Imagination's Quest To Provide A Third Major Mobile Platform

By acquiring MIPS Technologies, Imagination hopes to build a strong platform to compete against the incumbent ARM and daunting challenger Intel on a more equal footing. We go through the company's portfolio to determine its strengths and opportunities.

The Mobile Line-Up

The mobile market is a gold mine for successful chip-makers, but it’s especially good for IP providers like Imagination and ARM, which aren't burdened by the heavy lifting of manufacturing and still end up with products in hundreds of millions (if not billions) of devices.

Mobile Products

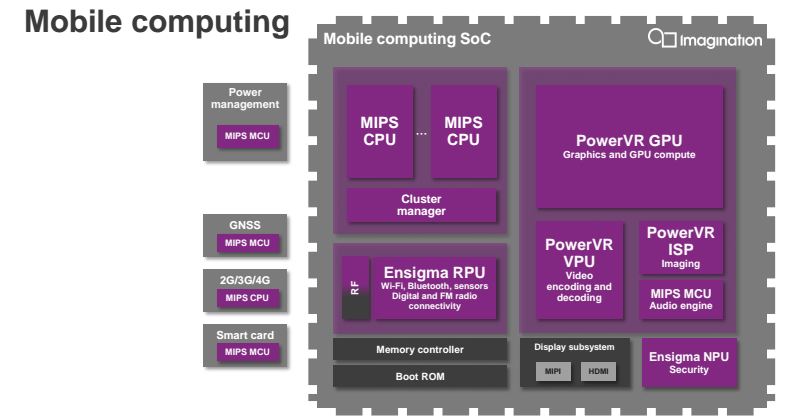

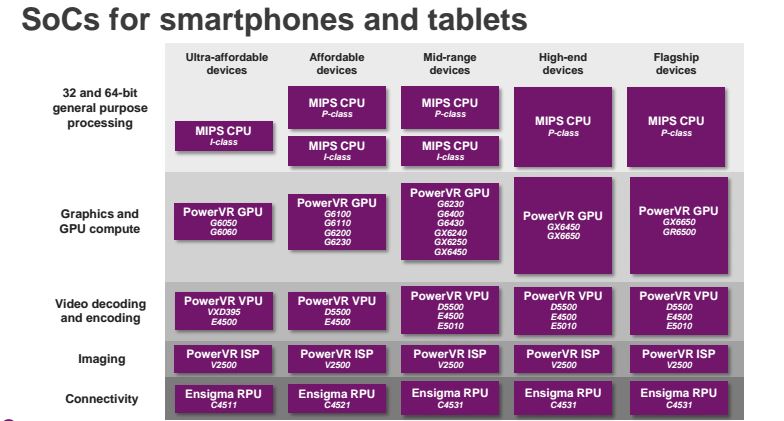

In this mostly ARM-dominated market, Imagination now offers design IP for major SoC components, from MIPS CPUs to PowerVR GPUs and connectivity modules, in devices from the ultra-low-end up to the flagship level.

At the bottom of the spectrum, Imagination offers the I-class MIPS CPU cores to compete against ARM's Cortex-A7. At the high-end, it has the P-class MIPS cores, comparable to ARM’s Cortex-A15. For the mid-range, customers can choose between the I- and P-class cores, depending on their application.

Although the company acquired MIPS just one and a half years ago, Imagination has been in the GPU business for a lot longer. Naturally, it has a wider variety of options at all levels, from the low-end half-cluster G6050 (for ultra-low-end devices) to the flagship-worthy GX6650 (a mobile Kepler competitor) and the ray tracing hybrid GPU, the GR6500. Notice that last year’s high-end GPU, the G6430 found in Apple’s iPad Air, is now offered at the mid-range.

Imagination offers a variety of video accelerators, too. But in terms of ISPs and connectivity modules, there seems to be only one option for each across all market segments.

Mobile Competitors

It’s no secret that the mobile market is dominated by ARM-based CPUs, with Imagination only getting into the host processing space recently by acquiring MIPS Technologies, and Intel not having managed to establish a strong foothold yet either.

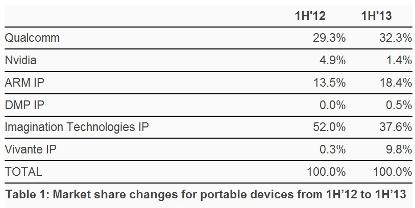

In the mobile graphics market, things are a little different; Imagination is the established leader there. However, ARM has been seeing more success with its Mali GPU IP thanks to Samsung, but also other smaller licensees in China. While not a direct IP competitor, Qualcomm’s integrated graphics technology is also taking from Imagination’s market share recently. In 2013, Imagination’s slice of the mobile GPU pie shrank from 52% to 37%.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

As we can see from the table, Nvidia lost most of its market share in the mobile graphics market last year. But with the switch to its Kepler architecture, and soon Maxwell, the company could recover some of that. As we've already seen from Tegra K1, its newest design is a lot more competitive than the previous-gen SoCs.

Nvidia also has an advantage with the OpenGL 4.4 API support, which will take time for the competition to implement. Before that happens, there's a good chance we'll see games ported down to the mobile space from the desktop, which would run on Nvidia's Tegra processors. For now, though, that competitive advantage is mainly hypothetical. Without the design wins and showcase titles, there's not much else to report on. At least other companies are pushed to innovate faster.

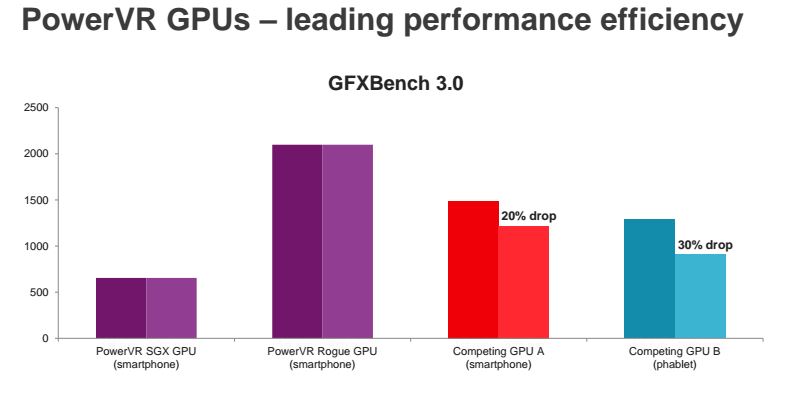

In this GFXBench 3.0-derived benchmark that loops 30 times, charted out by the folks at Imagination, it’s easy to see which GPU maintains its performance over time and which ones throttle after a period of time. If we're to believe this information, the PowerVR Rogue GPU doesn't throttle, while the competition does. Of course, we know that there are unaccounted variables to consider. How big are the form factors being compared? What clock rates are being used? What device vendors do with the SoCs they pick has a ton of influence on how well they run in the wild.

Then again, we've noticed similar trends in our own lab. Apple's devices running iOS tend to start and finish strong in GFXBench, while a lot of the Android-based competitors without PowerVR graphics are far less consistent. Just look at the issues we ran into inSamsung Galaxy S4 Slows Down Under Heavy Load in 4.4.

For now, Imagination remains a mobile graphics leader with healthy market share and strong GPU IP. The competition is getting fiercer every year though, so we'll see how the space plays out.

Current page: The Mobile Line-Up

Prev Page Introduction To Imagination Technologies Next Page Wearables, Home Entertainment, And AutomotiveLucian Armasu is a Contributing Writer for Tom's Hardware US. He covers software news and the issues surrounding privacy and security.

-

ZolaIII The compared ARM chip is indeed Cortex A15. Arm narrowed difference with Cortex A17. MIPS in a current displayed generation have some advantages over ARM like multithreading & a fact that new SIMD is better performing & fully double precision support (something that NEON SIMS lacks & it's very important). The MIPS architecture (basically instruction set) is biger than arm & silicon footprint there fore in more basic implementation must be bigger. How ever it's more optimal then ARM or x86 for that mater. The license cost less than for ARM. Their are none successful implementation in consumer oriented electronic of last two generations of MIPS cores (Aptive & Warrior) this is something that Imagination can't push alone. When it comes to GPUs Rogues are not on the Kepler level bat they are not much behind either. The fact is that their driver's are only ones on pair with Nv's. Magic behind no performance drops on big demanding workloads over time lies in design trick used collaboratively between Apple & Imagination on a Cyclone A7 soc. It's a L3 memory block placed between CPU and GPU cores that can act more like a TBL cache for GPU.Reply

The only one who can change tide is Intel bat with a cost of losing monopoly & moving away from it's x86 architecture (which to start with whose bad). Intel is currently more on a self destruct path then considering to adapt MIPS. How ever they are more than interested in a Imagination GPUs.

Problem with Warrior is that 64 bit design is not still presented & ARM will soon present second generation design. Somehow this is ironically on many ways as Intel and MIPS both have 64 bit instruction sets for very long time now & they didn't really used this advantage over ARM. Second point of irony is that Intel is responsible that MIPS is not more largely adopted & spread in the first place & that many core architecture is far from user space, otherwise we cold had all of this ten years ago.

We will see what (close) future will bring us. -

xenol I hope Imagination all the best against the well entrenched ARM. But of course, if they don't offer a better solution (faster or cheaper or easier to program, etc.), then there will be problems.Reply -

Joao Ribeiro Two decades ago you'd see MIPS CPU's in advanced computing devices like graphics workstations and mainframes.Reply

In those days talking about an Intel CPU in a Mainframe would be something of a joke.

Let's see if Imagination will be able to create a new breed of technology worthy of it's name and history. -

ZolaIII Now something really interesting when Joao did mention RISC processors.Reply

This represents the real free (of any manufacturing fee) hardware & it's literary opened & bare metal (as all architecture is open sourced). It comes from same chantry that is home to ARM and Imagination technology. For now I would say that the Cambridge boy's are more than on a right track with: hard & wide isa, in order CPUs & FPGA integration.

lowRISC:

http://www.lowrisc.org/ -

g-unit1111 How many more mobile platforms do we need? We have iOS, Android, Windows Phone 8, Blackberry OS, Web OS, Firefox OS, Fire OS, I could go on and on and on. Last thing I need is another app store account! :lol:Reply -

Marlin Schwanke As I recall, Intel has a significant stake in Imagination Technology. I can just Imagine what they are saying about this move into the CPU space. Also Apple owns a slice of this pie. Can you Imagine them moving to their own proprietary CPU\GPU based on this IP? I Imagine that ARM probably should be the most worried here.Reply -

somebodyspecial Did kepler throttle at anandtech etc in gfx bench? I think maybe they need to update their charts or add one called Competitor GPU C to the table? ;)Reply

Considering it dominated all the other socs in gpu tests at anandtech, I'll wait to see what 6650 can do vs. K1 before I believe anything in a chart where they don't even name the competitors.

http://www.anandtech.com/show/8296/the-nvidia-shield-tablet-review/5

Considering it beat ipad air and mini by 2.5x I won't hold my breath about perf here. Ipad air has a 6430 IIRC. Are there any devices with 6450/6650 or 6500 benchmarked yet? 6450 looks the same (ops and clusters) as 6430, so this won't do squat. So I guess I'm only asking about the 6650 or 6500. Manhattan offscreen 31.7 for kepler and 13 for both mini and ipad air. I don't see how rogue6 catches them.

In January Anandtech said this:

"In which case Series6XT equipped SoCs would start appearing in 2015, likely in the latter half."

If that's the case it will be facing Maxwell 20nm (likely June/July) which is truly designed for mobile period and scaled to desktops after. They only added 2 clusters (up from 4 to 6) and as anandtech says not even going wider, so just the extra clusters really.

"Imagination is scaling up performance internally, we’re not seeing them go with outright wider GPUs for the Series6XT family (at least not yet). So Series6XT’s performance improvements will come from these internal changes, including performance optimizations and any wider blocks within."

http://www.anandtech.com/show/7629/imagination-technologies-announces-powervr-series6xt-architecture-available-for-immediate-licensing

That doesn't sound like it will even double perf and they look like they'd need a triple to catch Kepler let alone maxwell 20nm later. Also S810 is only supposed to be 30% faster than S805 in gpu so again, will be well behind kepler also. NV has tablets to themselves for a while. Google isn't going with them for nothing and others will likely follow. Denver should be more power efficient than K1 A15rp3. The cpu side is in house with denver, so either you do better on power or IMHO you have failed at making a cpu...LOL.

http://www.tomshardware.com/news/imagination-powervr-rogue-series6x-graphics,25659.html

Apparently targeting ES3.0 and unity 4.0?

http://blog.imgtec.com/powervr/here-are-eight-powervr-graphics-sdk-tutorials-for-game-developers

There is a tag here of 3.1, but no mention in the post and this is last month. NV's K1 however already runs it and is aimed at unity5 and unreal 4 (should be, it's a desktop chip).

In the release notes they say this:

New: OpenGL ES 3.0 SDKs for iOS and Android.

New: OpenGL ES 3.1 SDK for Windows and Linux emulation.

When will it be OUT of emulation and part of the SDK period, like the mention the 3.0 is? To me it seems they are quite a bit behind NV, and not sure when anyone will be getting full OpenGL 4.4 as toms notes above. NV is now ahead in perf by a long ways and feature set which should sell some units especially now that we know it gets 11.5-13hrs in a chromebook with a 3200mah battery and 13.3in screen. Not bad.

http://us.acer.com/ac/en/US/content/model-datasheet/NX.SHEAA.007

Acer with Haswell 2955 says 8.5hr for 3950mah, but only 11.6in and 1366x768.

http://us.acer.com/ac/en/US/content/model-datasheet/NX.MPRAA.007

4GB 32GB SSD 13.3in K1 model still gets 11.5hrs and 45w psu, same 3220mah battery.

http://us.acer.com/ac/en/US/content/model-datasheet/NX.MPRAA.012

Acer K1 13in with 1080p, 3220mah but 11.5hr. I think haswell 2955 loses based on the specs. Intel, PowerVR and Qcom all seem behind now. Denver should improve things more in Nov as it drops the 4+1 A15, for plain dual core @2.5ghz and is in house.

Having said that, with 20nm versions not far away from everyone, I'll wait for any tablet/chromebook or even a shield device ;) That will be an impressive jump for everyone and should be a huge leap for games across the board as I believe even the junkers should catch K1 at 20nm. Of course NV will get the 20nm bump also, just saying the low-end should allow everyone to play K1 type games too which is great for android gaming. 20nm should mean we see a billion units sold with pretty close to K1 type gpu power. This in turn should mean they don't have to aim so dang low on games, as the common denominator should be K1 level roughly (maybe only mid-range and up, but then again that in itself is a huge market anyway). Either way 20nm means android gaming is moving on up :) Die consoles die. ;) 14nm should put the final nail in them I hope, and they'll only have ~25-30mil (if that at the pace they're slowing to) in the market vs. 1.2B+ mobile devices sold YEARLY. I can't see how console will survive that as devs will just run to mobile even more than now as GDC already shows.

-

sb1370 I haven't seen any major end user MIPS device (except routers).Reply

Despite of VMs, many apps use native codes for performance and power advantages.

Also Android is not everything. They need to attract other Corps (such as Microsoft - back to Windows NT on MIPS).