The Week In Storage: SSDs In Space, SSDs Back On Earth, 3D NAND String Stacking

This week in storage finds the Tom's team readying itself to bring our readers the latest news from Computex 2016, which promises to bring about a wave of 3D NAND-powered SSDs, among other assorted storage goodies.

M.2 SSDs will likely take center stage at Computex next week as more vendors play catch-up with the Samsung 950 PRO leverage the diminutive form factor to increase density and performance. M.2 SSDs are becoming more commonplace, so it was only a matter of time before someone designed a water block for them. The Aqua Computer kyroM.2 SSD watercooler satisfies the obsessive watercooling desires (even if only for decorative purposes), but it requires stepping back to a PCIe adapter card in lieu of the motherboard connector.

Toshiba is back in the game with its new 8 TB X300 Desktop HDD, which ties Seagate for the lead in desktop density (WD is at 6 TB). Unfortunately, Seagate and HGST are already shipping 10 TB HDDs in enterprise flavors, so it may be only a matter of time before they leapfrog Toshiba once again in the desktop segment.

Samsung originally offered its 750 EVO for OEM and system integrators at 120 GB and 240 GB capacity points, but announced this week that it is expanding the SSD to the retail market (that means us) and adding a 500 GB model.

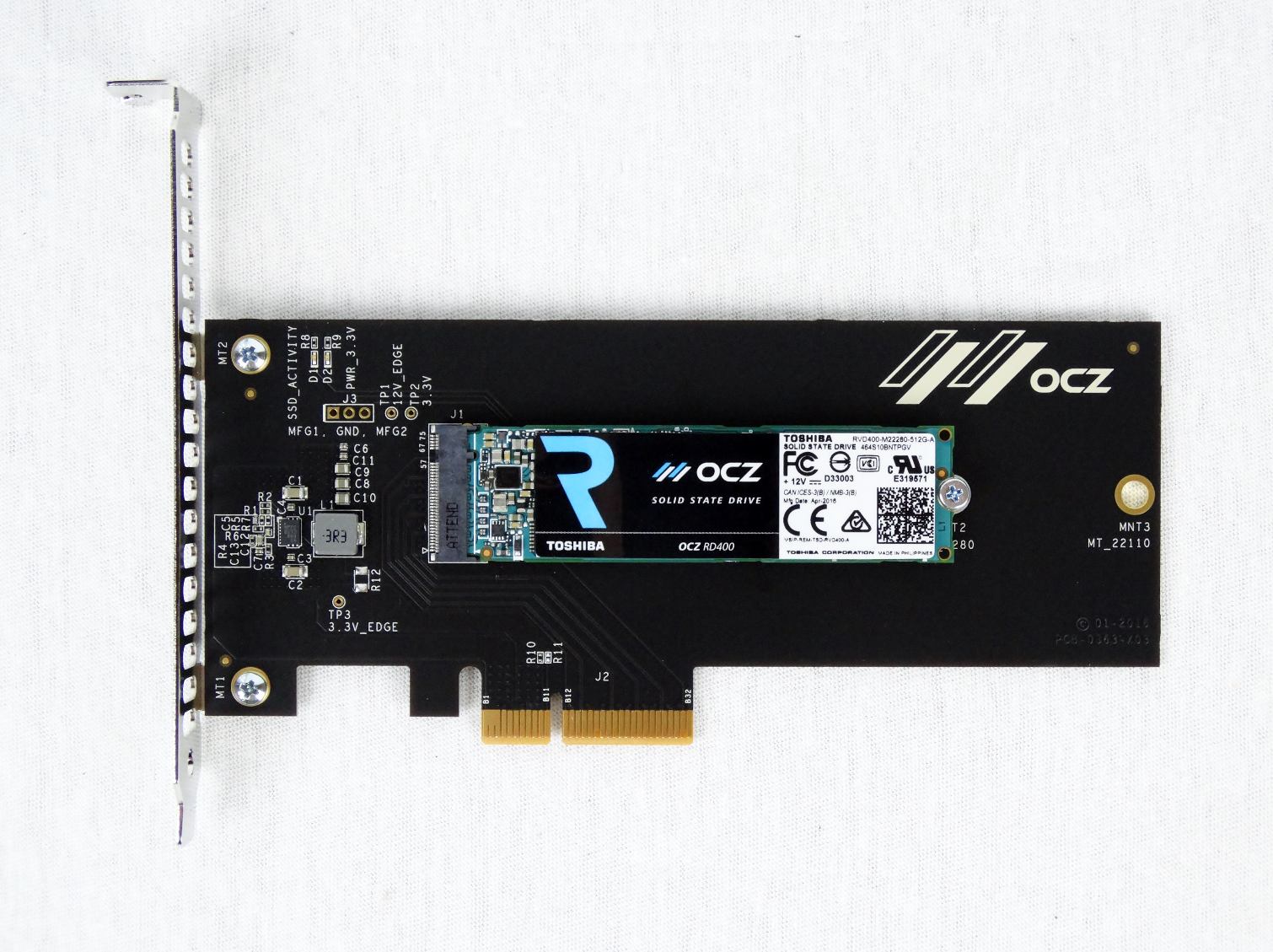

Chris Ramseyer put the M.2 OCZ RD400 (RevoDrive) NVMe SSD through the Tom's wringer and found it to offer class-leading density and solid performance, but it requires some work in the pricing department.

SSDs In Spppaaace!

Cloud Constellation Corporation is a startup (with an undisclosed amount of funding) that plans to rocket cloud storage into space (literally).

If all goes as planned, the SpaceBelt Information Ultra-Highway will consist of seven satellites (with more in the future) ringing the globe. Each satellite contains its own storage and laser-based uplink/crosslink communication system, and the company claimed to have developed technology that will reduce the $4 billion price tag down to $460 million.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The company claimed that the laser uplinks will communicate with earth-based transmission centers in less than a quarter of a second. The SpaceBelt will circumvent a number of nefarious earth-based threats to our data, such as earth-based transmission lines (which can be physically attacked), natural disasters (but what of solar storms?), the internet itself, privacy regulations and jurisdictional data protection laws.

The SpaceBelt will house petabytes, and perhaps even exabytes, of storage. NAND-based storage devices are the obvious storage medium for the project due to their numerous space-friendly attributes.

SSDs are much lighter than HDDs, which is important to cram as much storage capacity per rocket as possible. NAND storage is also denser, which is advantageous within the confines of a cramped satellite. The storage solution will likely be an entirely custom design, but as an example, the SanDisk InfiniFlash packs 512 TB of storage into a 3U chassis (which can likely double with 3D NAND).

NAND-based devices are almost impervious to shock and vibration, so they will fare much better on the ride up to orbit than an HDD would. Granted, most HDDs have actuator arm locks that secure them in place during transit, but one could still envision the little HDD heads vibrating wildly during ascent, thus surely leading to more than a few failures.

Any type of NAND-based storage implementation would be subject to other challenges, such as an increase in exposure to cosmic rays that cause data loss (even here on earth). Some vendors, such as Intel, already test SSDs against such intangibles with particle accelerators, so the challenges of storing data in space are surmountable.

What may prove to be insurmountable, though, is for the company to get enough funding to actually shoot its storage into space.

SSDs Come Back Down To Earth

Western Digital held an investor call yesterday to revise its earnings forecast to include SanDisk, which it purchased two weeks ago. The company indicated that it expects its fourth quarter revenue to climb from ~$2.7 billion to ~$3.45 billion. Samsung pays licensing fees to SanDisk for its NAND IP, and WD reported that the companies are currently renegotiating the terms of the royalty fees.

WD also commented on the state of the NAND market during the question and answer session. In response to a question about a pending NAND shortage, WD President and CEO Steve Milligan responded;

"In terms of NAND…generally we expect things to get a little tight as we move through the back half of the year. How that will perpetuate itself, or play out from a pricing standpoint, I think it is too early to make a call on that."

The company expanded on the topic and said that signs of the impending shortage, driven by the slow transition to 3D NAND, are already apparent in the spot market. The statements echo recent predictions made by Phison's Company Chairman and by the analyst firm Trendfocus. Silicon Motion (a prominent SSD controller manufacturer) joined the chorus this week as Wallace Kou, President and CEO, also predicted a shortfall.

3D NAND production is behind schedule for all of the NAND fabs. Industry analysts contend the delay is due to 3D NAND yields that are below 80 percent (a key profitability benchmark). WD refused to answer directly if it had achieved yields over 80 percent, but indicated that it would increase 3D NAND production as its yields improve. The company also indicated that profitability is the problem slowing its 3D NAND transition, and that increasing yields will help it achieve 3D NAND price crossover with 2D NAND, which the company expects to happen in mid-2017.

3D is undoubtedly the future of NAND, but manufacturing it in a cost-effective manner is proving to be the sticking point. Marketing-savvy Intel carefully indicated during its 3D NAND launch that its NAND was cost-competitive with previous-generation IMFT 20nm NAND, but it left out the fact that it is not cost-competitive with Micron's 16nm 2D NAND. Many speculate that Samsung has not reached price parity either, which makes sense due to its increasing use of 2D 16nm TLC.

3D NAND will not become widespread until it becomes profitable, and Barclays predicts that it will not reach 50 percent market penetration for another 12-18 months. This is leading to (and could intensify) the looming shortage, which may last a bit longer than expected. Buy your SSDs now.

Another key to increasing profitability is to stack the layers higher, but that is also proving to be a challenge with current techniques...

This Week's Storage Factoid

Today's 3D NAND weighs in at 32 to 48 layers, but increasing the density beyond 100 layers appears to be an impossible challenge due to the limitations of high-aspect ratio etch tools, which etch the holes in the NAND (1.8 billion for Samsung 48-layer NAND). Today's tools have 30:1 to 40:1 aspect ratios for 32- and 48-layer NAND, respectively, but creating 64-layer NAND will require an aspect ratio of 60:1 to 70:1.

The only problem? There are no tools that can achieve that aspect ratio.

Several NAND vendors are reportedly developing a new "string-stacking" method that will merely stack the 3D NAND devices on top of each other. For instance, three 48-layer stacks will be stacked upon each other to create a 144-layer chip.

String stacking may allow for scaling up to 300 layers, but the vendors are still working on a method of linking the stacks. The real challenge will be to produce it in a cost-effective manner. Unfortunately, the NAND fabs have not even mastered that for standard 3D NAND as of yet.

Paul Alcorn is a Contributing Editor for Tom's Hardware, covering Storage. Follow him on Twitter and Google+.

Follow us @tomshardware, on Facebook and on Google+.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.