Graphcore reportedly explores sale: Arm, OpenAI, and Softbank named as rumored potential buyers

Bleeding AI processor designer reportedly considers strategic options.

Graphcore, a U.K.-based artificial intelligence (AI) processor developer, is considering its strategic options. The company is facing difficulties raising money from investors and may be seeking a buyer for a deal worth around $500m (£400m), reports The Telegraph. Among the potential purchasers the newspaper names Arm, OpenAI, and Softbank, though none of these entities confirmed any talks with Graphcore.

Despite raising over $700 million from investors like Microsoft and Sequoia (with a massive valuation at $2.8 billion as of late 2020), Graphcore has struggled to become a viable player on the market of AI processors with its intelligence processing units (IPUs), partly due to closure of its China business due to U.S. AI technology restrictions last year.

The company reported an 11% increase in losses ($204.6 million in 2022), with revenue dropping from $5 million to $2.7 million, according to The Telegraph. The company has taken measures to cut costs in response to its financial challenges, which included staff layoffs and closing international offices. To continue operations and compete in the AI chip market, Graphcore needs to raise more funds by May 2024. These funds may come from existing investors, or a buyer.

Rumored interested parties include Arm, SoftBank, and OpenAI, but no official statements have been made. The sale might face scrutiny from national security officials due to the strategic importance of AI technology.

Meanwhile, Chrysalis, a London-listed fund with a Graphcore stake, revealed in December that one of its a portfolio companies was in process of being sold. Soon after, it sharply raised its Graphcore stake's value, hinting at a sale, according to Zeus Capital analysts. This adjustment implied Graphcore's valuation at $528 million, based on an investor's estimate. Baillie Gifford, another Graphcore investor, also upped its valuation of Graphcore.

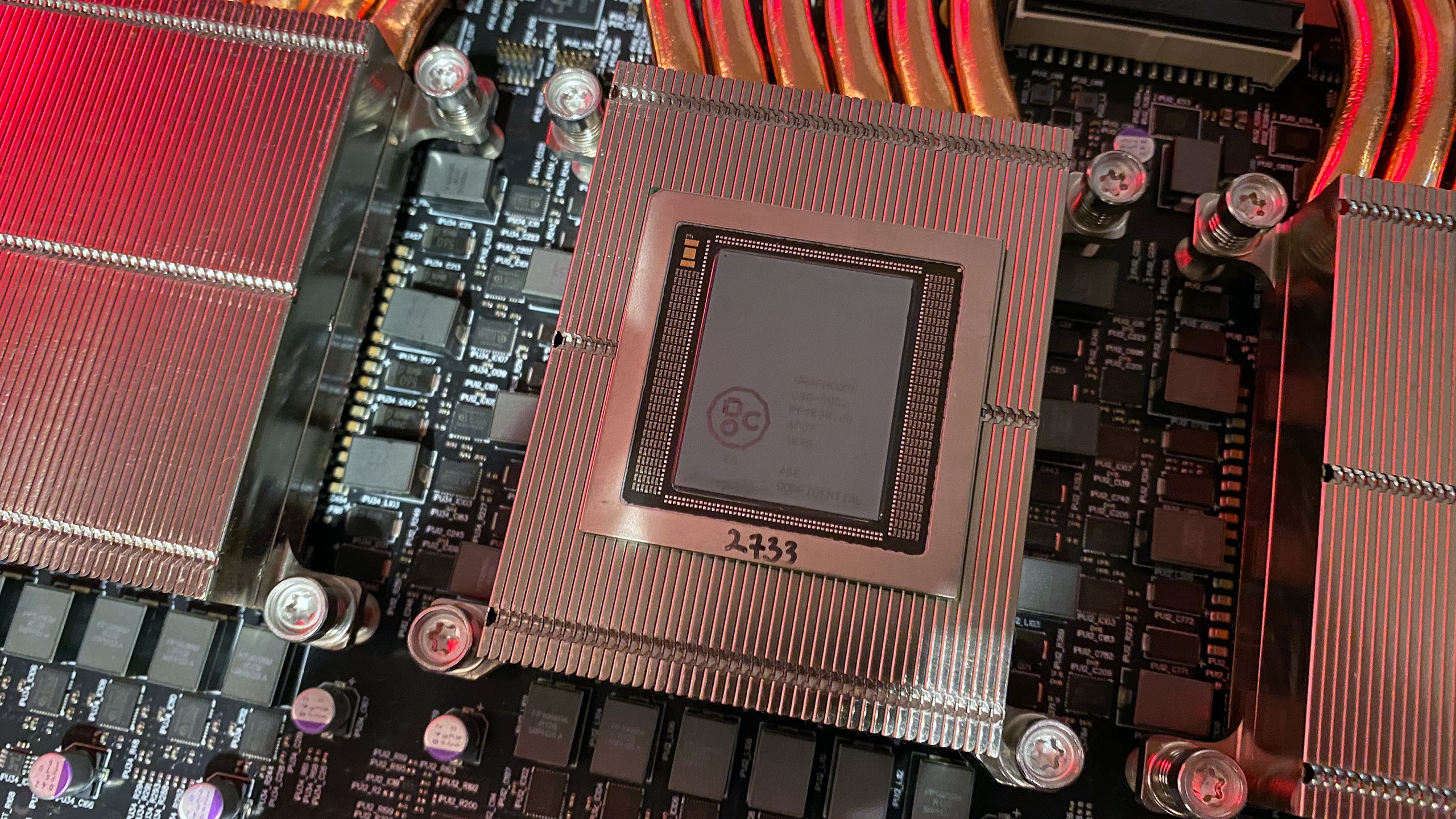

Graphcore got into headlines in 2020, when it released its Colossus MK2 GC200 intelligence processing unit (IPU) that featured 59.4 billion transistors and was the industry's most complex chip at the time. Each GC200 IPU packs 1,472 independent IPU cores with SMT that can handle 8,832 separate parallel threads and carries 900 MB of SRAM with an aggregated bandwidth of 47.5 TB/s per chip (eliminating need for external memory) as well as 10 IPU links to scale-out with other GC200 chips. From performance point of view, each GC200 offers up to 250 FP16 TFLOPS, which is comparable to Nvidia's A100's 312 FP16 TFLOPS (yet lower than 624 FP16 TFLOPS with sparsity), but the market did not bite.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

TechLurker There would be certain humor in another UK company being effectively bought by Softbank, as well as humor in being bought by Arm, which is also a property of Softbank.Reply

Maybe the UK can work out a joint deal with Softbank to retain a degree of controlling stake, but I doubt the UK can afford to do so and will still likely lose control regardless. -

bit_user ReplyEach GC200 IPU packs 1,472 independent IPU cores with SMT that can handle 8,832 separate parallel threads and carries 900 MB of SRAM with an aggregated bandwidth of 47.5 TB/s per chip (eliminating need for external memory) as well as 10 IPU links to scale-out with other GC200 chips.

Ah, thanks for reminding me who that was! I saw the Hot Chips talk, but forgot the "900 MB of SRAM" was from GraphCore. IIRC, that chip was made on TSMC N7, and supposedly devoted more than 50% of its die space to SRAM (or maybe that's yet another Hot Chips presentation I'm remembering?)

Anyway, here's the presentation from Hot Chips 2021:

https://hc33.hotchips.org/assets/program/conference/day2/HC2021.Graphcore.SimonKnowles.v04.pdf

While it's key to have lots of on-die SRAM, it really won't help with very large models, if you don't also have a decent amount of DRAM bandwidth. That could be where they had issues. -

bit_user Reply

IIRC, Softbank snapped up ARM in 2016, after the Pound plummeted in the wake of a certain referendum. I wonder if British assets are still trading at a discount...TechLurker said:There would be certain humor in another UK company being effectively bought by Softbank, as well as humor in being bought by Arm, which is also a property of Softbank. -

whatinthehardware Given the lead investors Microsoft and Sequioa wrote off their Graphcore investment I would say it should be picked up wholesale. Whether the owners now try to claim it is now magically worth a lot more because of the LLM hype cycle and NVIDIA stock surge (which Graphcore couldn't compete with) it will be interesting to see what happens here given Graphcore have a new chip being released soon.Reply

Retail investors buying up a stock in a frenzy is one thing but large companies and PE firms throwing billions at this hype cycle to try and invade NVIDIAs moat is another. -

bit_user Reply

Not a moat, but a swamp! Both Lisa Su and Jim Keller have said so.whatinthehardware said:to try and invade NVIDIAs moat is another.

: ) -

whatinthehardware Indeed, which is why I find the ARM acquisition unlikely and the OpenAI one dubious. Softbank will throw money at anything though and will have plenty of cash if they sell even a small portion of their ARM stock next month. There's plenty of dumb ideas to throw a few billion at this year and they're just the guys for it.Reply