Bitcoin comes roaring back as it hits 2023 high, but AI remains the largest threat to GPU pricing - gaming GPUs are safe from miners for now

Perfect storm of ETF approval and lower interest rate expectations sparked the rise.

Bitcoin has shown some strength with a ~12% rise over the past week, and it broke the $42,000 barrier at one point today. The last time this iconic cryptocurrency held this kind of dollar valuation was in April 2022. According to reports, the surge in BTC today has two major propellants: growing confidence that a Bitcoin exchange-traded fund (ETF) will be approved, and expectations of interest rate cuts in the U.S.

Thankfully, gaming GPUs should be safe from the price hikes we've seen in the past, as GPU mining remains relatively unprofitable — you can in theory make over $1 per day with an RTX 4090 right now (after power costs), but that would still require years of continuous mining at current rates just to break even. On the other hand, a new wave of GPU price hikes has hit the GPU market due to US sanctions for AI processors, leading to GPU smugglers soaking up the supply to smuggle graphics cards into China. We also have what appears to be a shift with GPU makers prioritizing AI-centric GPUs.

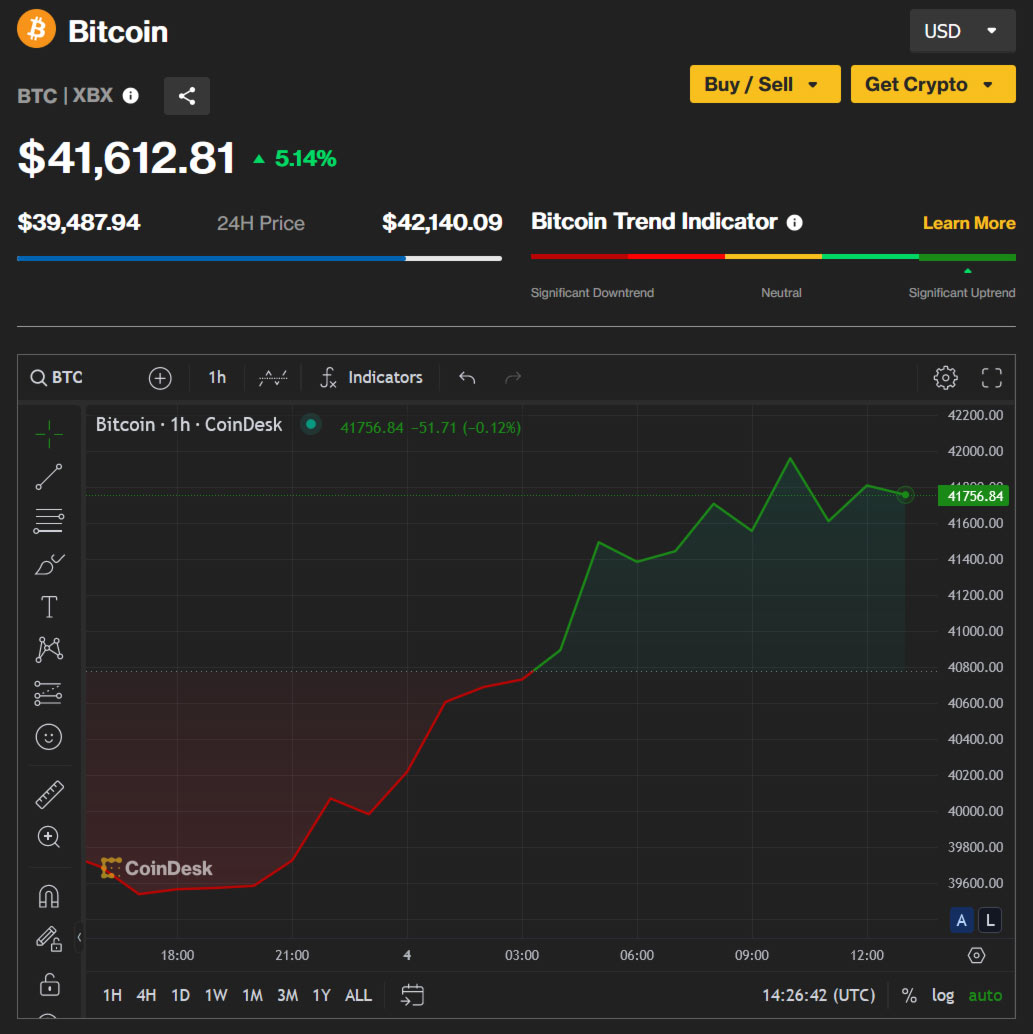

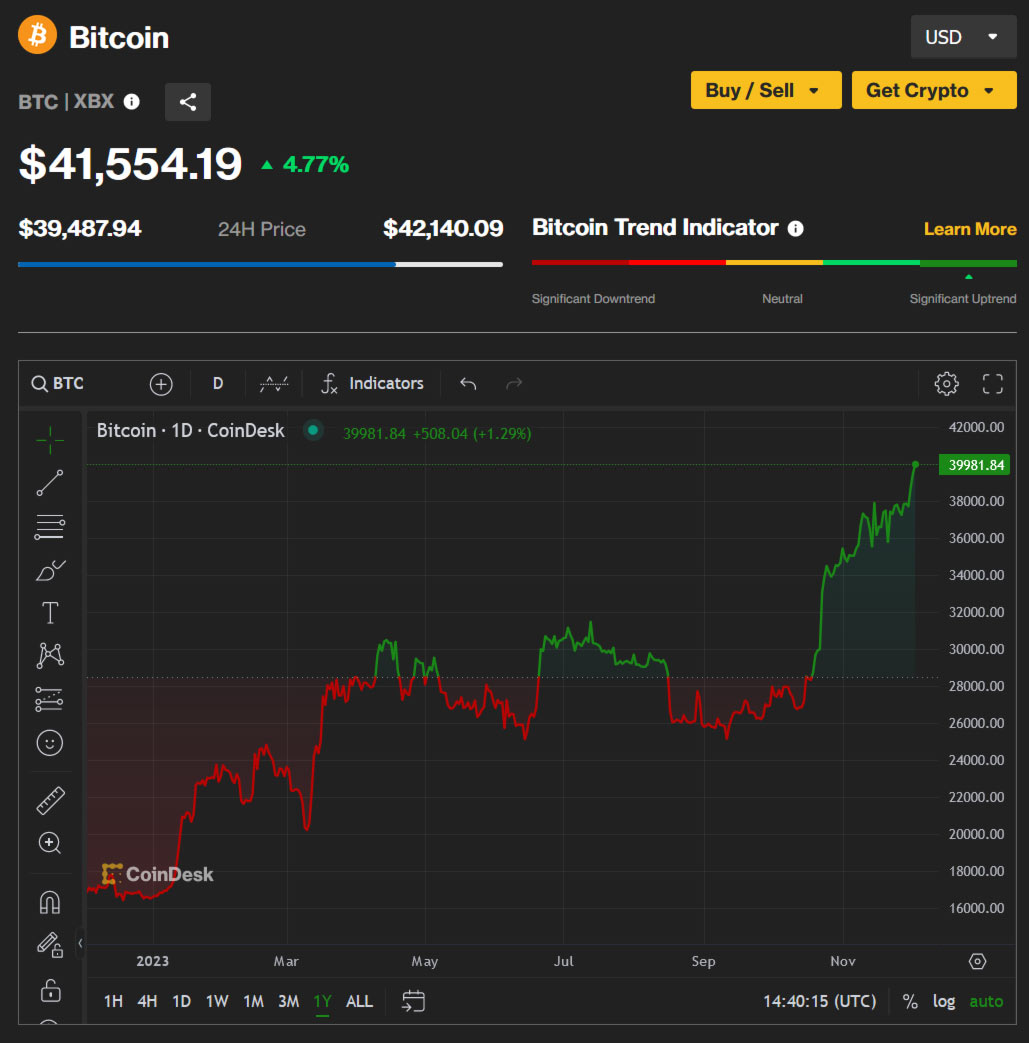

You can see the rate of Bitcoin’s climb today and over the last year in the above charts and screenshots (via Coindesk). Today’s 5% rise looks pretty strong, though it looks like the $42,000 mark is finding some resistance after the surge from the high $39,000's. Pondering over the yearly chart, the recent valuation spurt looks even more impressive.

It wasn't long ago that we wrote about Bitcoin becoming stronger: In late October, we highlighted the cryptocurrency’s 20% rise over a week. It hasn’t dropped back since then, and probably the main reason for continued strength is continued expectations regarding ETFs. Yes, we mentioned ETFs as one of the big reasons behind BTC’s rise in late October, and the likelihood that the US Securities and Exchange Commission (SEC) may finally give the go-ahead for this type of investment is stronger than ever.

Some key observations behind ETF optimism include reports that SEC officials met with representatives from Grayscale, BlackRock, and the Nasdaq last week. Moreover, an SEC memo said it was considering converting the Grayscale Bitcoin Trust into an ETF, a move blocked as recently as August.

Forecasts that recessionary forces are weakening are another impetus behind the rise in BTC. Subsequently, banks are expected to cut interest rates, making traditional savings less attractive and more speculative investments like shares and crypto more attractive.

Retrospective: GPU prices the last time BTC was $42,000

The last time BTC cruised at over $42,000 was in April 2022. This was in the months just before the Ethereum merge, so consumer GPUs were still in demand for cryptocurrency mining. We couldn’t resist taking a peek at the Tom's Hardware April 2022 GPU price index to thrill at the horrors of RTX 30-series and RX 6000-series pricing.

At that time, a card like the GeForce RTX 3090 cost $1,770, the RTX 3070 was $777, and even the RTX 3050 was $356. Skipping forward to the latest eBay pricing figures, those three cards can be grabbed for $704, $279, and $169, respectively. Oh, what a difference the demise of GPU mining makes! Bitcoin (and crypto in general) is now largely mined on ASICs and other specialized silicon, and while GPUs are still used for mining some cryptocoins, they currently aren't very profitable — certainly not enough that companies would invest in buying tens of thousands of GPUs.

Current-gen GPU pricing isn’t exactly a bed of roses, though. Low to mid-range GPU pricing has made PC gaming much more accessible again. However, we have noticed an unwelcome trend in high-end GPU prices, like the upward creep of the GeForce RTX 4090 in retail. There are some indications that RTX 4090 prices are being affected by people/organizations grabbing these consumer cards for AI acceleration.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

Giroro "I've only lost 35% percent of all the money I gave to these scammers, when it used to be 60%" = "Comes roaring back"Reply

I guess you should buy more of these fake internet numbers now, because certainly you won't lose all your money again, for a fourth time. You'd better hurry too. Because it's only a matter of time before literally every other crypto company gets Bankman-Fried-ed. Bitcoin is selling out fast. It's getting so rare you could say it literally doesn't exist. -

Tonet666 Reply

:ROFLMAO::LOL::ROFLMAO::LOL:Giroro said:"I've only lost 35% percent of all the money I gave to these scammers, when it used to be 60%" = "Comes roaring back"

I guess you should buy more of these fake internet numbers now, because certainly you won't lose all your money again, for a fourth time. You'd better hurry too. Because it's only a matter of time before literally every other crypto company gets Bankman-Fried-ed. Bitcoin is selling out fast. It's getting so rare you could say it literally doesn't exist. -

dalauder Reply

Not that you're really wrong, but all our money in banks is "fake internet numbers". We just trust them, and the U.S. government more. I'm not sure how long trusting governments more will last though--for sure a couple of decades, right?Giroro said:...I guess you should buy more of these fake internet numbers now, because certainly you won't lose all your money again, for a fourth time... -

palladin9479 Well for those who bought into it when it crashed, they just doubled their money.Reply

Say it with my everyone,

Buy panic

Sell hysteria.