Intel posts flat year-over-year earnings and bleak outlook, warns about macroeconomic pressures

Tariffs yet have to impact Intel.

Intel on Thursday posted its financial results for the first quarter of 2025. The company's earnings were flat year-over-year; however, its losses deepened, and its gross margin declined despite lower operating expenses. While sales of the company's data center grade products demonstrated signs of growth, sales of client CPUs declined compared to the same quarter a year ago. Perhaps more importantly, Intel gave a bleak outlook for the second quarter due to macro challenges.

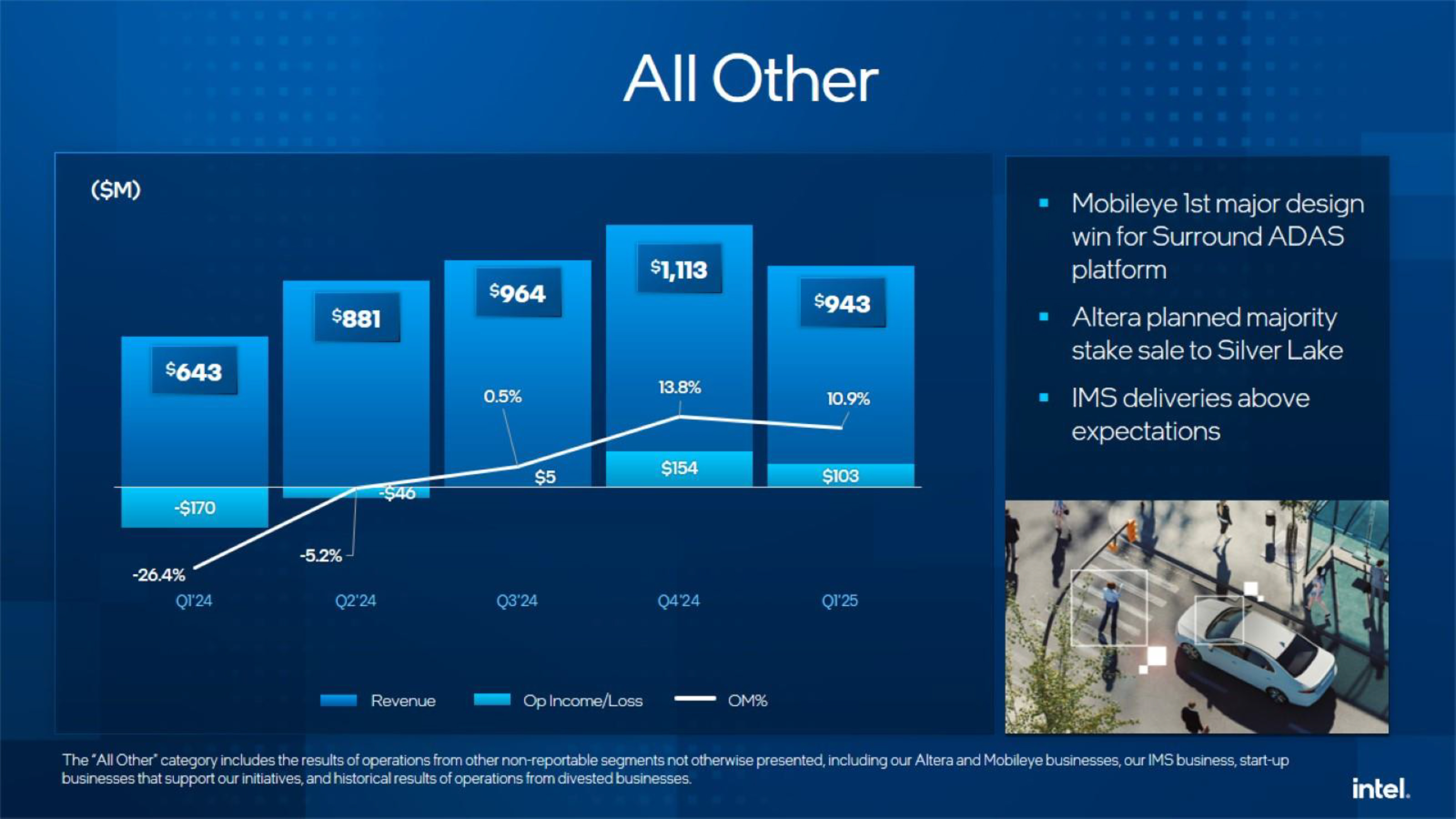

In the first quarter of 2025, Intel reported flat year-over-year revenue of $12.7 billion, with a net loss of $821 million, nearly twice the amount compared to the same quarter a year ago. The company's gross margin declined to 36.9%, pressured by a product mix, startup costs for the 18A ramp-up, and uncertainties (which Intel referred to as macroeconomic headwinds).

The company's operating expenses — including research and development (R&D) as well as management, general, and administrative costs (MG&A) — declined to $4.8 billion in Q1 2025 from $5.9 billion in Q1 2024. However, despite this decline, the company's losses increased.

"The first quarter was a step in the right direction, but there are no quick fixes as we work to get back on a path to gaining market share and driving sustainable growth," said Lip-Bu Tan, Intel CEO. "I am taking swift actions to drive better execution and operational efficiency while empowering our engineers to create great products. We are going back to basics by listening to our customers and making the changes needed to build the new Intel."

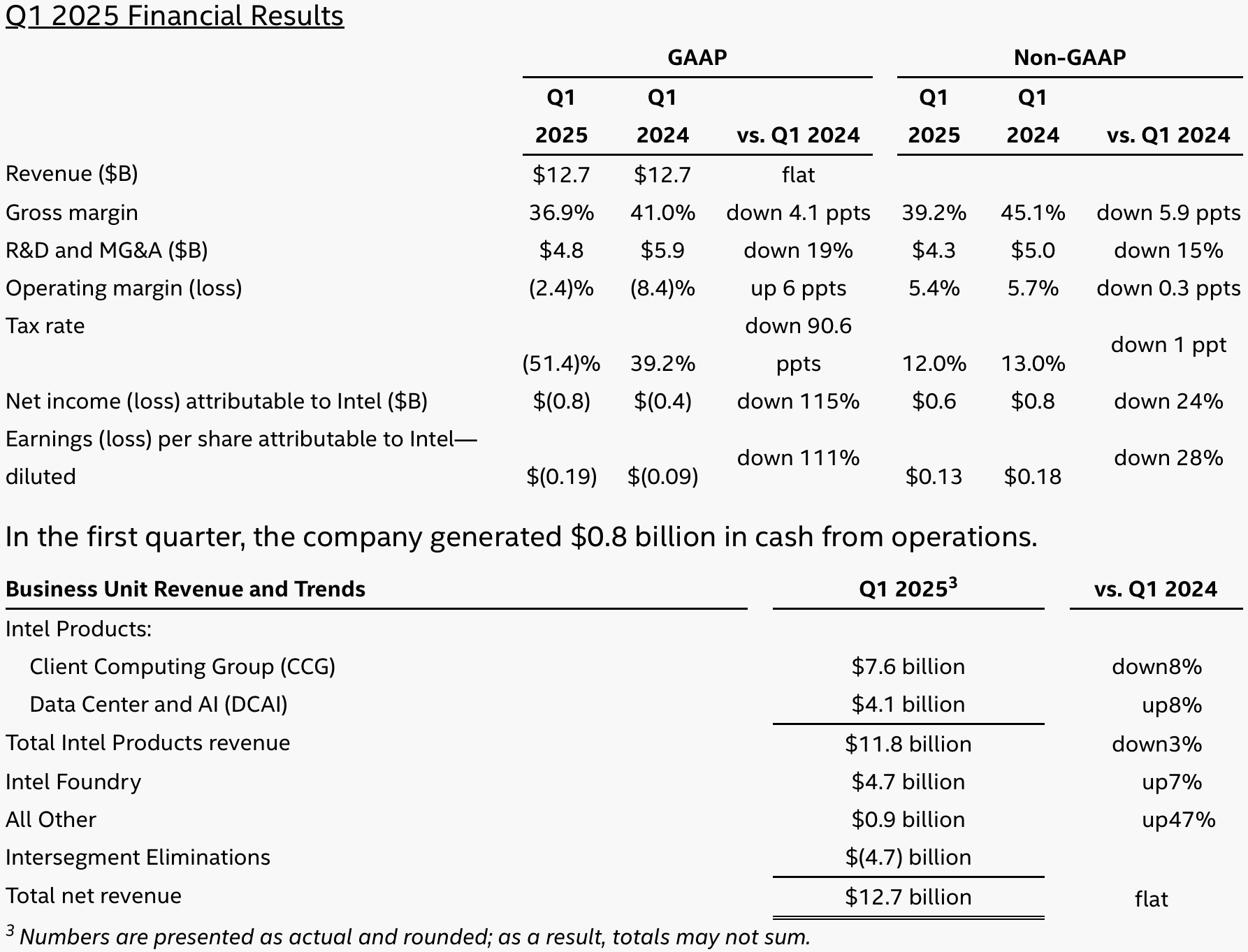

Perhaps the most alarming sign is that Intel's Client Computing Group (CCG) revenues fell 8% year-over-year to $7.6 billion. This drop was attributed to weaker-than-expected PC demand, particularly in the consumer segment, competitive pricing, and unfavorable product mix that includes a plethora of products made by TSMC. Interestingly, many of Intel's customers favored older-generation products like Raptor Lake over newer, higher-cost platforms such as Meteor Lake, Arrow Lake, and Lunar Lake.

Despite these challenges, Intel noted demand for AI PCs from business customers, as well as enterprise fleet upgrades and Windows 10 end-of-service migrations, although this was insufficient to offset the broader softness in consumer sales.

Intel's Data Center and AI (DCAI) business unit reported $4.1 billion in revenue in Q1 2025, achieving an 8% year-over-year increase, making it one of the few growth areas for the company. The performance was primarily driven by strong demand from hyperscalers for host CPUs in AI server deployments. However, the segment faced margin pressure due to competitive dynamics from AMD, product mix, and elevated demand for older-generation parts rather than newer offerings.

Despite the revenue growth, Intel acknowledged macroeconomic uncertainty, potential spending pullbacks, and competition from AMD and Arm-based server solutions as risks that could affect DCAI performance in the coming quarters. The company remains focused on stabilizing market segment share and increasing average selling prices (ASPs) while preparing for the ramp of its next-generation server products.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

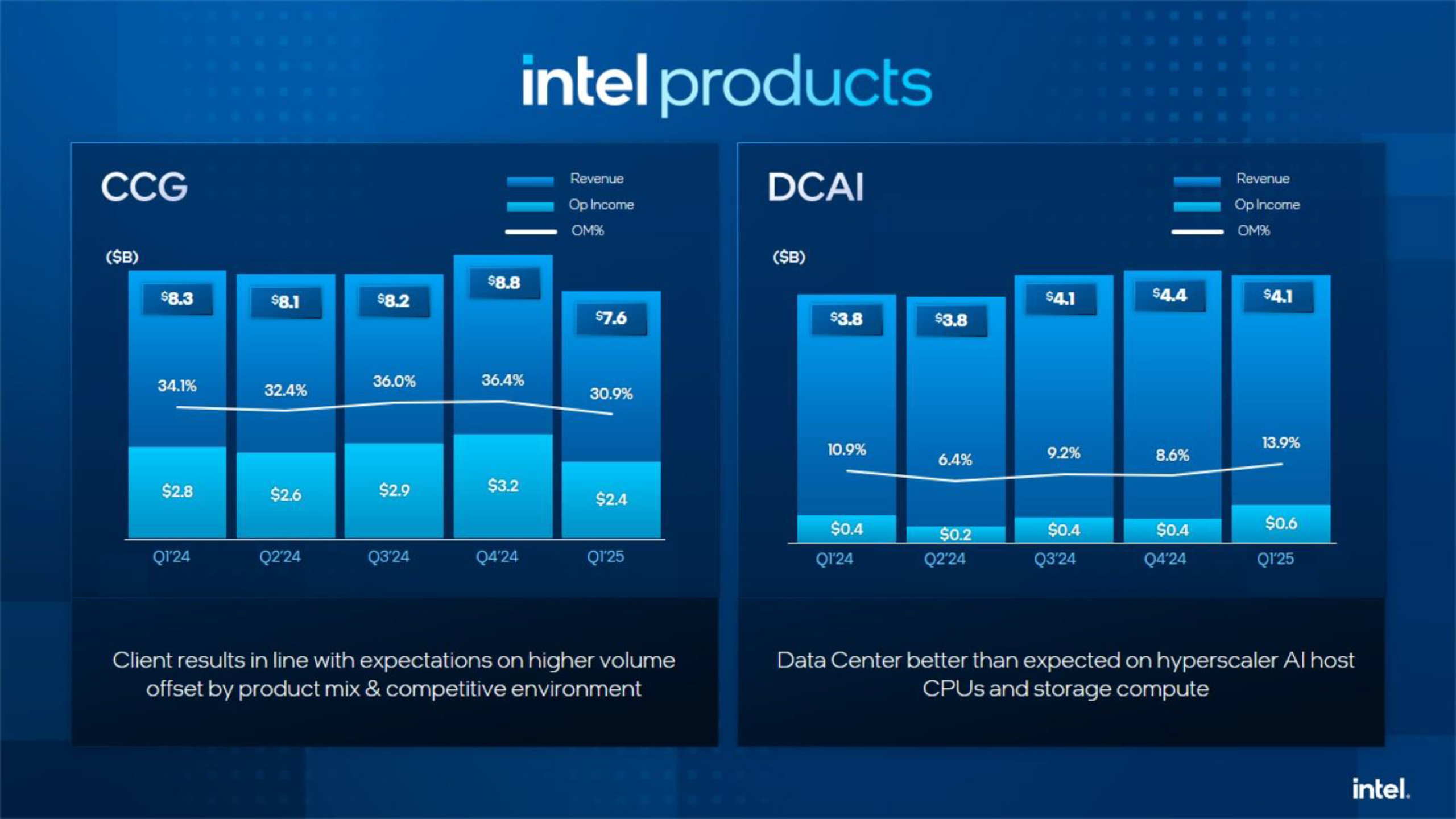

Intel Foundry reported $4.7 billion in revenue, reflecting a 7% year-over-year increase driven mostly by internal demand, particularly from Intel's own product groups for wafers and advanced packaging services. Despite revenue growth, the Foundry segment continued to operate at a significant loss, posting an operating loss of $2.3 billion, which remained roughly flat compared to the previous quarter.

Intel's Lip-Bu Tan reiterated at the conference call that the company's Foundry success hinges not just on manufacturing capabilities but also on building customer trust, improving process design enablement, and supporting a broader range of customer flows. For now, the key mission of Intel Foundry is to ramp up production of Intel 18A-based Panther Lake and then Clearwater Forest processors in late 2025 – 2026 to prove that IF has a node that is competitive with TSMC's N2.

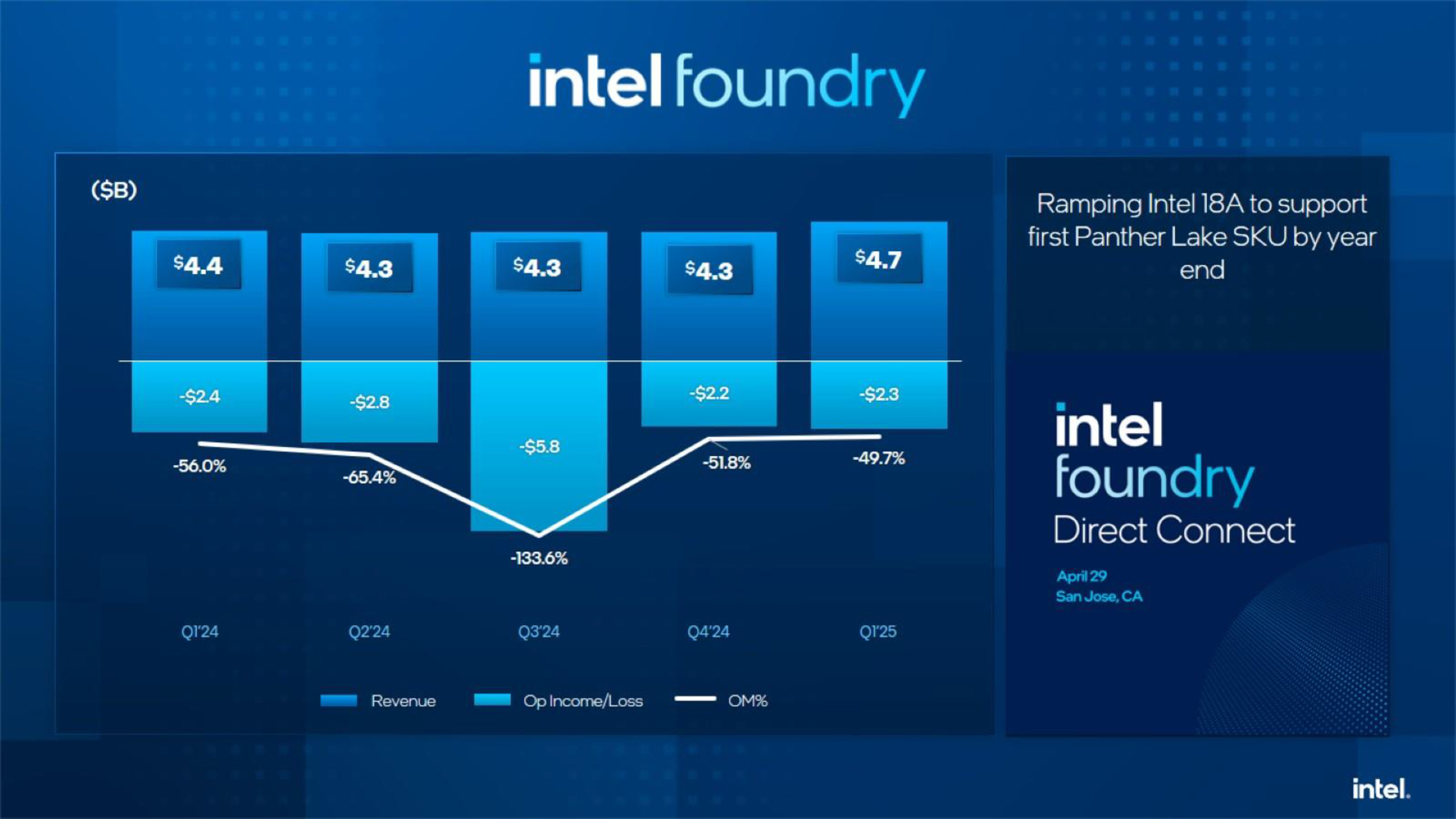

Intel's non-core businesses — such as Altera (FPGA business), Mobileye (computer vision for the automotive industry), IMS (multi e-beam photomask writing tools), and others — generated $943 million in revenue, marking a substantial 47% year-over-year increase. The group achieved $103 million in operating profit, a notable improvement compared to a $170 million loss in the same period last year.

For Q2 2025, Intel expects revenue between $11.2 billion and $12.4 billion, representing a potential 2% to 12% sequential decline from the first quarter and about a billion decline YoY, with gross margins forecasted at 34.3% due to product mix and Intel 18A startup costs. The wide guidance range indicates significant uncertainty due to macroeconomic risks as well as potential tariff impacts.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

DS426 CCG being down is not good especially considering Microsoft has forced at least enterprises' hand on replacing non Windows 11 compatible PC's, not to mention consumers that also make the switch. Yes, this is something that spans over a larger course of time than a year, and the biggest movements will be in CY2025. We'll see how Intel pulls through vs. AMD.Reply

Guess we're looking at a PC market crash at the end of 2025 (Windows 10 death date is Oct. 14th) and into 2026 then? That means products will need to be really compelling if they don't want to see any CCG slump (or mitigate the crash anyways), not just bought because they had to be bought. They mentioned macroecon, which at this time has more uncertainty than anything. Hopefully that'll change soon. -

jg.millirem “Unfavorable product mix” is an unnecessarily nice way of saying that Intel’s competitors are making better chips.Reply