U.S. Cracks Down on Russian Crypto Miners

Adding cryptocurrency-focused companies to the sanctions list.

The U.S. Treasury has announced its intention to sanction Bitcoin miners operating in Russia, extending its international sanctions' reach towards cryptocurrency. The pressure continues to pile on the Russian state following its invasion of Ukraine as in the third month of conflict, with the international community still looking for ways to strangle Russia's economic power. Cryptocurrencies stood as one of the last sanction-free bastions. No more.

"By operating vast server farms that sell virtual currency mining capacity internationally, these companies help Russia monetize its natural resources," Under Secretary for Terrorism and Financial Intelligence Brian Nelson said in a press release early Wednesday afternoon.

While currently there's no actual way for the U.S. or any other centralized entity to enforce cryptocurrency-bound sanctions at an individual wallet level, the U.S. can still apply TeFi (Traditional Finance) sanctions as well as technological import sanctions on entities. That's exactly what the U.S. Treasury has done, by updating its sanctioned entity list with Russian-bound BitRiver, a company specializing in Bitcoin mining through hydropower. The company employs around 200 employees across three Russian offices.

“Russia has a comparative advantage in crypto mining due to energy resources and a cold climate. However, mining companies rely on imported computer equipment and fiat payments, which makes them vulnerable to sanctions,” continued the statement.

The crackdown aims to reduce Russia's ability to weather the sanctions storm it's currently operating under - irrespective of the complexity of such mechanisms. Sanctions, however, are a moving target: the U.S. and its Russia-sanctioning allies have to proactively plug any gaps that would give the country breathing room to finance its war efforts.

“The United States will work to ensure that the sanctions we have imposed, in close coordination with our international partners, degrade the Kremlin’s ability to project power and fund its invasion,” he added.

Cryptocurrency transactions in Russia have been increasing alongside sanctions, signaling a doubling-down on digital assets as a way to bury otherwise locked FIAT funding. According to cryptocurrency data service Glassnode, the number of Russian Bitcoin wallets increased from 39.9 million to 40.7 million since the February invasion. Yet Russia has a population of around 144 million citizens - and the ratio of wallet per user isn't necessarily 1:1.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

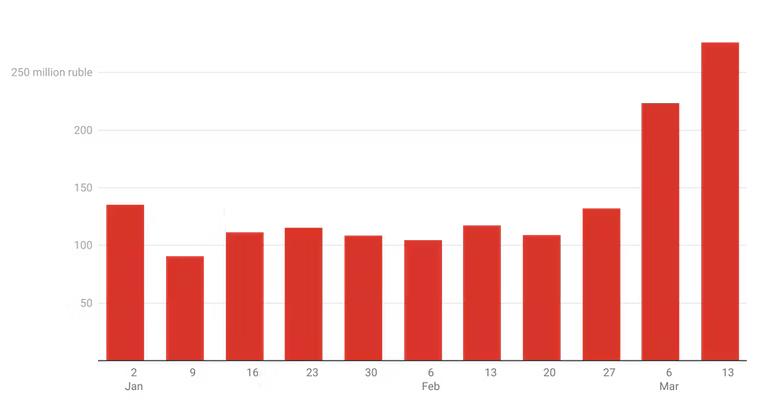

However, the amount of rubles being poured into the crypto space has to be tempered with the rubles' own tragical descent in value. The largest bar in the above graph indicates a weekly crypto transaction value of 250 million rubles for the week of March 13th, increasing two-fold over the same period in February. But with the crash in the Russian currency's value, that amounted to around $2 million dollars. Hardly enough to fund a military invasion.

At the same time, the average Bitcoin-to-ruble transaction value in Russia reached around $580 in February - a far cry from the US average of $2,198 in the same time frame.

It remains to be seen how deeply the U.S. is willing - and able - to go in the cryptocurrency sanctions space. Of note is that sanctions aren't as one-sided as one might hope for, as the semiconductor and energy industries have shown following the invasion. Sanctions in the cryptocurrency space, like in any other, may also hurt legitimate businesses - many of them located in the U.S. - if they translate into falling cryptocurrency prices. But judging from recent developments and the value of Russian cryptocurrency transactions, that in itself might not be such a likely risk. Time, as always, will tell.

Francisco Pires is a freelance news writer for Tom's Hardware with a soft side for quantum computing.

-

InvalidError We may finally find out how far the world is willing to go to stop Russia and other autocrats from laundering assets through crypto.Reply -

digitalgriffin ReplyEndymio said:The Russian ruble closed yesterday at 79.25, slightly higher than it was just before the invasion. And China, India, and Pakistan -- 3 of the 5 largest nations on Earth -- are all buying record levels of Russia's primary exports. China just last week inked a deal that will double their imports of Russian natural gas. The sanctions don't appear to be working as well as some people believe.

The rubles value is being artificially propped up through a series of actions by the Russian central bank. It will collapse on itself. See "economics explained" sanctions on youtube

zrK2B2yMPrA -

digitalgriffin Replyescksu said:It is impossible to sanction Russia. Russia is one of the largest commodity exporter in the world. Russia exports more than just oil and gas, wheat, oil, iron ore, nickel and other metals etc, not unusual since Russia is the largest nation by land size.

This world is finite and resources are finite. For commodity, its not like you can simply go shop elsewhere. Its not like the rest of the world has all the commodities sitting there waiting for pple to buy (like in a supermarket). It takes alot of time and effort to locate and mine. You cannot simply increase production.

Russia's economy based on GDP is tiny. They quite simply never modernized. And while you are quite correct that it takes years to build out infrastructure to support new fuel sources, the damage has been done. Within 3 years Russia will be mostly shut out. India and China sees this as an opportunity to do business. Europe will buy LNG from USA until they transition. China will get wheat and fuel from Russia. Russia will still suffer.

Binkovs battlegrounds analyzed this very well along with economics explained. And I mostly agree with their assessment. Europe will suffer. Russia will suffer a lot more. -

InvalidError Reply

Biden did none of those things. Though he did promise a ban, he didn't actually do it. All he did is ban the issuance of new leases since oil&gas companies are already sitting on 6000+ unused licenses. Blame oil&gas sitting on a hoard of unused leases (and using inflation as cover to jack up their profit margins) for rising prices.Endymio said:Where do you think that natural gas is going to come from? The Biden Administration has blocked gas pipelines, offshore production of gas, fracking for gas on federal lands, and blocked new LNG production facilities and transport of LNG by rail.

If inflation was real, the consumer price hikes would yield little to no increases in corporations' net profit since most of the retail hikes would go to cover operating costs. Most corporations however are posting massive profit gains, which means a large chunk of "inflation" is just corporations fleecing their customers because they can. -

InvalidError Reply

My point is that if inflation was truly due to production costs (ex.: energy) then corporations passing those costs down to consumer would mean little to no net increase in their profit. Their profits are increasing far in excess of consumer prices, which means they are price-gouging.Endymio said:Eh? You have it entirely backwards. Higher energy prices are driving inflation, not the result of it.

As far as "supply and demand" goes, higher retail prices in the face of stagnant wages means people's effective buying power is going down., especially for non-essential stuff. There was no shortage of margarine back when the regular price was $1.50 per tub that now goes for $3+ "regular" price and still goes "on sale" for $1.50 every few weeks. However, most publicly traded grocery store chains are posting massive profit increases. Most of the retail price increases there are going straight to the executives and shareholders, nothing to do with their increasing wages or energy costs. -

digitalgriffin ReplyEndymio said:That doesn't pass the sniff test, sorry. Currency exchange rates are determined by a nation's balance of payments. With the world price of oil and gas nearing all-time highs, and Russian exports at record levels, their currency certainly will not "collapse".

BTW, the ruble has risen two more pips since I posted my first comment.

Look at the video I referenced you and you'll see what has happened to inflate the ruble. 20% interest rate was used encourage Russians to hold the ruble. They are also forbidden for exchanging it for foreign currency. Other actions keep the value artificially high. However it can't be sustained, as the economics explained video alludes -

digitalgriffin Reply

The truth is in the middle groundInvalidError said:Biden did none of those things. Though he did promise a ban, he didn't actually do it. All he did is ban the issuance of new leases since oil&gas companies are already sitting on 6000+ unused licenses. Blame oil&gas sitting on a hoard of unused leases (and using inflation as cover to jack up their profit margins) for rising prices.

If inflation was real, the consumer price hikes would yield little to no increases in corporations' net profit since most of the retail hikes would go to cover operating costs. Most corporations however are posting massive profit gains, which means a large chunk of "inflation" is just corporations fleecing their customers because they can.

6000 leases isn't high or low. The problem is OPEC and other oil producing nations (Russia included) didn't want USA to become a controlling influence on the Petro Market. Thus they sold at or below cost. This caused a lot of fracking and oil drilling to stop in the USA as it was no longer profitable. Right now prices are high causing Petro companies to start using those leases. But they have limited concurrent exploring capability. So they are limited by qualified personnel to exploit said resources. It's a long lead time from lease to pumping.

Part of the problem is refineries. No new ones have been built, so there's not enough refining taking place. While current plants are expanding to their limits, there is a serious lack of new plants exacerbating the problem. The last was in the 80's -

InvalidError Reply

Energy costs are only one part of the input costs of everything else practically every company is posting record profits despite allegedly rising costs. There was no margarine shortage at my local supermarkets before the typical tub price went from $1.50 to $3 and if "energy cost" was the real reason for the coordinated price hikes, that would only explain 30% of it at best.Endymio said:I'm sorry, but this is far afield. Oil and gas prices aren't up because of "production costs". -

digitalgriffin Reply

Moscow Limits Foreign-Currency Trading to Shore Up Struggling Ruble (wsj.com)Endymio said:The interest rate is correct. Your second statement is false -- there is no ban on exchanging rubles for foreign currency. And you're still missing the point. Russian exports are up both in volume and in price. Those exports must be paid for. Either they're paid for in rubles, or in foreign currency ultimately exchanged for rubles. Either way -- the ruble stays high.

As I said, Russia is in emergency panic mode. The Rubble WILL collapse. Their long term suffering is set.