Intel awarded $8.5 billion in funding for building chipmaking fabs - CHIPS Act funding to boost US semiconductor manufacturing

Intel also gets a 25% tax credit for up to $100 billion.

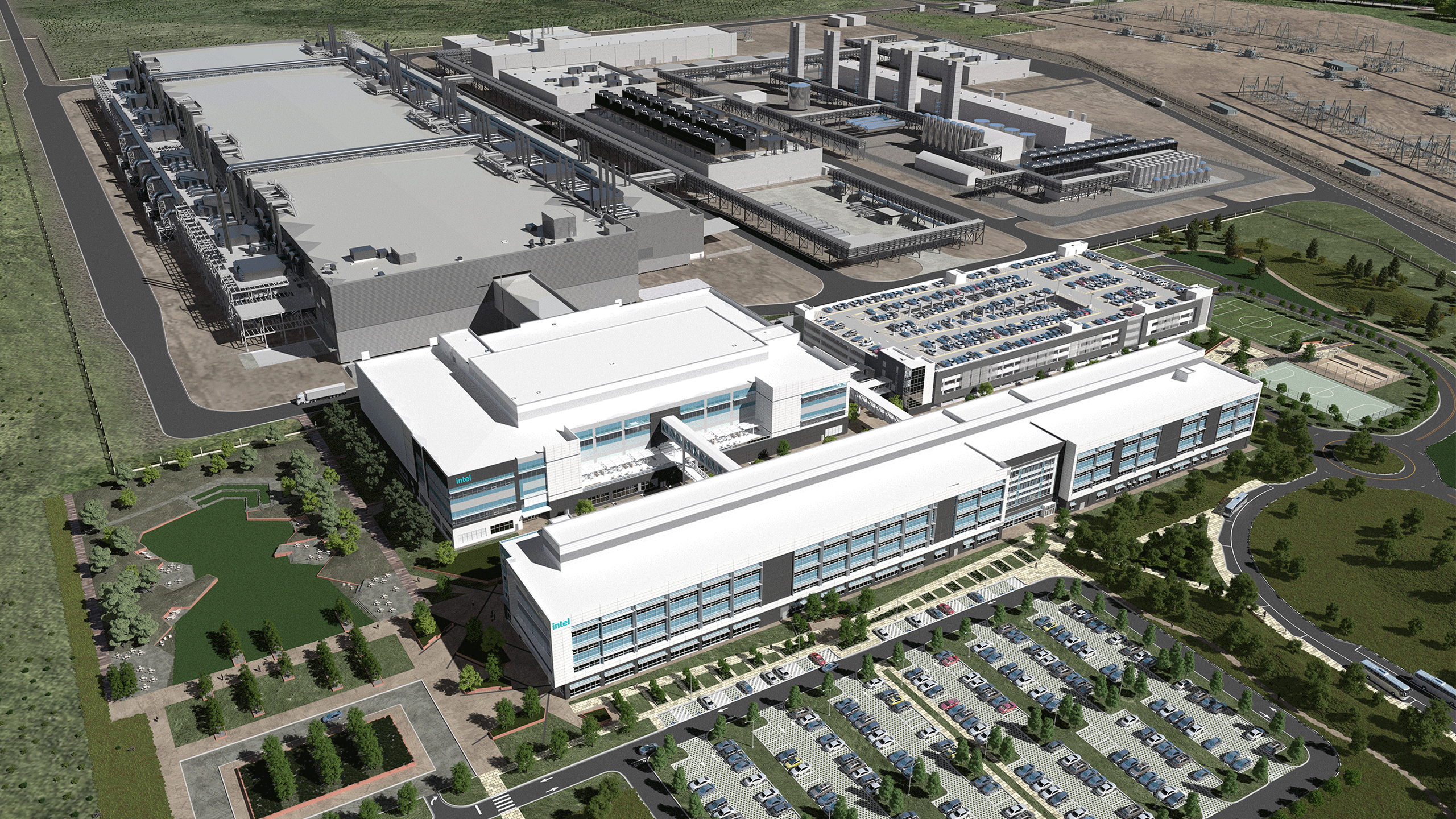

The U.S. Commerce Department announced today that it has come to a preliminary agreement with Intel to provide the chipmaker with $8.5 billion in direct funding for commercial semiconductor manufacturing in the United States, along with $11 billion in loans with a low interest rate and a 25% investment tax credit on up to $100 billion of Intel’s capital investments. The funding comes as the byproduct of the CHIPS Act, which seeks to provide direct funding to revitalize domestic chip production. President Joseph Biden is heading to the company's Ocotillo campus in Chandler, Arizona, for a ceremony today to announce the deal.

The funding will help offset costs for Intel’s chipmaking facilities in Arizona, New Mexico, Ohio, and Oregon. Aside from the direct $8.5 billion in funding, Intel will also be eligible for $11 billion in loans from the Commerce Department. Intel says these are long-term loans at very low interest rates but didn’t elaborate on the specific terms. The loans will help Intel secure funding for the large capital investments required to build leading-edge fabs while also potentially reducing the need for further funding partnerships like the deal it signed with Brookfield earlier this year, which involved granting Brookfield a 49% ownership stake in Intel’s Arizona fab in exchange for $15 billion in funding.

Beyond the direct funding and loans, Intel can also claim an Investment Tax Credit from the Department of the Treasury of up to 25 percent of $100 billion in capital expenditures that it makes over the next five years. "This will help incentivize Intel to make over $100 billion worth of investments in manufacturing," Secretary of Commerce Gina Raimondo said.

Intel CEO Pat Gelsinger says the company is ”fully expecting that we'll see 25% on $100 billion, so over $25 billion of tax benefits.” Intel can take the tax credits as soon as it makes investments, and the company already received a tax credit during the fourth quarter of last year for expenditures at its New Mexico packaging facility.

The CHIPS funds will go to new fabs and advanced packaging facilities located across four states. Intel will build two leading-edge fabs in Chandler, Arizona, to build chips on its Intel 18A node. Two fabs will be converted into packaging facilities in Rio Rancho, New Mexico. Intel's New Albany, Ohio, campus will see two planned leading-edge fabs, and Intel's Hillsboro, Oregon campus will see "expansion and modernization," including high N.A. extreme ultraviolet lithography from ASML that Intel recently started installing. Intel expects 25 to 30% of its investments to go to building the manufacturing facilities, with the remaining ~70% spent on the tools it will install in the fabs.

This is the largest CHIPS funding announcement yet, and senior administration officials seem to believe it will be the largest set of payments coming out of the bill, assuming Intel meets its milestones. The CHIPS Act will dole out a total of $52 billion to multiple companies, which had left the amount that would be dedicated to Intel up to debate. Gelsinger told the press at a pre-brief that Intel had accomplished its funding objectives and received “about” the amount it had expected.

Intel is the only chipmaker with design, R&D, and manufacturing in the U.S., positioning it to play an important role in national security matters. However, the CHIPS Act funding only applies to Intel’s commercial endeavors and not to any spending from the U.S. defense and intelligence agencies. Gelsinger said during a briefing yesterday that any funding for defense or intelligence initiatives would be entirely additive to the CHIPS Act funding, meaning the company would receive additional funding for those types of projects. Gelsinger said that Intel is having active discussions with the relevant defense and intelligence agencies and that “I quite look forward to being able to have more to say on that in the future.”

Ahead of the announcement, Secretary of Commerce Gina Raimondo said that funding with Intel will put the government on track to meet ambitious goals under the Biden administration to produce chips in America.

"Last month, I set an aggressive goal for the CHIPS program that America would produce roughly 20% of the world's leading-edge chips by the end of the decade — to remind everyone we're at 0% today," Raimondo said. "And we believe we're going to get to 20% by 2030. And this announcement is going to put us on track to meet that goal."

Intel and the Commerce Department's agreement is a "preliminary memorandum of terms," or PMT, based on Intel's application to the CHIPS program. Final award amounts will be on due diligence from the Department, so it's possible the terms may change when finalized. The awards also remain subject to the availability of funds.

The White House and Commerce Department said that the expansion and building of Intel facilities will create as many as 30,000 jobs in construction and chip development. The announcement includes Intel spending (including $50 million from the CHIPS Act, the focus of which has yet to be determined) on training local workers and providing childcare reimbursement programs. This will be a key part of the political side of this initiative. In Arizona, TSMC battled with local labor unions after it brought in Taiwanese workers and claimed U.S. workers weren't skilled enough for the project. Intel has made lots of partnerships with colleges and apprenticeship programs, but those initiatives will take time to bear fruit.

This agreement is the fourth PMT under the CHIPS Act. Previous agreements included $35 million for BAE to produce chips in New Hampshire; $162 million for Microchip Technologies to expand facilities and specialty production in Colorado and Oregon; and $1.5 billion for GlobalFoundries to build out fabs in New York and Vermont. The Commerce Department is expected to announce funding for TSMC and Samsung products in the coming weeks.

The building of new chip plants is a cornerstone of CEO Pat Gelsinger's vision to not just create Intel's own designs but also to build out its Intel Foundry business for other chip businesses, including Microsoft on 18A, and the U.S. Department of Defense (also on 18A).

Gelsinger also confirmed that Intel’s Ohio fabs will open in 2027 or 2028, a delay from the original plan of 2025 due to start-up challenges and market conditions. Gelsinger also said that while the CHIPS Act is a solid foundation that will allow the company to meet its goals, he fthat a second CHIPS Act will be necessary to fully rebuild America’s R&D and supply chain pipelines. However, no official discussions around a potential second round have begun yet.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

watzupken This is not unexpected. Intel is a US company and probably the biggest fab owner at the same time. It makes little sense that the US government will fund any other foreign fabs more.Reply

In my opinion, all these talk about creating more fab is not sustainable. Again, fabs don't magically create chips out of thin air. You need resources to produce chips, including things like the right workforce, having access to plenty and stable electric and water supply. Throwing money at building fabs and buying equipment is not sufficient. I may be wrong, but let's see what happens when all these planned fabs are ready for operation. -

rluker5 This is good news for US chip manufacturing. I had serious doubts that the CHIPS Act would deliver in an effective manner, but it has.Reply

And before the AI manufacturing boom has passed as well. Even after AI demand wanes, there are still lots of chips to be made on new nodes. -

PEnns Replywatzupken said:This is not unexpected. Intel is a US company and probably the biggest fab owner at the same time. It makes little sense that the US government will fund any other foreign fabs more.

In my opinion, all these talk about creating more fab is not sustainable. Again, fabs don't magically create chips out of thin air. You need resources to produce chips, including things like the right workforce, having access to plenty and stable electric and water supply. Throwing money at building fabs and buying equipment is not sufficient. I may be wrong, but let's see what happens when all these planned fabs are ready for operation.

There are employees whose sole job is to look at a project like this and study all the factors you mentioned. They call them analysts, project managers, etc who create feasibility studies to look at every aspect and scrutinize all possible constraints. before they grab a shovel and start digging a simple trench.

I doubt there is a single entity worth its salt that would look at the map, choose a random spot and say "this is where we are building a billion+ $ factory. Here's the money and start building!" -

ezst036 The unbroken streak of success of lobbyists continues.Reply

Lobbyists - 9

Everyone else - 0 -

kealii123 Reply

Ya, how can I get some of that sweet government honey?ezst036 said:The unbroken streak of success of lobbyists continues.

Lobbyists - 9

Everyone else - 0

As usual, subsidies for the billionaires, inflation for the rest of us. -

ekio Tax payers are funding Intel now…Reply

Are we going to get shares for this investment or free cpu at least?

Of course not, the richest get richer, the rest get f**ked. -

rluker5 Reply

Also AMD and Nvidia (indirectly, but still significantly), although those are taxpayers from Taiwan and South Korea. All for pretty much the same reasons.ekio said:Tax payers are funding Intel now…

Are we going to get shares for this investment or free cpu at least?

Of course not, the richest get richer, the rest get f**ked.

Intel is such a large recipient because they are doing most of the leading edge semiconductor manufacturing in a country promoting that industry within their borders.

If AMD or Nvidia were building high NA EUV fabs in the US they would receive CHIPS funds as well. -

kjfatl Reply

It's called the boom-bust cycle. There are two or three ways to survive this as a business. One is to so dominate the market that on one else can survive without government intervention. TSMC fits this category while continually accepting Taiwanese government subsidies.. One is to be highly profitable and immediately reinvest, knowing that there will be periods of overcapacity. Intel used to do this, but gave up on reinvestment for a few years of false profit. One is to outsource your production and hope that supplier prices don't go up to the point you are unprofitable. AMD and NVIDIA have taken this approach.watzupken said:This is not unexpected. Intel is a US company and probably the biggest fab owner at the same time. It makes little sense that the US government will fund any other foreign fabs more.

In my opinion, all these talk about creating more fab is not sustainable. Again, fabs don't magically create chips out of thin air. You need resources to produce chips, including things like the right workforce, having access to plenty and stable electric and water supply. Throwing money at building fabs and buying equipment is not sufficient. I may be wrong, but let's see what happens when all these planned fabs are ready for operation.

Intel is at the point where they still have the process knowledge to regain their position as the dominant supplier of expensive high-end digital electronics. What they lack is cash. TSMC and Samsung will likely remain the leaders of midrange to high end semiconductors. China will be happy with the entire bottom 1/2 of the market.

I'm leaving out a lot here like memory suppliers, analog suppliers like TI, LEDs, power switching electronics. etc.