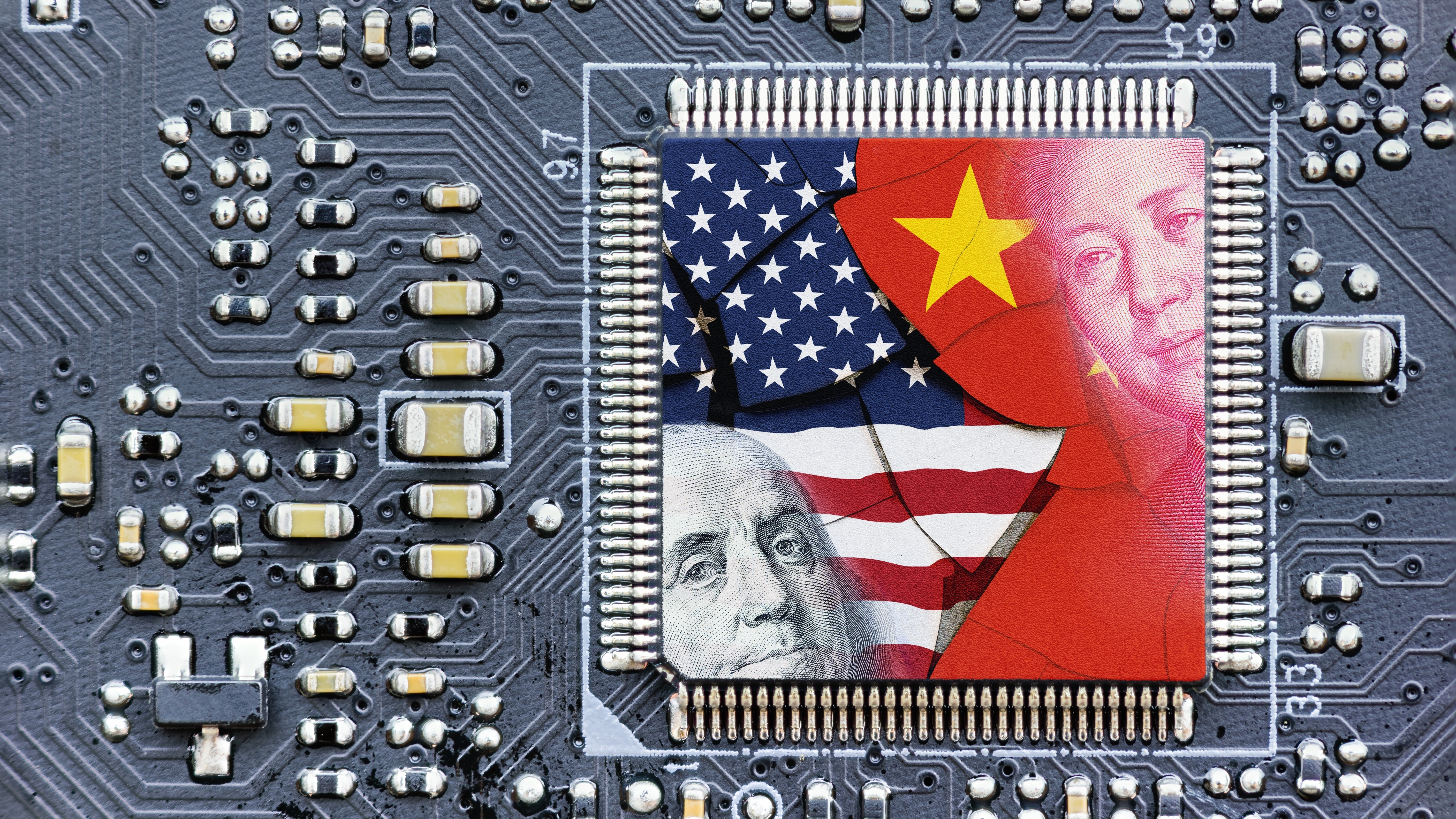

US to increase tariffs on Chinese semiconductors by 100% in 2025 — officials say it protects the $53 billion spent on the CHIPS Act

"Raising the tariff rate on semiconductors is an important initial step to promote the sustainability of these investments." - White House

U.S. President Joe Biden has announced sweeping tariff increases across several Chinese imports, notably semiconductors, electric vehicles, batteries and battery components, solar cells and many components that make up our tech. According to a White House press release, tariffs on Chinese semiconductors will increase from 25% to 50% in 2025, effectively doubling its tax rate.

The semiconductor industry is seen as critical for any modern society to function, with appliances as simple as microwaves to advanced autonomous military drones and everything in between requiring them. The U.S. also sees it as a strategic resource: U.S. Commerce Secretary Gina Raimondo told the U.S. Congress that a Chinese seizure of TSMC, the largest semiconductor manufacturer globally and supplier of 92% of the chips in the United States, would devastate the U.S. economy.

The U.S. is making moves to bring itself back to the forefront of semiconductor technology. It passed the CHIPS Act in 2022, which allocates $280 billion to spur the growth of American semiconductor companies like Intel and to entice international companies like TSMC to set up shop in the U.S. Raimondo is even calling for a second round of investments to help keep America in the lead, especially as China combats U.S. sanctions by massively increasing its legacy chip production.

America’s move to block technology transfers to Chinese tech firms has also pushed the latter to develop homegrown alternatives. For example, the Netherlands prevented ASML from exporting its advanced lithography equipment to China, technology that is used to create high-tech chips. Chinese President Xi Jinping then told the Dutch Prime Minister that China did not need ASML for its technological progress. Soon after, Chinese firm Naura Technology announced that it was jumping into the lithography tools market, alongside Shanghai Micro Electronics Equipment Group (SMEE).

China will not take these new tariffs lying down, especially as it contends against the U.S. for global power. Liu Pengyu, a spokesperson for the Chinese Embassy in Washington, said, “We hope the U.S. can take a positive view of China’s development and stop using overcapacity as an excuse for trade protectionism.” While China has yet to respond to these new tariffs, Liu noted that China is a huge export market for American soybeans — and Tesla sold hundreds of thousands of cars there in 2023.

Although most trade and labor leaders, and many Democrats in the Senate and Lower Houses, praised Biden’s move, there were a few objections. David French, the executive VP for government relations for the National Retail Federation, said, “As consumers continue to battle inflation, the last thing the administration should be doing is placing additional taxes on imported products that will be paid by U.S. importers and eventually U.S. consumers.”

Colorado’s Democrat Governor Jared Polis also tweeted on X, “This is horrible news for American consumers and a major setback for clean energy. Tariffs are a direct, regressive tax on Americans and this tax increase will hit every family.” On the other hand, the Republican National Committee is saying that Biden isn’t tough enough on China, and that his announcement is just “a last-minute election year ploy to gaslight voters into thinking he is tough on China.”

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Whether this move is based on policy or a political act to gain votes for Biden in the upcoming U.S. presidential election, the new tariffs will increase the prices of semiconductors and several other high-tech goods across the board. This is just the latest move in the on-going trade war between both countries, especially as the U.S. has a trade deficit with China amounting to over $250 billion.

We have yet to see how this trade war will affect American technology, but China has taken leaps and bounds in developing its own tech. Despite the numerous sanctions that prevent Chinese companies from acquiring technology from the U.S. and its allies, the Chinese government is continually pushing for developments in this space that could eventually make it a leader — with or without the input of American tech.

Jowi Morales is a tech enthusiast with years of experience working in the industry. He’s been writing with several tech publications since 2021, where he’s been interested in tech hardware and consumer electronics.

-

-Fran- A new type of Chicken Tax?Reply

Because now everyone drives a "light truck" made in the USA for sure!

Oh wait...

Regards. -

edzieba Reply

My first though was on whether this applied to directly imported ICs only, in which case importing ICs on PCBAs and then desoldering them would be a workaround depending on margin (just like the Chicken Tax is dodged by importing 'passenger vehicles' and then removing the seats and windows). If the tax is applied to PCBAs, then that opens a MASSIVE can of works in tracing the origin and unit cost of every single IC on your board, and is likely unworkable.-Fran- said:A new type of Chicken Tax?

Because now everyone drives a "light truck" made in the USA for sure!

Oh wait...

Regards. -

watzupken American taxpayers foot the bill for the CHIPS act and now have to face higher prices for goods. So it’s a lose lose situation. Perplexing decision.Reply

At least get the supply sorted out before pulling off stunts like this that hurts American citizens. -

Notton The real problem with the CHIPS act is that it focuses too heavily on processors, and not DRAM.Reply

Something like 90% of DRAM is produced in South Korea, despite Micron (USA) having 19% market share. -

2Be_or_Not2Be Yeah, the hard part of tariffs hitting consumers the most is right, because short-term capitalist greed sent all the manufacturing to China a long while ago. So the US would have rebuild quite a chunk more of manufacturing in-house again to be able to produce electronic goods in the US that might be price-competitive with tariff price-increased electronics goods imported from China. But would take a good amount of years, and I think short-term capitalist greed is just looking to move country of import, if anything.Reply -

ivan_vy Reply

and as always, consumer will pay in the end for the rebuilding of manufacturing capacity.2Be_or_Not2Be said:Yeah, the hard part of tariffs hitting consumers the most is right, because short-term capitalist greed sent all the manufacturing to China a long while ago. So the US would have rebuild quite a chunk more of manufacturing in-house again to be able to produce electronic goods in the US that might be price-competitive with tariff price-increased electronics goods imported from China. But would take a good amount of years, and I think short-term capitalist greed is just looking to move country of import, if anything.

tariffs, tax exemptions and CHIPS act will come from tax payers. -

gg83 Reply

Manufacturing is leaving China rapidly. Products are already being made in other countries. This actually protects the American consumer by preventing them from buying garbage products.watzupken said:American taxpayers foot the bill for the CHIPS act and now have to face higher prices for goods. So it’s a lose lose situation. Perplexing decision.

At least get the supply sorted out before pulling off stunts like this that hurts American citizens -

bigdragon These tariff increases look to take effect prior to the CHIPS Act funding recipients getting their new production facilities up and running. The likely result is that inflation and price increases will get government policy support -- that's not good. Don't tell me you hear my complaints about price increases and corporate greed and then further enable both!!Reply

Every company protected by the tariff increases and receiving CHIPS Act funding needs to have punitive taxes enforced against its executives and board members. -

slightnitpick It would be better to subsidize domestic purchases from these CHIPS act manufacturers instead of raising tariffs. But it's easier to raise tariffs than to raise other sorts of taxes to support a subsidy.Reply

China is more than capable of building high quality products. When they don't, it's because the US importer asks for the cheapest price, resulting in cost-cutting measures that impact quality.gg83 said:Manufacturing is leaving China rapidly. Products are already being made in other countries. This actually protects the American consumer by preventing them from buying garbage products.

What the US needs is higher standards for what is allowed to be imported into our country. Else the bad-quality merchandise is just going to come from somewhere other than China. -

NinoPino Reply

Apple docet.gg83 said:Manufacturing is leaving China rapidly. Products are already being made in other countries. This actually protects the American consumer by preventing them from buying garbage products.