China AI Server Market Expected to Quintuple In Size, Hit $16 Billion By 2027

IDC survey charted 54% growth from H1 2022 to H1 2023.

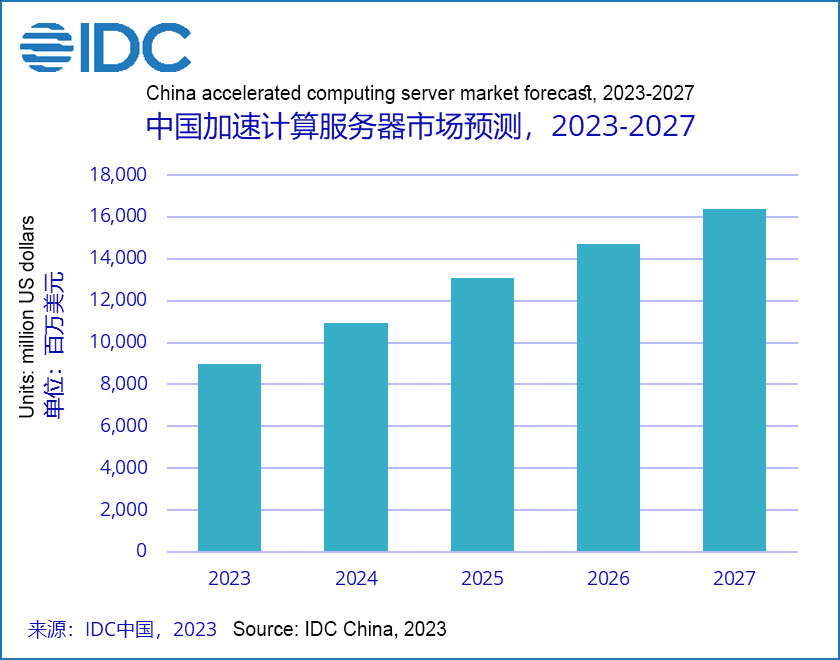

According to a new report published by International Data Corporation (IDC), the AI server market is surging in China. Based on IDC’s latest market data, the size of the accelerated computing market in China grew an impressive 54% from H1 2022 to H1 2023. Moreover, the corporation forecasts that the market, valued at US$3.1 billion, will grow to US$16.4 billion by 2027.

Before we ponder the forecasts, it is worth looking at the state of the China AI market more closely today. IDC says that GPU servers still dominate the market in 2023, accounting for 92% of servers deployed. The remaining 8% of servers are said to be accelerated by processors such as NPU, ASIC, and FPGAs.

IDC also focuses on who is creating these AI servers for the Chinese market. It observes that Inspur, H3C, and Ningchang are the top three suppliers, accounting for more than 70% of the market.

Regarding what kinds of businesses are using AI, IDC asserts that the most significant users of AI are still internet services. Servers dedicated to AI internet service enhancements make up about half of the market, with the remaining demand coming from the financial, telecommunications, and government sectors. With the whole market on the up, it isn’t surprising to hear that all these sectors want more AI and have doubled their AI server use over the most recently surveyed period.

IDC provided some reasoning behind the growth in AI server adoption. It notes that AI is moving from narrow specific tasks like image and speech recognition to more comprehensive, human-like intelligence tasks like generating content and steering decisions. In the future, it sees newer, larger AI models providing better solutions in areas such as the metaverse, urban governance, medical health, scientific research, and more.

IDC reckons Chinese companies seeing AI's most significant benefits so far are set to drive investment in this technology over the next three years. It forecasts that “China’s accelerated server market will reach US$16.4 billion by 2027.” Interestingly, it sees non-GPU servers grabbing a larger share of the AI server market over that time, but not by very much, rising from 8% to 12% by 2027. Whether this change will be spurred by demand/supply and geopolitics or by improved AI accelerating ASICs isn’t made clear.

Last, IDC notes that China’s local AI chip makers are rapidly growing, with government support accelerating progress. The latest figures show that half a million locally sourced/developed accelerator chips were used in AI servers in China in H1 2023. That quantity addressed 10% of the entire server market in the country.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.