Cost of Bitcoin Mining Hits 10-Month Low Amid Crypto Crash

But 10 months ago Bitcoin’s valuation was roughly double what it is today.

Cryptomining has been in the headlines in recent months for all the wrong reasons if you are a cryptocurrency investor or speculator. It isn’t all doom and gloom for crypto, though, as we have recently reported on newer, more efficient mining equipment becoming available from the likes of Intel and Bitmain. Moreover, on Thursday, Bloomberg reported that the cost of mining Bitcoins had reached a 10-month low.

Some may have scoffed at the new ASIC cryptomining systems becoming available this summer, considering the dire valuation charts for all the major blockchain-based currencies. However, it now looks like new efficient mining systems coming online are quickly having a beneficial impact on the bottom lines of mining operations. Even with the ongoing crypto crash, the difference between costs and crypto valuations makes mining operations sound highly profitable for the time being.

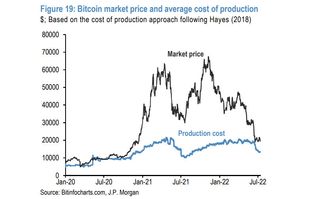

According to data from JP Morgan, at the start of June, cryptomining operations were spending $24,000 to mine one Bitcoin (BTC). Today, they expect to mine a Bitcoin after spending only $13,000. To put that into perspective, you can sell 1 BTC today for almost $21,000, which is better than a 60% profit.

The Bloomberg report asserts the reduction in mining costs is entirely down to the deployment of more energy-efficient mining rigs. One must also remember that this is happening while energy prices are rocketing worldwide. That makes the mining cost reductions and efficiency of the latest mining equipment all the more impressive.

Cheaper Mining to Result in Lower Bear Market Valuations?

Interestingly, a crypto valuation theory shared in the source report suggests that lowering the production cost could negatively impact BTC valuations. In other words, some see the production cost as a resistance line buoying BTC, and perhaps other major cryptocurrencies. If this line can be shifted down, so too can crypto valuations when we are in a bear market.

We mentioned above that 1 BTC is worth about $21,000 today. Some might feel the valuation is very low, but if we learn from history and the two previous bull/bear markets Bitcoin has been through, we should expect it to drop to about $13,000 before the pain ends (80% down from its peak), and before there can be a recovery. However, where we stand in 2022, with a war in Europe and on the precipice of a recession, we shouldn’t expect things to pan out exactly the same, or reverse as quickly as in 2018 and late 2020.

Overall, it is interesting to see such a dramatic cut in the costs of Bitcoin mining (and likely other currencies too). Whether reduced mining costs will contribute to further reductions in valuations, or help miners stay afloat during this slump, remains to be seen. Similarly uncertain are the depths of the worldwide inflation, recession and financial issues we will see through 2022 and beyond.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Mark Tyson is a Freelance News Writer at Tom's Hardware US. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

Most Popular