Ampere's 80-Core Altra Chips Take on Intel Xeon and AMD EPYC Rome

80 cores, mesh interconnect, and low power. What's not to like?

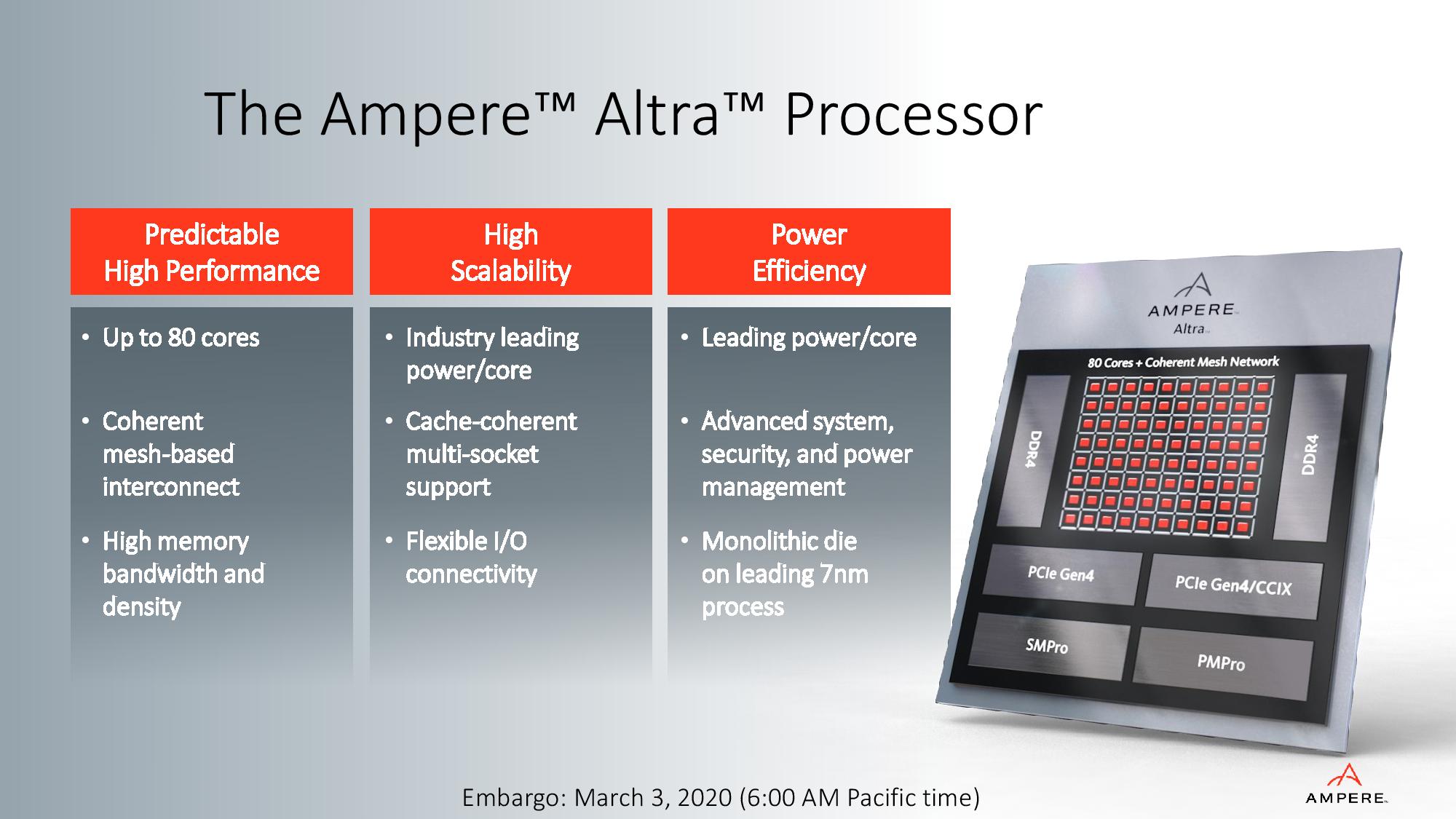

ARM servers have long held the promise of breakthrough power efficiency and performance, and Ampere took its first big step forward to delivering on those goals with the announcement that its Altra 80-core chips, which consume a mere 210W, are shipping now in both single- and dual-socket systems. The company wades into an ultra-competitive market with x86 competitors like AMD's EPYC, which currently offers leading connectivity options and core counts, and Intel, which is now competing on both price and differentiated features. The ARM ecosystem is also ripe with new competitors forming, like forthcoming chips from startup Nuvia and Amazon's Graviton2 chips.

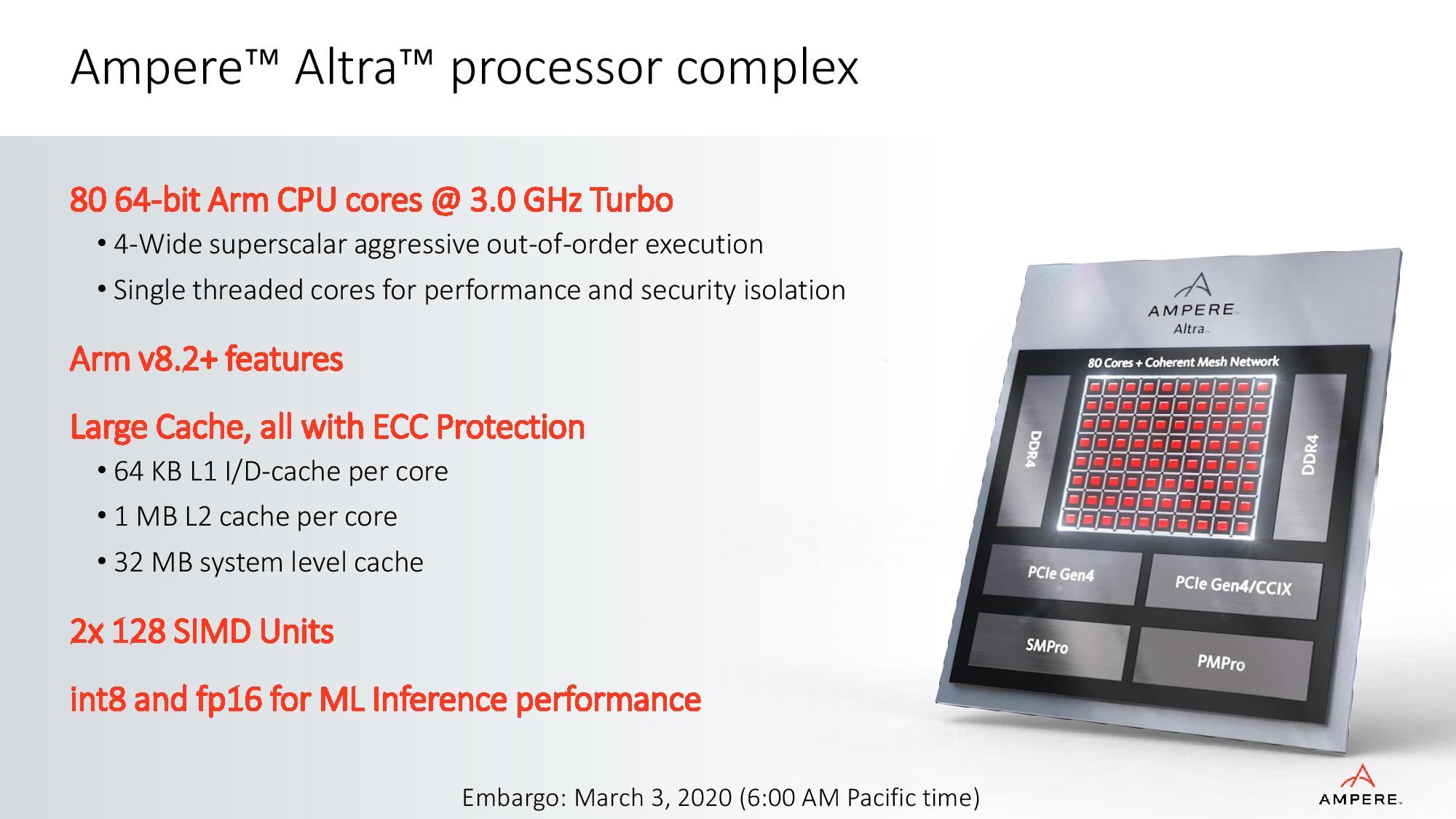

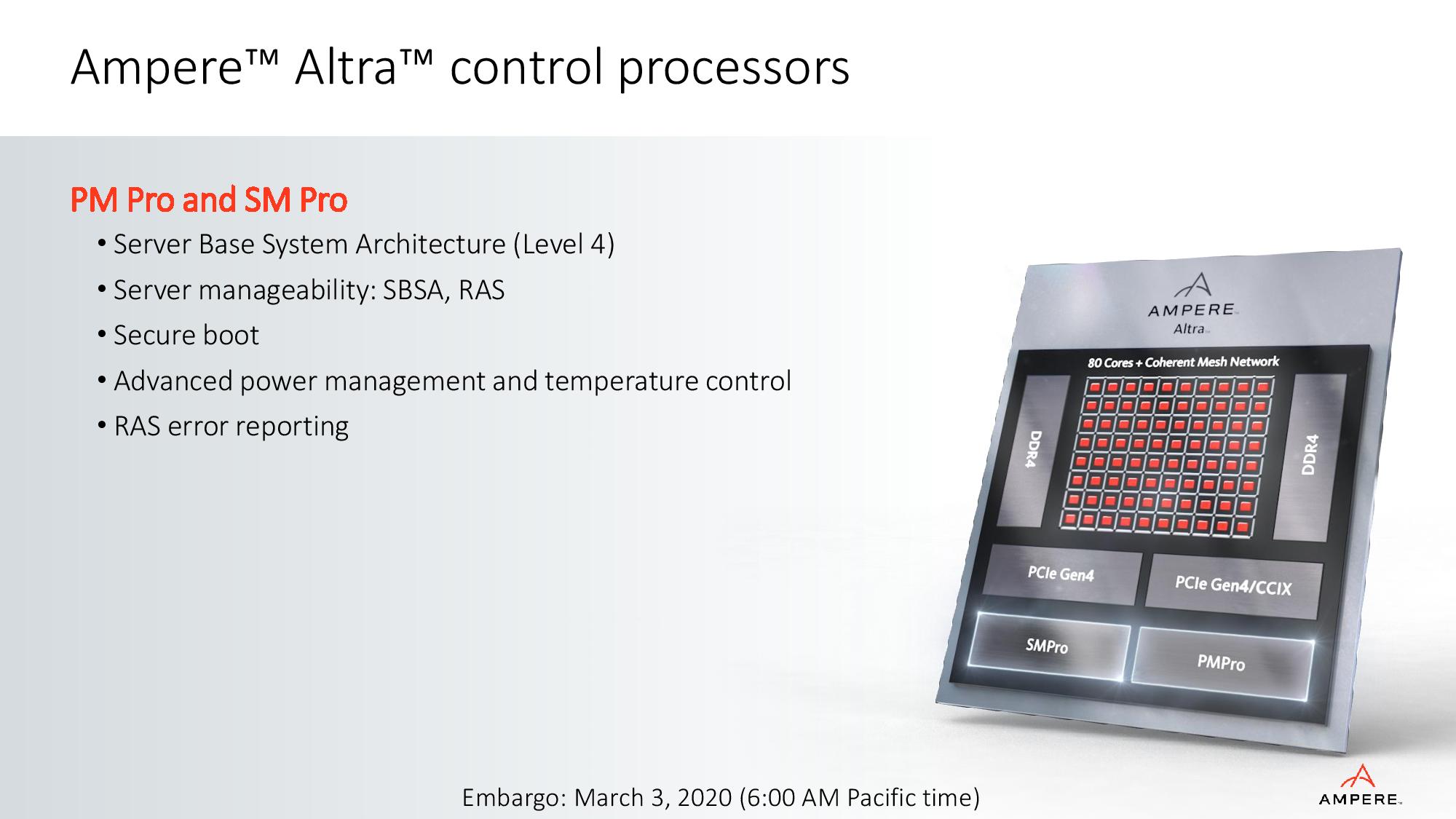

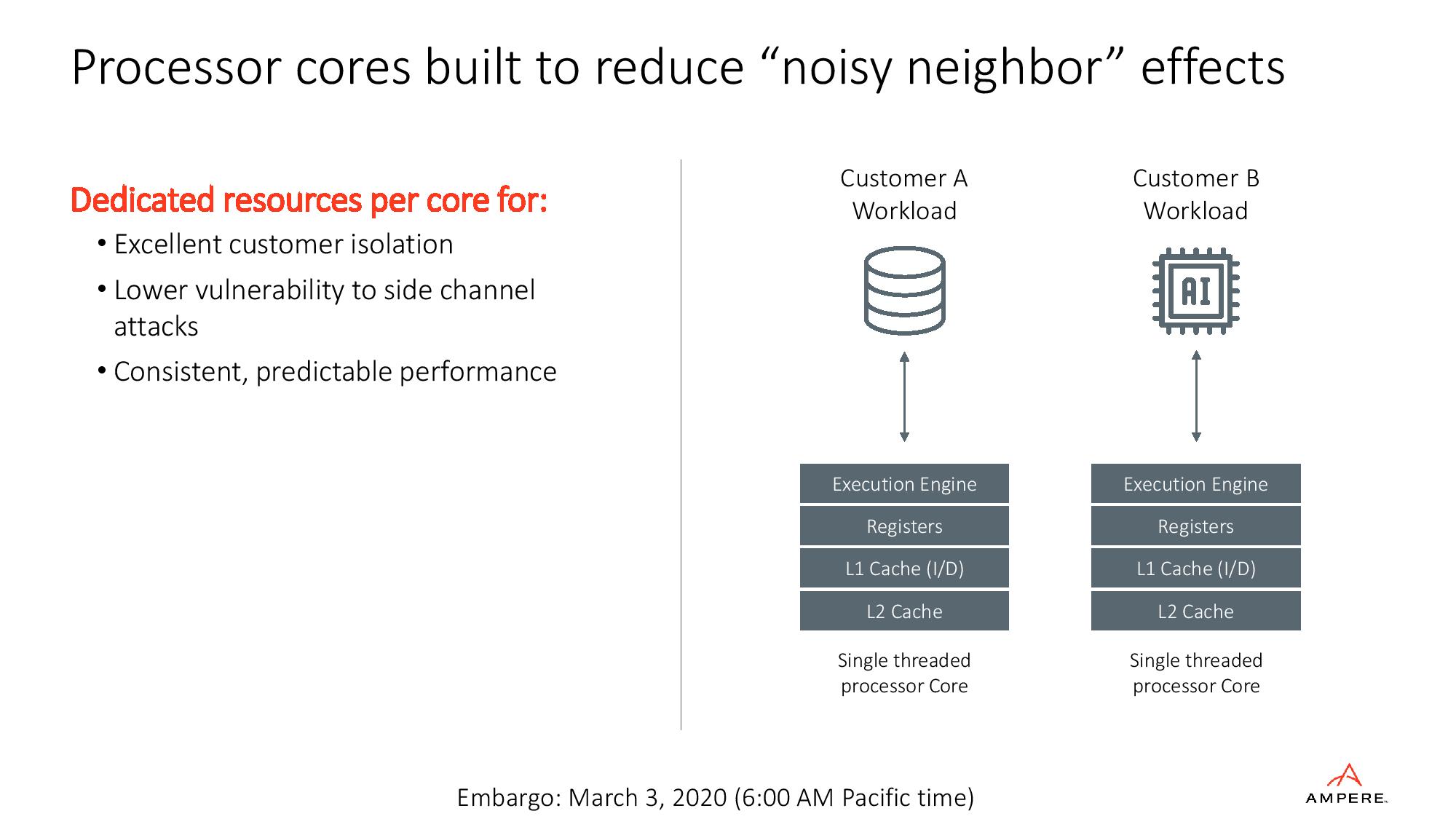

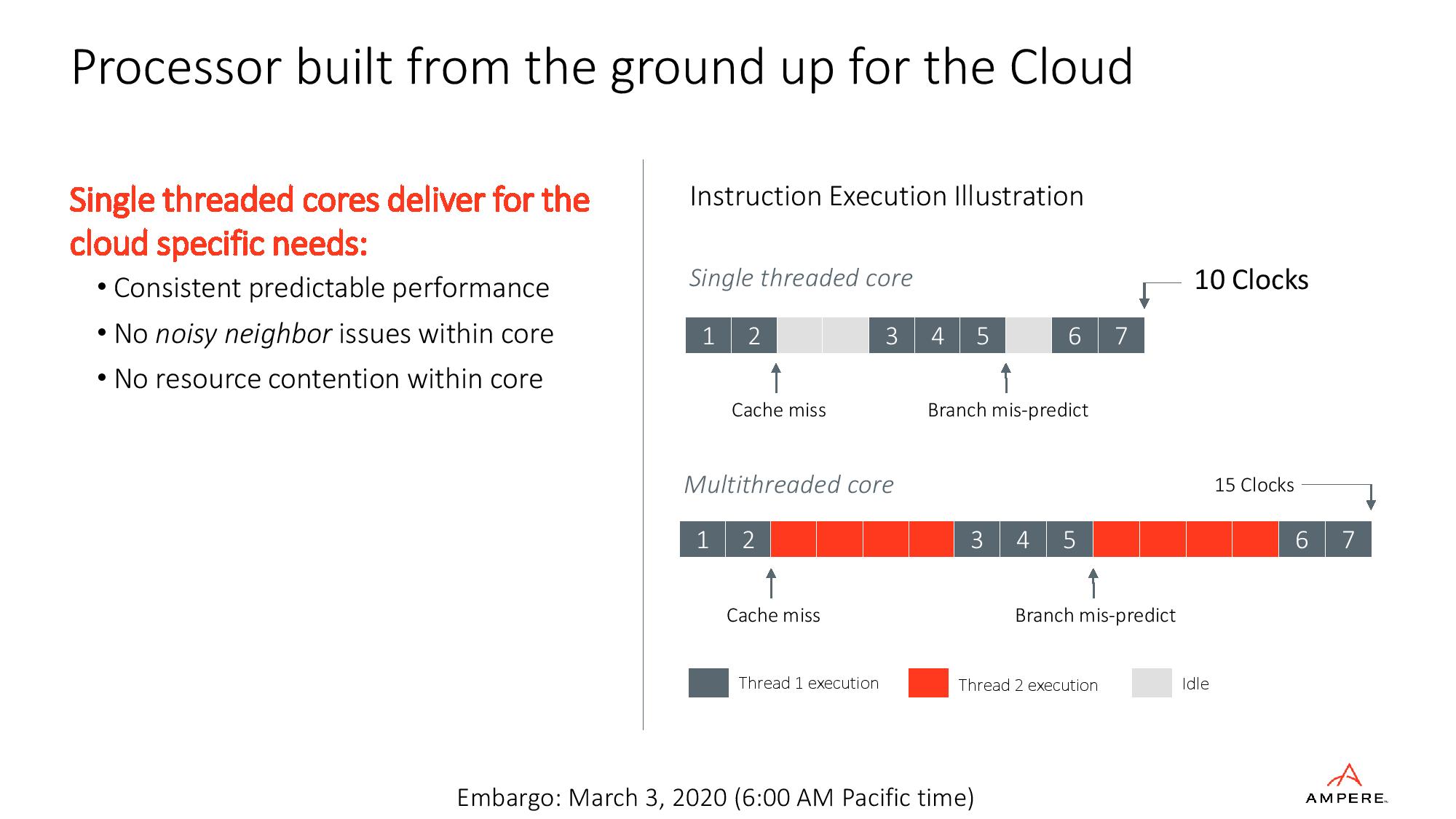

Ampere fabs the Altra processors on the 7nm TSMC process to enable up to 80 cores on a single die that are tied together with a coherent mesh interface. Unlike Intel's Xeon and AMD's EPYC, the ARM cores come without threading, meaning that software executes on a single thread per core. Ampere positions this as providing lower power consumption, enhanced security via a lack of shared resources, and a more precise quality of service. Clocks weigh in at a 3.0 GHz boost, but the company hasn't shared base clock information.

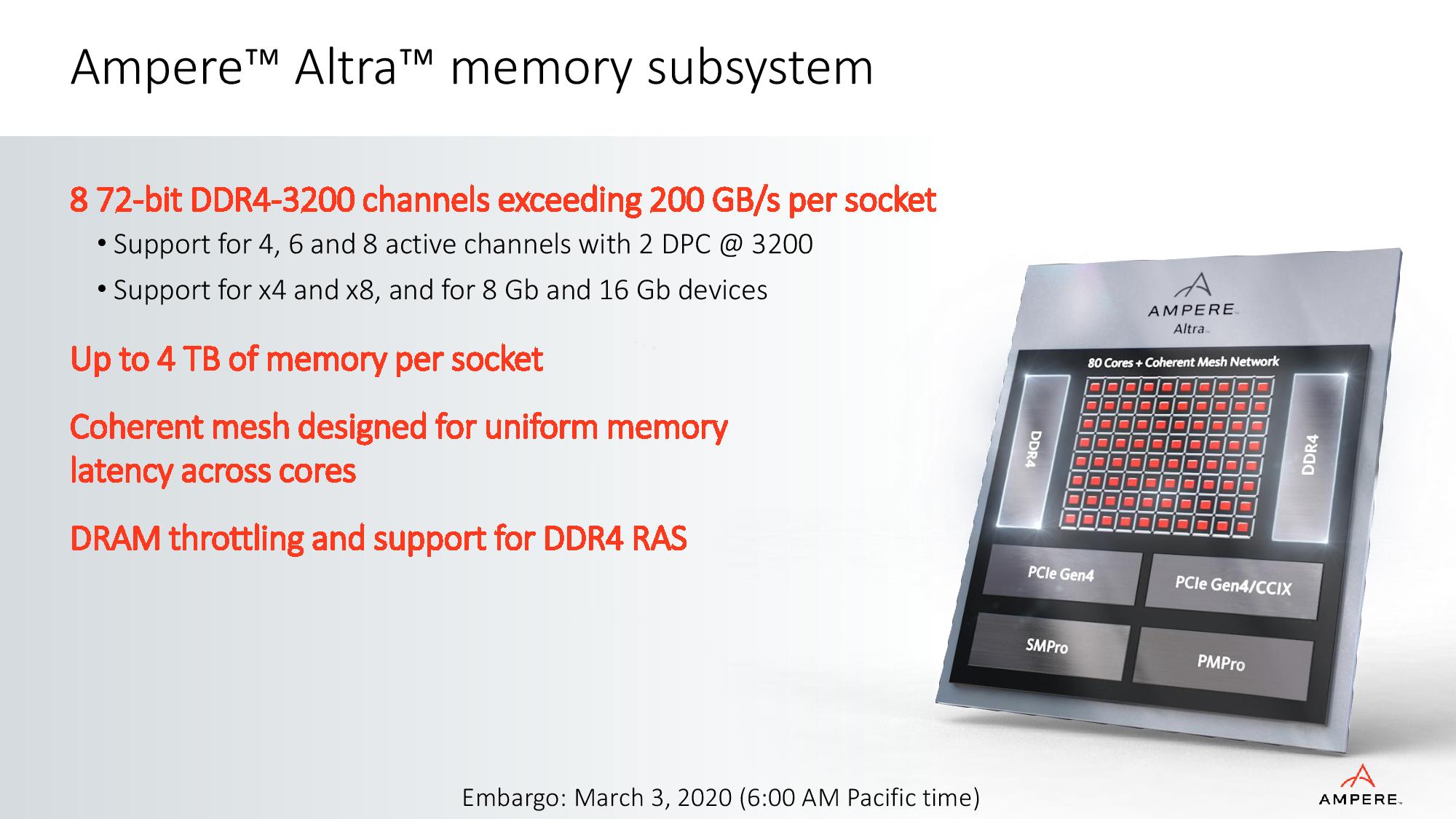

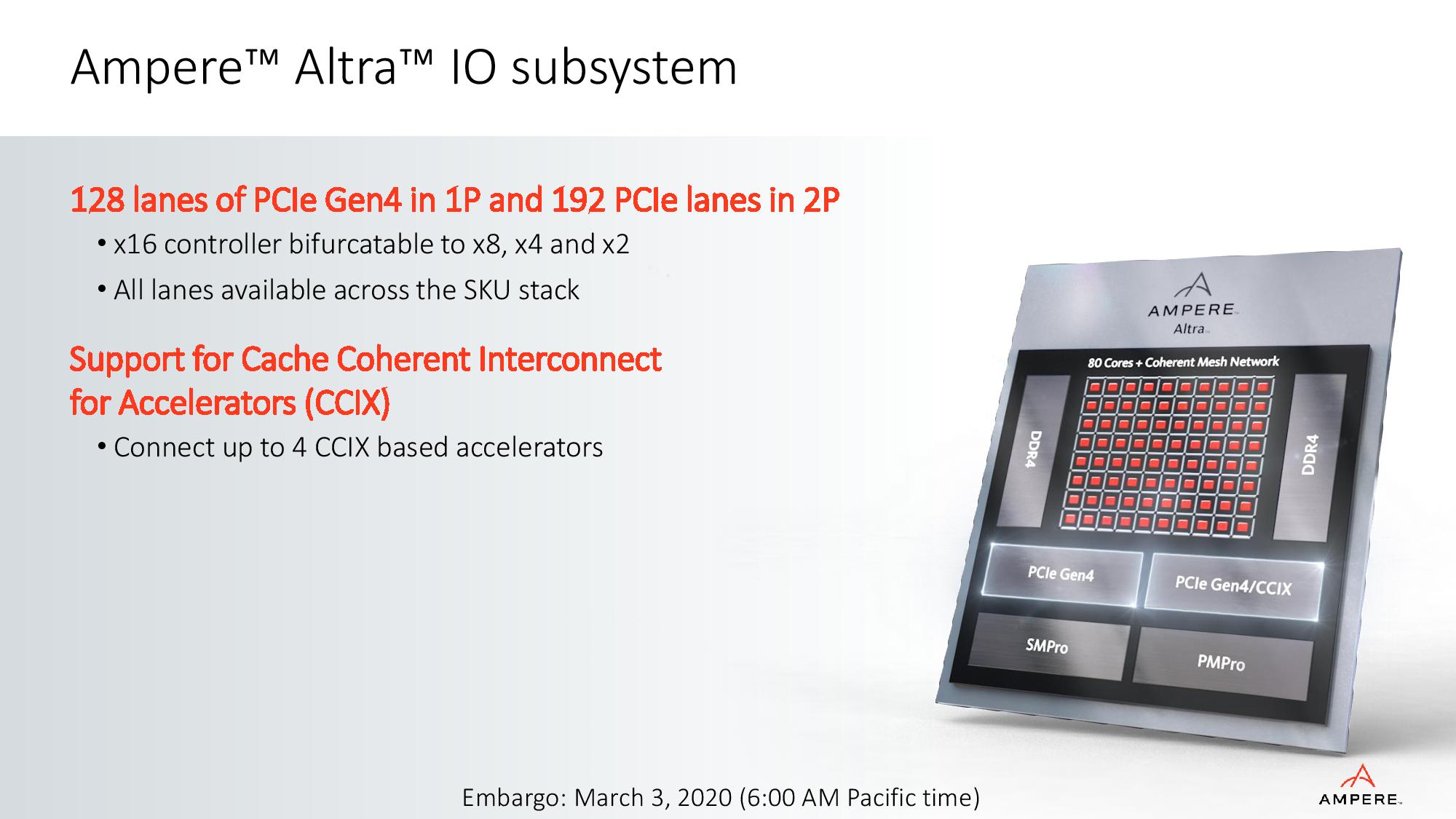

The Neoverse N1-based chips come armed with up to eight channels of DDR4-3200 memory (4TB max), which provides up to 200GBps of throughput per socket, tied via a mesh interconnect to the ARM v8.2+ (the company roped in some enhancements from v8.3 and v8.4) cores. The chips also come with the modern trimmings we've come to expect, like 128 lanes of PCIe 4.0 in a single-socket server and 192 lanes in a dual-socket, along with support for the CCIX interface to provide cache coherency for up to four connected devices (CXL in the future).

Altra also supports INT8 and FP16 for inference workloads, a key in today's AI-driven infrastructure, and come equipped with 32MB of total L3 cache along with 1MB of L2 and 64KB of L1 instruction/data cache per core. Vectorized code is fed through two 128-bit SIMD units.

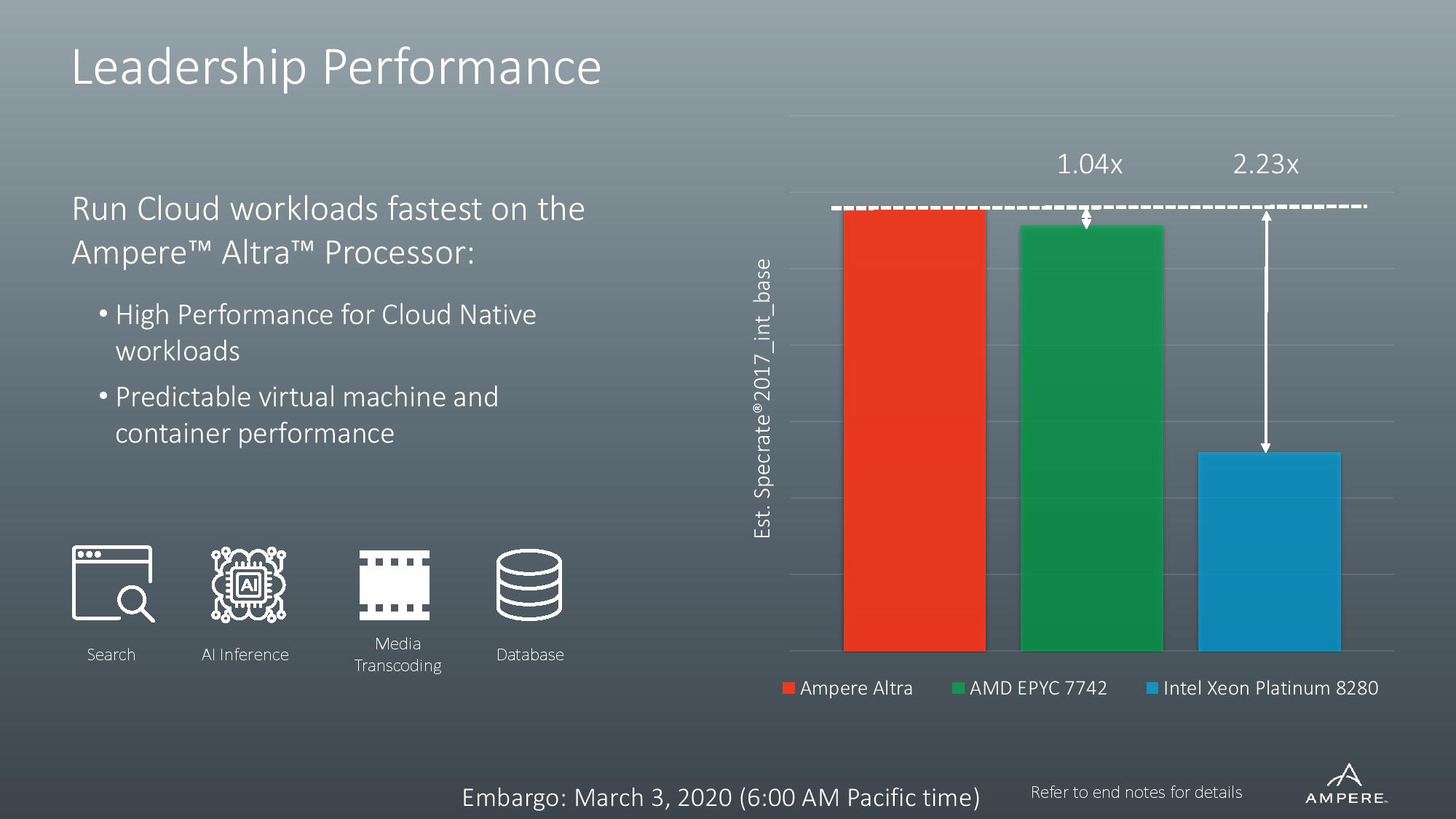

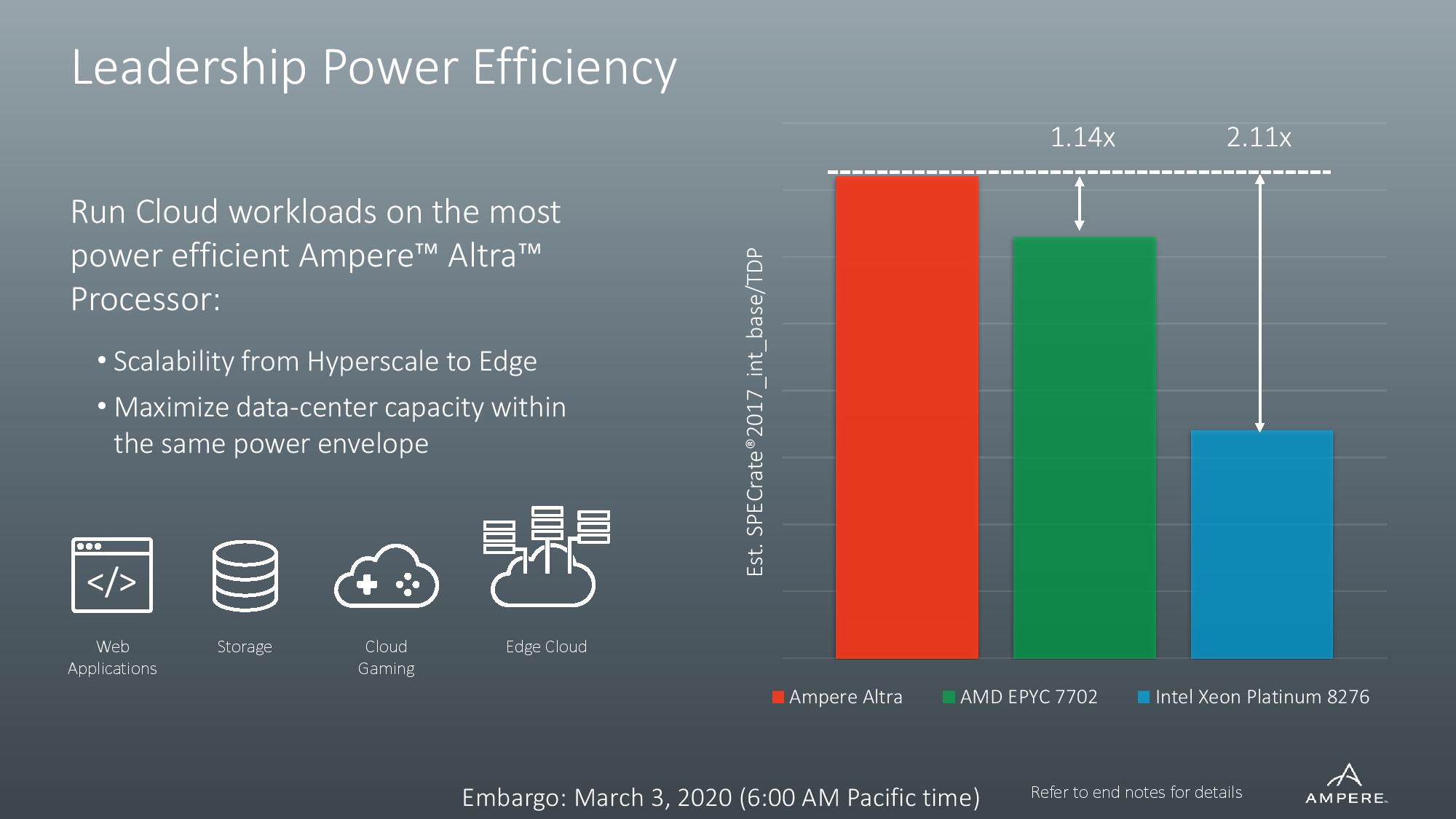

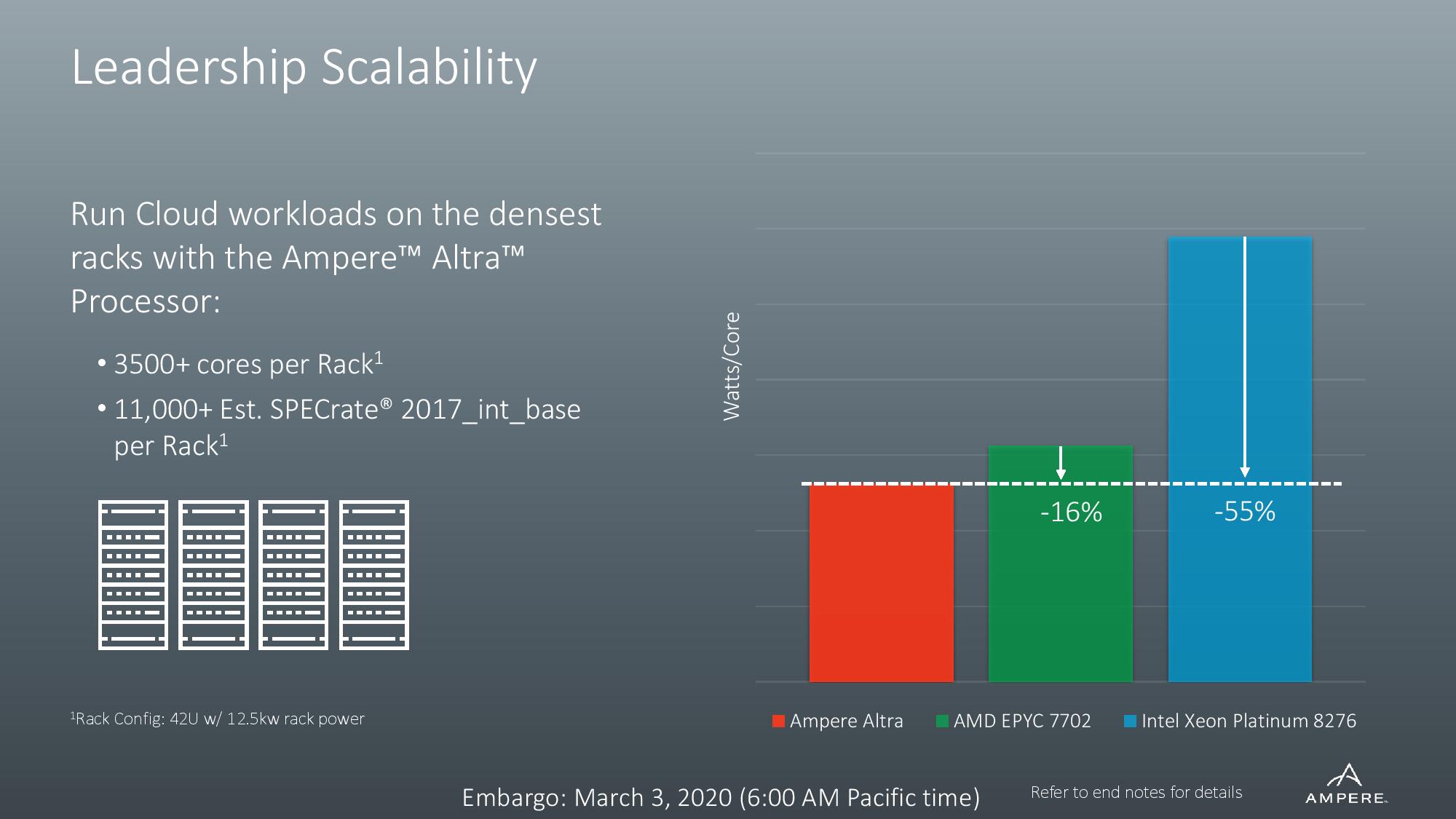

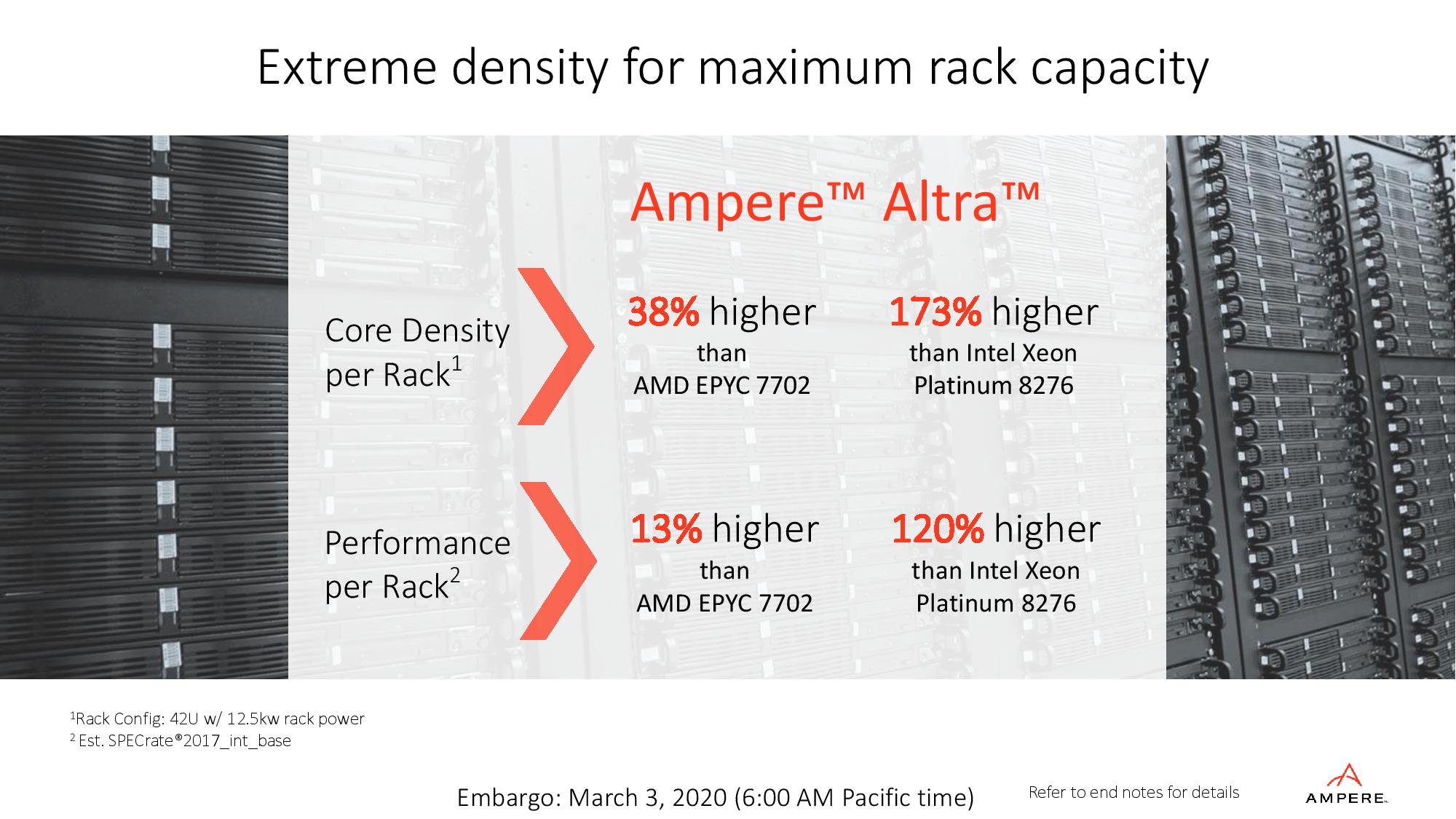

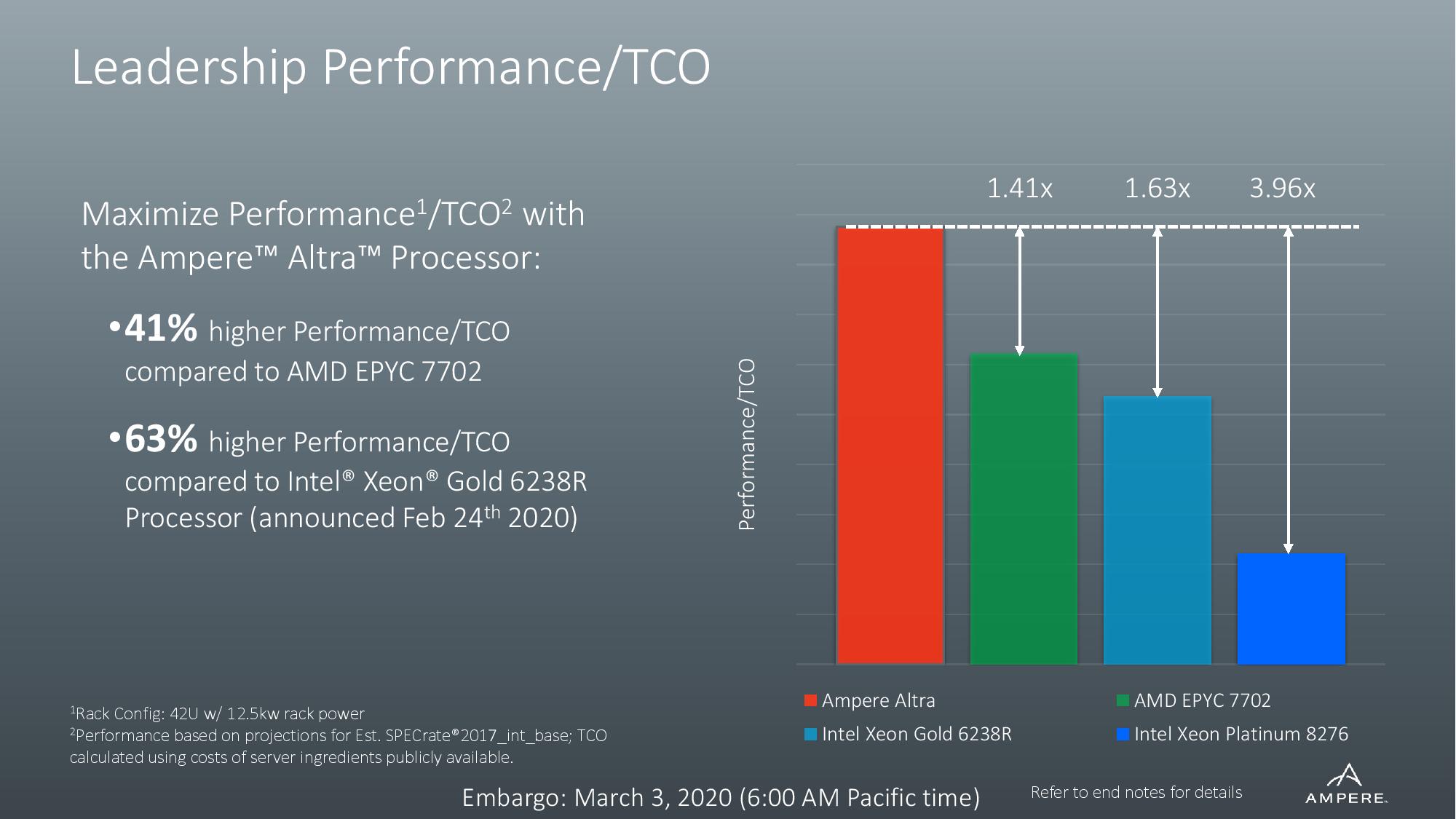

Ampere claims industry-leading per-core power consumption, which in turn enables the heftier core counts, but hasn't released detailed performance metrics. However, the company does claim the industry's highest density with up to 3,500 cores per rack, an important capability due to rack-level power constraints. The company compares its overall projected performance to servers with Intel's 8280 and AMD's EPYC 7742, beating the former by a large margin. As pointed out by ServeTheHome, Ampere "de-rated" the EPYC and Intel platforms by 16.5% and 24%, respectively, to adjust for compiler differences. STH notes that this practice is common, and Ampere disclosed it clearly in the footnotes.

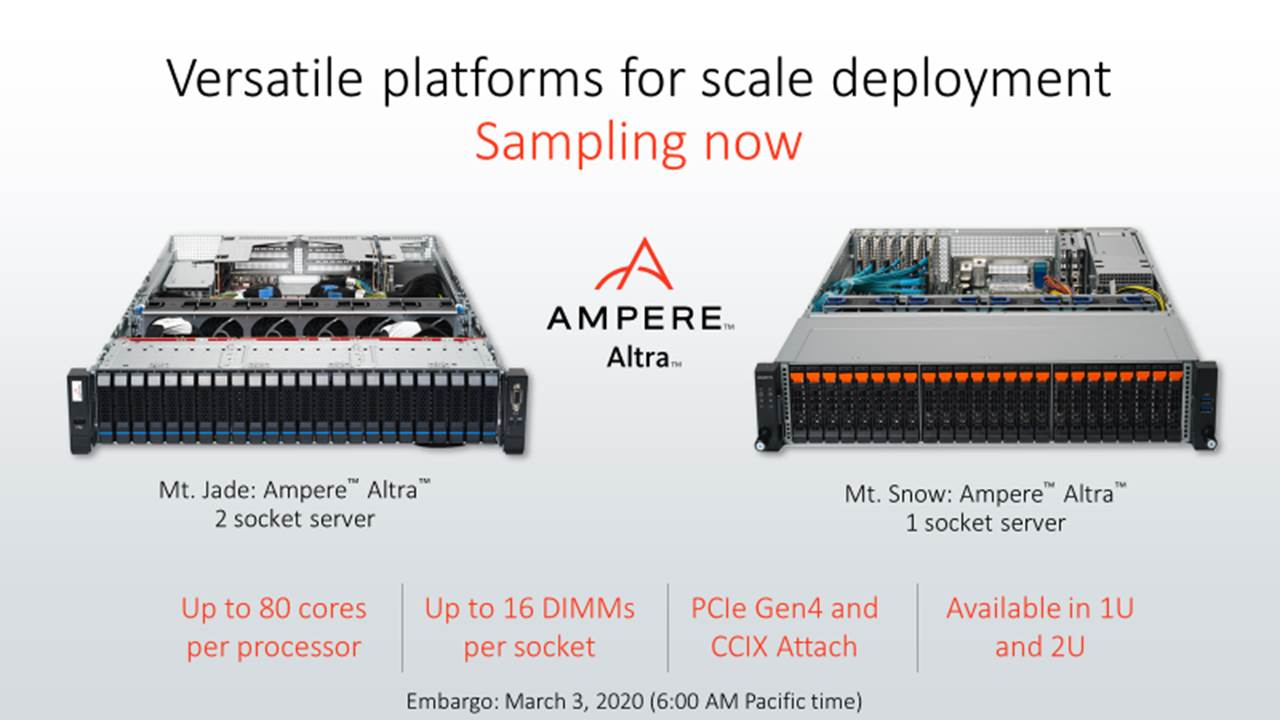

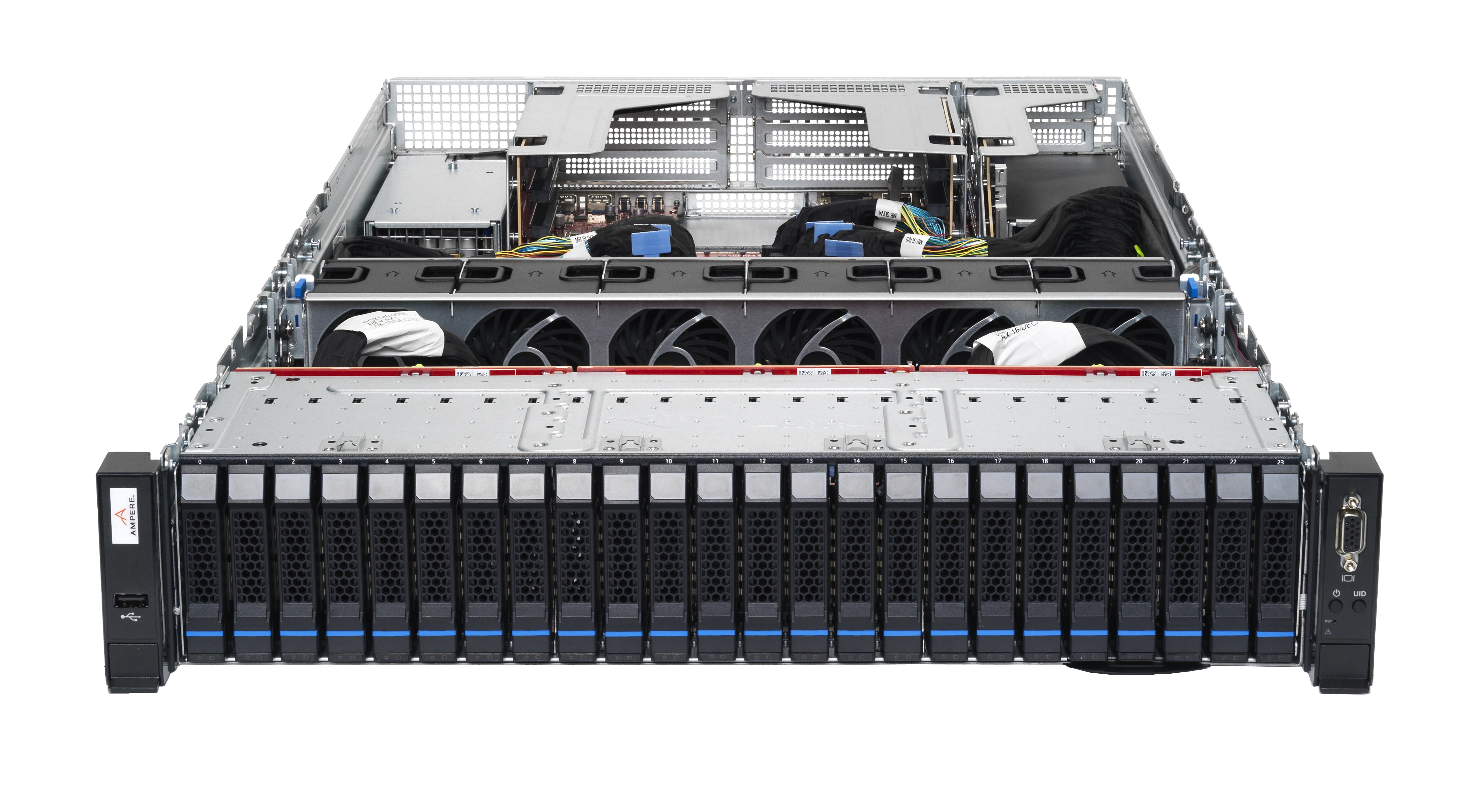

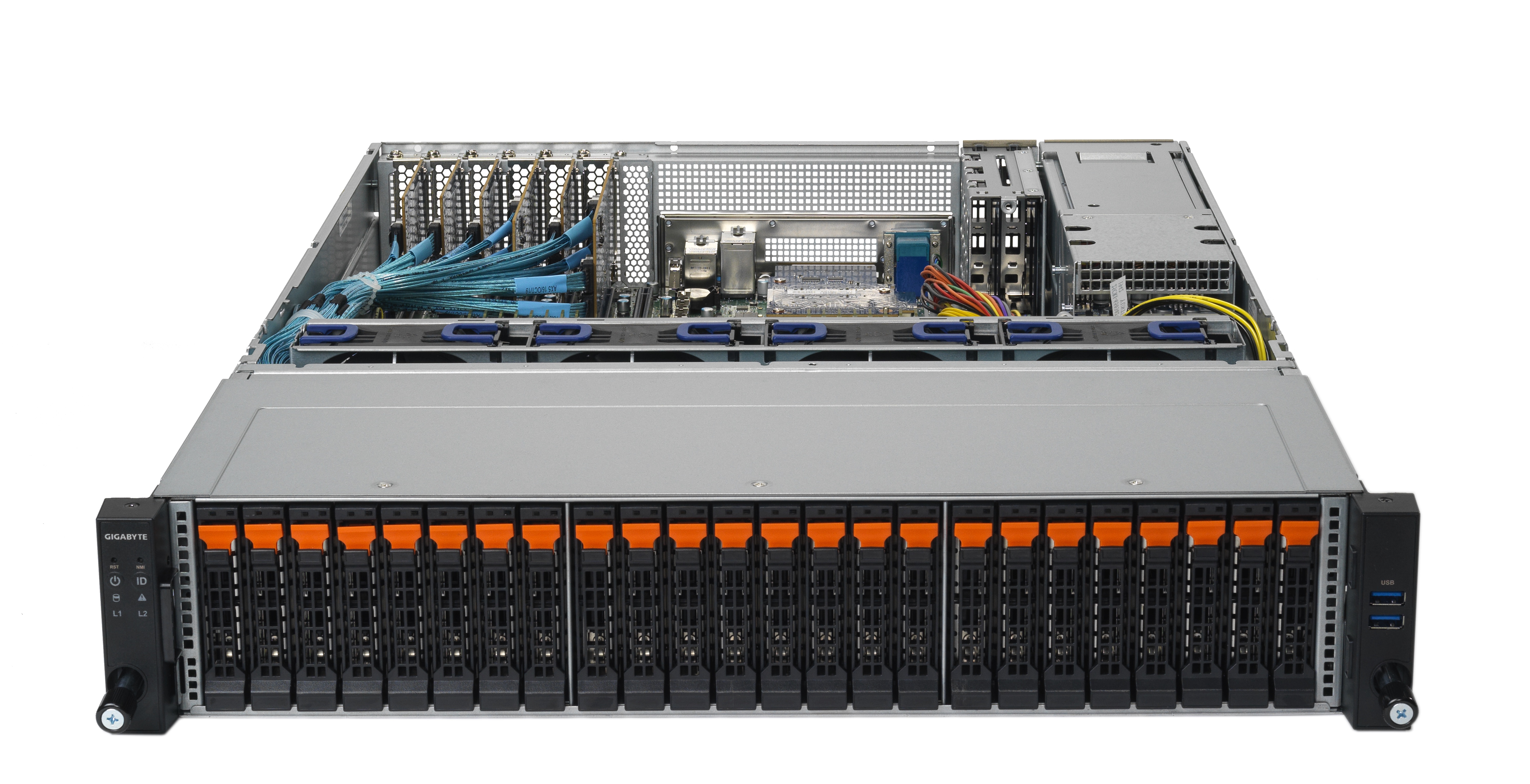

Ampere wraps all of this up in two server solutions that are currently being evaluated by cloud service providers. These servers come in both 1U and 2U flavors and support up to 16 DIMMs per socket. As mentioned, the company supports CCIX across the PCIe Gen4 interface, but has joined the CXL consortium that seems to have emerged as the preeminent future solution and will move to the interface when its chips evolve to the PCIe 5.0 specification.

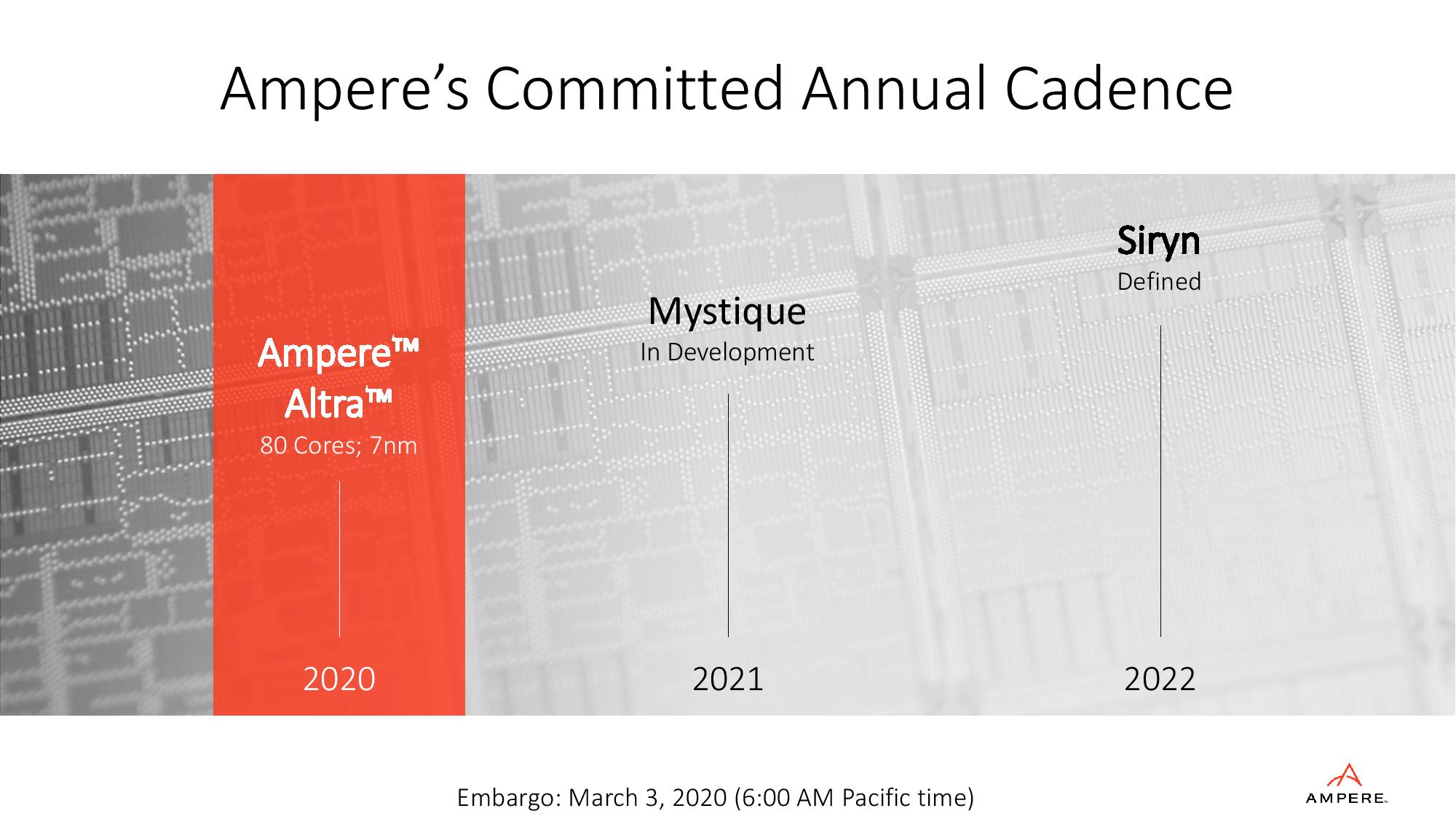

Ampere isn't sharing details about the various chips in its product stack, or pricing. However, we do know that the SKUs will span from 40W up to the "200W+ range." All models will come with the same feature sets, meaning no disabled PCIe connectivity or memory capacity support for lesser models, instead differentiating on cores and power consumption. The company also has Mystique and Siryn models coming in 2021 and 2022, respectively.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Ampere lists Oracle (its CEO sits on Oracle's board), Microsoft Azure, Canonical, VMware, Lenovo and Gigabyte, among others, as companies either evaluating the hardware or optimizing software for the Altra platform. The chips will be generally available mid-year.

Ampere could have a strong single-socket play with 80 cores and 128 lanes of PCIe crammed into slim 1U servers, rivaling AMD's leading core counts in that segment, along with the overall lead in core counts for the broader dual-socket server ecosystem. A foe on the ARM front has emerged in AWS's Graviton2 chips, but those chips are captive to AWS infrastructure, so they may simply enable broader support for the ARM software ecosystem. Newcomer Nuvia, which is grabbing headlines due to a very public spat with Apple, is also shaking up the scene. We shouldn't expect to see silicon from that company for quite some time, leaving Ampere an opportunity to strike after several years in development.

Paul Alcorn is the Editor-in-Chief for Tom's Hardware US. He also writes news and reviews on CPUs, storage, and enterprise hardware.

-

thisisaname Interesting that is two things called Ampere , this and Nvidia next generation GPU.Reply -

kenjitamura Reply

Well, three things if you include that an Ampere is the unit measurement for current. And four if you include that the term is derived from the last name of a long gone french physicist.thisisaname said:Interesting that is two things called Ampere , this and Nvidia next generation GPU.

Nvidia has named a lot of it's architectures after former physicists/mathematicians such as Turing, Volta, Pascal, Kepler, and Maxwell. The practice is rampant in the technology industry like in the case of Tesla motors. -

TechLurker So even ARM beat Intel to the PCIe 4.0 field. While not a big deal at the moment, it's still something they can wave as being on top of the curve alongside AMD. At least it provides more impetus to find a way to maximize use of PCIe 4.0.Reply -

ta152h I guess you didn't know that Intel has had Ice Lake out for a while now, so not really. Ice Lake has 4.0, even though the majority of their chips are still stuck on 3. But that's changing.Reply -

corncob_say Reply

If AMD has as much trouble as it does just getting customers to switch from INTEL then this new entry will have a really hard time if they expect to get to become commercially feasible. "Its long way to the top if ya wanna Rock n Roll".admin said:Ampere takes on Xeon and EPYC with its Altra ARM server chips in two new server platforms.

Ampere's 80-Core Altra Chips Take on Intel Xeon and AMD EPYC Rome : Read more -

escksu Replycorncob_say said:If AMD has as much trouble as it does just getting customers to switch from INTEL then this new entry will have a really hard time if they expect to get to become commercially feasible. "Its long way to the top if ya wanna Rock n Roll".

May not.... It depends alot on the software. If this CPU can run oracle dabatase and other enterprise applications well, then adoption rate may be good. -

Paul Alcorn Replycorncob_say said:If AMD has as much trouble as it does just getting customers to switch from INTEL then this new entry will have a really hard time if they expect to get to become commercially feasible. "Its long way to the top if ya wanna Rock n Roll".

Agreed, ARM faces massive challenges for mass deployment. Ripping and replacing all your code is no small task, but it was certainly a lot more attractive before an x86 alternative (EPYC) came along. EPYC is really sucking the oxygen out of the ARM data center conversation. Ampere's coming in a bit below expectations, and Nuvia is a bit too far off to really matter much right now. Graviton2 is interesting, but spurious benchmarks and indirect comparisons do little to tell us of the actual worth of the platform. I'm of the mind that Amazon is probably carving these out for cloud customers at a loss, just to enable the platform. It wouldn't be the first time AWS took that tact. In fact, it's been the business model forever.

In short, I think we're a long way from ARM being a major player in the data center. -

Deicidium369 Reply

Tiger Lake has PCIe4 - not Ice Lake. Ice Lake SP (Xeon) and Rocket Lake S will be PCIe4ta152h said:I guess you didn't know that Intel has had Ice Lake out for a while now, so not really. Ice Lake has 4.0, even though the majority of their chips are still stuck on 3. But that's changing.

https://ark.intel.com/content/www/us/en/ark/products/196597/intel-core-i7-1065g7-processor-8m-cache-up-to-3-90-ghz.html