Chip-Maker SMIC Tries to Work Around Import Restrictions

SMIC cannot get enough raw materials and consumables due to inclusion into Entity List.

Due to the ongoing trade war between the world's top economies, Semiconductor Manufacturing International Corp. (SMIC) has had to change its research and development priorities several times, which had a drastic impact on its roadmap.

Instead of developing a leading-edge extreme ultraviolet (EUV) process technology, the company is now looking into chiplets and advanced packaging instead. Yet, the company has another issue: it cannot get enough raw materials and consumables.

After Huawei Technologies, SMIC is among several companies that suffered the most from the ongoing trade war between the U.S. and China. So far, the company has had to abandon development of leading-edge fabrication processes that rely on EUV lithography, cease expansion of its advanced production capacities, put development of sub-10nm nodes on hold, and refocus to mature fabrication processes.

The U.S. government has its own view on this: SMIC has or is about to become a government-owned company, which gives the People's Liberation Army (PLA) access to advanced technologies. Recently, the company started to think about changing direction of its R&D activities to packaging and chiplets. But there are immediate pressing issues for the company: it cannot get enough raw materials to keep its existing fabs running.

But before getting into details of the SMIC's current tactics, let's take a look at the history of the company to understand the logic behind its tactical decisions.

The Phantom Menace

Traditionally, SMIC's main strengths have been mature process technologies as well as quotes below those offered by its rivals from Taiwan, such as TSMC and UMC. Today 45nm and thicker nodes account for the lion's share of the company's revenue (i.e., over 90%) and SMIC is pretty successful with its business model. For example, it produces over 50% of Qualcomm's PMICs and has dozens of customers who use legacy technologies for their products, according to data from China Renaissance.

Being an ambitious company, SMIC started a project to close the gap with TSMC sometimes in the first half of 2010s. The company needed to invest in process technologies R&D as well as in massive fabs since huge R&D spending only pays off if you produce very high volumes.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

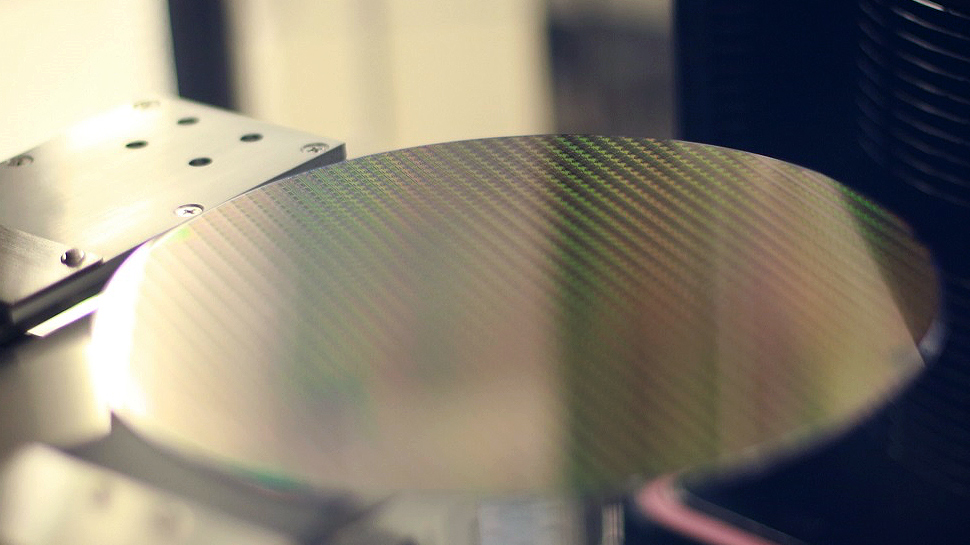

The company massively increased its research and development budget in the recent years. In 2014, SMIC's R&D expenditures were $189.7 million, or 9.5% of revenue. By 2019, the R&D spending increased to $629 million, or 20.7% of revenue. SMIC has never really equipped a GigaFab-class production facility (a fab with a production capacity of over 100,000 wafer starts per month, according to TSMC's classification), yet Christopher Yim, an analyst with Bocom International Holdings Co., says that SMIC’s latest 300-mm fabs in Beijing and Shanghai, which officially were capable of 50,000+ WSPM, could accommodate 'loads' of tools.

The vastly-increased R&D spending as well as huge fab buildings indicate that the company was preparing to significantly increase usage of its advanced nodes and become a small yet skilled player in the world of leading-edge process technologies. Of course, that would have been a result of a massive funding from the Chinese government and local authorities, something that competing countries do not exactly like.

The Empire Strikes Back

The first hit that SMIC took in the recent years was its inability to obtain its already purchased ASML's Twinscan NXE scanner to continue its EUV R&D. ASML said that it needed an export license from the Dutch authorities to distribute EUV to China due to the Wassenaar Arrangement, yet many said that the U.S. administration asked the Dutch government not to grant the license.

For SMIC, banning its sub-10nm efforts fundamentally means banning its 14nm efforts too since most of the equipment used for 14nm could also be re-used for its sub-10nm projects. That is why the company is refocusing its efforts so it uses proven technologies.

The second hit SMIC took was the restriction of exports of dual-use advanced technologies to China, Russia and Venezuela to combat development of military technologies. In addition, the U.S. government restricted exports of equipment produced by U.S. companies to Hong Kong, which served as a way for Chinese companies to obtain sophisticated production tools without needing to get a license from the U.S. government.

Since SMIC was late to the EUV train (when compared to Samsung Foundry and TSMC), the company started development of its 12nm, N+1, and N+2 process technologies that relied purely on deep ultraviolet (DUV) lithography and were aimed at inexpensive chips that did not require a high transistor density. Both N+1 and N+2 were considered as sub-10nm fabrication nodes and this is where SMIC got a yet another major hit, the inclusion into the U.S. Department of Commerce's Entity List.

Plainly, the DOC demanded manufacturers of equipment and other technologies (e.g., software, but not limited to) essential to produce semiconductors using 10nm nodes or finer to apply for an export license, which would be subject to a presumption of denial. While ASML, the main producer of lithography scanners, is in the Netherlands and does not need to comply with the U.S. restrictions, there are many companies in the U.S. that produce fab tools without which AMSL's scanners are useless.

A New Hope

One of the ways for a chip designer to make its processor hit its performance targets is to throw in more throw in more transistors into it. Normally, new process technologies allow you to increase transistor budgets every 18 ~ 24 months without a significant cost increase, but since SMIC does not have access to leading-edge production tools, it will not really be able to rely on Moore's Law in the coming years. But there is another way to increase transistor count: use more silicon.

It is easier to design, bring up, and produce a number of smaller chips than one big chip. AMD already uses chiplet design to build its server and desktop CPUs with more than eight cores, Intel uses chiplet design to produce its codenamed Lakefield processor and intends to use it for its codenamed Ponte Vecchio Xe-HPC graphics processor.

SMIC director Dr. Shang-Yi Chiang said in a recent interview with Tech News that instead of investing heavily in EUV, the company was looking into advanced packaging and chiplet technology, based on a report from China Renaissance.

"He emphasized that heterogeneous integration (HI) and chiplets may be essential for SMIC to be one of the top-tier foundry players in the future, especially considering the path of node scaling into the EUV era no longer looks feasible for the company given the explicit US stance of ‘presumption of denial’ on license applications for N10-and-below tech exports to SMIC," the report says.

It will of course take years for SMIC to develop technologies like Intel's EMIB or Foveros, but these technologies will be required in the future whether or not SMIC will be able to produce chips using leading-edge production technologies. Therefore, for now it does make a lot of sense for the company to refocus its R&D efforts from leading-edge EUV-based technologies to advanced packaging.

Revenge of the Sith

Advanced packaging technologies as well as sophisticated nodes will make SMIC more competitive several years down the road, but for now the company has more pressing issues. Because of its inclusion into DOC's Entity List, it cannot obtain necessary chemical raw materials and consumables like spare parts from U.S.-based companies without a license, which can essentially stop its operations at any time.

It usually takes weeks for the U.S. Department of Commerce to review license applications and it is not guaranteed that they will grant an appropriate export license. As a consequence, SMIC is already facing a tight supply of chemical materials and some consumables, according to a DigiTimes report.

Without the necessary raw materials and spare parts, at some point, SMIC may have to stop manufacturing before its gets chemicals or parts, which will ruin time-to-market schedules of its customers, which means that some of them will have to switch to other contract makers of semiconductors. Furthermore, it is unclear whether SMIC will be able to get spare parts for its advanced equipment used to make chips using its 14nm fabrication process.

Summary

SMIC significantly increased its R&D spending in recent years and has designed several advanced technologies, but has not managed to develop a leading-edge fabrication process.

There are a number of upcoming megatrends that will inevitably drive demand for services offered by SMIC as well as other contract makers of semiconductors, yet the company will not be able to produce expensive chips that require advanced technologies, which will naturally lower its potential revenue and profitability.

Instead of spending loads of money on EUV-based nodes, SMIC is about to refocus its investments on sophisticated packaging and chiplet technologies. Furthermore, it will concentrate on securing its positions on the market of mature nodes as they have always been its core business.

Unfortunately for SMIC, its inclusion into the U.S. Department of Commerce's Entity List limits its abilities to procure semiconductor equipment, spare parts, and chemical materials from American companies. To that end, SMIC's short-term future will largely depends on the willingness of the new U.S. administration to grant appropriate licenses.

Therefore, assuming that SMIC has stockpiled enough modern DUV scanners and other tools (as well as spare parts) to build sufficient capacity to compete against its bigger rivals, its N+1 and N+2 processes might have good chances to become relatively popular in the coming years. Meanwhile, neither N+1 nor N+2 nodes are going to be competitive with leading-edge nodes from other companies when they enter mass production in 2021 ~ 2023 timeframe.

Furthermore, even though SMIC has several R&D teams working on new fabrication processes, its roadmap looks increasingly uncertain as the company will be unable to adopt EUV lithography and GAAFET structures — the key enablers for next-generation nodes — for years to come.

Or Uncertain Future for SMIC?

But while EUV and GAAFETs are important for SMIC’s long-term future, the inclusion of the company into the Entity List brings a host of challenges that may force the company to change its plans dramatically, some analysts believe.

SMIC can get DUV scanners from ASML without any restrictions. Lithography tools are very important for production of semiconductors, but they are not the only tools used at a fab. There is equipment used for high-precision metrology, deposition, etching, photoresist stripping, and wafer cleaning that is made primarily by companies from the USA.

There are alternatives from Europe and Japan, but an insertion of a new tool always means a change of the whole flow, a lengthy and risky process. If the company fails to get one advanced tool or spare parts for it on time, this ruins its whole production flow. In the worst case scenario, the company might need to halt production using its FinFET process technologies and retrofit its capacity for legacy nodes.

“We believe the build-up of spare parts/materials should keep SMIC’s operations afloat for 3-6 months, even if its US suppliers now need to get licenses before shipping, and the chance of a positive response is deemed low,” wrote Szeho Ng, an analyst with China Renaissance Securities, in a note to clients. “Our base case now assumes that its FinFET businesses will largely halt (given the high reliance on U.S. tech supply, and the strategic importance of the tech for making core chips in sensitive markets), with the installed capacity retrofitted for lower-ASP legacy 300-mm (28-90 nm nodes) manufacturing. 200-mm (130nm-and-above nodes) fabs will stay as business as usual, in our opinion.”

At present SMIC’s FinFET business probably accounts for 2% ~ 3% of the company’s revenue, so even if the company has to halt production using 14nm and cancel 12nm and N+1 plans, it is not going to suffer a significant sales drop. But advanced nodes tend to be profitable and attractive for big clients. Furthermore, retrofitting new fabs for older technologies will automatically bring net profits down (tools to be replaced have not depreciated yet, which means losses).

Overall, the analysts believe that SMIC’s future largely depends on the U.S. government’s attitude towards the company rather than on its own R&D expertise or manufacturing prowess.

“We see the U.S. government’s attitude towards SMIC as remaining the key to its destiny, as an imminent full decoupling of the company from the U.S. tech reliance (even for legacy 300-mm) may not be as easy as some industry watchers expect,” wrote Ng. “The U.S. tech influence goes beyond the equipment/materials areas, and goes further upstream to the EDA markets where the U.S.’s global dominance is even higher. Furthermore, it remains to be seen what the attitude of Japan may be, as it also plays a fairly important role in global equipment/materials supplies.”

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Endymio ReplyThe company needed to invest in process technologies R&D as well as in massive fabs ...

According to the FBI, in the US alone there are over 2,500 active industrial espionage cases open against China and Chinese entities. A significant number of these deal with semiconductor fabrication technology. The "investment" here is primarily theft of IP from Western companies. -

Godfree Roberts Reply

According to court records, China has never stolen significant American IP and few cases against China have resulted in serious penalties.Endymio said:According to the FBI, in the US alone there are over 2,500 active industrial espionage cases open against China and Chinese entities. A significant number of these deal with semiconductor fabrication technology. The "investment" here is primarily theft of IP from Western companies.

The FBI is blowing smoke.

Prosecuting Chinese "Spies": an Empirical Analysis of the Economic Espionage Act. By Andrew Chongseh Kim. Cardozo Law Review. Vol 40:749http://cardozolawreview.com/wp-content/uploads/2019/01/Kim.40.2.6.newcharts.pdf

Conclusion: This Study finds that Chinese and other Asian-Americans are disproportionately charged under the Economic Espionage Act, receive much longer sentences, and are significantly more likely to be innocent than defendants of other races. From 1997 to 2009, 17 percent of defendants charged under the act were of Chinese descent, but after 2009, that rate tripled to 52 percent. Furthermore, the average sentence for defendants with Chinese names convicted of espionage was 25 months, compared with 11 months for those with Western names. Similarly, 48 percent of defendants with Western names escaped imprisonment and received only probation—more than double the 21 percent rate of those with Chinese names.

Although it is possible that Asian-Americans are prosecuted more often because they commit espionage more often, it is also possible that they are prosecuted more often because the DOJ has focused more resources to detect and punish spying related to Asian countries and defendants and so spends fewer resources investigating espionage conducted by defendants of other races.

This Study also suggests that the DOJ is more likely to file charges prematurely, based on weak evidence, when the case involves an Asian- American defendant.

Although some of these disparities may reflect legitimate concerns over the risk of flight, they may also reflect implicit biases with regard to the loyalty of Asian-Americans to the United States.

In addition, this Article reveals that the traditional justifications for pretextual prosecutions generally do not apply to convictions of Asian-Americans originally suspected of espionage for false statements. Rather, these convictions harm the accountability of the DOJ, may serve to punish otherwise innocent minorities simply for being wrongfully profiled, and, ultimately, may force loyal Americans to refuse to cooperate with investigators for fear of being punished for false statements.

By addressing racial biases and creating more transparent processes for charging and resolving espionage cases, however, we can reduce the number of innocent Americans charged with espionage and minimize the harm caused by these unfortunate cases. -

Have you looked at Chinese military aircraft? And you tell me they haven’t stolen anything or significant amounts of anything? Your post is pure bollocks. Studies you referred to are absolute BS as wellReply

-

Endymio Reply

So all those guilty pleas and guilty verdicts are faked?Godfree Roberts said:According to court records, China has never stolen significant American IP

According to a WSJ article in 2019, direct losses from Chinese theft of IP from US firms are a minimum of several hundred billion dollars; indirect losses cannot be easily calculated, but are certainly much higher.

Prosecuting Chinese "Spies": an Empirical Analysis of the Economic Espionage Act. By Andrew Chongseh Kim.

This isn't a study; it's an opinion article written by an Asian-American lawyer. It's conclusions are rather laughable -- if the spike in espionage cases against Chinese citizens over the last couple of decades were due simply to "prejudice against Asians", you'd see large increases in prosecution of Japanese, Vietnamese, and other Asians. Instead, the increase comes primarily from a single source: agents working under the direction of the PRC.

As for the so-called "stiffer penalties" meted out, most industrial espionage cases are minor: a single individual trying to make a little extra cash. Cases involving conspiracies plotted by foreign governments are significantly more serious, and certainly merit more severe penalties.