Intel will cancel 14A and following nodes if it can't win a major external customer — move would cede leading-edge nodes to TSMC and Samsung

Then exit the leading-edge process technologies completely.

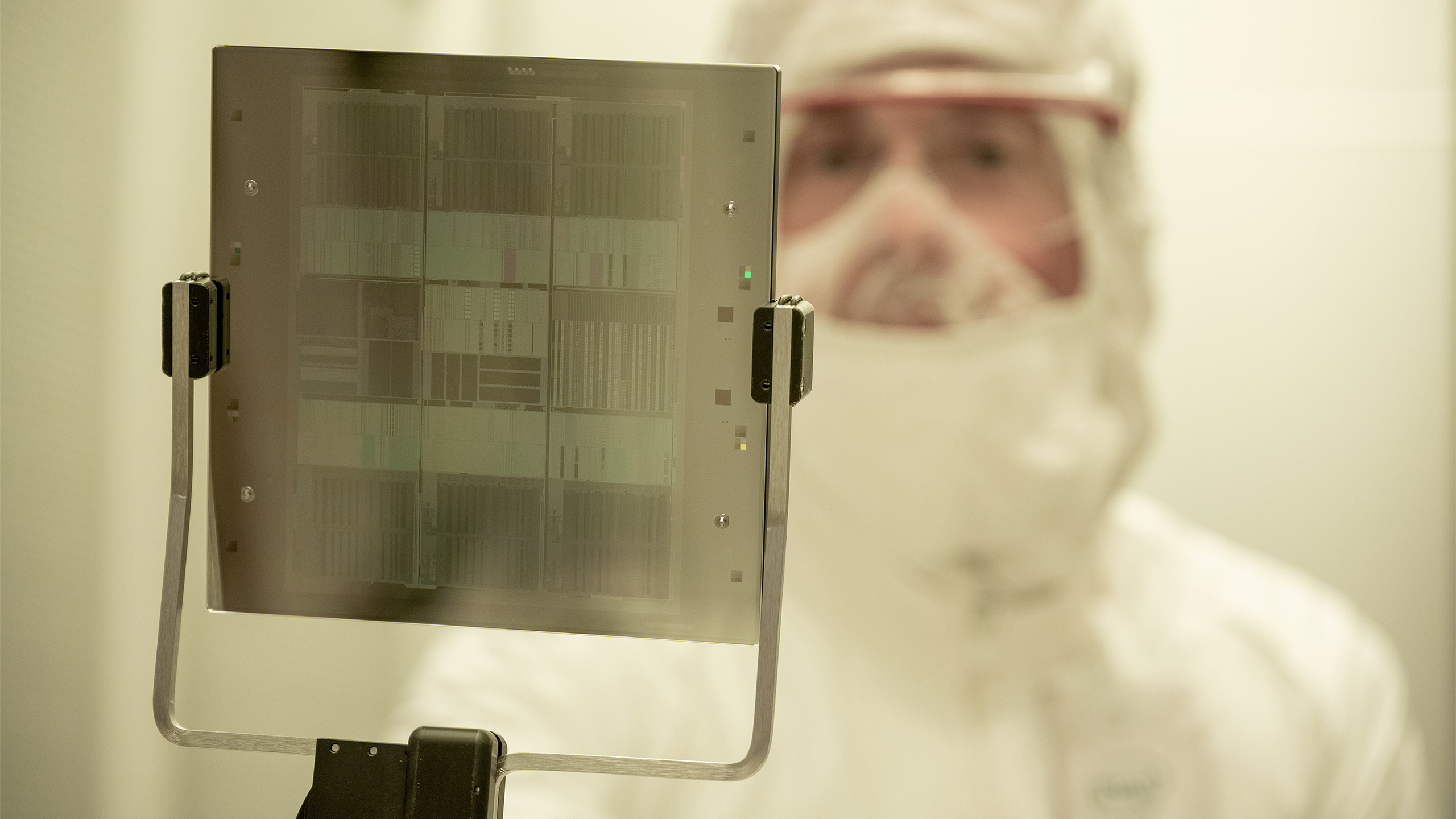

Intel may slow down or even cancel development of its 14A process technology (1.4nm-class) if it fails to land a major external customer for this production node, or if the fabrication process fails to meet crucial milestones. This is the first time Intel has admitted to considering withdrawing from the leading-edge semiconductor technology race for a major node, essentially leaving leading-edge process technologies to TSMC and possibly Samsung Foundry.

Among the topics Intel discussed during its earnings call on Thursday were its approaches to investing in production capacity and the development of next-generation process technologies, as well as its focus on improving its return on investment and profitability. While the company remains committed to its roadmap through Intel 18A and 18A-P, the continuation of its next-generation Intel 14A process depends heavily on attracting a major outside customer and meeting specific development milestones.

"If we are unable to secure a significant external customer and meet important customer milestones for Intel 14A, we face the prospect that it will not be economical to develop and manufacture Intel 14A and successor leading-edge nodes on a go-forward basis," a statement by Intel in a 10Q filing with the SEC reads. "In such event, we may pause or discontinue our pursuit of Intel 14A and successor nodes and various of our manufacturing expansion projects."

The Intel 14A node is planned as the successor to the 18A and 18A-P nodes, and is aimed at both internal products and external clients. However, the company made clear that it may halt or abandon 14A development if it cannot secure a large external partner or achieve critical progress targets. This represents a major shift in Intel's strategy toward market-driven node development, where new technologies must demonstrate commercial viability before being developed and before appropriate tools are purchased to enable high-volume manufacturing.

"The 14A is the process node, but clearly I will make sure that I see the internal customer, external customer, and volume commitment before I put CapEx," said Lip-Bu Tan, chief executive of Intel, during the company's conference call with analysts and investors. "But that is something that has to meet my requirement in terms of performance and yield. It's a lot of responsibility to be serving our customers, make sure that we can deliver the result — consistent, reliable result — to them, so that their revenue can depend on us."

Modern leading-edge process technologies cost billions to develop. Intel spent $16.546 billion on research and development (R&D) in 2024, with a significant portion allocated to the development of 18A, 18A-P, 14A, and other process technologies. While it is challenging to determine the exact cost of the 14A project, it is safe to say that it will be in the billions of dollars.

Additionally, Intel 14A is expected to be the company's first process technology to utilize High-NA EUV lithography for at least three critical layers. Each ASML Twinscan EXE:5000/5200 High-NA EUV tool is projected to cost around $380 million. Therefore, procuring two such tools for a fab to enable high volume manufacturing (HVM) on 14A will cost Intel a whopping $760 million. Given such vast upfront costs, Intel needs to ensure that these tools will be used by both internal products and external customers.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

For now, Intel has at least one internal design planned for 14A, though the company is keeping its options open. If 14A does not move forward, future Intel designs needing greater transistor density and performance than 18A-P could be manufactured using third-party foundries (read: TSMC).

If Intel ultimately cancels 14A and its successors, it expects to continue building the majority of its products in-house on nodes up to 18A-P through at least 2030. This is expected to support a wide range of offerings, while limiting capital deployment to technologies and fabs. However, it remains to be seen what happens to Intel's margins if its most advanced products are made by external foundries (i.e., TSMC) using their leading-edge nodes.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

thestryker The writing was on the wall with the valuation collapse and it became pretty much inevitable the second they forced Gelsinger out. The supposed investors don't want to build a company's future if it interferes with making money now.Reply

While bad leadership certainly caused the situation that Intel found themselves in this is at best equally bad. The fabs will likely be sold off and we'll have another GloFo except I suspect there will be a lot more job losses because it would cost money to convert DUV fabs to be usable. -

bit_user Such announcements are exactly the opposite of how you instill confidence in prospective customers!Reply

The correct approach would be:

"Intel remains committed to ensuring these nodes are competitive and delivered on-target."

...or something like that. Threatening to cancel them could end up being a self-fulfilling prophesy. -

thestryker Reply

The cynic in me says this is working as intended.bit_user said:Such announcements are exactly the opposite of how you instill confidence in prospective customers! -

TCA_ChinChin Sad to see Intel potentially being relegated to another GloFo. Having more options in the leading edge and competition with TSMC is always a good thing.Reply -

Geef Try to think of it like this. AMD chips have used less power for a long time. If Intel changes their focus on making their current chips use less power overall and add a couple AI pieces then they should be fine for the next couple generations.Reply -

usertests It's going to be fun to see what happens to the abandoned 18A node. Hoping for cheap Wildcat Lake and Panther Lake goodies.Reply -

JamesJones44 Intel should spin out the Foundry business at this point, it's clear that it's not a priority for Lip-Bu. Otherwise I just don't see customers having faith that Intel in its current form will be able to compete and without investment it will just die. I think the Foundry would have a better chance on their own of both drawing investment and drawing external customers. I'm not saying it would or wouldn't be successful on its own, just that I think it would have a better chance at succeeding vs what this announcement sounds like (abandonment).Reply -

Rakanyshu Reply

Pretty much what i think, someone must be wanting a fab for pennies and its working on that dealthestryker said:The cynic in me says this is working as intended.