Report: Chip Sales Suffered Fourth Largest Decline In 35 Years

According to the World Semiconductor Trade Statistics (WSTS) organization, which pools sales data from chipmaker member companies, global chip sales have dropped by 15.5% sequentially in the first quarter, accounting for the largest decline in the past 35 years. The sales dropped 13% on a year-over-year basis.

Fourth Largest Decline In Four Decades

WSTS said that chip sales totaled $96.8 billion in the first quarter, down from the $114.7 billion the companies made in the previous quarter. The first-quarter revenue was down 13% from $111.1 billion on a year-over-year basis.

The three-month average revenue in March was $32.3 billion, down 1.8% compared to February this year, and 13% lower compared to March 2018.

John Neuffer, president and CEO of the Semiconductor Industry Association (SIA) trade group, said:

“Sales in March decreased on a year-to-year basis across all major regional markets and semiconductor product categories, consistent with the cyclical trend the global market has experienced recently.”

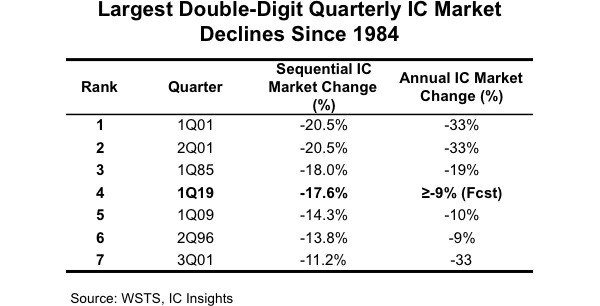

IC Insights, a market research firm, said that the real first-quarter revenue decline was actually 17.1%, calling it the largest sequential decline since 2001 and the fourth largest since 1984. There have been seven chip sales quarterly declines larger than 10% since 1984. In each year in which this occurred, the chip market declined by at least 9% for the year, according to IC Insights.

Double-Digit Decline Expected In 2019

IC Insights noted that the first quarter of the year is usually the weakest, with an average decline sequentially of 2.1% over the past 36 years. However, this year, the drop was much larger than the average, and the research firm is expecting double-digit decline for the year. Intel, one of the main party's responsible for the slowdown in PC sales for the last couple of quarters, has also said that it expects its own CPU shortages to last until at least the third-quarter this year.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

China and Europe registered sales growth in Match compared to the previous month, but Europe saw a decline of 6.8% year-over-year. All the other regions saw declines of over 9%.

Neuffer urged U.S. regulators to adopt policies that would spur sales growth for the chip industry, such as increasing investment in scientific research, attracting and retaining a top technology workforce, and ensuring open markets and strong protection of intellectual property.

Lucian Armasu is a Contributing Writer for Tom's Hardware US. He covers software news and the issues surrounding privacy and security.

-

ElectrO_90 Who would have thunk it...... something most people have and don't need to upgrade.... it's like so unexpected....Reply

I just can't believe it... surely this is not true.... -

JamesSneed I think AMD and Intel are both getting hit with lower CPU sales because everyone is waiting to see what AMD has with Zen 2. I bet it's even starting to happen in the data center at least for replacing old servers because if you have two valid choices you can negotiate better pricing even if you stay with Intel.Reply -

Deadhound I can atleast say, Im for sure watiting until Zen 2, and wouldn't suprise me that others also are. Combined with a few other things.Reply

Honestly way less need to upgrade, and consoles are in the beginning of their end-phase, new gen have been teased/semi-announced (2 more years atleast), and have been out for some time. So I'd guess most people have bought the console they wanted -

Diabl0 ReplyJamesSneed said:I think AMD and Intel are both getting hit with lower CPU sales because everyone is waiting to see what AMD has with Zen 2. I bet it's even starting to happen in the data center at least for replacing old servers because if you have two valid choices you can negotiate better pricing even if you stay with Intel.

Yes, I also am waiting for Ryzen 3000. Should I buy a Core i5 for 215 Euro when the MSRP is 180$ ? No thank you. -

shrapnel_indie We got Zen 2 just around the corner....Reply

We got Intel not able to produce as many CPUs as they'd like...

We got people satisfied with their current hardware...

All that can impact the sales numbers... Did these guys take the Intel situation into account? Did they report on raw numbers, or weighted/adjusted numbers? -

honkuimushi It's interesting that 3 of the quarters were from 2001, right in the middle of the dotcom burst. And 1985 was the depths of the Video Game crash and just before the introduction of the 386. It's not exactly reassuring company.Reply

Hopefully the Zen 2 architecture and price points will be good enough to make more OEMs open to AMD and the 3rd and 4th quarter sales will be better than forecast, even if Intel can't fully resolve their shortages. -

paul horn New processors and new motherboard designs coming with so many changes and dates unknown. Intel slow moving forward, AMD not getting along with Linux, and new PCIe about to release. The size of investment is not small for a real increase in performance.Reply