GlobalFoundries gets 1.5 billion from CHIPS fund, $600 million from NY state

Vows to invest $12 billion in U.S. sites over the next decade.

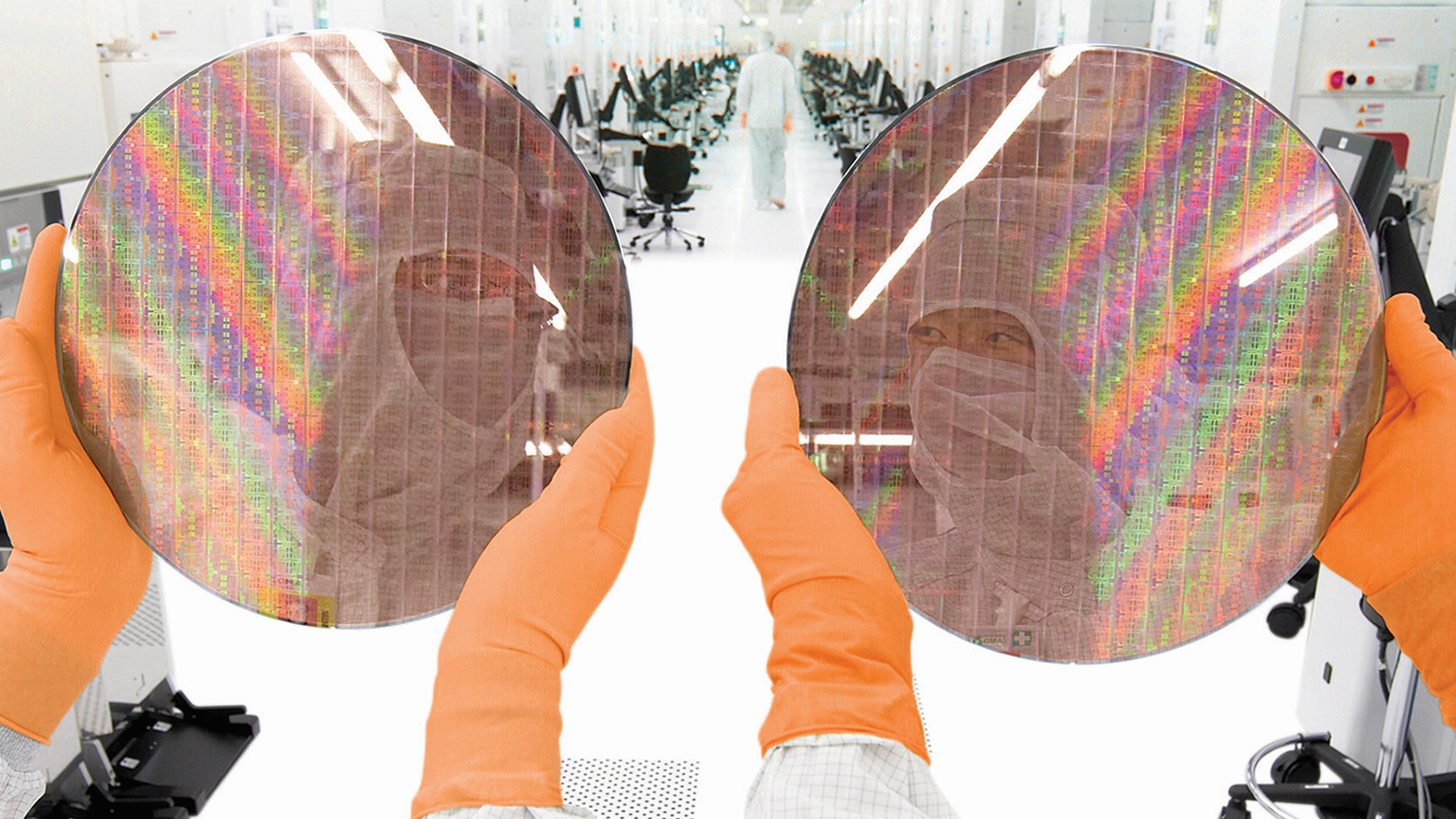

The U.S. Department of Commerce on Monday revealed its intention to provide $1.5 billion in direct funding to GlobalFoundries under the U.S. CHIPS and Science Act. Additionally, the company is set to receive over $600 million in support from the state of New York over the next decade to aid in its growth and modernization efforts. This financial support will enable GlobalFoundries to upgrade existing manufacturing capacities in the U.S. and build new ones to meet the demand for U.S.-made chips in automotive, aerospace, defense, and other industries.

GlobalFoundries said it has a $12 billion investment plan for its U.S. manufacturing sites over the next decade that involves public-private partnerships with federal and state governments and strategic ecosystem partners. The company said that this investment package is expected to help it meet the increasing demand for domestically produced chips and create over 1,500 manufacturing jobs and approximately 9,000 construction jobs.

By supporting GlobalFoundries and encouraging it to invest in American semiconductor facilities, the U.S. government boosts the competitiveness and strength of the U.S. semiconductor industry, which is among the key purposes of the CHIPS and Science Act. GlobalFoundries has outlined three key projects to invest in in the upcoming quarters.

First, the company intends to expand its Fab 8 in Malta, NY, to manufacture chips for automotive applications using fabrication technologies already in use at its facilities in Germany and Singapore, which essentially means bringing trailing nodes to Fab 8. This upgrade is vital for meeting the growing demand from the automotive sector as it transits to electric and software-defined vehicles. Additionally, the project will broaden the scope of GloFo's Malta fab and increase its importance for important fundamentals, such as automotive.

Second, GlobalFoundries intends to construct an all-new fab module on its Malta campus. This upcoming facility aims to satisfy future demand for chips made in the U.S., catering to a variety of sectors such as AI, automotive, aerospace, and defense. The establishment of this new facility, coupled with the enlargement of the existing fab, is projected to triple Malta's present output to over one million wafer starts per year over the next ten years, which equals approximately 83,300 wafer starts per month (WSPM).

Last, the company aims to revamp its Essex Junction, Vermont facility by upgrading existing fab tools, expanding capacity, and installing tools needed to mass-produce next-generation gallium nitride (GaN) chips whose usage is growing in various applications such as electric vehicles, data centers, communications, and power grids.

"These proposed investments, along with the investment tax credit (ITC) for semiconductor manufacturing, are central to the next chapter of the GlobalFoundries story and our industry," said Dr. Thomas Caulfield, president and CEO of GlobalFoundries. "They will also play an important role in making the U.S. semiconductor ecosystem more globally competitive and resilient and cements the New York Capital Region as a global semiconductor hub. With new onshore capacity and technology on the horizon, as an industry we now need to turn our attention to increasing the demand for U.S.-made chips, and to growing our talented U.S. semiconductor workforce."

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Companies like AMD, Qualcomm, General Motors, and Lockheed Martin have praised the grants, emphasizing the importance of the U.S. semiconductor supply chain for emerging applications in automotive and IoT industries as well as global trends like 5G, AI, high-performance computing (HPC), and edge computing.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

DavidLejdar Cool. Maybe it will help to develop a system, which ensures that doors on planes "Made in America" have the bolts they need, huh? :)Reply

Anyhow, NY state is also, where the Avelia Liberty trainsets are being assembled, which are expected to enter service this year, operated by Amtrak. They will replace the Acela Express, on the Northeast Corridor (between Boston and Washington D.C.).

Avelia Liberty is going to be something you haven't seen in the U.S. yet, reaching speed of over 200 mph - with 3-phase AC induction motors, and a total power output of 7,000 kW (9,400 hp). The trains of the projects "Texas High-Speed Train" and "California High-Speed Rail" will reach similar speeds, and thank to new tracks likely over greater distance. But that will take a while apparently.

Talking about which, do you think that the "Buy America Act" of 1982 had a role in the U.S. railsystem being somewhat underdeveloped? I mean, does it inhibit growth, when first before one can build i.e. high-speed rail, that entire supply chains are needed to be had in the U.S. for every part needed? Wouldn't it have helped, to simply acquire at least a starter set e.g. from Europe, as well then some parts from already paid for factories?

Similarly I wonder about the "Build America Buy America Act" of 2021. I mean, aside from the question about why at least Latin America isn't allowed to help by providing some export to the U.S., is it going to drag things, when there is a need for things, which don't exactly need a factory on every continent, while such factory can easily cost into billions?

In example, here I am in Europe with a "next-gen" construction material, which involves quite some facilities to be involved in the production thereof. Setup of production chain costs $10bn, and average revenue is expected to hit $1bn per year. And eventually setting up a factory in the U.S. is not a problem as such, but the construction of factories and fine-tuning and approval can easily take years. And, does it really help the U.S. when this construction material isn't allowed to be used for years, simply due some economic policy? -

gg83 Reply

Trains are a little off topic here. Maybe amtrak will use GF chips? I don't see High-Speed rail working here in NY. There isn't any place to build new rails, and the existing rails are used to often to make drastic changes.DavidLejdar said:Cool. Maybe it will help to develop a system, which ensures that doors on planes "Made in America" have the bolts they need, huh? :)

Anyhow, NY state is also, where the Avelia Liberty trainsets are being assembled, which are expected to enter service this year, operated by Amtrak. They will replace the Acela Express, on the Northeast Corridor (between Boston and Washington D.C.).

Avelia Liberty is going to be something you haven't seen in the U.S. yet, reaching speed of over 200 mph - with 3-phase AC induction motors, and a total power output of 7,000 kW (9,400 hp). The trains of the projects "Texas High-Speed Train" and "California High-Speed Rail" will reach similar speeds, and thank to new tracks likely over greater distance. But that will take a while apparently.

Talking about which, do you think that the "Buy America Act" of 1982 had a role in the U.S. railsystem being somewhat underdeveloped? I mean, does it inhibit growth, when first before one can build i.e. high-speed rail, that entire supply chains are needed to be had in the U.S. for every part needed? Wouldn't it have helped, to simply acquire at least a starter set e.g. from Europe, as well then some parts from already paid for factories?

Similarly I wonder about the "Build America Buy America Act" of 2021. I mean, aside from the question about why at least Latin America isn't allowed to help by providing some export to the U.S., is it going to drag things, when there is a need for things, which don't exactly need a factory on every continent, while such factory can easily cost into billions?

In example, here I am in Europe with a "next-gen" construction material, which involves quite some facilities to be involved in the production thereof. Setup of production chain costs $10bn, and average revenue is expected to hit $1bn per year. And eventually setting up a factory in the U.S. is not a problem as such, but the construction of factories and fine-tuning and approval can easily take years. And, does it really help the U.S. when this construction material isn't allowed to be used for years, simply due some economic policy?