Nvidia reportedly books entire server plant capacity through 2026 to build Blackwell and Rubin AI servers, pushing out other potential customers

Using forward thinking to ensure dominance.

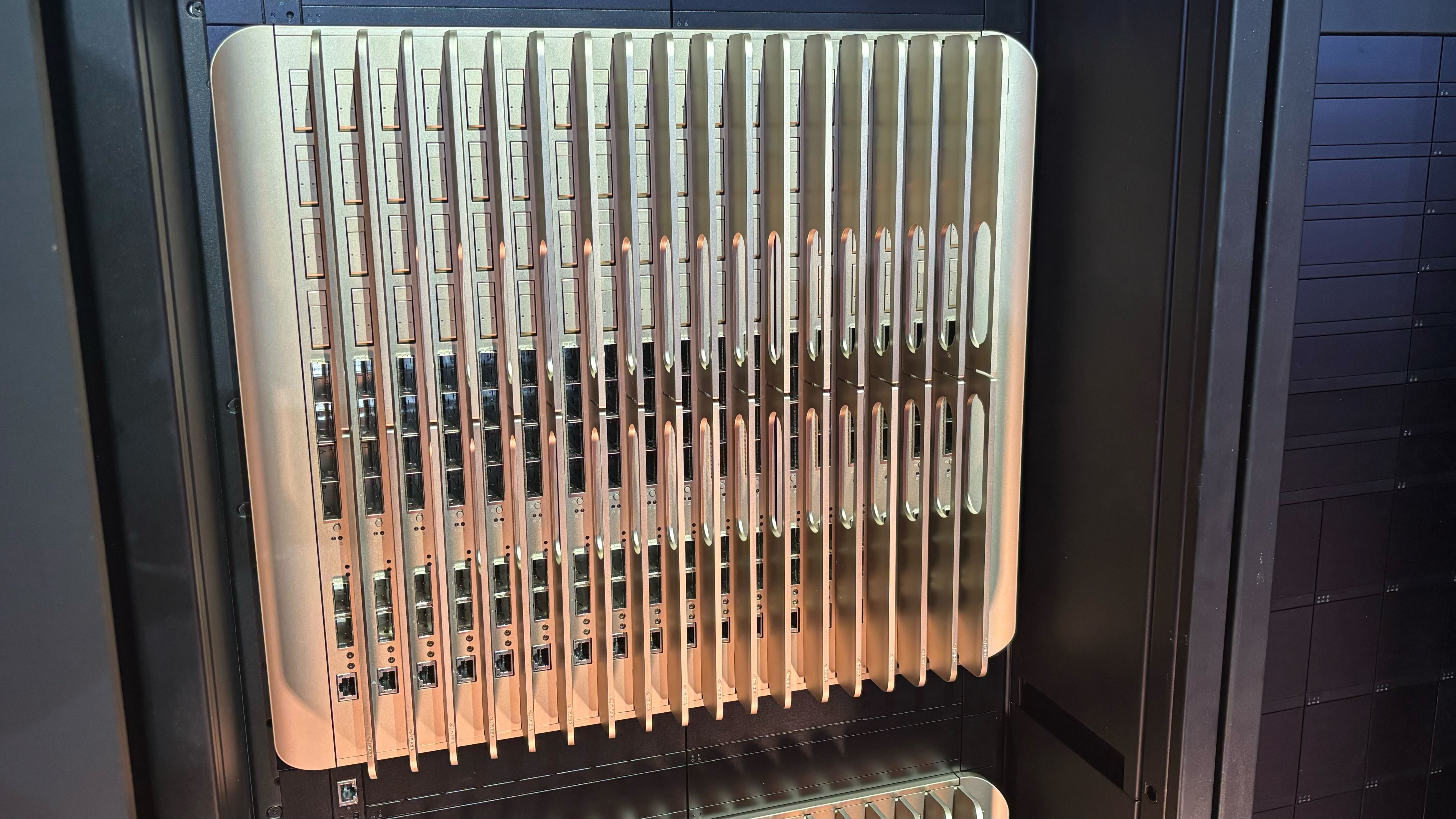

Being the world's largest supplier of processors for AI applications requires Nvidia to stay ahead of rivals in terms of technology and supply. To that end, Nvidia books the vast majority of TSMC's CoWoS capacity and is becoming actively engaged in the broader AI supply chain. To ensure that its clients get the Blackwell and Rubin-based machines they need, Nvidia this week booked an entire Wistron server plant in Taiwan to build AI servers, according to Economic Daily.

Wistron's facility near Zhubei in the Southern Taiwan Science Park began production this quarter and was officially inaugurated on June 19. Economic Daily claims Nvidia has secured all available capacity at the plant, with confirmed orders extending through 2026. While this information has not been formally confirmed, the chief executive of Wistron said at the inauguration event that current contracts for AI servers extend at least a year into the future, according to Commercial Times.

The production capacity of this particular plant is unknown, but Wistron's seven plants employ over 7,000 people and collectively produce approximately 240,000 systems based on the Blackwell platform each quarter. Due to the rapid growth in demand, the company anticipates that its existing capacity may not be able to keep pace with demand as early as 2026, according to the report.

To handle increasing workloads, Wistron has already secured an adjacent building from Lianfa Textile to serve as a second plant (A2) in Zhubei. This site is scheduled to go online next year and will also build Nvidia-based servers. Once both sites are operational, the company's AI-related production capacity in Taiwan is expected to double.

Shipments of AI servers became primary growth drivers not only for Wistron but also for Quanta (the largest producer of AI servers) and Foxconn in recent years. Therefore, Wistron has been steadily expanding its manufacturing footprint across Taiwan, including upgrades to its existing facilities in Hsinchu's Hukou district over the past two years. In addition, Wistron is also building a brand-new AI server plant near Dallas, Texas, and is expanding existing capacities in the U.S.

Securing capacity at server manufacturers ensures that Nvidia's partners, including system suppliers and cloud service providers, receive their Nvidia-based machines when needed and in the quantities they require, despite tight supply. This not only ensures a robust supply chain and a steady increase in Nvidia's revenue, but also ensures that its rivals are unable to use the same capacities to build their products. Considering the significant demand for AI servers these days, we can hardly blame Nvidia if the company did, in fact, secure capacity at server assembly plants.

Follow Tom's Hardware on Google News to get our up-to-date news, analysis, and reviews in your feeds. Make sure to click the Follow button.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.