Intel promises sweeping changes to combat stagnation with new foundry strategy, AI focus, and the return of Hyper-Threading — but losses threaten to curtail ambition

Intel's Q2 revenue flat year-over-year, but losses deepen, and outlook remains bleak

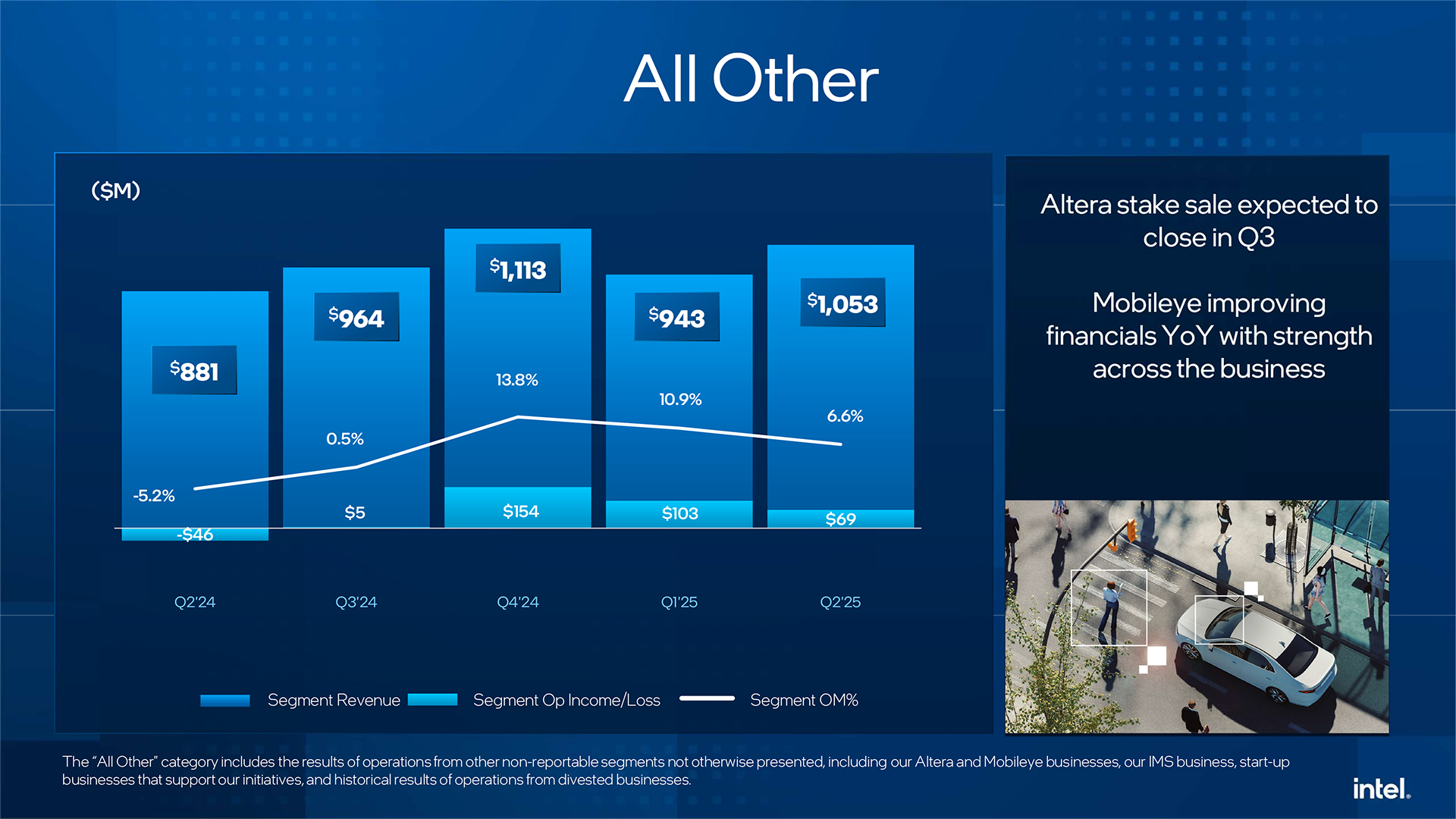

Intel on Thursday disclosed its financial results for the second quarter of 2025 and made several announcements about its future. The company posted flat year-over-year revenue of $12.9 billion; however, losses deepened to $2.9 billion as gross margin declined further amid flat operating expenses. This is mostly due to charges associated with the company's restructuring. During the conference call, Intel also revealed its new strategies for AI, foundry, and x86 products. Intel CEO Lip-Bu Tan also made sweeping announcements regarding Intel's business operations.

The birth of a new Intel

During the conference call with analysts and investors, Tan revealed a lot about the company's future, including its plans to change strategies for AI, foundry, core x86 businesses, and even organization and culture. He also revealed that the transformation of the company involves cutting its workforce to 75,000 by the end of the year, which means that the company will have laid off over 30,000 people by the end of 2025.

"Over the last three months, I have completed a systematic review of every organization and function reporting to the CEO," he said. "These reviews included detailed analysis of headcount, skillset, spending, site distribution, executive population, and restructuring plans. We have much work to do in building a clean and streamlined organization, which we have started. […] Our goal is to reduce inefficiencies and redundancies and increase accountability at every level of the company. We need to right-size and scale back the company while ensuring that we are retaining our best internal talents and hiring the best external talents from industry and universities. During Q2, we completed the majority of the actions needed to achieve our year-end target of 75,000 employees. […] These actions are necessary not just to reduce our operating expenses, but to make the company more agile, collaborative, and vibrant to simplify our business and improve our product and process execution."

The new x86 products strategy: Bring back Hyper-Threading, each design needs CEO approval

Tan emphasized a back-to-basics approach to Intel's x86 product strategy, aiming for architectural discipline, streamlined execution, and competitive positioning in both client and server markets.

He indicated that the Panther Lake processor, built on the Intel 18A node, remains on track to launch by the end of 2025, with additional SKUs following in the first half of 2026. He expects Panther Lake to reinforce Intel's strong position in notebooks across consumer and enterprise.

For server CPUs, Granite Rapids is ramping as planned and is performing well in AI host nodes and storage, but broader share gains in hyperscale workloads will require time and improvement in performance-per-watt, which essentially means that Intel is having a hard time competing with AMD's EPYC.

At the same time, he acknowledged that Intel's CPUs are uncompetitive in high-end desktops. To improve the competitive positions of Intel's high-performance CPUs, Tan said Intel plans to re-enable simultaneous multithreading (SMT) to P-cores in client processors.

Tan is also introducing a new policy that all major chips will require his personal review and approval of designs before tape-out, to ensure high margins and simplify the product line-up. "I have already begun this process," he said.

Looking forward, the directive to Intel's silicon teams is to focus on clean, simple architectures with better cost structures, a more focused SKU line-up, and improved product margins.

Intel to overhaul foundry strategy

Tan outlined a major shift in Intel's foundry and CapEx strategy, moving away from massive investments in capacity that were common for Intel in recent years. He acknowledged that Intel's past approach — building massive capacity far ahead of actual demand — was 'unwise and excessive,' leading to a 'fragmented factory footprint' and underutilized fabs. Instead of expanding based on internal forecasts, Intel will tie capacity and capital spending strictly to volume commitments and milestone-based triggers, which promises to ensure that investment aligns with both customer needs and financial returns.

"I do not subscribe to the belief that if you build it, they will come," said Tan. "Under my leadership, we will build what customers need, when they need it, and earn their trust through consistent execution."

To reinforce this disciplined approach, Intel has cancelled (or halted?) its manufacturing projects in Germany and Poland, is consolidating its assembly and test operations in Costa Rica, and will slow construction pace in Ohio, though retain the flexibility to accelerate if needed.

On the process technology front, Tan reaffirmed Intel's commitment to 18A, the node to be used for at least three generations of Intel's consumer and server products, including Panther Lake, Clearwater Forest, and Diamond Rapids. The company's chief financial officer, Dave Zinsner, acknowledged that Intel does not expect loads of foundry customers with 18A, yet the company still positions the production node for both Intel's products and external customers.

The CEO of Intel also emphasized that Intel 14A will be the company's first foundry-first node, designed in collaboration with external customers and tailored to meet their specific performance and cost needs. However, Tan made it clear that future investments will be contingent on Intel’s ability to secure external demand and deliver return on capital, rejecting the notion of building on expectations.

As a result, if Intel does not find at least one major external customer for 14A, the company may abandon or slow down its development and cease investments in 14A-capable capacity, which will essentially mean that Intel will cease developing leading-edge process technology and will produce its most advanced products at external foundries. This marks a significant philosophical transformation of Intel and highlights that Tan is at least considering much deeper changes at Intel than initially thought. But, for now, Intel remains committed to developing 14A.

"18A is important to us for the three generations of internal products, and then when we are ready, then we can go outside with more confidence to get a customer to support us," Tan said. "And then on the 14A, same as the A14 from TSMC, the timing is all in 2028 – 2029."

New AI strategy: Focus on inference and software

Tan described Intel's previous approach to AI as fragmented and overly focused on traditional silicon and training workloads, lacking a cohesive system and software stack. Under his leadership, Intel will now shift toward a full-stack AI strategy that integrates hardware, system-level design, and software.

The new focus will build on Intel's existing silicon assets — x86 CPUs and Xe GPUs — with the aim of building a more tightly integrated platform. The company will strengthen its investments in AI software to make its platform more competitive, yet Tan admits that this will take time.

Strategically, Intel is concentrating its AI efforts on areas where it believes it can differentiate and disrupt, particularly in inference and agentic AI, rather than competing directly with Nvidia's AI accelerators, such as H100 or B200.

From now on, Intel will develop AI products by learning more about upcoming AI workloads, then designing a software stack for such workloads, and only then developing hardware for such needs, eventually delivering a full-stack AI solution.

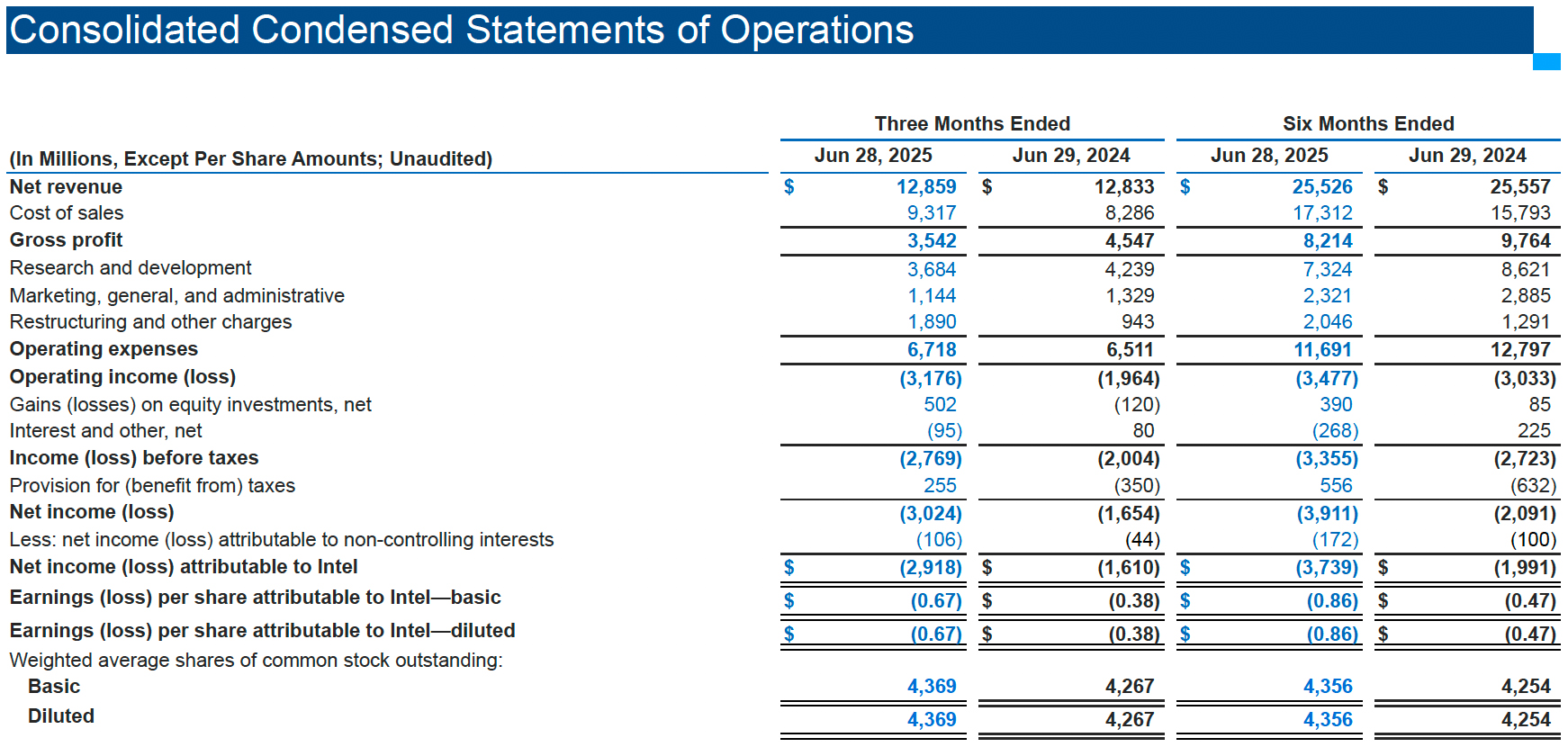

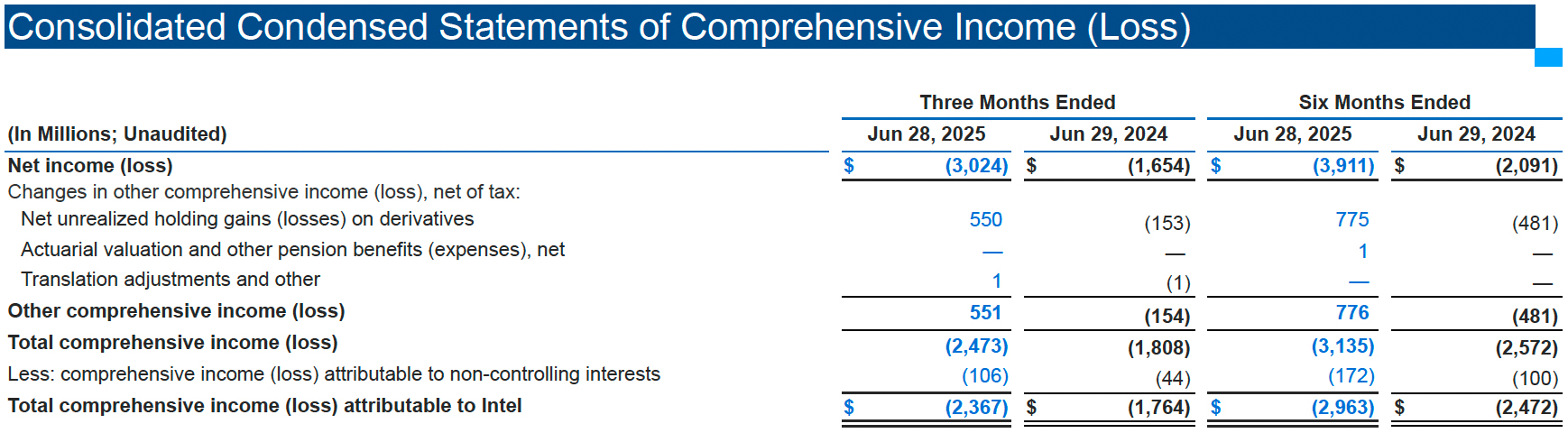

$12.8 billion revenue, $2.9 billion losses

For the first quarter of 2025, Intel earned $12.9 billion, up slightly from $12.8 billion in the same quarter a year ago. However, the company's losses for the quarter totalled $2.9 billion, up from $800 million in the previous quarter, and up from $1.6 billion in Q2 2024. The company's gross margin dropped to 27.5%, pressured by a product mix, severance payments to laid-off employees, an impairment charge, and accelerated depreciation ($797 million), related to manufacturing assets deemed no longer usable for operations.

In Q2 2025, Intel spent approximately $3.7 billion on R&D (down from $4.2 billion in Q2 2024) and $1.1 billion on mergers and acquisitions (down from $1.3 billion in Q2 2024). As Intel continued investments in advanced nodes like Intel 18A, new product development, and trimming administrative costs through restructuring. The company also recorded $1.9 billion in restructuring and impairment charges, primarily related to severance and the write-down of underutilized fab tools. These expenses contributed significantly to Intel's quarterly operating loss, but are part of the company's effort to streamline operations and reduce long-term costs.

"Our operating performance demonstrates the initial progress we are making to improve our execution and drive greater efficiency," said Tan. "We are laser-focused on strengthening our core product portfolio and our AI roadmap to better serve customers. We are also taking the actions needed to build a more financially disciplined foundry. It’s going to take time, but we see clear opportunities to enhance our competitive position, improve our profitability and create long-term shareholder value."

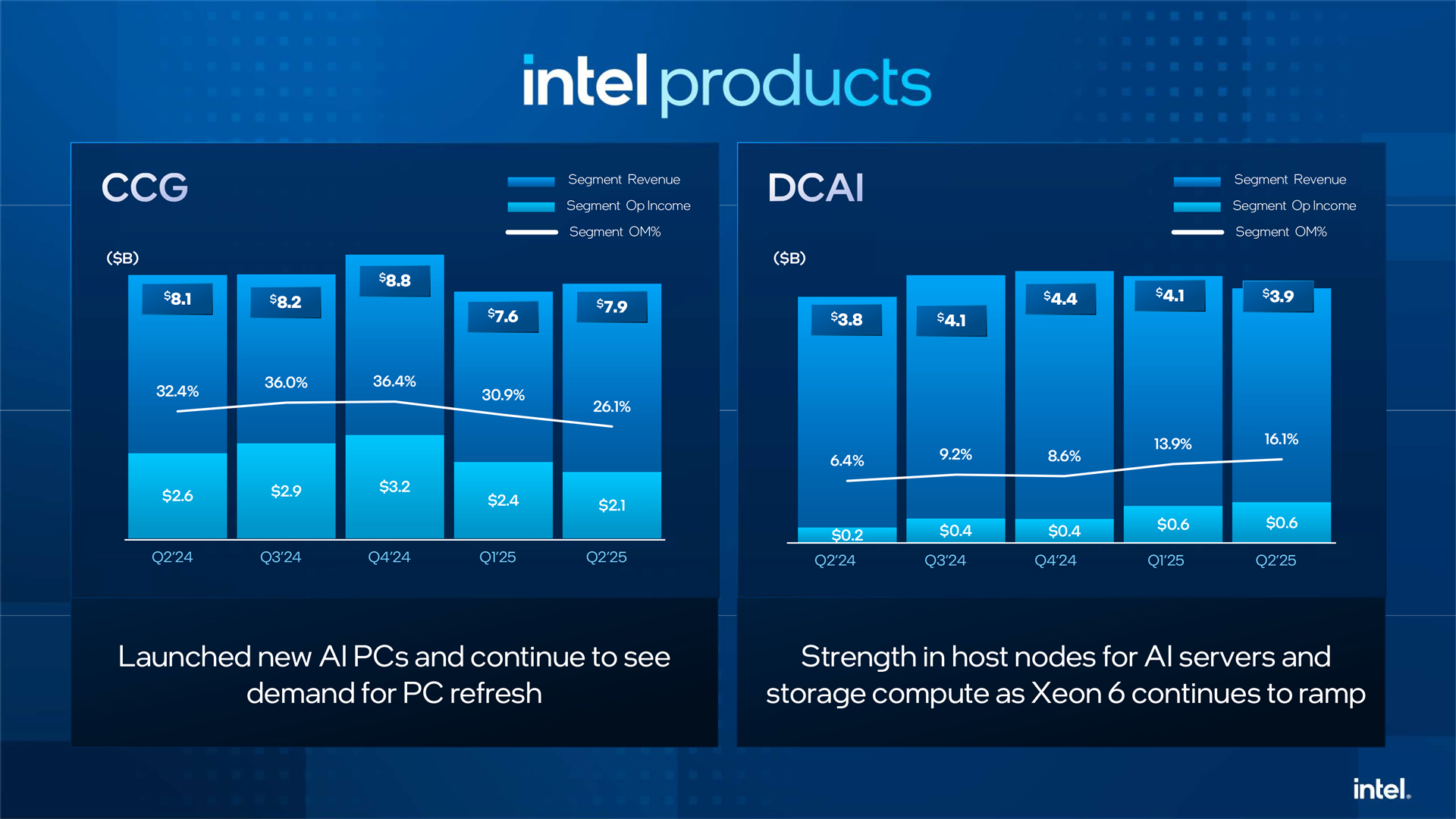

Intel's Client Computing Group (CCG) in Q2 2025 generated $7.9 billion in revenue, down from $8.1 billion in Q2 2024. Operating income dropped both sequentially and year-over-year to about $2.1 billion, due to lower volumes and incremental charges. Average selling prices (ASPs) remained stable, compared to the same quarter a year ago.

In Q2 2025, Intel's Data Center and AI (DCAI) group delivered $3.9 billion in revenue, representing a 4% increase year-over-year. This growth was primarily driven by stronger server CPU volumes, which rose 13% compared to Q2 2024. This is a result of demand recovery across hyperscale and enterprise customers. Also, the operating margin (OM) of the business unit increased to 16.1%, up from 6.4% in the same quarter a year ago.

However, ASPs in this segment declined by 8%, primarily due to competitive pricing pressures and a shift in product mix. Despite the pricing headwinds, operating income improved by $391 million year-over-year, aided by a $524 million drop in operating expenses due to workforce reduction and structural cost cuts.

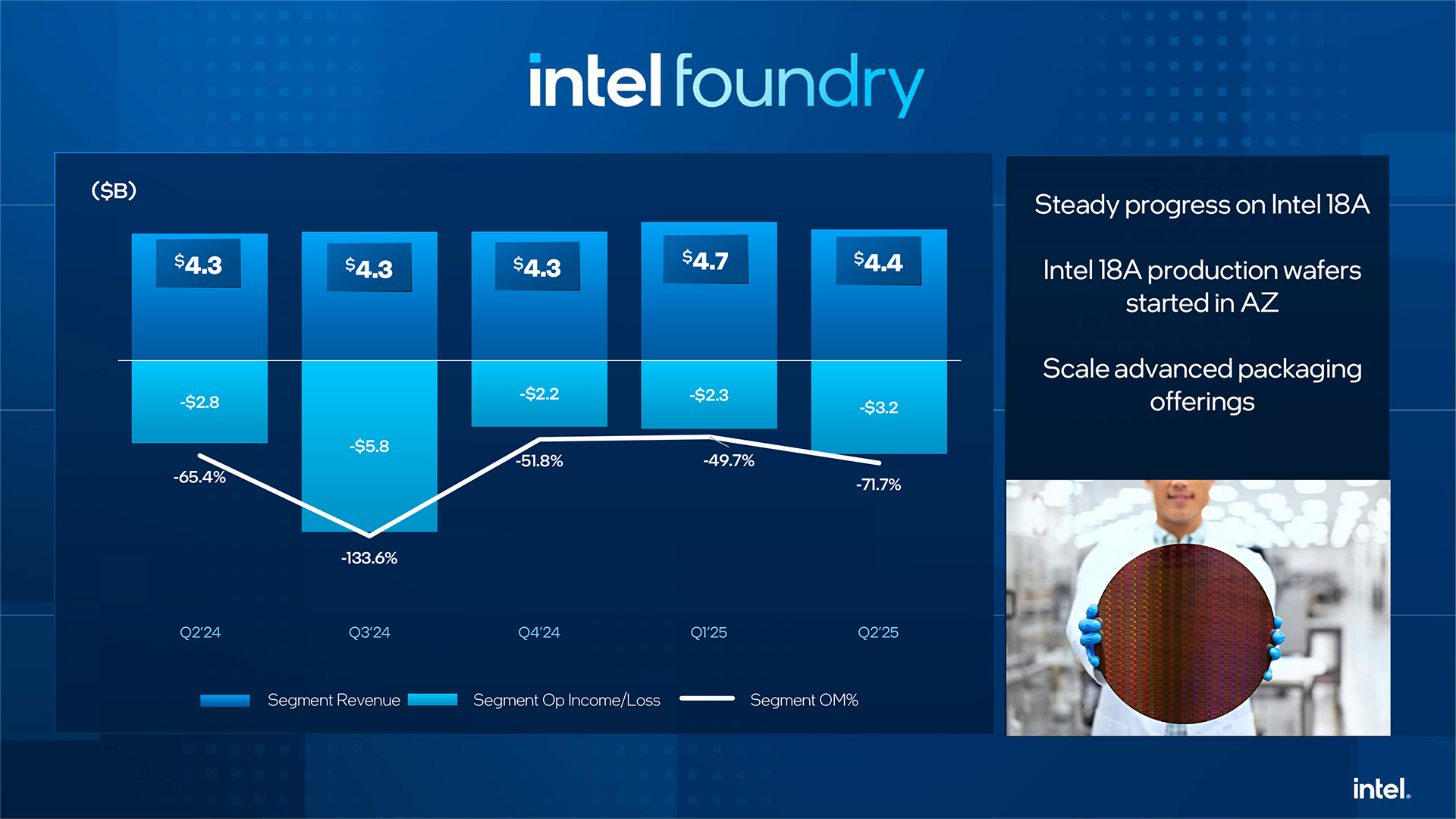

In Q2 2025, Intel Foundry's revenue totalled $4.42 billion in revenue (up 3% YoY), but remained deeply unprofitable with an operating loss of $3.17 billion, driven by 18A start-up costs, and $797 million in impairment and accelerated depreciation charges related to underutilized fab tools. The vast majority of foundry revenue came from Intel's internal use, with external customer sales flat, at just $22 million. Although the segment benefited from $185 million in cost savings tied to restructuring, it continues to be a drag on Intel's overall financials. Despite these setbacks, Intel expects its foundry business unit to reach breakeven by 2027.

Typically, sales of CPUs and supporting components are up in the third quarter of the year, as PC makers begin to procure processors for the back-to-school season and start to prepare for the holiday season. However, this is seemingly not the case for Intel. For Q3 2025, Intel projects its revenue between $12.6 billion and $13.6 billion, which is down $200 million by the midpoint of the quarter. Nonetheless, because the company took most charges in Q2, its third-quarter gross margin is expected to be 36%.

These financial results, in addition to the sweeping changes that Tan is making to Intel, paint a curious picture for Intel for the rest of 2025 and beyond. The company has been sailing through rocky waters for some time, and it appears that despite the changes that leadership is looking to make, the storm is yet to pass for Team Blue.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Jame5 I yearn for the days when companies were a single company, not dozens of sub-companies.Reply

Mostly in the medical field, but technology is right up there as well. -

thestryker ReplyTo improve the competitive positions of Intel's high-performance CPUs, Tan said Intel plans to re-enable simultaneous multithreading (SMT) to P-cores in client processors.

Though this might be a seemingly reasonable assumption he didn't say this at all. He was talking datacenter with regards to SMT. The only products in datacenter I'm aware of without SMT are the E-core parts and adding SMT to them would seemingly defeat the purpose of them.

This is the SMT quote from Tan's letter:

In data center, we are focused on regaining share as we ramp Granite Rapids while also improving our capabilities for hyperscale workloads. To support this, we are reintroducing simultaneous multi-threading (SMT). Moving away from SMT put us at a competitive disadvantage. Bringing it back will help us close performance gaps. We are also making good progress in our search for a new leader of our data center business, and I plan to share more on that this quarter.

-

Brainle55 When we look at what Intel's new CEO, Lip-Bu Tan, is doing, we can only conclude that Pat Gelsinger has done an "excellent job." His predecessors, for that matter, have done the same.Reply

Tan seems to be as "open-minded" as Gelsinger, continuing to ignore four billion potential customers: smartphonians. And then, as always, what's happening in the world of GPUs (Graphics Processing Units) is still ignored at Intel.

The same could be said of Microsoft; even though it's making record profits, it would be nothing if it, too, stopped being blind to the world of smartphonians.

And they're considered "geniuses." It seems we don't have the same definition of that word. -

Crystalizer Generally in business you have to work in a part of the industry where you are strongest. Intel tried going mobile with its atom and it was horrible.Reply

Smartphones has their king, a king that intel can't beat. If intel had better processor for smartphones don't you think they wouldn't sell it? -

jg.millirem I would like to read this article, looks like it covers Intel stuff at a level Shilov has often done in the past, but now I can’t because the Tom’s owners want me to shell out….7 ten-dollar bills now.Reply