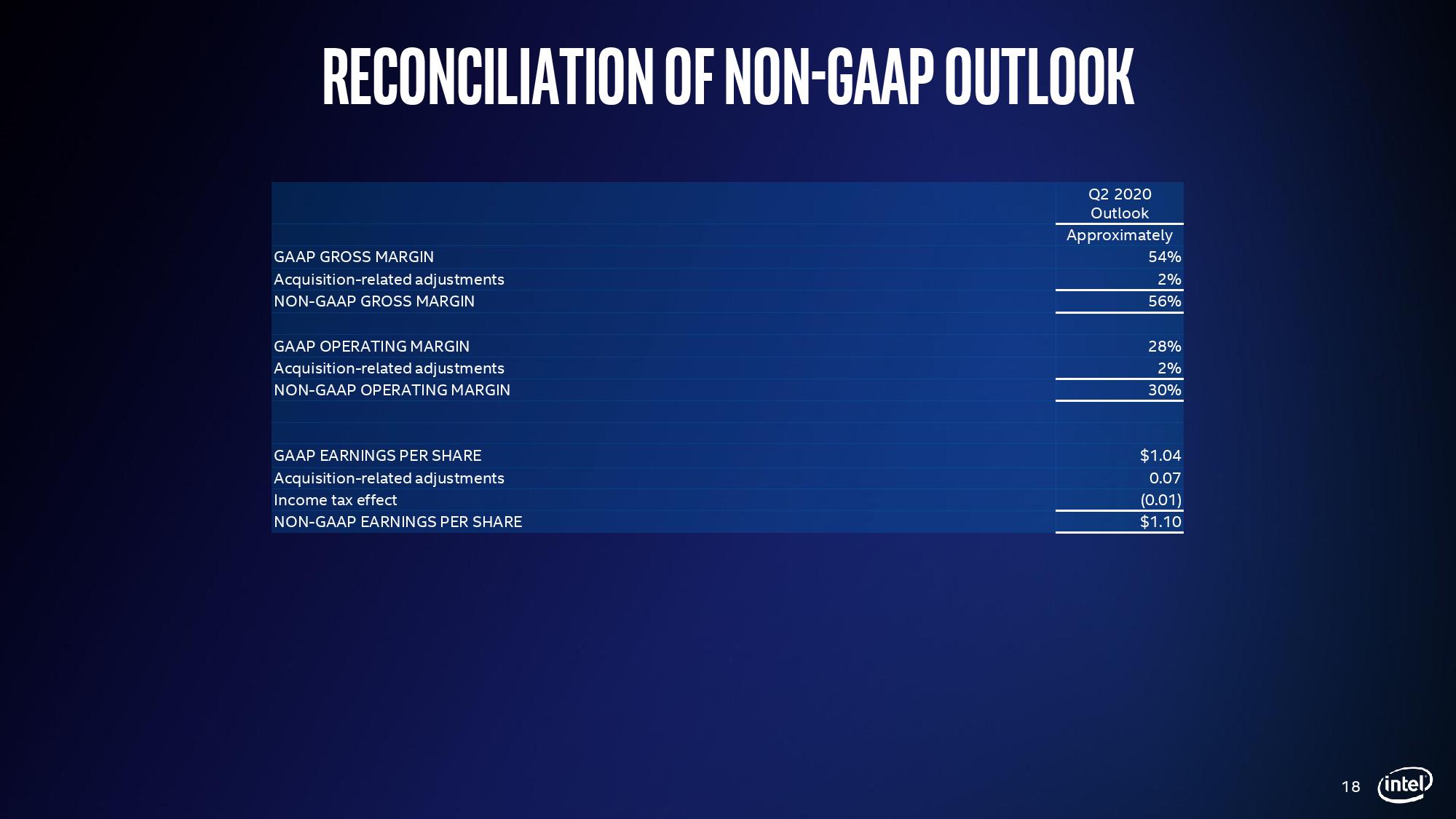

The company did share Q2 guidance, projecting that PCs will be flat to slightly up while data center will enjoy a 35% YoY increase in the quarter. Intel guided for $18.5B in the second quarter, beating expectations of $17.79B.

However, Intel expects its desktop PC, enterprise, government, and automotive segments to recede in the latter half of the year, so it didn't provide full-year guidance due to uncertainties around a global demand slump. Intel says it has already seen declines in its IOTG, industrial, retail and automotive segments and expects some of the initial quarantine-spurred demand to cool in the second half, with a global recession impacting PC sales along with enterprise and government segments.

In spite of the looming challenges, Intel CEO Bob Swan struck a note of resolve as he cited a famous quote from former CEO Andy Grove, "Bad companies are destroyed by crises; good companies survive them; great companies are improved by them."

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

watzupken I feel the surge in data centers and laptop revenue is largely due to the sudden need to spruce up work from home capabilities due to COVID 19. At least its clear for laptops where people are snapping up the affordable ones so that its easier for 2 or more to work/ study from home. I suspect the demand will weaken for the rest of the year.Reply -

InvalidError Reply

While there is no doubt that covid-19 will have bumped sales from work-from-home needs, you also need to keep in mind that Intel was already on back-orders going into "covid season" so Intel's sales would likely have been even better without the supply chain disruptions.watzupken said:I feel the surge in data centers and laptop revenue is largely due to the sudden need to spruce up work from home capabilities due to COVID 19. -

Deicidium369 Reply

Pauladmin said:Intel announces its 10nm+ Tiger Lake will land in the middle of the year.

Intel Earnings: 10nm+ Tiger Lake Arrives Mid-Year, Company Withdraws Guidance : Read more

who cares how many "projected" designs AMD has - still will be less than Intel - and think about the Intel designs - they will sell rather than rotting on the shelves... Will bet you they have more REAL designs and not "Projected" designs...

Still waiting on this DESTRUCTION of Intel by AMD... -

Deicidium369 Reply

Agreed there, probably a little soft, would expect Q2InvalidError said:While there is no doubt that covid-19 will have bumped sales from work-from-home needs, you also need to keep in mind that Intel was already on back-orders going into "covid season" so Intel's sales would likely have been even better without the supply chain disruptions.

Upgrading data centers is not something that happens in fits and spurts - it is a continual process - whether ppl work from home or at the office - they are still using the same data center equip - MAYBE the VPNs boxes were upgraded or increased licenses.watzupken said:I feel the surge in data centers and laptop revenue is largely due to the sudden need to spruce up work from home capabilities due to COVID 19. At least its clear for laptops where people are snapping up the affordable ones so that its easier for 2 or more to work/ study from home. I suspect the demand will weaken for the rest of the year.

I have 65 people now working from home, rather than at the office - we had started to order the Palo Alto Networks end points, got the hardware really really quickly - took almost 2 weeks to get the licenses to allow them to start being provisioned and deployed. -

everettfsargent So, since I'm the stupidest person in the world, I'll ask, once again, my stupidest question ever. When will Intel release desktop (or higher HEDT, workstation or server) silicon that has TPW north of 60W and at any process node that is less then 14nm? AFAIK, it would appear to be sometime this decade, century or millennia.Reply

Is there some sort of bookie accepting bets for a given year in this decade? I'm thinking February 22, 2022. -

TerryLaze Reply

Certainly not for as long as they have one record quarter after the other selling 14nm,there is no company in the world that would be that stupid.everettfsargent said:So, since I'm the stupidest person in the world, I'll ask, once again, my stupidest question ever. When will Intel release desktop (or higher HEDT, workstation or server) silicon that has TPW north of 60W and at any process node that is less then 14nm? -

Deicidium369 Reply

I at one time was an Intel HEDT user - Socket 2011v3. When I was building desktop systems for my engineers - i looked into the socket 2066 CPUs and decided to spec dual socket Supermicro Socket 3647 systems. Installed a single 28 core Xeon Platinum and 512GB of DDR4 ECC as well as an RTX6000.everettfsargent said:So, since I'm the stupidest person in the world, I'll ask, once again, my stupidest question ever. When will Intel release desktop (or higher HEDT, workstation or server) silicon that has TPW north of 60W and at any process node that is less then 14nm? AFAIK, it would appear to be sometime this decade, century or millennia.

Is there some sort of bookie accepting bets for a given year in this decade? I'm thinking February 22, 2022.

The Xeon Scalable had processors to fit whatever use case, and had the advantage of more memory channels and a BMC. Did try out a Threadripper, but with no ISV optimizations, and it's janky memory controller, it was a joke. At the time my workflow look like this

AutoCAD, Autodesk PowerMill, Dassault Solidworks, Dassault CATIA, Siemens NX, couple of other Dassault programs and for simulation Ansys.

AutoCAD didn't need optimizations, but Solid Works, CATIA and Ansys did and performance on the AMD system suffered significantly.

Since then we have moved over to Creo.

So really, the HEDT market can be addressed by the i9900K and assuming the 8 and 10 core Comet Lake on the lower end and Xeon on the higher end. So to me, there isn't really an HEDT segment anymore. Once again, AMD shooting where the market WAS rather than where it will BE.

And since you are the stupidest person in world - YOUR WORDS

Mid year Tiger Lake will drop - 10nm+ Willow Cove cores (2nd gen) and the Gen12 graphics which are first to be branded Xe. This is Xe LP. They are talking about systems for the holidays - Ice Lake started shipping in volume to OEMs in May 2019. Looks like Tiger Lake will start shipping about the same time to OEMs - I bought my Dell 13 2-in-1 with Ice Lake in October - would expect to see Tiger Lake available in October as well - and hopefully the NUC11 around the same time.

3rd quarter 10nm+ Ice Lake Xeon with upto 38 cores drops - this is for single and dual sockets in the Whitley platform (new chipset, new socket, PCIe4) and the 14nm Cooper Lake (with bfloat16 for AI) will use the same platform, but will only be 4 and 8 socket. 2 very different workloads.

Later this year Rocket Lake-S drops - 14nm but with Willow Cove cores and a cut down Xe compared to Tiger Lake. Vastly improved IPC (1st gen Ice Lake Golden Cove IPC was increased 30%+ and the 2nd gen Willow Cove would likely see a similar increase over IPC on Ice Lake) So new cores, architecture, PCIe4 running on frequency optimized 14nm - so 4Ghz minimum desktop CPU - the last 14nm Desktop flagship - and the first not to be based on Skylake. Z490 boards already shown - socket 1200 for Comet Lake, and Z590 for Rocket Lake/PCIe4.

Sorry Later this year - not 2022 - that would be when the full production Intel 7nm (equiv to TSMC 3-4nm) will drop with the Ponte Vecchio Xe and Saphire Rapids Xeon. PCIe5 + DDR5.

Intel has had ONE single stumble in it's lifetime and all of a sudden they are incompetent - yet TSMC has been the opposite - FINALLY getting a node right, and they can do no wrong. You kiddies have a very limited understanding of the history of Intel and AMD / Global Foundry (before having to sell its manufacturing arm, because they could not afford to plow the money into creating new/next node, and needed to keep the lights on - Core had dropped around this time, obliterating AMD for more than a decade) And AMD has been "destroying" Intel for several decades now - and yet somehow this "destruction" leads to record quarter after record quarter. -

Deicidium369 Reply

They do not understand business. IF that 14nm process was at TSMC the first + would have made it 13nm and the 2nd + 11nm and would be labeled as 10nm in it's current form. Intel doesn't care - doesn't need to impress Apple or AMD or Nvidia... so the heavy marketing about "7nm" (really 10nm class) isn't necessary.TerryLaze said:Certainly not for as long as they have one record quarter after the other selling 14nm,there is no company in the world that would be that stupid.

Intel knows what the market wants - they have deep ties to the OEMs, and seems as though they are fine with Intel's 14nm and will happily build systems based on the 10nm stuff as well. When Ice Lake Xeon is released, PCIe4 will finally go mainstream and in high volume.

I love it when they start to talk stock prices - and you have to explain P/E ratios and how AMD has one of the highest at 160x (higher is NOT better or stronger) and the market average is 16x and Intel is 12x. IF AMD stock price was calculated at 16x *industry average) then it's stock price would be $5 not $50. -

mitch074 First generation Ryzen and threadripper were quirky, that's for sure. Had Intel answered then, no one would have cared for AMD outside of console space.Reply

Intel tacked a couple cores to their existing lineup, and got hit with Meltdown and Spectre.

Then AMD solved most of the problems of first gen Ryzen with BIOS updates (including Spectre) and solved the rest with second gen (Zen+) and 12nm (which is very much like 14nm+++)

Intel answered by taking a couple more cores to they existing lineup, people started saying that Intel wasn't doing much.

Now AMD put third gen Ryzen out - and this time they double the amount of cores overnight, go to 7nm (which is very much like Intel's unusable 10nm), get the IPC crown, the performance per watt crown, the price per core crown, on their whole lineup including ones Intel can't hit (64 cores per package) so much so that industry leaders have to revise their licensing models...

Intel's answer is to activate smt on their lower tier stack.

For the first time since x86-64 came out, Intel is again a follower instead of a leader. That always hurts in high tech.

You can say what you want, nowadays the best performing HEDT machine has a 64-core AMD CPU in it and uses PCI-E 4 NVMe. You can't have that with Intel. -

everettfsargent Since we all seem to be discussing vaporware CPU's, what if AMD releases a 5nm chiplet this year? Say like a 4950X with 32 cores (64 threads) running at 4.5 GHz all core turbo for an MSRP of ~$750US.Reply

Oh and this is Intel's 2nd stumble, they are repeating their Pentium GHz at all costs back when AMD released the Opteron or some such. Again, I know that I am the most stupidest person ever on this planet, but for all intents and purposes, heat dissipation below the 14nm node is Intel's main problem, no chiplets to spread that heat and so 5+ years to a so-called real 10mn desktop node that will forever run slower then there 14++-++-++ node.

2nd stupidest question ever asked by the most stupidest person ever on this planet. Will Intel ever release a CPU smaller then the 14mn node that has a top all core turbo speed over 5.3GHz with 12+ cores? In other words, can Intel defy/defeat the conservation laws of thermodynamics? Meaning something that does not requite LNG as in a 247 DIY desktop or some such.

Right now, chiplet CPU's appear to be such a no brainer.