Tariffs could increase tech prices by up to 70% and reduce GDP by $69 billion according to CTA report

Game consoles will be hit the hardest, and laptops could increase in price by 34%.

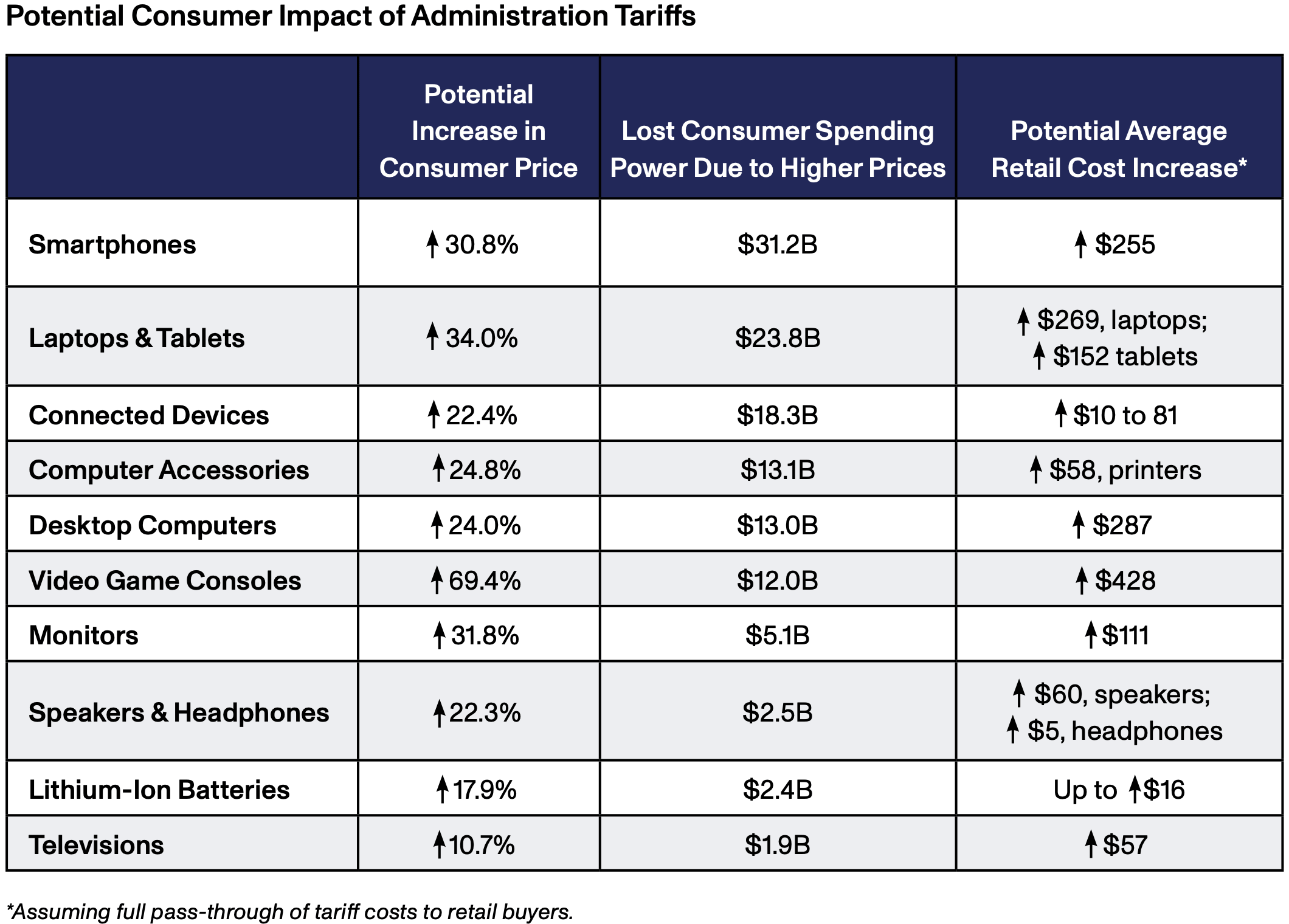

The export tariffs enacted in April are expected to raise retail prices by 11% to 70% across different categories, cut consumer spending by $123 billion annually, and shrink U.S. economic output by $69 billion, according to a report by Trade Partnership Worldwide (TPW), published by the Consumer Technology Association (CTA) on Wednesday.

There are a couple of catches: the report, which evaluates how recent U.S. tariffs will affect prices of 10 widely used technology products in the U.S., assumes that all tariffs will come into effect, and that there will be full pass through to retail buyers.

On April 2, the Trump administration introduced a tariff program under the International Emergency Economic Powers Act that included a 10% general rate on all imports and increased rates for 57 countries by between 11% and 50%. A 10% universal tariff went into effect on April 5, while higher rates were applied to specific countries starting April 9.

A pause was placed on the elevated country-specific tariffs on April 10, though the baseline 10% tariff remained. On April 11, electronics and semiconductor-based products were temporarily spared from these new tariffs, but a Section 232 probe into the broader electronics supply chain launched on April 16 brought renewed tariff risks, with early 25% duties already applied to materials such as aluminum and steel, as well as vehicles. Perhaps most importantly, tariffs on goods from China (except electronics) surged to 145%.

The TPW study modeled a scenario where the 90-day hold on tariffs ends in July, and higher rates resume on affected goods. Products not complying with the U.S.-Mexico-Canada Agreement (USMCA) trade rules would face stacking tariffs (i.e., up to 50%), whereas Chinese goods could be hit with combined rates of 145%. The analysis covered batteries, client PCs (desktops and laptops), displays, game consoles, tablets, TVs, headphones, and various computer accessories.

Game consoles and PCs

Game consoles face the steepest projected increase, with average tariffs climbing from 0% to 130%. Because 87% of these devices come from China, which would be subjected to a 145% rate, prices could rise by as much as 69%, or $428 more per unit, the report says. As a result, imports could fall 71%, and domestic production, which makes up only 1% of the market, would rise by just 62%. Consumers are expected to cut back purchases by 73%, resulting in a $12 billion drop in their overall purchasing power. The U.S. economy would lose $10.4 billion annually from this single category alone.

Laptops and tablets are projected to become 34% more expensive. For now, these items are exempt from country specific tariffs, but they could still be taxed under the Section 232 review. Nearly 79% of laptops and tablets are made in China and for now there are no manufacturing capacity in the U.S. to replace gigantic assembly facilities in China.

As a result, TPW expects average price hikes of up to $269 for laptops and $152 for tablets. Imports would decline 47%, while domestic output would increase only 5%. The result would be a $23.8 billion annual loss in consumer spending power and a $12.3 billion reduction in GDP.

Desktop computers are largely sourced from Mexico and other countries rather than China, but they would face a price hike from 0.3% to 42.3% because of tariffs. With limited U.S. production capacity (under 9% growth expected), prices could increase by 24%, adding about $287 to the average retail cost of $1,193. Imports are forecast to drop 53%, and consumption by 42%. The result would be a $13 billion loss for consumers and a $5.1 billion hit to GDP.

TPW did not conduct a research on how tariffs affect computer components. For now, these items are exempt from country specific tariffs, but they could still be taxed under the Section 232 review. However, if graphics cards and motherboards continue to be sourced from China and are not exempt from tariffs at some point, they are are subject to combined U.S. tariffs reaching up to 145% or more — similar to those applied to other China-made tech products such as game consoles and computer accessories. This could raise the retail price of a $500 graphics card to over $1,200 and a $200 motherboard to nearly $500 — assuming full cost pass-through. Given China's dominant role in assembling these components, short-term diversification of supply is limited, meaning most of the tariff burden will fall directly on U.S. consumers. As a result, PC builders and gamers would face significantly higher costs, potentially delaying upgrades or reducing demand across the DIY computing sector.

Taiwan-made graphics cards and motherboards would also face substantial price increases, though less severe than China-made ones, depending on how tariffs are applied. If they do not qualify for duty-free treatment under the USMCA and are not explicitly exempted, they may face a 25% tariff and a 25% Section 232 tariff (if electronics and semiconductors are included), totaling a potential 50% tariff (as these tariffs stack).

This would increase a $500 graphics card from Taiwan to around $750, and a $200 motherboard to $300, assuming full pass-through. Since Taiwan is a major supplier of high-end motherboards and graphics cards, the impact would still be significant but not as extreme as for Chinese products. U.S. buyers would still see elevated prices, but these goods may become more attractive relative to China-made ones, depending on how the final tariffs end up stacking. But can Taiwan satisfy the needs of the U.S. market?

Displays and TVs

Displays are 67% sourced from China, so they would be hit with average tariffs of 43.3% (10 to 25% on all imports and 45% to 145% Chinese imports, so the average is 43.3%) or more, up from 0.5%, raising prices by 32% or $111 per unit. Imports would fall by 48%, and U.S. production would rise by only 10%. This category alone could lead to $5.1 billion in lost consumer power and a $2.8 billion economic decline.

Unlike computer monitors, TVs are largely sourced from outside of China, but they would still see tariffs increase to 22.4% from 1.6%, raising average prices by 11% — or $57 per unit. Imports would decline by 15%, domestic output would rise only 2%, and the resulting loss in consumer spending power would be $1.9 billion, with a $1.6 billion GDP reduction, according to TPW.

Mobile electronics and accessories

As 78% of smartphones are imported from China, they are projected to face a 39.5% average tariff rate under the combined measures. This could push up consumer prices by about 31%, or $255 more than the current average of $826. The absence of domestic production means alternative supply will be difficult to secure quickly. Imports are projected to drop by 48%, and purchases are expected to fall by the same amount. As a consequence, this shift would erase $31.2 billion in spending power and lead to a $17.9 billion economic loss, TPW believes.

Connected devices, including smart speakers, smart watches, wearables, and Wi-Fi-connected gadgets, would become 22% more expensive, according to the report. While countries like Vietnam have been gradually increasing production of devices such as Apple's AirPods in the recent years, Chinese companies still produce a substantial share of these items. Consequently, TPW says import reductions of 40% are likely, with a 6% increase in U.S. production. Consumers would pay $81 more for smartwatches, $20 more for fitness bands, and $10 more for speakers. Total loss in consumer power would reach $18.3 billion, and economic output would contract by $7.8 billion.

Speakers and headphones, around half of which come from China, would face 86.6% average tariffs, up from 0.9%, raising prices by 22%, according to TPW. Headphones would cost $5 more, speakers $60 more. Imports from China would drop 99.8%, and total imports would shrink by two-thirds. Production in America would grow by 24%, while consumption would fall 39%, yielding a $2.5 billion reduction in consumer power and a $1.5 billion GDP loss.

Computer accessories like keyboards, printers, mice, and docks would see prices rise by 25%, with average tariffs moving from 1.5% to 39.5%, TPW believes. Imports would drop nearly in half, and production in the U.S. would climb by just 12%. Printers could cost $58 more, and the total reduction in consumer buying power is projected at $13.1 billion. The broader economy would contract by $7.6 billion.

Finally, lithium-ion batteries for consumer electronics, most of which come from China, would see tariffs rise from 5.9% to 117.7% — raising prices by nearly 18%. Imports would fall 71%, and local production would grow by 16% at best. Prices would rise up to $16 per unit, causing a $2.4 billion loss in consumer power and a $2.0 billion impact on GDP.

While the tariffs aim to stimulate U.S. manufacturing, the study shows they'll mainly impact consumers, who will face significantly higher prices amid limited domestic production gains to offset them.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

rambo919 Reply

Honestly.... as ridiculously cheap as tech is in the US.... they won't die from an increase up to what the third world pays. Everyone is just entitled without realizing how entitled they are.dalek1234 said:"Tariffs could increase tech prices..." You're missing the "in the States" part.

Life must be good having a slave army in a foreign country making everything cheap for you. -

logainofhades Oh look another tariff article. Seriously, is this all Tom's knows how to post about these days?Reply