Evidence mounts that China has sanctions-defying 5nm tech — Huawei reportedly preps new AI processor built with Chinese fabs' N+2 node

But can it build enough of them?

TrendForce, a market intelligence firm, reports that Huawei is prepping a successor that will be made using SMIC's N+2 fabrication technology. Huawei's HiSilicon's post-Ascend 910B AI chip is expected to offer higher performance, partially due to its new process node — the next-generation AI processor purportedly uses SMIC's N+2 process technology (which some believe is a 5nm-class node).

This marks the second such Huawei effort that's thought to employ the sanctions-defying SMIC 5nm node — the company recently listed a laptop with an advanced chip with 5nm manufacturing tech, a feat previously thought impossible due to U.S sanctions. Huawei has already shocked the world with its mass production of Huawei's HiSilicon Kirin 9000S processor using its second-gen 7nm process technology, a feat also once thought impossible, but its purported move to 5nm is even more impressive.

Moving forward to a new node makes a lot of sense for the next-gen accelerators, but there are two big snags. First, Huawei's push into smartphones means most of SMIC's capacity goes to that consumer market, including the Kirin 9000S, which might leave less room for making AI chips. Second, SMIC is blacklisted by the U.S., making it hard to get the advanced chipmaking tools and the spare parts it needs. As such, the company may not have the production volume to build enough processors for Huawei's needs.

Huawei has used its existing Ascend 910B chip for artificial intelligence (AI) workload acceleration for some time now, and it is believed that its performance is comparable to Nvidia's A800/A100 processor. So the Ascend 910B looks rather competitive from the raw potential side of things, but its software differs from Nvidia's CUDA, which will slow its adoption as many workloads are optimized for Nvidia's platform. But even facing these issues, the tightening U.S. restrictions might push Chinese companies to rely more on homegrown chips like the Ascend 910B.

Huawei's Ascend 910B is currently used to run the company's cloud services and is also sold to other Chinese companies, like Baidu, which bought over a thousand of these processors to build 200 AI servers. Another customer is iFlytek, who teamed up with Huawei for enterprise large language models (LLMs) that use the Ascend 910B as part of the 'Gemini Star Program' that kicked off in August.

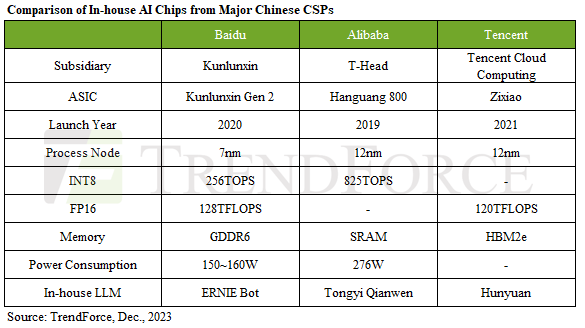

Reacting to the tightening of U.S. sanctions against China's supercomputer and AI sectors, Chinese cloud service providers like Baidu and Alibaba are doubling down on developing their own AI chips. Baidu made its own AI processor, the Kunlunxin, yet it also plans to use the Ascend 910B along with expanding Kunlunxin's use in its AI infrastructure. After buying CPU IP supplier Zhongtian Micro Systems and starting T-Head Semiconductor, Alibaba also designed its own AI accelerators, including the Hanguang 800, mainly for Alibaba Cloud.

The path to making top-tier AI chips in China is rough, largely due to sanctions against China's semiconductor and supercomputer sectors as well as an inability to procure electronic design automation (EDA) tools for leading-edge nodes, such as TSMC's N2 and Samsung's SF3. These restrictions are a big hurdle for designing chips on advanced process technologies and pose long-term challenges for Chinese chip designers in general. Despite these roadblocks, China is determined to keep pushing forward in the global tech race.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

Murissokah The more I hear about these sanctions, the more convinced I am that this can only backfire.Reply -

semmster1025 They couldn't have made a better move if they are trying to make them independent, and therefore stronger. After all, it's not like they are starting from basics, or have limited resources... I think I see what's happening. Just buying time.Reply -

Order 66 The only thing that trying to stop China from getting their hands on more advanced tech will do is make them try harder to get it. Like with Micheal Jordan in the NBA, IIRC, He was fined for wearing different color shoes, but yet he kept wearing them.Reply -

JamesJones44 The point of sanctions are to slow someone/something down. Considering China had access to the machinery to make chips all the way down to ~2nm for years, it's no surprise they can produce 7nm and 5nm chips. When anyone will know if the sanctions are working is when that equipment breaks or when they get close to the nm length the equipment was designed for.Reply

If China is able to make its own equipment that can go lower than their existing equipment acquired from western sources then I would say it's clear that they have "defied" sanctions. At this point it's hard to say if it's just a continuation of refinement for equipment they already have or they have really defied sanctions. -

Avro Arrow I'm pretty certain that Huawei can produce enough of these chips. If there's one thing that China has demonstrated over and over again it's that nobody should ever underestimate their capacity for the production of goods, any goods.Reply

Sooner or later, some unscrupulous corporation will find a way to supply the latest silicon production tech to China. Sure, China will probably pay 3-5x what the tech is worth but China doesn't care and that kind of money would be an incredibly strong motivator for certain people. -

The Chinese will be in the Tech lead within 5 years spurred on by the US Govt sanctions, in no time they will quickly and easily form a new found trade umbrella with other countries in that hemisphere that will position them as the world leader and will tell the US and the west to go swing as well as increasing the price of all the consumer goods we buy from them mark my words its coming the US will be very sorryReply

-

A reminder that politics of any kind are to be kept out of these forums. Failure to comply will result in closure of the thread and possible sanctions on the violator/s.Reply

-

hotaru251 funny thing about sanctions....it only stops direct sales...did americans give up booze during the prohibition? no...it still got via back channels.Reply -

ivan_vy Reply

5 years is pretty short time, 10 years to be competitive, in 20 years might surpass west in some areas.craigss said:The Chinese will be in the Tech lead within 5 years spurred on by the US Govt sanctions, in no time they will quickly and easily form a new found trade umbrella with other countries in that hemisphere that will position them as the world leader and will tell the US and the west to go swing as well as increasing the price of all the consumer goods we buy from them mark my words its coming the US will be very sorry -

ivan_vy Reply

if there is money to spend, there is someone willing to sell. And not just finished goods: manpower, IP, tools, they can solve the problem by throwing money at it, they are already doing that.Avro Arrow said:I'm pretty certain that Huawei can produce enough of these chips. If there's one thing that China has demonstrated over and over again it's that nobody should ever underestimate their capacity for the production of goods, any goods.

Sooner or later, some unscrupulous corporation will find a way to supply the latest silicon production tech to China. Sure, China will probably pay 3-5x what the tech is worth but China doesn't care and that kind of money would be an incredibly strong motivator for certain people.