China Increases Localization of Chipmaking Tools, But Still Lags Behind

China can replace some of the foreign tools at fabs, but not all of them.

China has made significant strides in its semiconductor sector development, with over 40% of its manufacturing equipment now being locally produced, according to a DigiTimes report that cites data compiled by Bloomberg. This growth, fueled by significant R&D investments and governmental support, has doubled in just two years. However, there's still a reliance on foreign lithography tools, as Chinese companies can barely produce competitive scanners.

Recent reports from Korean media 'Ddaily' highlight that China's push for self-reliance in the semiconductor equipment sector has seen its localization rate surge to over 40%, a significant uplift from 21% in prior years. This rate has extended to over 50% in specific areas like physical vapor deposition (PVD) and oxidation.

The growth in China's semiconductor industry is not just about numbers. To achieve them, massive investments have been made. Among the various segments of China's semiconductor manufacturing chain, equipment manufacturers stand out with the highest investment in R&D. Over the past two and a half years, these manufacturers have consistently invested more than 10% of their revenues in R&D.

Two companies, in particular, Advanced Micro-Fabrication Equipment Inc China (AMEC) and Naura Technology, have been at the forefront of this R&D push. AMEC has maintained an average R&D ratio of over 13% in the past two and a half years, while Naura Technology has allocated 11% of its revenue towards R&D activities. Both AMEC and Naura specialize in tools for etching and deposition. By contrast, contract chipmaker SMIC and outsourced semiconductor assembly and test (OSAT) tend to limit their R&D spending to 10% of revenue.

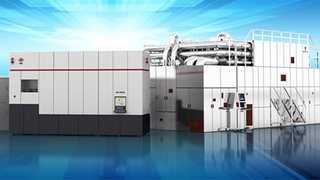

While China's semiconductor sector has seen impressive growth, the key challenge to replace lithography scanners from Dutch and Japanese companies has not been resolved. Shanghai Micro Electronics Equipment Group (SMEE), a state-backed firm, earlier this year promised to introduce its first scanner capable of producing chips on a 28nm process technology by the end of 2023, but it remains to be seen when the company can make these scanners in volume and when they replace those made by ASML, Canon, and Nikon. For now, the localization rate for lithography equipment in China is in the single-digit percentage range, the source report claims.

Several factors have been instrumental in China's semiconductor advancements. A vast domestic market, combined with strong governmental backing, has provided the necessary impetus. Additionally, the country's robust R&D capabilities and financial support from the capital market have further propelled its journey towards semiconductor self-reliance.

Stay On the Cutting Edge: Get the Tom's Hardware Newsletter

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a Freelance News Writer at Tom’s Hardware US. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

mitch074 Reply

Doubled in 2 years. In the next 2 years, at this rate, they could have 50 to 80% of their lithography locally sourced. In 5 years, they may just overtake competition on most used nodes, and nip at the heels of the market leaders.Admin said:Chinese companies produce more wafer fab tools, but still cannot make competitive lithography scanners.

China Increases Localization of Chipmaking Tools, But Still Lags Behind : Read more

In 10 years, they may make monster companies like TSMC, Intel or Samsung irrelevant.

Why?

Because US embargo gave them the impetus to do so - aim for foot, press trigger. -

Li Ken-un Reply

Remind me in ten years. lolmitch074 said:Doubled in 2 years. In the next 2 years, at this rate, they could have 50 to 80% of their lithography locally sourced. In 5 years, they may just overtake competition on most used nodes, and nip at the heels of the market leaders.

In 10 years, they may make monster companies like TSMC, Intel or Samsung irrelevant.

Why?

Because US embargo gave them the impetus to do so - aim for foot, press trigger. -

mitch074 Reply

OK - take electric cars. It started 10 years ago. Who's both the largest market and the biggest maker? Take note: it's not the USA and it's not Tesla (https://www.ev-volumes.com/).Li Ken-un said:Remind me in ten years. lol

So, yeah - we'll see in 10 years. -

stonecarver Looking back Historically He who controls the water controls the population. The stakes are different, modern times same outcome. :unsure:Reply -

Li Ken-un Reply

Are we talking about gallium, rare earths, and such in this case?stonecarver said:He who controls the water controls the population.

I mean, the standard disclaimer for investment products is usually “past performance is not an indicator of future returns.” Depending on how far back you look, different states had their moment at different times. The U.S. was indisputably in the lead in the past.mitch074 said:OK - take electric cars. It started 10 years ago. Who's both the largest market and the biggest maker? Take note: it's not the USA and it's not Tesla (https://www.ev-volumes.com/).

So, yeah - we'll see in 10 years. -

stonecarver Reply

In a way I guess but my end result knowing getting a foot hold on who dominates future products CPU/GPU for whatever product will be a game changer.Li Ken-un said:Are we talking about gallium, rare earths, and such in this case?

cell phones

toasters

cars

your new TV

on and on

Again looking back historically ATT or Bell were the gods of the industry back in the day. Cell phones a gimmick only for the rich so lets not worry.

At lot of people have never even had a land line in there home. Cell phones are now the Gods of today.

So He who control's the water. could be he who is ahead of the game control's the industry.

I'm trying extremally hard not to make what I'm say political.

There is a big movement going on out there and should not be brushed off as ....................were good -

DalaiLamar ReplyLi Ken-un said:It’s still 2023. This should not be a surprise.

Gotta to give them some cope. But we know. -

mitch074 Reply

I'm trying to compare two sectors that are rather similar (technology + raw materials) and with a similar starting point : the Chinese government started pushing it as an industry.Li Ken-un said:Are we talking about gallium, rare earths, and such in this case?

I mean, the standard disclaimer for investment products is usually “past performance is not an indicator of future returns.” Depending on how far back you look, different states had their moment at different times. The U.S. was indisputably in the lead in the past.

2008 : Beijing has to host the Olympics. the city is overcome with pollution, central power is dictating that car emissions must go down drastically.

2018 : fossil fuel powered vehicles are hugely restricted in all Chinese cities. Consumers start buying electric cars en masse, where they were previously limited to small 2-wheeled and 3-wheeled vehicles that are now extremely common if cheap. The richest ones buy a Tesla.

2023 : electric cars have become extremely common in most cities, most are made locally, the majority by local companies. Finishing is excellent (0.3mm tolerance), battery techs are varied (not only Li-Po), price range and accessories go from barebone to top notch.I've been to China once a year until 2019 (then, pandemic). My wife went again this summer. I've owned a small EV for the last 8 years, and when I replace it later this month, it will be a MG.

And there was no embargo on foreign EV cars - now there IS one, so if anything, they may just go faster on the transition.

Most Popular