The Week In Storage: 15 TB SSD For Only $10K, Samsung Rains On WD's Parade, Micron's Poison Pill

The week in storage began with big SSD news as the vendors all jockey for attention. We have a busload of interesting news this week, so let's dispense with the flowery segue and get right to it.

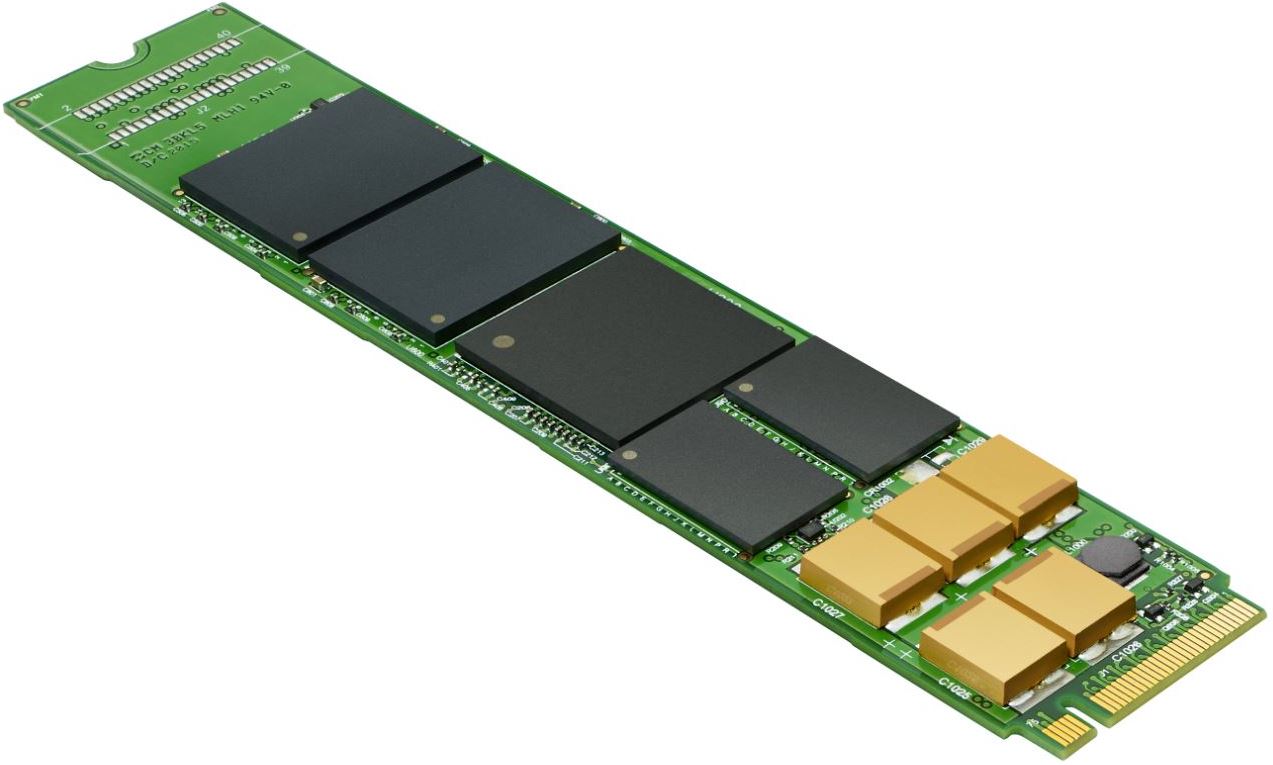

Seagate bulked up its SSDs with additional NAND so that it can pack up to 2 TB of capacity in the M.2 package, and it also rolled out a powerful PCIe version that brings stunningly low power consumption and solid performance specifications. Seagate is using planar NAND for this capacity jump and simply adding more packages, so expect more capacity increases soon when the company transitions the platform to 3D NAND.

Western Digital has completed its metamorphosis into a NAND manufacturer, and as such, it announced the launch of its new BiCS3 64-layer 3D NAND, which stacks more layers to provide up to 256Gbit per die. The company broke the aspect ratio barrier, which is one of the key reasons the industry is beginning to experiment with string stacking. However, others are close behind, as we cover below.

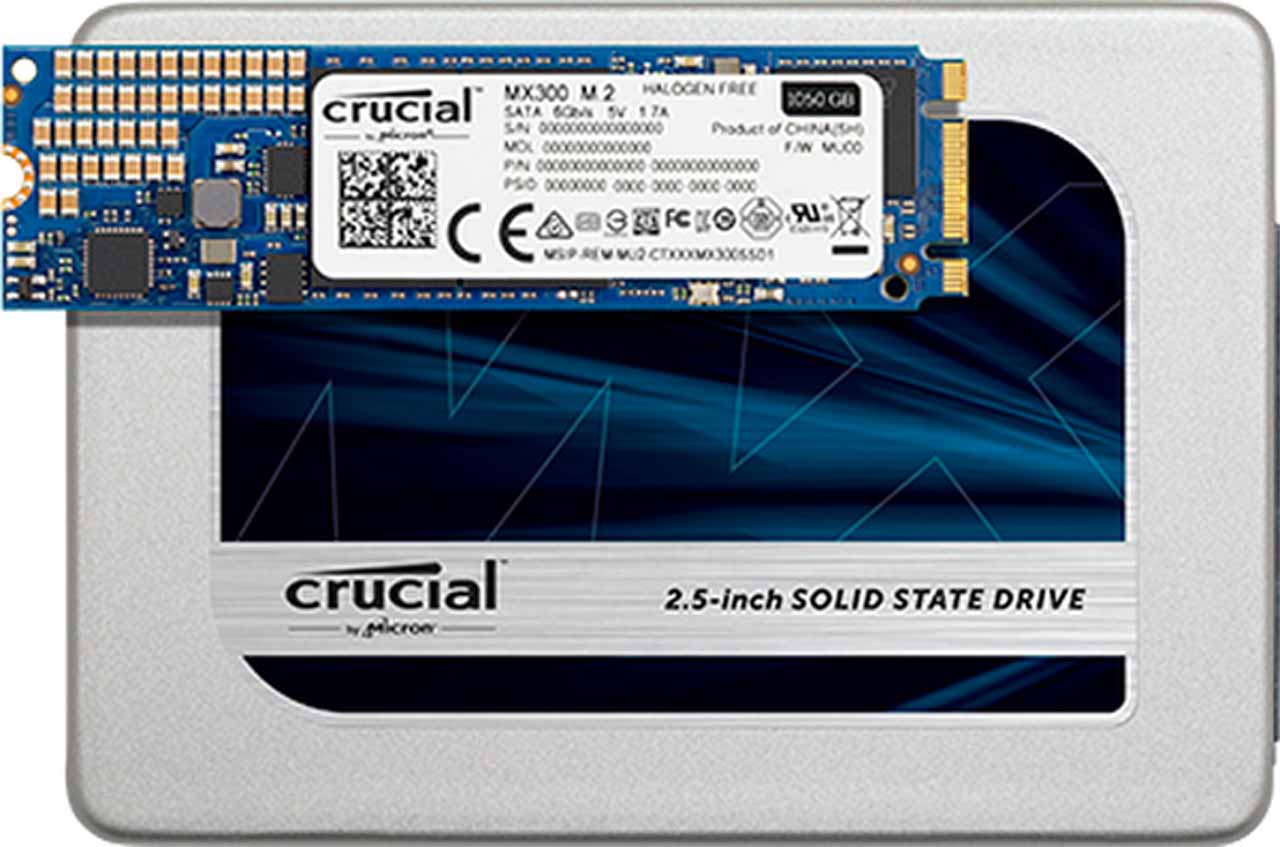

Crucial announced that its MX300 series is now available in a wider range of funky capacity sizes (275 GB, 535 GB) that top out at 2 TB. The odd sizes are born of Micron's super-dense TLC NAND, and the company also disclosed that it has an M.2 variant headed to market in August. The MX300, which we found to offer a compelling price point but choppy performance, becomes only the fourth consumer SSD to break the 1 TB barrier.

Chris Ramseyer tackled the 500 GB Samsung 750 EVO with our demanding suite of tests and found that Samsung's 16nm planar (2D) NAND delivers on the performance front, albeit with a lower 100 TB endurance threshold. Samsung continues to dominate the SSD market, but its latest value-centric SSD is still more expensive than some competing bottom-dollar SSDs. Chris thinks that Samsung will score a touchdown with most users anyway due to its 850 EVO-like performance, which has the power to upset the entire value-SSD roster.

The world of storage is changing fast, particularly on the NAND front; let's peek at some other interesting news items this week.

Samsung Offers "Competitively-Priced" 15.36 TB SSD For Low Low Cost of $10,000 (Also Pre-announces 64-layer V-NAND)

Samsung wowed the world during last year's Flash Memory Summit with its 15.63 TB SSD. The news of the record-setting SSD went semi-viral, but as we noted in our initial coverage, 15 TB of flash is going to be an expensive proposition. The rather obvious prediction has proven to be true, and the PM1633a has popped up at several retailers for ~$10,000. Also, the PM1633a isn't going to slip into your laptop, or even into a normal desktop PC, without a SAS adapter.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The PM1633a is a 12Gb/s SAS dual-port SSD, which means that there are actually two paths into the SSD, and it comes in a 2.5" form factor with a 15mm Z-height. The density is important because it surpasses the density of even the latest 3.5" 10 TB HDDs in a much smaller package, but the 15mm thickness will keep it out of any mobile device.

Samsung leverages its 3rd-generation 48-layer 3D V-NAND, which has a 256Gbit density per die, to provide the spacious digs. Samsung stacks 16 die into each of the 32 packages, which is 512 GB per package. SSDs, at least the fast ones, also require a DRAM-to-NAND ratio of 1MB of DRAM per 1GB of NAND, so Samsung utilizes a total of 16 GB of DRAM.

With more RAM than most desktop PCs, we would expect the SSD to be fast, and it is. The PM1633a provides up to 200,000/32,000 random read/write IOPS and comes with a 1 DWPD endurance rating, which equates to a total of ~28 petabytes of data that you can write to the SSD over its five-year warranty period.

You aren't going to find this SSD in the bargain bin at ~$0.65-per-GB, but for enterprise customers, it is an incredible value. Samsung's 3D V-NAND is taking over the datacenter, even EMC went all-in on Samsung SSDs, and the PM1633a's destiny stands as the perfect example of how the company is displacing other entrenched SSD vendors.

Packing nearly 16TB of flash into one small package is impressive, but we want more, right? Well, Samsung is already working on it...

Samsung Rains On Western Digital's 64-layer NAND Parade

Western Digital/SanDisk made headlines this week when it announced that it would begin mass production of its BiCS3 64-layer 3D NAND in large quantities in the first half of 2017. The company has yet to have any of its 3D NAND, such as its current-gen BiCS2 NAND, hit the market, so the timeline seems to be rather aggressive.

Samsung was first with 3D NAND on the market (to the tune of several years), and it is obviously nonplussed by WD's entrance into the NAND production game. During its 2Q 2016 earnings, the company indicated that it now has its fourth-generation 3D NAND under development and that the new generation of V-NAND will feature 64 layers, which matches the height of WD's NAND, but Samsung did not mention the density of the fourth-generation product. The company is currently producing 256Gbit die, and a significant density increase could allow it to match or exceed Intel/Micron's market-leading 364Gbit density.

Samsung is going to beat WD to market, too, as it indicated that it would begin shipping products based upon its newest NAND by the end of the year. Samsung can already cram 15.36 TB into a 2.5" SSD with its previous-generation NAND, so one can only wonder what it will offer with the new 64-layer V-NAND.

Samsung also mentioned that there is a NAND shortage coming, though many of our contacts indicate that it is already well underway.

Micron's Taking a Poison Pill

Micron filed a form 8-A with the SEC that invokes a rights issue that is triggered if any sole entity, such as a person or group, were to buy more than 4.99 percent of its shares. The market commonly refers to the technique as a "poison pill," as companies typically use it to avoid an unwelcome takeover attempt. The move has spurred widespread conjecture that Micron is under duress and about to be bought out, which makes sense considering the recent market consolidation.

There are several theories as to the identity of the potential suitor, but some seem more probable than others. The promise of a NAND fab is that it provides the ultimate low-cost advantage, along with engineering and time-to-market advantages, which breeds plenty of interest. Apple is the single largest NAND consumer in the world, and purchasing its own fab would put it on equal footing to its NAND fab-powered rival Samsung.

Intel also might be interested, as Micron has the option to buy out Intel's stake in their IMFT partnership in 2018. Seagate is also a commonly-named potential suitor, largely because it needs to counter WD's purchase of SanDisk. However, even though Seagate and Micron already have a strategic alliance, Seagate also has plenty of financial woes, which reduces the likelihood (but I still think its likely).

The Chinese government and its long-tentacled state-controlled Tsinghua Unigroup corporation are among the most likely to attempt to buy a majority stake of Micron, and they have already been busy.

Tsinghua Group Merges with XMC

XMC became the first Chinese-owned flash fab early this year, and the company has plans to open a total of six 300mm fabs. The entrance of a new player into the elite NAND club has the potential to upset the delicate supply and demand of the market, which could be particularly devastating to the incumbent NAND fabs.

Analysts peg China's chip consumption between $98 and $200 billion per year, so it has a vested interest in developing its own indigenous production facilities. The country has used the state-controlled Tsinghua, along with numerous other subsidiaries and initiatives, to bulk up its investment in semiconductor IP.

Tsinghua took another step forward this week as it merged with XMC to create the Changjiang Storage Co. This development is also intriguing because XMC/Tsinghua has reportedly been attempting to negotiate a 3D NAND licensing agreement with Micron.

China has immense production capabilities, but it lacks the IP to produce patent-protected semiconductor products, which places the onus on licensing the technology from others.

Perhaps the licensing talks with Micron did not go well, and the newly formed Changjiang Storage Co. is the mystery company that wishes to buy Micron. It wouldn't be the first time that Tsinghua tried to buy its way into the NAND market; its Unisplendour subsidiary attempted to buy a 15 percent stake in WD, which then immediately bought SanDisk, but it was rebuffed by the US CFIUS watchdog. If at first you don't succeed...

In either case, Changjiang Storage Co. is one to watch, as it may just upset the somewhat orderly NAND market.

This Week's Storage Tidbit

WD revealed that it suffered a $351 million loss during 4Q 2016, which is a far cry from the $220 million profit it scored during the same quarter last year. The results are somewhat surprising, as it was WD's first financial reporting that includes its new SanDisk progeny. One would expect SanDisk to help boost profits, but WD did purchase the company for a great price due to its under performance, so it may be a drag on financials until they right the ship.

WD is in a great position with the strategic advantage of its own fab and wide product portfolio, but the company indicated during its financial call that layoffs are coming in the near future.

Seagate has also laid off a large swath of employees and closed several factories, but that isn't stopping it from giving out raises and bonuses to several of its executives this week, thus proving that the you-know-what truly does roll downhill.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

gorfmaster1 Things are getting interesting right now in the storage world. There could be a huge paradigm shift soon.Reply -

Paul Alcorn Reply18357672 said:Things are getting interesting right now in the storage world. There could be a huge paradigm shift soon.

I couldn't possibly agree more. NAND is changing the game, so what Seagate does about its lack of a fab is going to be interesting.

I think the biggest sleeper is China, though. They are making a huge push into semiconductors across all segments, including CPU and DRAM, and it is partially funded by the government. It is also part of a larger plan that is totally outlined by the government, so we might see some really anti-competitive activity very soon. -

slashdot Where are all the consumer NVME SSD? Where is Phison E7? Who cares about enterprisy storage m.2 SSD, can't buy them?Reply -

Paul Alcorn Reply18358206 said:Where are all the consumer NVME SSD? Where is Phison E7? Who cares about enterprisy storage m.2 SSD, can't buy them?

Yeah, it seems that a 2TB M.2 for us regular guys is a bit off in the future, but it is important that Seagate was able to do it, and with regular 2D NAND, no less, because it shows that it is coming. Bleeding-edge tech *usually* starts in the enterprise then works its way down to us.

As to the E7, well. No idea when that will come to market, but I expect details to emerge at the flash memory summit in a few weeks. -

jimmysmitty Reply18357672 said:Things are getting interesting right now in the storage world. There could be a huge paradigm shift soon.

Yup. We have this plus we have 3DXpoint and other new technologies that will cause a shift in the storage world.

Hopefully we will see TBs worth of SSDs at much more affordable prices soon. -

hannibal Ssd prises Are going up for some time, so no price drops for at least half of year or even longer.Reply

But eventually we can Expect them to start declining again. -

xyriin Anyone else nervous about a Chinese state controlled-company owning a significant portion of NAND production when they currently control a large chunk of the raw material market as well?Reply

There is the firmware issue as well but that's a whole other story. -

shrapnel_indie Reply18358206 said:Where are all the consumer NVME SSD? Where is Phison E7? Who cares about enterprisy storage m.2 SSD, can't buy them?

This count? http://www.tomshardware.com/news/plextor-m8pe-order-ssd-m-2,32364.html