Samsung Challenges Intel For Chip Leadership

It appears as if the chip industry had a much better 2010 than 2009, as the global semiconductor business is estimated to have gained about $70 billion in sales last year.

Gartner reports that global chip sales surged to $299.4 billion.

"The industrywide upturn was due to the combination of pent-up demand that had built in the wake of the worldwide economic recession, and rebuilding of semiconductor inventories that were significantly depleted during the recession and early recovery," said Peter Middleton, principal analyst at Gartner.

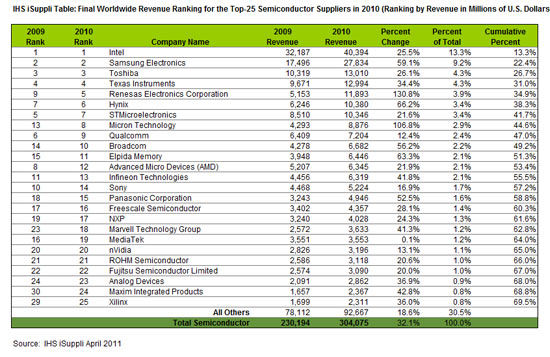

IHS iSuppli came to a similar result and highlighted a race between Intel and Samsung for the dominance in the chip market. Intel increased its sales expand to $40.4 billion in 2010, which translates to a 25.5% improvement over 2009 and a 13.3% market share. Samsung, however, jumped by 59.1% from $17.5 billion to $27.8 billion last year, according to iSuppli. The industry average was 32.1% in iSuppli's charts and 30.9% in Gartner's result.

“The rise of Samsung is one of the biggest stories of the last decade in the worldwide semiconductor market,” said iHS iSuppli analyst Dale Ford. “When experts discuss competition for Intel, they almost always focus on Advanced Micro Devices (AMD). While it is true that AMD is Intel’s major competitor in the microprocessing unit (MPU) market, Samsung is the primary rival of Intel for overall semiconductor market share. And although they are mainly indirect competitors in the marketplace, Intel and Samsung have been ranked No. 1 and No. 2, respectively, for a number of years.”

Since 2001, Intel’s market share has ranged between 11.9% and 14.8%, while Samsung held just 3.9% in 2001. Meanwhile, Samsung has seen its revenues grow by 355% from 2001 to 2010, allowing the company to expand market share and raise its ranking, iSuppli said.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Douglas Perry was a freelance writer for Tom's Hardware covering semiconductors, storage technology, quantum computing, and processor power delivery. He has authored several books and is currently an editor for The Oregonian/OregonLive.

-

LuckyDucky7 I wonder what would happen if Samsung were to enter into direct competition by developing an x86 CPU?Reply -

geekapproved I ran samsung memory in my computer in the late 90's, they been doing this a long time. I always hoped they would buy AMD and give them the boost they need.Reply -

ta152h This is yet another poorly titled article to get people to read it.Reply

This is no challenge at all. They are in almost completely different markets, and neither is challenged by the success of the other. Does Intel care if Mobil sells a lot of oil and has greater earnings? Why should they care if Samsung sells a lot of memory chips? In some ways, they benefit from it, if they improve performance.

Samsung and Intel are both top shelf makers. I've used their products for many years (as have many), and have to say I'm rarely disappointed. Well, except for Samsung hard disks, which have been unreliable for me (but they are being sold now anyway). -

captaincharisma TA152HThis is yet another poorly titled article to get people to read it.This is no challenge at all. They are in almost completely different markets, and neither is challenged by the success of the other. Does Intel care if Mobil sells a lot of oil and has greater earnings? Why should they care if Samsung sells a lot of memory chips? In some ways, they benefit from it, if they improve performance. Samsung and Intel are both top shelf makers. I've used their products for many years (as have many), and have to say I'm rarely disappointed. Well, except for Samsung hard disks, which have been unreliable for me (but they are being sold now anyway).Reply

well that statement should make AMD fanboi's breathe a sigh of relief because that list Has AMD at number 12

-

eddieroolz This news right after (or before) news that Samsung has sold their HDD division. I guess Samsung is going to focus hard on their memory chips now.Reply -

TitusFFX lol texas instruments actually has still kept grounds fairly well even though they are known for mostly calculators.Reply -

danwat1234 titusffxlol texas instruments actually has still kept grounds fairly well even though they are known for mostly calculators.Reply

Yea, TI calculators runs at 12MHZ or so and a Motorola 68000.

When will make a calculator that can actually graph instantly??

/TI rant and their stupid hold on the the marketplace with overpriced calculators that have 1980s computing power in them. -

TitusFFX >.> no clue when they will actually upgrade the technology but at least I've yet to see one of them explode into a ball of fire due to poor ventaliation or overheating ^.^Reply