AMD Posts 70% Year-Over-Year Revenue Increase as Sales of EPYC CPUs Skyrocket

AMD earned $6.55 billion in Q2; net income dropped to $447 million.

AMD on Tuesday reported its revenue of $6.6 billion for the second quarter of 2022, its highest quarterly revenue ever. In addition, all AMD products, including CPUs and GPUs, increased in Q2 2022. Nonetheless, shipments of products for client PCs started to demonstrate softness because of growing inflation and a challenging macroeconomic environment.

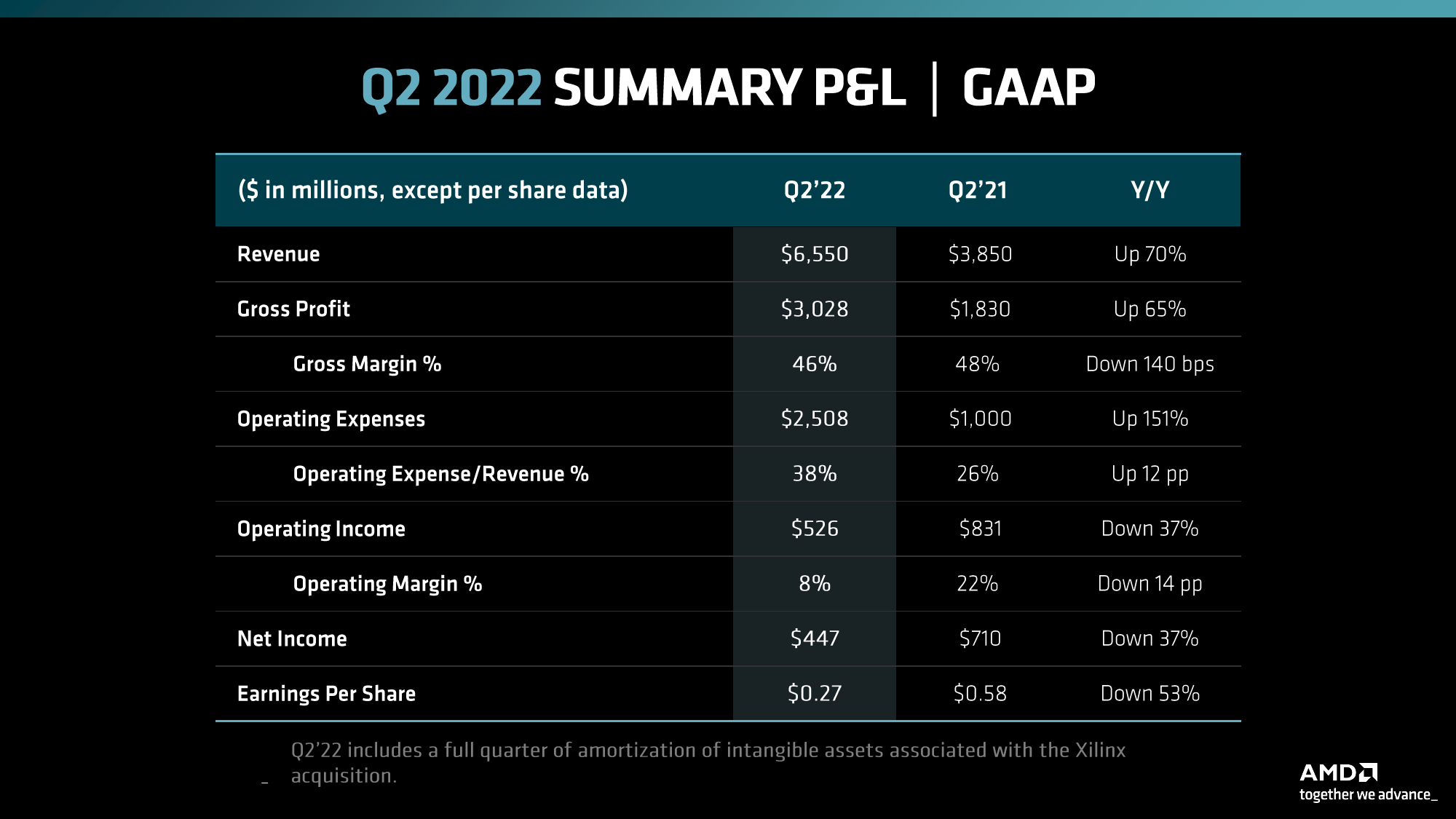

AMD's revenue for the second quarter of 2022 increased 70% year-over-year due to the company's products success and adding products from Pensando and Xilinx to AMD's family. The company posted a gross of 46%, net income of $447 million, and earnings per share of $0.27. While AMD's net income dropped 37% year-over-year, it was primarily due to the amortization of intangible assets associated with the Xilinx acquisition, the chip designer explained.

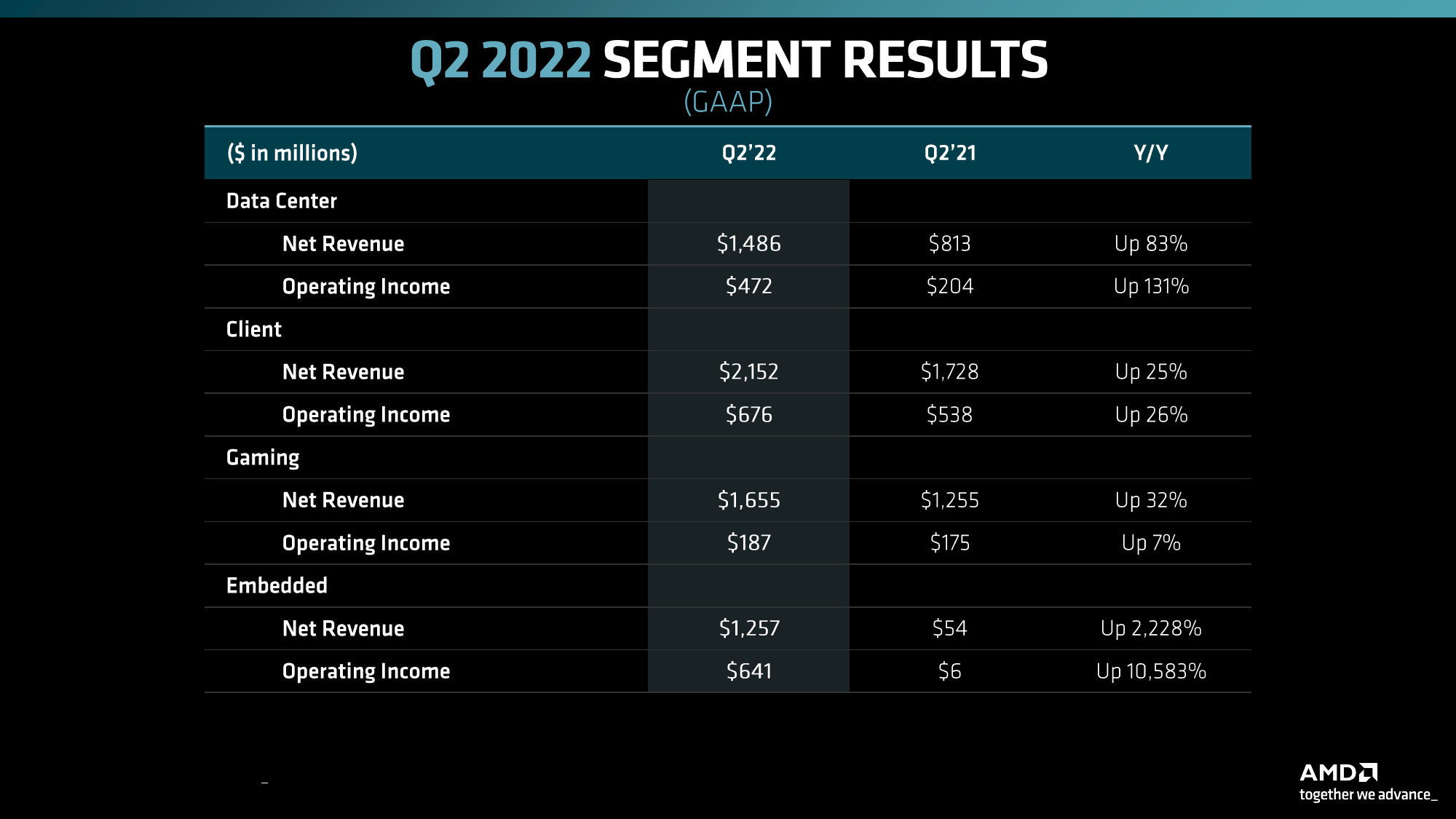

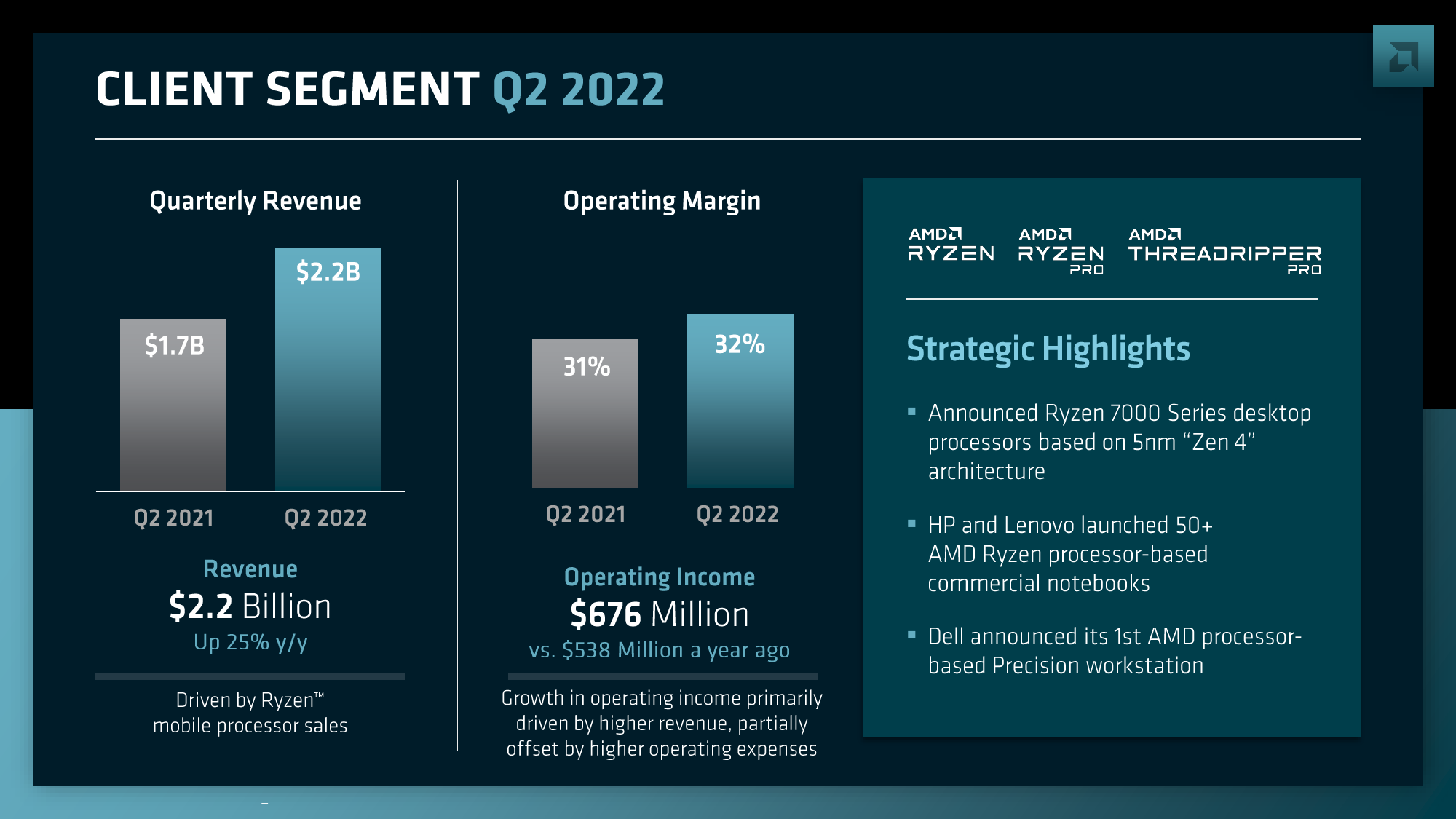

AMD's Client Computing segment — which includes desktop and notebook CPUs as well as chipsets — remained the company's main cash cow in Q2 with $2,152 billion revenue (up 25% year-over-year) and $676 million operating income (a YoY growth). In addition, the chipmaker noted solid sales of its mobile Ryzen CPUs and their increased average selling prices (compared to the same quarter a year ago), which helped boost client computing segment revenue.

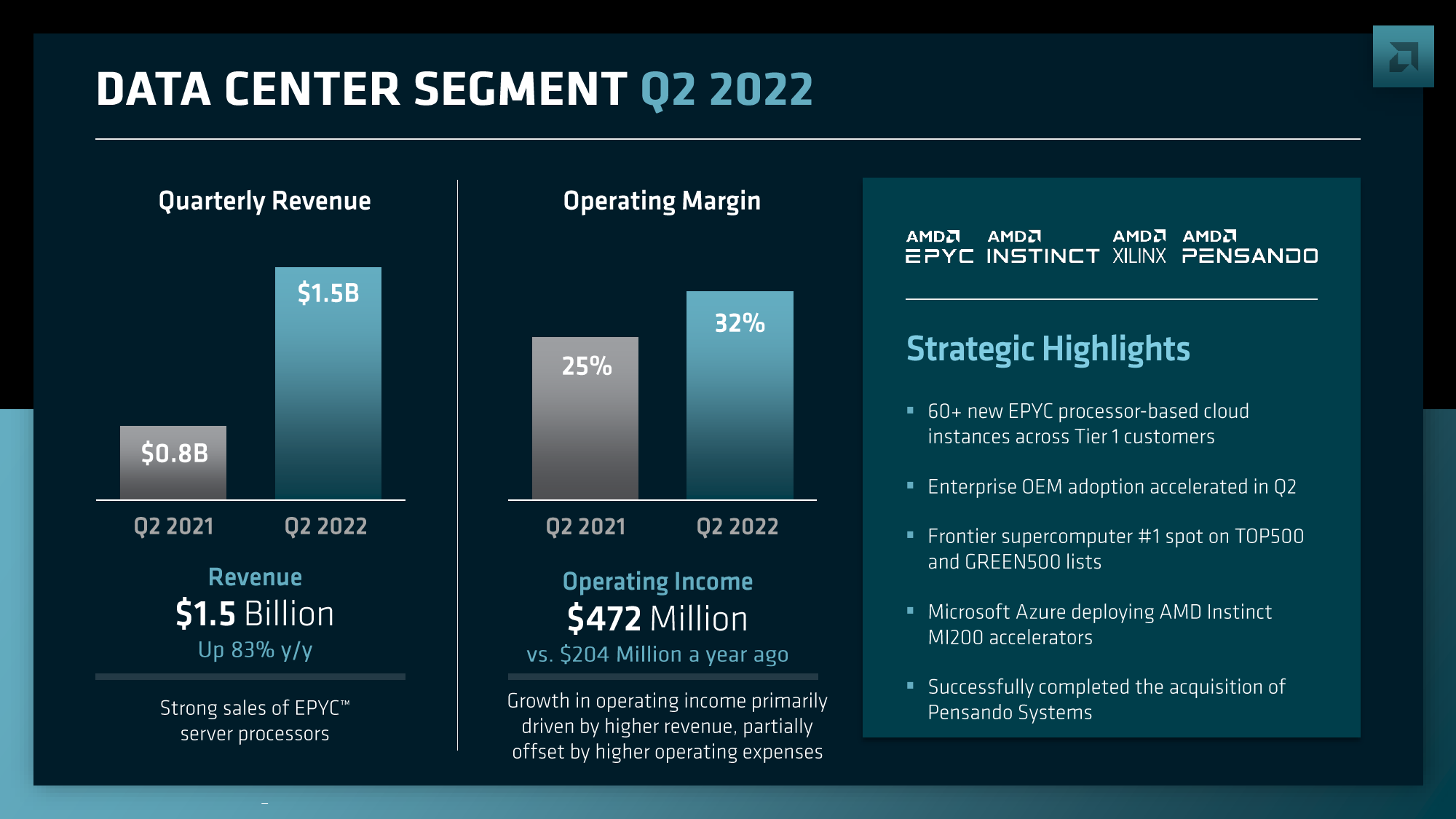

Sales of Datacenter products — CPUs, GPUs, Xilinx FPGAs, and Pensando DPUs — surged to $1,486 billion compared to Q2 2021, an increase of 83%. To a large degree, AMD's data center business unit posted a massive gain as it added FPGAs and GPUs to its lineup. Still, AMD's EPYC processor shipments increased as the company continued to win designs with server makers.

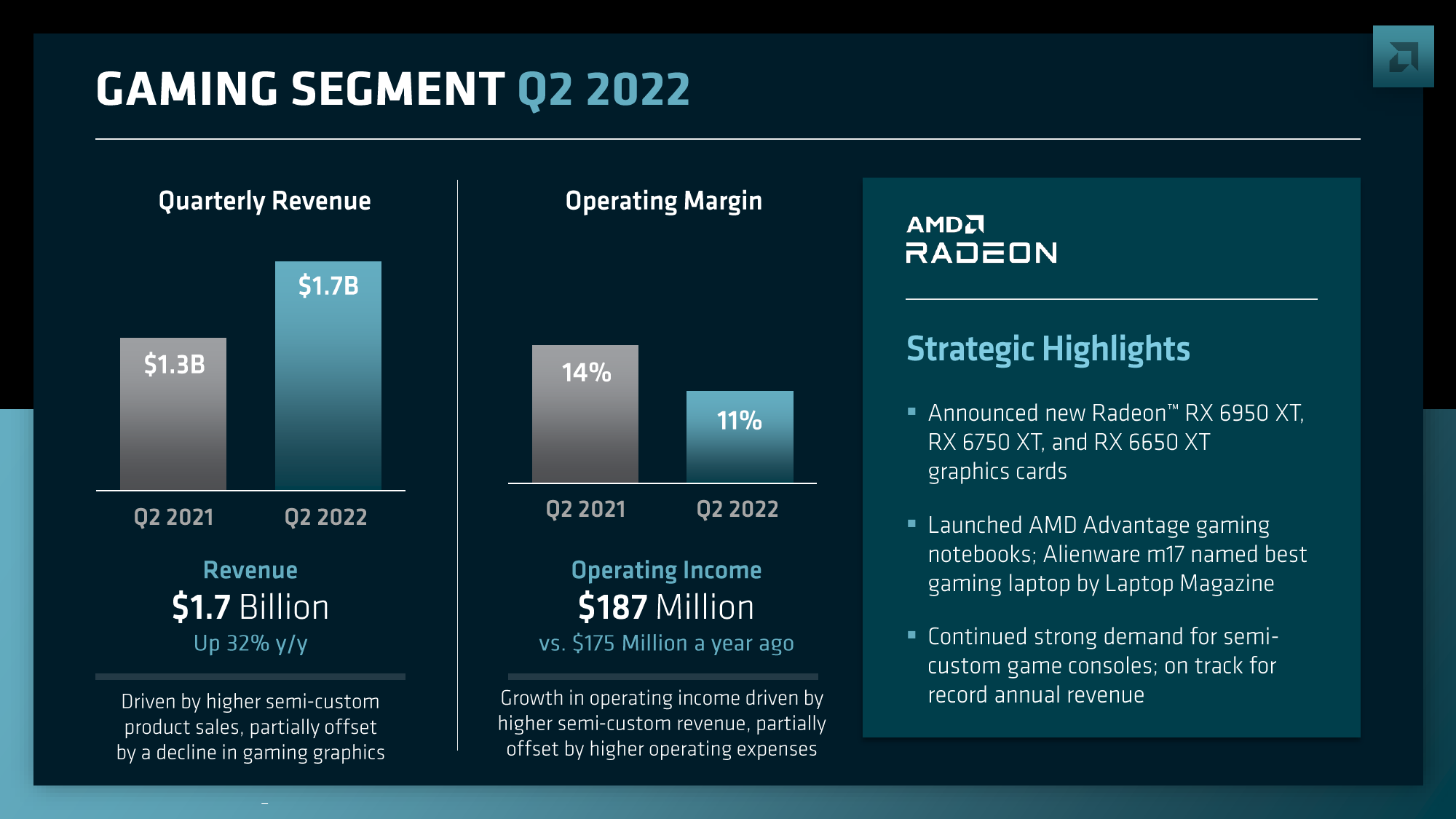

AMD's Gaming business — which includes client GPUs and console system-on-chips — demonstrated mixed results during the quarter. On the one hand, AMD's gaming hardware sales boosted 32% year-over-year to $1,655 billion. But on the other hand, the operating income of the business unit increased by only 7%, to $187 million. AMD said that mixed results resulted from slowing demand for consumer graphics cards by gamers and miners following strong 2021, slowing demand for client PCs, and dropping graphics card prices.

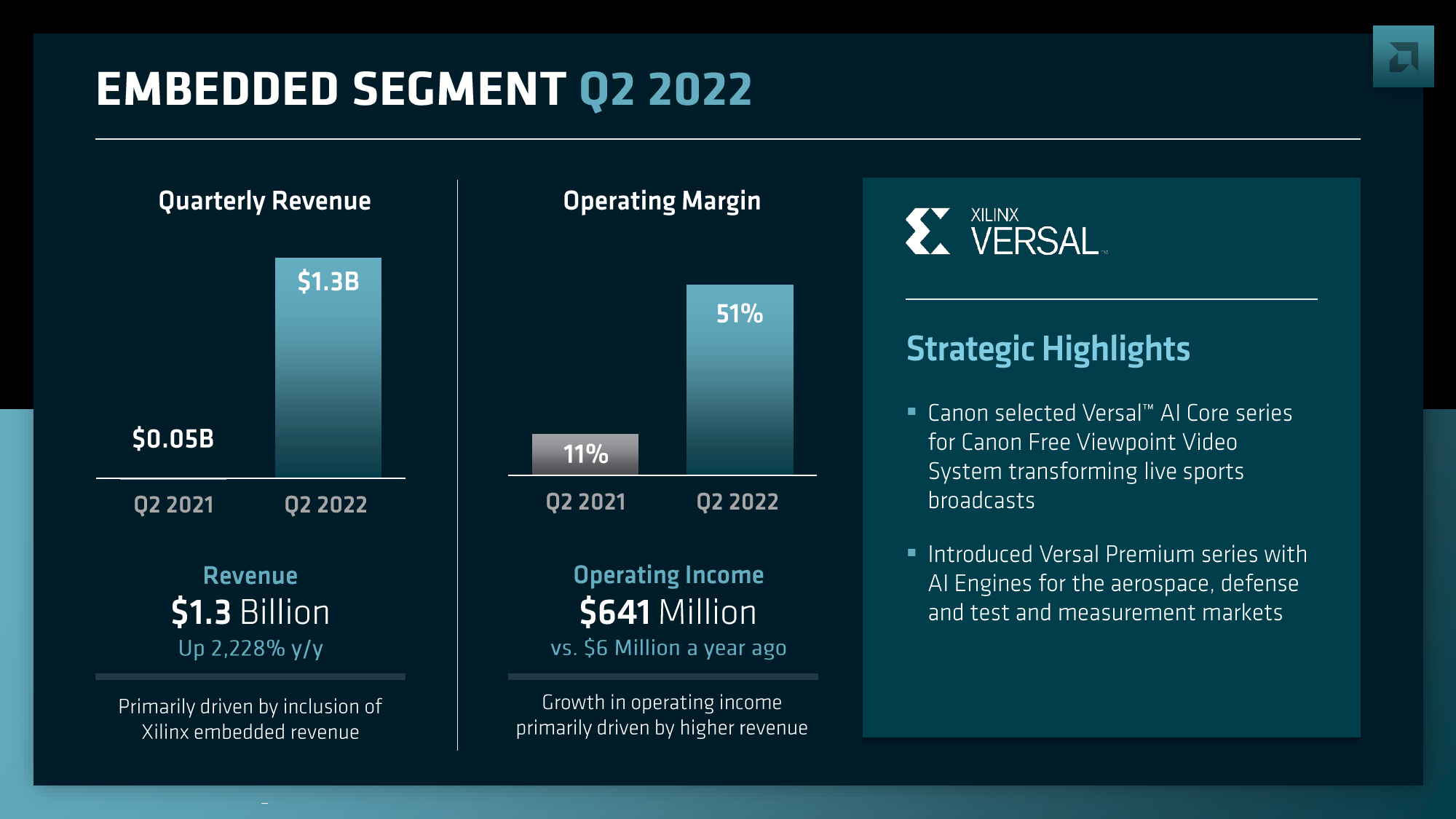

Shipments of AMD's Embedded products (which includes embedded solutions both from AMD and Xilinx) totaled $1,257 billion, an increase of a whopping 2,228% year over year primarily because of the low base effect as AMD's shipments of embedded products were not exceptionally high in the recent years.

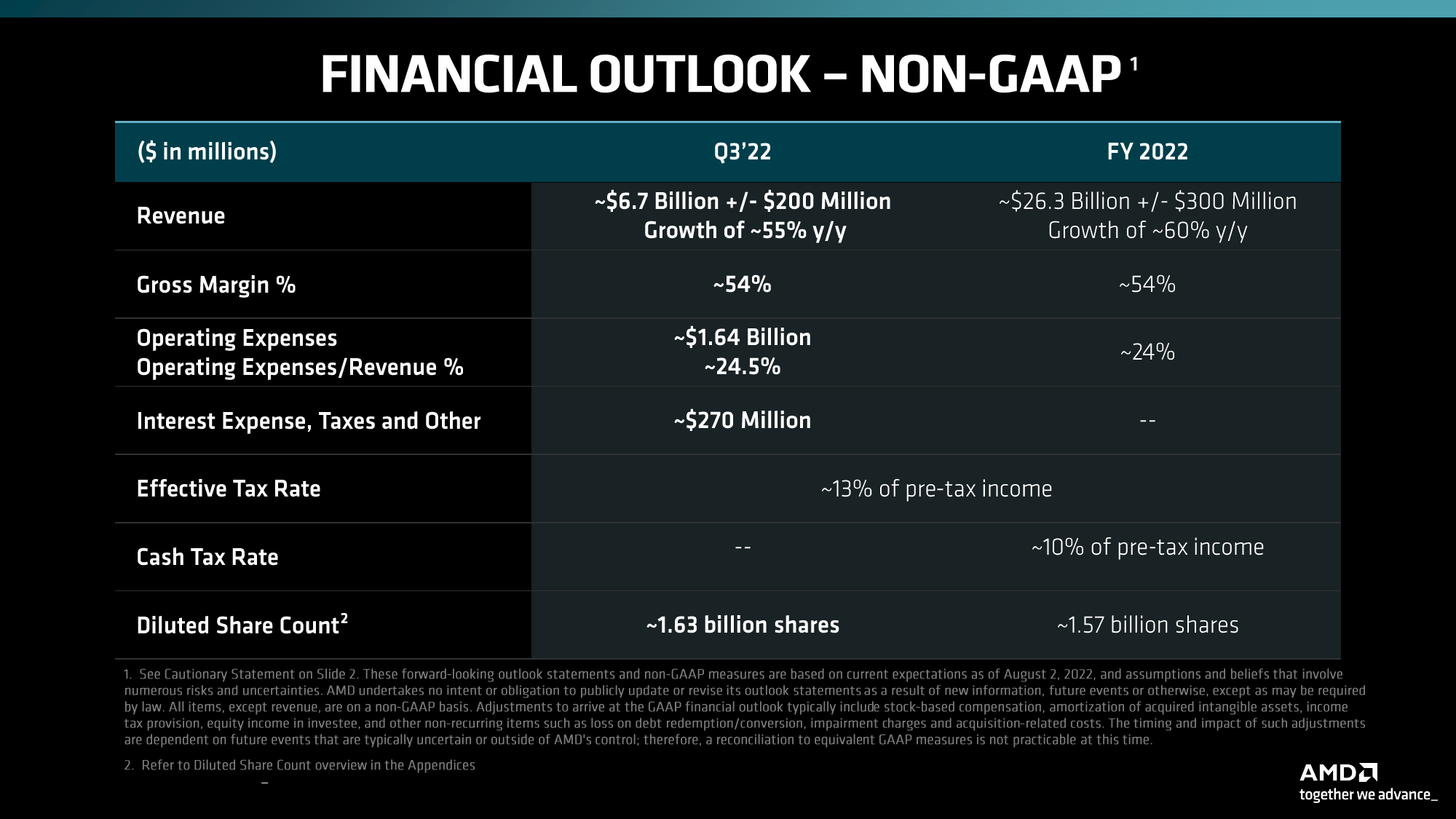

AMD expects its revenue to increase to $6.7 billion ± $200 million in Q3 2022, which is 55% higher than Q3 2021. The company expects its revenue growth to be driven primarily by expensive data center products and embedded products from Xilinx. While the company confirmed plans to release its Ryzen 7000-series 'Raphael' processors this fall and Radeon RX 7000-series GPUs based on its RDNA 3 architecture later this year, it did not quantify how these launches improve the results of its Client Computing and Gaming businesses. Meanwhile, AMD must maintain its $26.3 billion ± $300 million revenue guidance for 2022, an increase of 60% over 2021.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Awev The numbers do not add up, or you might be writing for the wrong audience, not the United States.Reply

AMD earned $6.550 billion in Q2; net income dropped to $447 million

and

the company's main cash cow in Q2 with $2,152 billion revenue

So in the first quote we are talking 6 billion 550 million in sales and fees, and 447 million in net income. In the second quote we are talking 2 trillion 152 billion, due to a comma, and not a decimal point. Two trillion is more than 30 times greater than six billion. Or is there something else that I did not see ? Sales and fees, earned, and revenue are the same are they not, for this articale? That is before expenses, such as advertising, rebates, promotions, salaries, rents and montages, and other deductions and operating costs, to give us the net income.

Intel failed to attribute their record losses to the competition, yet this shows what Intel is trying to hide from their investors. -

spongiemaster ReplyAwev said:Intel failed to attribute their record losses to the competition, yet this shows what Intel is trying to hide from their investors.

Intel's data center chip sales slide amid bleak Q2 earnings results

"Intel said that the poor results were mostly due to a weakened economy, supply chain and inventory disruption and “competitive pressures.”"

Looks like they did to me. -

escksu Replyspongiemaster said:Intel's data center chip sales slide amid bleak Q2 earnings results

"Intel said that the poor results were mostly due to a weakened economy, supply chain and inventory disruption and “competitive pressures.”"

Looks like they did to me.

HAHA, yes AMD did create competitive pressure for Intel. Intel's datacenter and AI revenue down 16%, thats around 700million... Pretty close with 600+ mil rise from AMD..

Of course AMD isn't the only factor but its definitely one of the most significant factor. -

watzupken Reply

I think to some extend, Intel is right (although they have been using this as an excuse for a few quarters now). I guess besides the point that AMD's product is very competitive now, the other 2 reasons may bespongiemaster said:Intel's data center chip sales slide amid bleak Q2 earnings results

"Intel said that the poor results were mostly due to a weakened economy, supply chain and inventory disruption and “competitive pressures.”"

Looks like they did to me.

AMD's market share is small. So there is a lot of room to expand as they have proved to produce competitive and yet well priced products

Intel have been delaying a lot of their products, which may result in less sales now as companies wait for newer products. After waiting for some time, I guess some may actually jump ship instead of waiting further.

Intel's dominance has been chipped away by AMD and ARM for some years now. In the recent year, we start to see that it is impacting their bottom line in a more tangible way now. I actually don't see a light at the end of the tunnel for Intel unless they suddenly come up with a miracle product that smokes all their competitors in every metric. -

-Fran- Wasn't AMD also supposed to have a terrible quarter beause Intel did? What happened, AMD? Why do you disappoint people like that?Reply

Heh.

Sarcasm aside, I can only say it was a good showing for sure. Their aquisitions have really paid off it seems, which is showing in their server market penetration. Once they start taking away long-term contracts from Intel, they'll be in longevity territory for sure (if they haven't already!). What I mean by this, is not depending on new sells, but get into the long-term re-deployment cycles that Dell, HP and other SI's do with big Corp.

I'll have a closer look at the numbers and see if I can find anything interesting around the consumer stuffs.

Regards. -

Awev Replyspongiemaster said:Intel's data center chip sales slide amid bleak Q2 earnings results

"Intel said that the poor results were mostly due to a weakened economy, supply chain and inventory disruption and “competitive pressures.”"

Looks like they did to me.

Notice that even when they do admit to competitive pressure it is more of an afterthought, not in the top three reasons given. While I gladly give Joe Biden and the democrats credit for high inflation, a recession, high gas prices, and a number of other less than desirable things, Intel has to accept some responsibility at some point, they can not run a company like Biden is running the country - with denial and blaming everything and everyone else, and expect to remain a viable company. -

spongiemaster Reply

Don't hurt yourself stretching so hard to find something negative to say when you were proven wrong. Not in the top 3 things? One, that wasn't a direct quote in the article, so we don't know what order Intel said it, and two, there's only 3 things listed, how do you figure competition is not in the top 3 reasons given when only 3 reasons are listed?Awev said:Notice that even when they do admit to competitive pressure it is more of an afterthought, not in the top three reasons given. -

Ogotai Reply

come on spongiemaster, even you should know there is NO way intel would ever admit that they lost sales to amd. even if every one knew it, and proved it, intel would never admit it.spongiemaster said:there's only 3 things listed, how do you figure competition is not in the top 3 reasons given when only 3 reasons are listed? -

watzupken As far as I recall, they have pushed the blame to overstocking and economy slowdown for the last 2 to 3Q. Unfortunately, I feel their decline will continue since they have been missing their product release timeline, and AMD and ARM are hot on their heels.Reply