Just 137 crypto miners use 2.3% of total U.S. power — government now requiring commercial miners to report energy consumption

The U.S government wants to crack down on the ballooning energy consumption of Bitcoin miners.

The U.S Energy Information Administration (EIA) is now requiring large-scale commercial cryptocurrency mining operations to report their power consumption. This initiative is part of a larger effort to regulate and penalize cryptocurrency mining due to the exorbitant amount of energy the industry consumes yearly. For now, the EIA is only collecting data, but this new data should give birth to new regulations that will penalize miners in the future. This comes as the company has released a study (first reported on by Inside Climate News) suggesting that cryptocurrency mining represents up to 2.3% of U.S. power demand.

“We intend to continue to analyze and write about the energy implications of cryptocurrency mining activities in the United States...,” EIA administratior Joe DeCarolis said in a release in January. “We will specifically focus on how the energy demand for cryptocurrency mining is evolving, identify geographic areas of high growth, and quantify the sources of electricity used to meet cryptocurrency mining demand.”

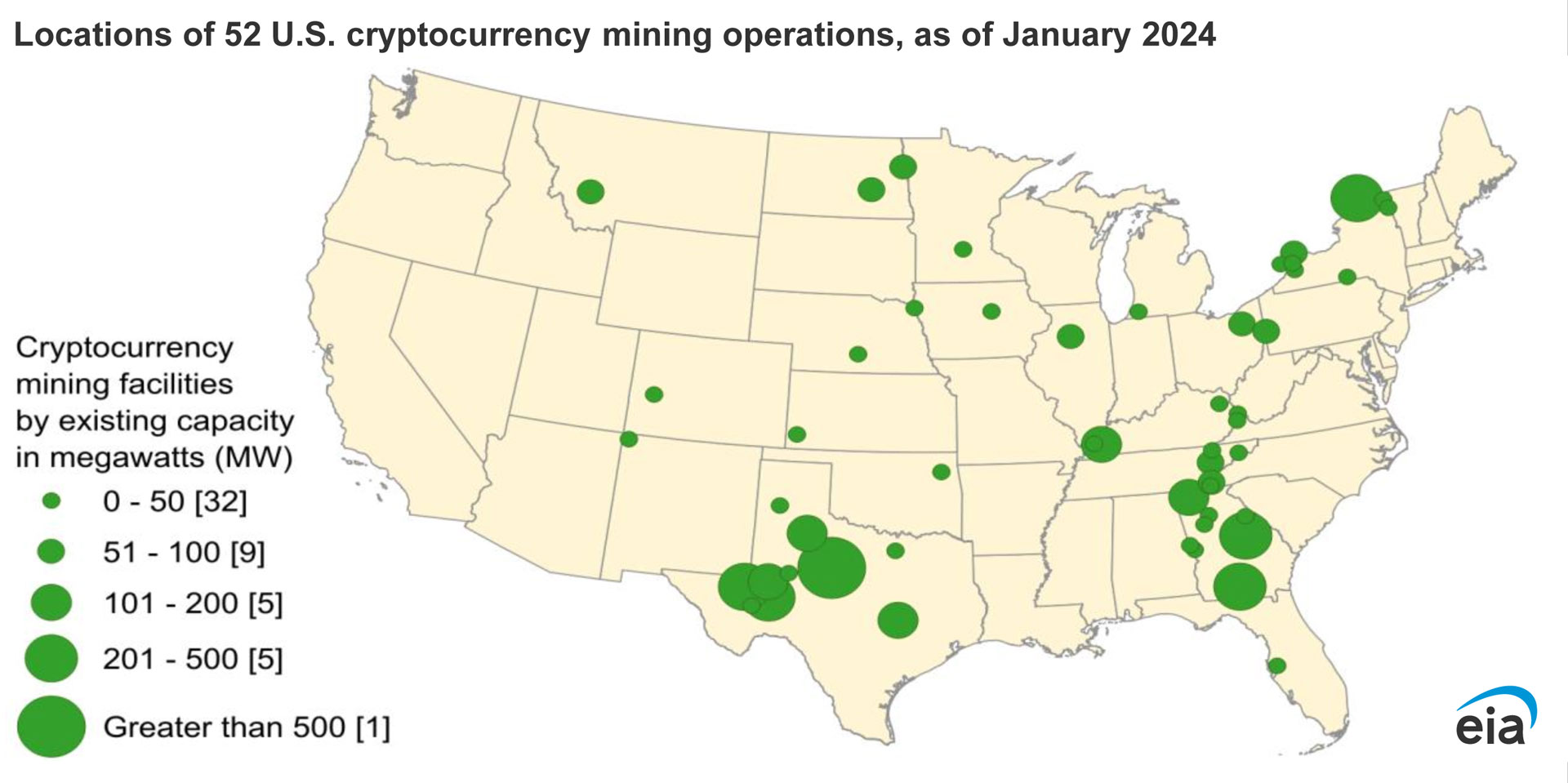

DeCarolis' words summarize that the United States will pay close attention to the environmental challenges cryptocurrency mining might be causing. We can surmise that the United States government specifically wants to crack down on mining operations that impact the reliability and sustainability of power in highly populated areas. Potentially leading to higher residential power costs and power shortage issues during peak hours. As of January 2024, the EIA has identified 137 cryptomining facilities.

The EIA found that crypto-mining operations in the United States has grown substantially over the past few years, to the point where all U.S-based crypto-mining operations consume 0.6% to 2.3% of the nation's entire electricity consumption alone. For comparison, the total U.S. Bitcoin mining industry consumes the annual power budget of Utah or West Virginia. The estimated power draw of Bitcoin mining worldwide is projected to be anywhere between 0.2% to 0.9% of global demand, equating to the same power draw as Greece or Australia by themselves.

Bitcoin mining is very power-hungry in the United States specifically due to the exorbitant amount of mining that actually takes place within U.S borders. The EIA found that the global share of Bitcoin mining that takes place in the U.S. grew from 3.4% in 2020 to a whopping 37.8% in 2022.

The incredible power demands of the Bitcoin industry are a result of the Bitcoin mining algorithm becoming more and more difficult every single year. Bitcoin today isn't what it was eight to ten years ago, where you could mine it on a single computer and net a decent profit. Nowadays, Bitcoin needs to be mined on hundreds of specialized mining devices (ASICs) to be gathered at all. The continuous difficulty of the Bitcoin algorithm, in turn, creates higher and higher power costs as the cryptocurrency gets harder to mine.

We can expect this power phenomenon to become greater as Bitcoin grows in popularity. 2024 is expected to be one of the most eventful years in Bitcoin history, with the cryptocurrency expected to blow past its record $69,000 high sometime after its halving event in April (when the reward for Bitcoin mining is cut in half) thanks to reduced mining profit and large-scale institutional adoption.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Aaron Klotz is a contributing writer for Tom’s Hardware, covering news related to computer hardware such as CPUs, and graphics cards.

-

NinoPino 2.3% if true is a crazy amount of energy for only 137 entities, I hope it is overestimated.Reply

But somebody knows some legitimate uses for cryptocurrencies (apart ransom, scam, extorsions and so on) ? -

digitalgriffin Reply

You forgot tax evasion, money laundering, and purchasing of illict goods.NinoPino said:2.3% if true is a crazy amount of energy for only 137 entities, I hope it is overestimated.

But somebody knows some legitimate uses for cryptocurrencies (apart ransom, scam, extorsions and so on) ? -

weber462 What advancements would have been made if that energy was used for scientific research?Reply -

derekullo Reply

Generating more electricity is easy just build a new power plant or add upgrades to an existing one.umeng2002_2 said:Electricity is a market. Who cares how much they used? Generate more.

Getting customers to pay more each month to finance an upgrade to an existing power plant or to build a new power plant all to satisfy the energy needs of a crypto-mining operation is the hard part. -

Kashmir74 Reply

Useless and most immoral take ever.umeng2002_2 said:Electricity is a market. Who cares how much they used? Generate more. -

Order 66 Reply

If said electricity is generated using renewable resources, that's fair, but most of it won't be at least not yet, anyway.Kashmir74 said:Useless and most immoral take ever. -

derekullo Reply

Arguably bitcoin's price is more stable than the Venezuelan bolívar which is experiencing 193% inflation as of 2023.NinoPino said:2.3% if true is a crazy amount of energy for only 137 entities, I hope it is overestimated.

But somebody knows some legitimate uses for cryptocurrencies (apart ransom, scam, extorsions and so on) ? -

NinoPino Reply

Oh sorry.😀digitalgriffin said:You forgot tax evasion, money laundering, and purchasing of illict goods. -

Kamen Rider Blade They need to be regulated into oblivion.Reply

Crypto Currency offers nothing of value to society.