AMD Looks To Diverse Revenue, Reduced Operating Expenses For Long-Term Financial Success

As with any company, there's always a financial issue. With AMD, it's even more pronounced considering that the first half of 2015 isn't off to a good start. According to CEO Lisa Su, the first half of 2015 will see a loss in profit, with the company holding only $800 million in cash. But for the latter half of 2015 and beyond, AMD has a focused plan to ensure growth while also reducing its debt and honing in on the most important markets.

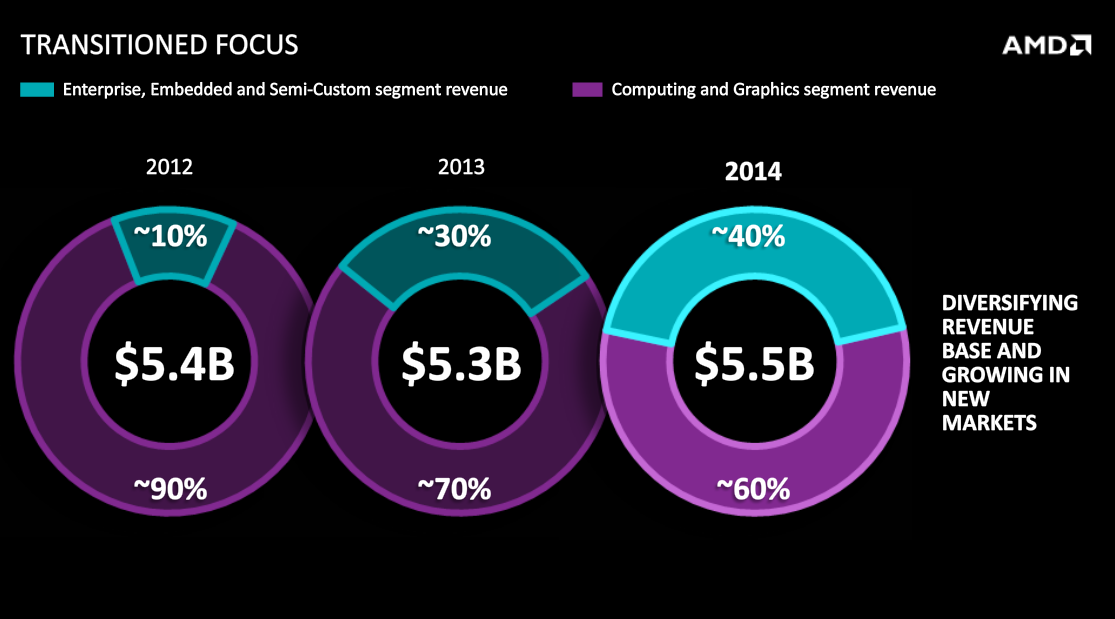

CFO Devinder Kumar explained the need to refocus the company's financial targets. In the past, 90 percent of revenue came from its computing and graphics division. Over the next few years, the revenue became more diverse. In 2014, computing and graphics only held 60 percent of the revenue, while AMD's enterprise, embedded, and semi-custom products had a firmer 40 percent.

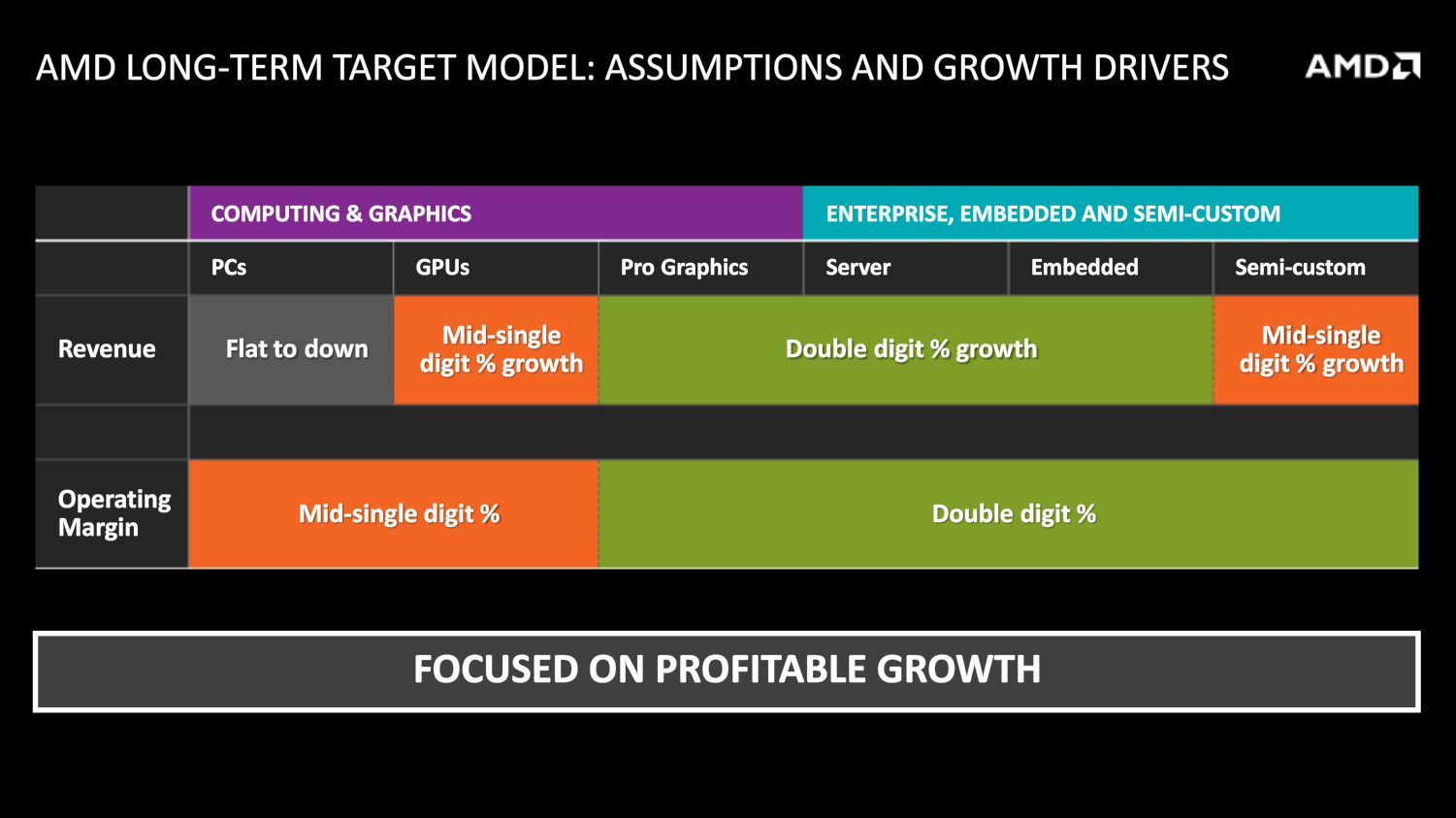

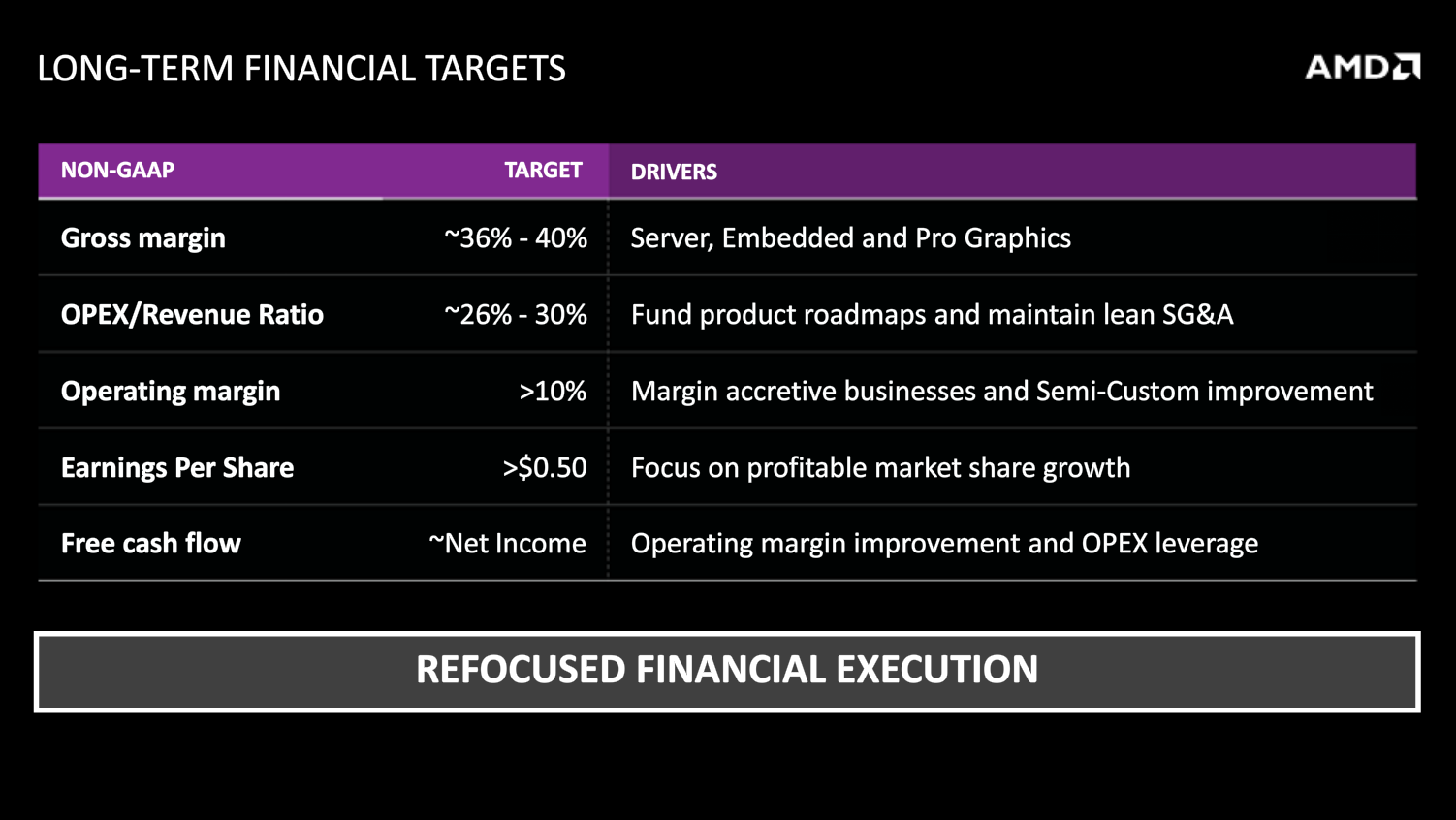

This diversity in revenue seemed to pay off to the tune of $5.5 billion. For the future, AMD sees its biggest revenue (specifically in double-digit percentage growth) from three specific areas: pro graphics, servers, and embedded products. In the long term, Kumar forecasted that the gross margin will increase by 36-40 percent from these three areas alone.

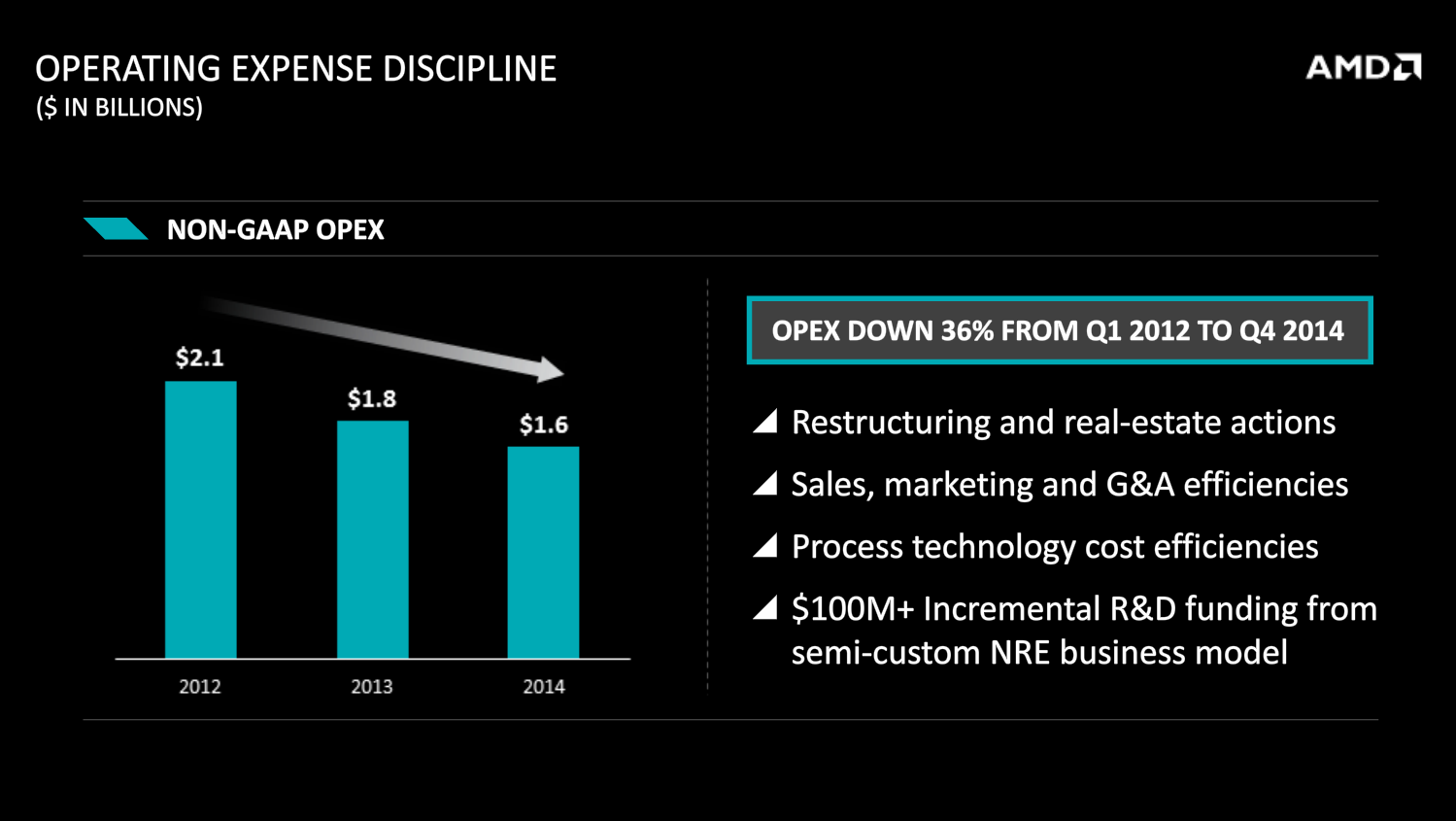

Another area of improvement was the operating expenses. In 2012, the operating expense was $2.1 billion. Last year, that cost dropped 36 percent, with the operating expense landing at $1.6 billion. The reason behind the lower expenses is mainly due to restructuring the finances. Other factors include more efficient sales, a reduction in the cost of processing technology, and the inclusion of over $100 million in R&D incremental funding, specifically for its semi-custom products.

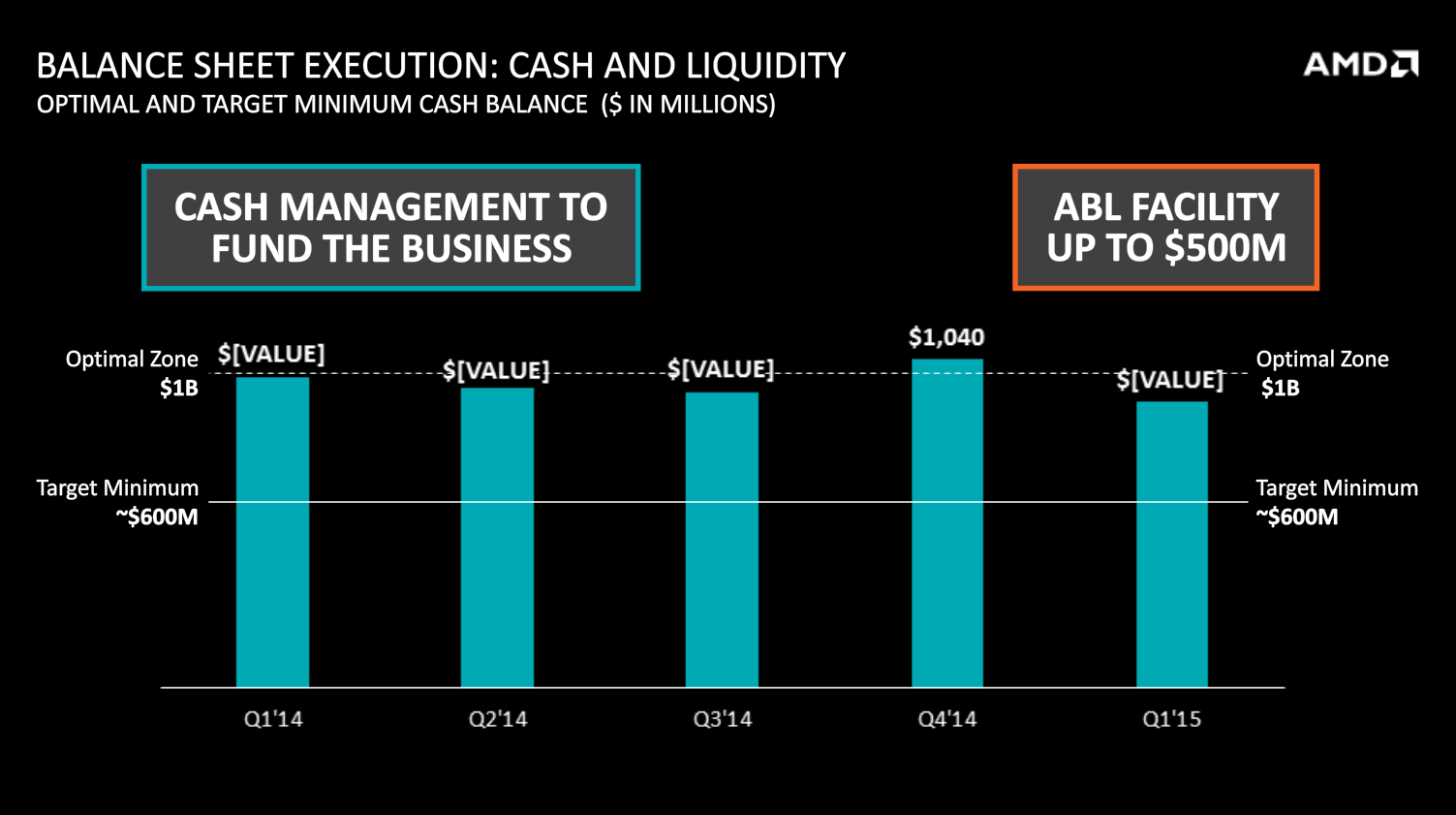

AMD has also done well by keeping enough cash on hand, even if it's lower than expected. Kumar said that the company needs to keep a minimum value of $600 million in cash and liquidity, with an optimal target of $1 billion. Fortunately, the company never came close to its minimum target. Instead, it stayed near the $1 billion mark through the first quarter of 2014. In Q4 2014, the amount of cash even exceeded $1 billion.

To make sure AMD stays afloat, Kumar also devised a financial system that would keep the cash amount close to $1 billion in the coming years. Any cash that exceeds the $1 billion mark would be used to reduce the company's debt, without further increasing it, as well as reducing the amount of debt interest with each payment.

The projected loss in the first half of 2015 doesn't exactly indicate that things are going downhill for AMD for the rest of 2015. In fact, it's the opposite; Kumar projected that the second half of 2015 will be profitable, with revenue rising up to 15 percent, and the amount of cash on hand increasing from $800 million to as high as $1 billion.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

In the long run, he expects the gross margin to increase 36-40 percent on AMD's diverse revenue. With more revenue comes more money for operating expenses, which Kumar expects to rise 26-30 percent.

Of course, this all hinges on the premise that AMD's products, especially in its three projected growth areas, are successful at release. The company seems to be on point with its somewhat constant cash flow, but it seems that even a small slip in profit could necessitate an entirely new game plan for AMD.

Follow Rexly Peñaflorida II @Heirdeux. Follow us @tomshardware, on Facebook and on Google+.

Rexly Peñaflorida is a freelance writer for Tom's Hardware covering topics such as computer hardware, video games, and general technology news.

-

carnetarian Sounds like AMD is throwing in the towel with CPUs/GPUs. If they're having trouble competing with Intel/Nvidia when that's their main focus, how in the world do they think they'll be able to compete if they start focusing on other things?Reply -

Johnpombrio Makes sense. AMD simply cannot compete financially with the Intel and NVidia R&D powerhouses so they are pulling valuable R&D resources away from them and putting it into segments where they can actually make a profit. Of course, they are up against all the OTHER companies competing for those other markets. Bottom line? Screwed either way. As long as the UAE Arabs keep bailing them out, they will survive tho and those guys have money to burn.Reply -

Symbiote_IV ReplySounds like AMD is throwing in the towel with CPUs/GPUs. If they're having trouble competing with Intel/Nvidia when that's their main focus, how in the world do they think they'll be able to compete if they start focusing on other things?

Not at all. AMD is about to rock the world with the 300 series(we can and should hope) and are gonna be bringin out APUs and CPUs soon enough as well. -

mystilez ReplySounds like AMD is throwing in the towel with CPUs/GPUs. If they're having trouble competing with Intel/Nvidia when that's their main focus, how in the world do they think they'll be able to compete if they start focusing on other things?

Not at all. AMD is about to rock the world with the 300 series(we can and should hope) and are gonna be bringin out APUs and CPUs soon enough as well.Sounds like AMD is throwing in the towel with CPUs/GPUs. If they're having trouble competing with Intel/Nvidia when that's their main focus, how in the world do they think they'll be able to compete if they start focusing on other things?

Not at all. AMD is about to rock the world with the 300 series(we can and should hope) and are gonna be bringin out APUs and CPUs soon enough as well.

I have to disagree...

So far what we know is that 300 series "OEM" are all re brands we no officially statement of HBM...

and them focusing on fiance usually means cutting corners... for there was no word on firing existing employee's that couldn't design a new architect that would innovate the PC world...

again my opinions will change once official statements are released by amd regarding new technology in the gpu/cpu field but for now my excitement has died :\