TSMC & Samsung Foundry Could Build Leading-Edge Fabs in Europe

The EU wants leading-edge semiconductor manufacturing facilities

The European Union has been a semiconductor production power, but the recent tensions between the U.S. and China, as well as the Trump administration's tepid attitude towards European allies, has caused EU authorities to rethink a number of the union's policies. Among other things, the European Union is reconsidering its reliance on chips developed and manufactured overseas. So far, the EU has kicked off its supercomputer initiative, CPU initiative, and is now reportedly proposing leading foundries to build a leading-edge fab in Europe.

Strengthening the Competitiveness of European Industry and Science

The vast majority of chips that the industry uses are developed in the U.S. However, several companies in Europe still design chips for automotive, IT, and telecom industries or at least use them, including Ericsson, Infineon Technologies, Nokia, NXP Semiconductors, and ST Microelectronics.

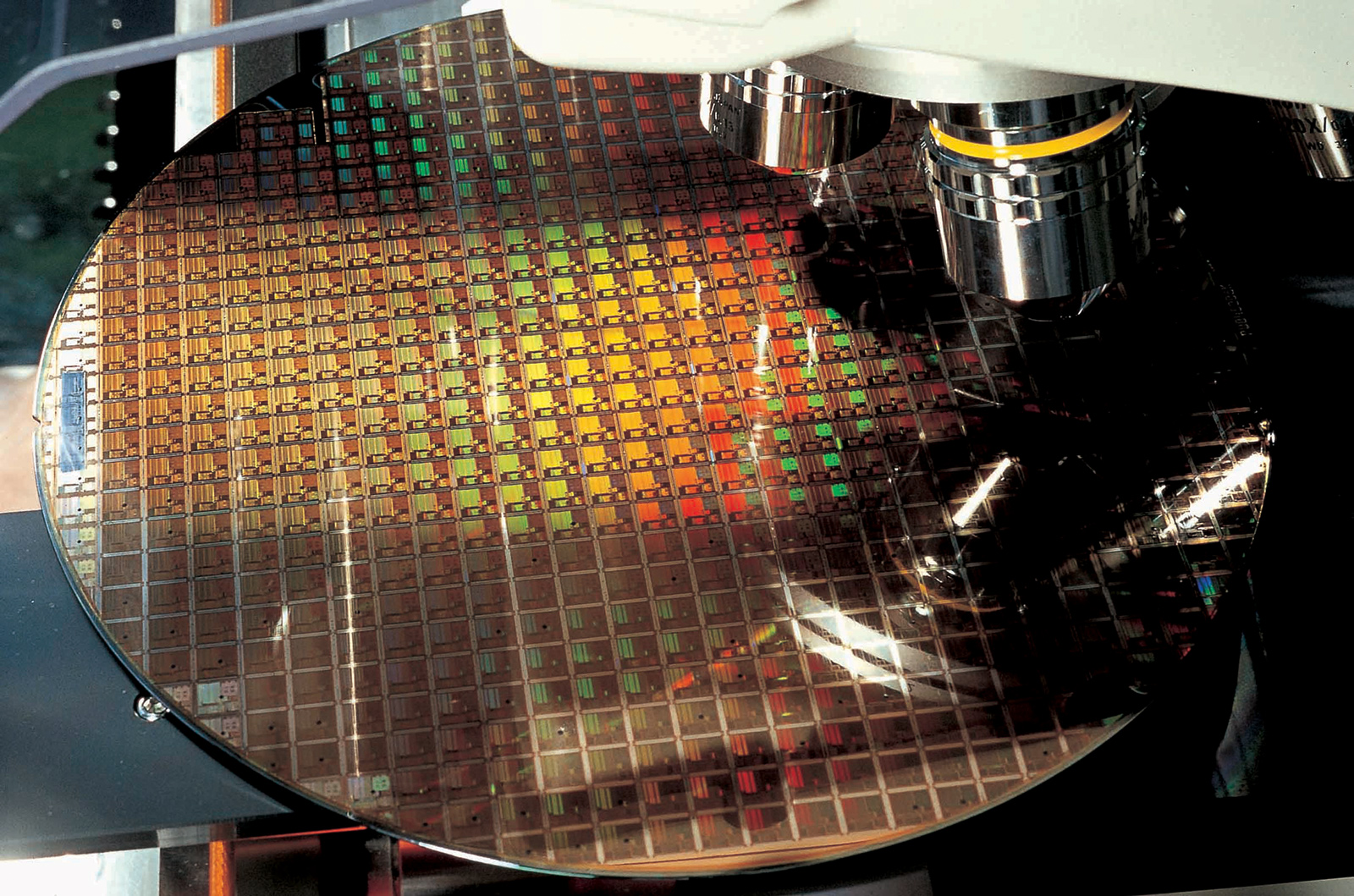

Not a lot of chips are actually made in Europe, though. Infineon, NXP, and STMicro produce some of their semiconductors at their own fabs but outsource a significant part of their chips to contract chip makers. GlobalFoundries, which once was part of AMD and produced the world's fastest microprocessors, transferred its leading-edge production to the U.S. over a decade ago and ceased to develop advanced nodes in 2018.

Today, the EU cannot build a petascale or exascale supercomputer using components developed and made on the continent. Meanwhile, high-performance computing (HPC) is used widely to solve various complex industrial and scientific challenges. Without appropriate technologies, Europe completely depends on chips designed in the U.S. and made in Asia.

The European authorities understand why these technologies are important, so the European Processor Initiative and the European HPC Initiative were launched in recent years. Meanwhile, to properly support both plans and be self-sufficient in terms of chip supplies, Europe needs its own semiconductor production industry to produce chips using mature, specialty, and cutting-edge fabrication processes. In fact, the EU wants to produce 20% of the world's chips and processors (by value) eventually, up from 10% today.

"Without an autonomous European capacity on microelectronics, there will be no European digital sovereignty," said Thierry Breto, a European Industry Commissioner, in a speech, reports Bloomberg.

Last year 17 EU member states signed a declaration to develop next-generation CPUs and leading-edge process technologies to make them. The states intend to invest $145 billion in such development and enhance cooperation, reports EE Times. The declaration precludes the launch of a European alliance on microelectronics, which is expected to happen in late Q1 2021. The alliance is projected to include the EU's major chipmakers, telecom companies, carmakers, and producers of medical and other high-tech equipment.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Catching Up with Asia

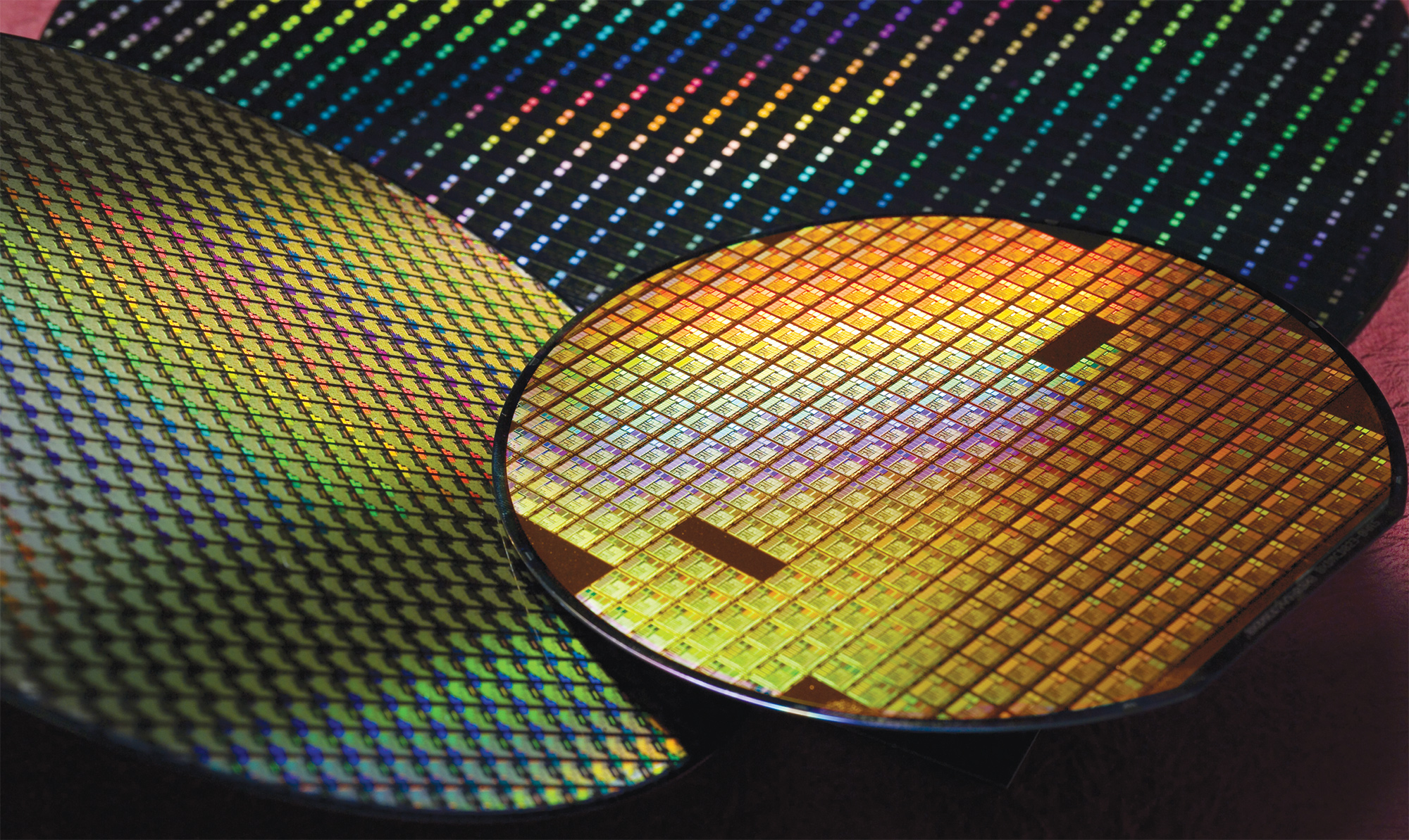

There are several ways for the EU to catch up with South Korea (Samsung Foundry) and Taiwan (TSMC) when it comes to fabrication processes.

One approach is to consolidate local chipmakers, fund development of both cutting-edge and specialty process technologies, and then provide financial help to build leading-edge fabs in Europe. Another way is to lure Samsung Foundry and/or TSMC to Europe with various incentives. Either plan is hard to accomplish, but it is even harder to make either of them work over the long term.

Firstly, it is close to impossible for GlobalFoundries and STMicro to catch up with Samsung Foundry and TSMC in the foreseeable future in terms of R&D. Since it is hardly possible for European chipmakers to quickly catch up with their Asian rivals, inviting companies from South Korea and Taiwan to Europe may be a somewhat more realistic idea.

Secondly, there aren't many European chip designers that require top-notch process technologies. Even fewer require the volumes that justify building an advanced fab that has to work at a nearly 100% utilization rate to be profitable. Recently Daimler, Volkswagen, and some other automakers complained that they could not procure enough chips from TSMC as the latter was busy making chips for other customers. The lack of chips significantly affects automakers and local economies as the automotive industry employs tens of thousands of people. Yet, chip consumers like automakers do not really use brand-new nodes and do not require large volumes of chips. For example, only about 3% of TSMC's revenue comes from the automotive industry.

Thirdly, semiconductor manufacturing facilities need to be upgraded often to stay on the cutting edge, which means regular investments and regular demand for advanced nodes from customers. So, to actually lure foundries to Europe, incentives alone are not enough. To make chip production viable on this side of the pond, a full-blown semiconductor industry that includes both designers and large consumers is needed.

Foundries Need to Mitigate Risks Too

A report from DigiTimes this week implied that TSMC might be actually considering a fab in Europe partly because if geopolitical tensions intensify and disrupt traditional semiconductor supply chains, it will risk losing customers. Samsung Foundry may think the same way too.

"When it comes to fab location selection, we need to consider many factors including customers' need," spokeswoman Nina Kao told Bloomberg last week when asked about cooperating with Europe. "TSMC does not rule out any possibility, but there is no concrete plan at this time."

It is noteworthy that companies like Intel and GlobalFoundries have manufacturing facilities on different continents, though GlobalFoundries offers different technologies at different fabs.

The World Stays Global

While it might be politically important to bring the most sophisticated semiconductor manufacturing operations to Europe, the world has become so global that it is close to impossible for a country or a bloc to become completely self-sufficient in the chip industry.

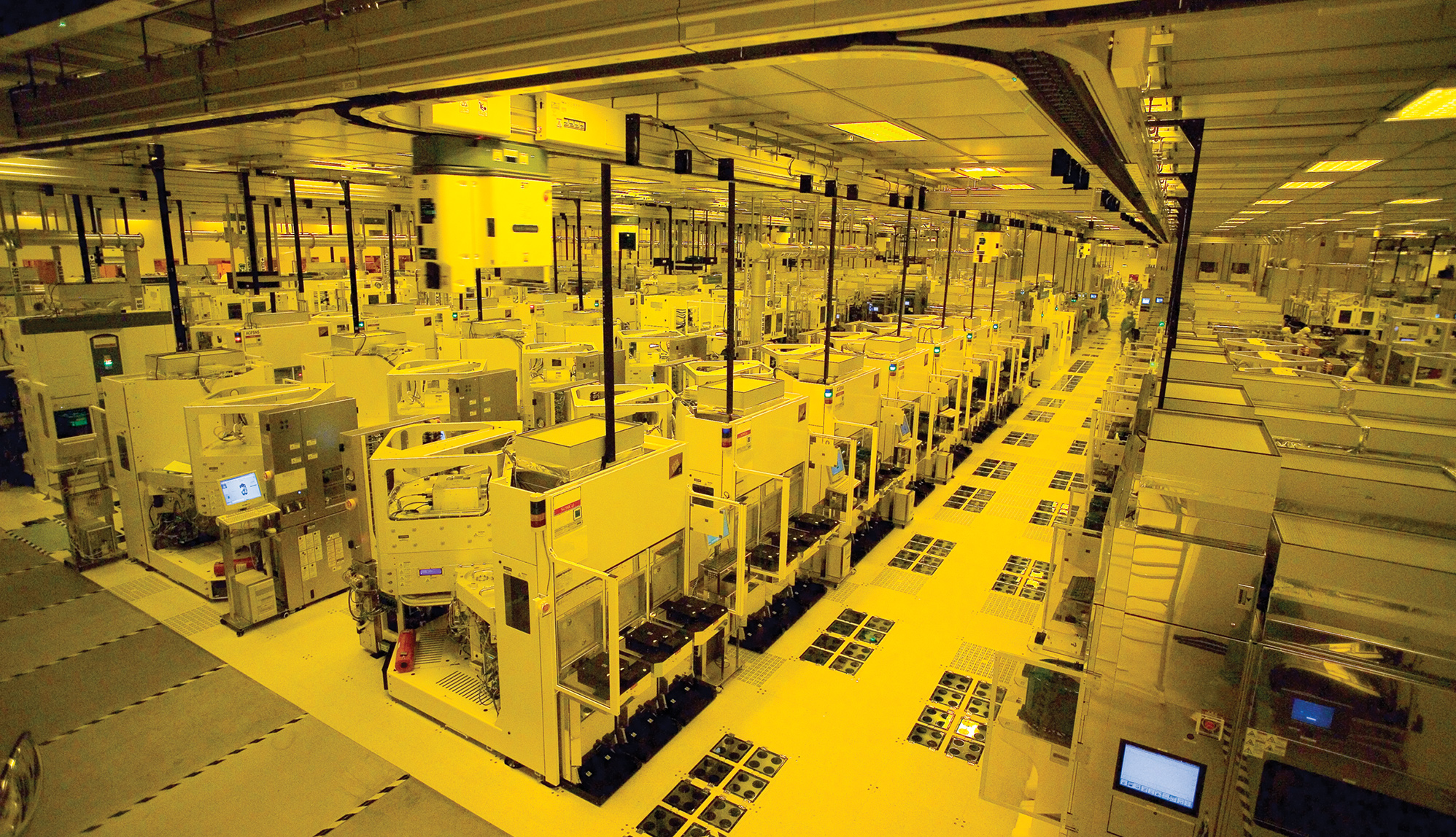

A modern fab uses tools produced by a dozen of companies from Europe and the U.S., pure chemicals made in Japan, and bulk wafers made in Asia or Europe. Each processed wafer has to be cut and each die has to be tested and packaged, which involves equipment manufactured in Asia. After a chip is produced and assembled, it needs to be put into an actual device, which is usually assembled in China using components from China, South Korea, and Japan. Finally, that device will run an operating system and software developed in the USA.

All-in-all, while digital sovereignty includes chips produced locally, it is not limited to semiconductor production but includes many more ingredients that are now spread across the world.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

UWguy Awesome go for it! At least they won’t have to worry about the power going out due to some minor weather event. Plus I’d feel better sending my money abroad than to some fascist red state.Reply -

watzupken I don't know if it is sustainable man. Currently they have fabs in Asia and now EU and US wants their fabs in their locations too. Running a fab is not cheap, and honestly, I am not sure if the demand will continue to be hot in the long run. The last thing these fabs want is a lot of idle resources. In my opinion, US wants TSMC on their soil because they are worried that China may try and retake Taiwan and thus, impacting their chip supply. I am sure TSMC is very attractive to China now given their fabs have been nerfed big time by US, and neither do they have access to cutting edge nodes over at TSMC and Samsung.Reply -

BogdanH I live in Europe. I can't say I have some big insight in all this, except what I read on media and my personal experience. And my impression is...Reply

Europe has totally failed in hi-tech electronics. Maybe some labs in Europe have "plans" and "test projects" (you get the idea), but all that is worthless if not brought to market to end consumers as a final product.

Once "big names" in European electronic industry totally lost the grip and heavy depend on foreign (Asian) technology. As for consumer market, most European "electronics companies" are actually only gluing imported components together and stamp their brand name on final product.

Yes, Europe should be interested on getting latest hi-tech facilities from elsewhere. Is the only way to be in touch with latest technology and learn from it -otherwise, Europe will literary become "old continent".