Top Cryptocurrencies Rocked By Double-Digit Losses Amid Crackdown Fears

2017 was a banner year for cryptocurrencies, but it could all be coming crashing down in 2018. For the second day in a row, the values of nearly all the top 100 cryptocurrencies are tumbling hard.

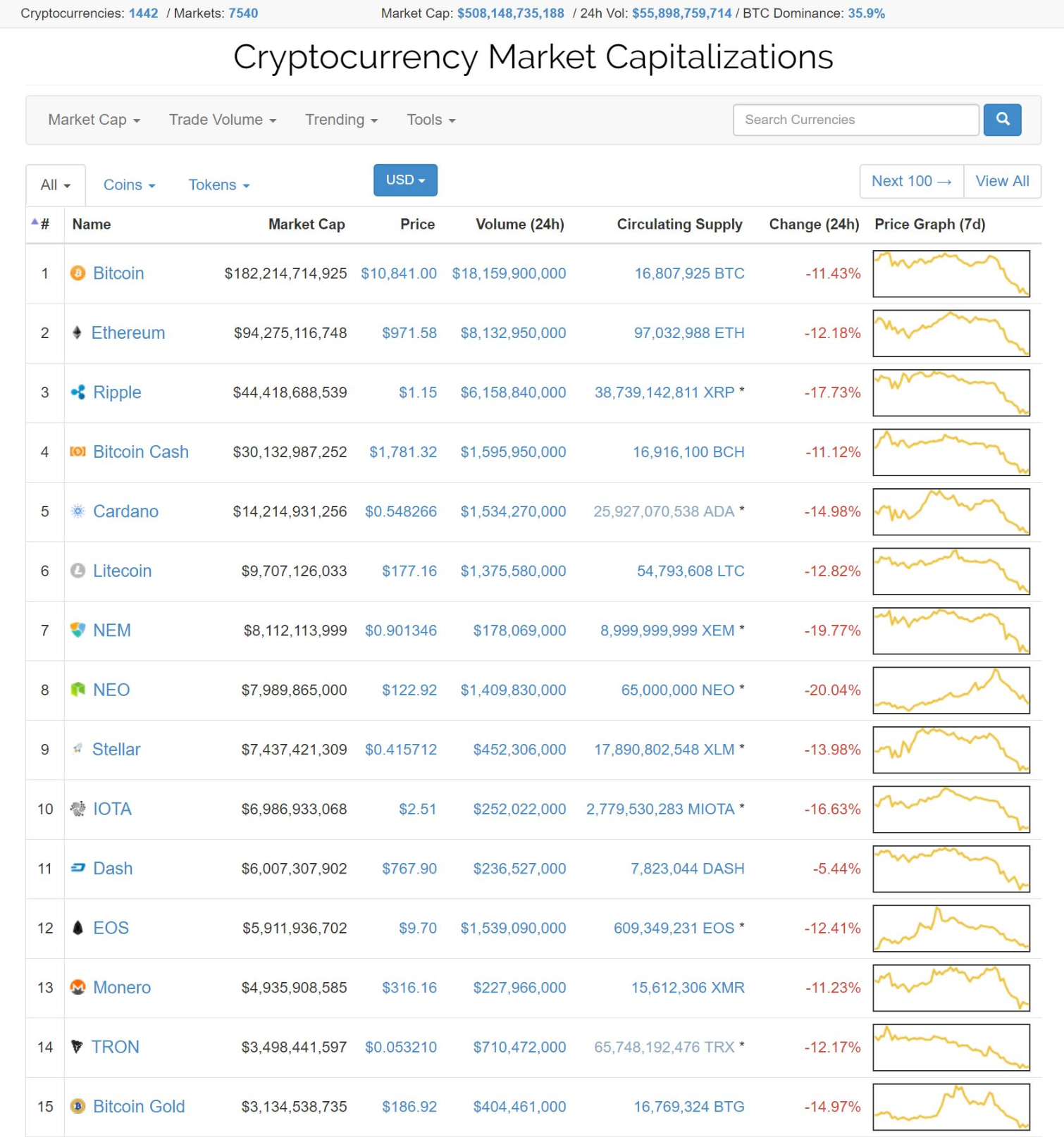

Just weeks ago, Bitcoin was trading for nearly $20,000. It's now selling for a lot closer to $11,000. Ethereum, which hit its all time high just days ago at $1,400+ per coin, is in a similar boat, now trading at less than $1,000. In fact, if you look at the graphs of almost any altcoin, you’ll see practically the same pattern. Everything tanked hard between January 15 and January 16. Some markets have stabilized and made a small recovery, but for the most part, if you have a cryptocurrency investment portfolio, you’re dealing with double-digit losses right now.

We’d be remiss to try and pinpoint the reason for the recent dive in cryptocurrency valuations. The world of crypto-trading is full of volatility, and crashes should be expected. However, it’s not every day that we see the entire market take a nose dive. Usually, while one currency is crashing, another up-and-coming token is flourishing, but this week everyone seems to be abandoning the digital currency markets.

The sudden change in investor sentiment is likely due to reports that authorities in South Korea and China are cracking down on cryptocurrency mining and trading. Last September, China started to scrutinize on cryptocurrency trading. Chinese authorities announced that the government considered the practice of fundraising through ICOs (initial coin offerings) illegal.

ICOs are to the cryptocurrency world what IPOs are to the investment world. When a new coin enters the market, its creators launch an ICO to sell the first round of coins to speculative investors. This raises money for the team that created the coin, which in theory would fund further development of the platform. And investors can get in at the lowest possible price and potentially secure high profits down the road. Unlike IPOs, which are heavily regulated and scrutinized by authorities, the ICO market is like the wild west. Regulations are few and far between, and practically anyone with a computer science background could launch a new coin, which makes investing in ICOs extremely risky. The upsides are high, but so are the risks. Investing in ICOs is a lot like gambling in that respect.

China also introduced new regulation that prompted the country’s largest cryptocurrency exchange to close its doors. Soon after China banned ICOs, South Korea banned the practice as well.

This week, China stepped up its efforts to curb the cryptocurrency markets with an announcement that it would block domestic access to platforms that enable crypto-trading. According to Bloomberg Technology, the Chinese government will also crack down on companies that provide “market-making, settlement, and clearing services for centralized trading.”

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

The South Korean government also played a pivotal role in this week’s crash. Last week, reports surfaced that suggested that South Korean authorities were preparing an all-out ban on cryptocurrency trading. On Monday, CNBC reported that South Korea’s Office for Government Policy Coordination clarified that a proposal to ban cryptocurrency trading is on the table, but a decision would not be made without “sufficient consultation and coordination of opinions.” The news instilled uncertainty in the cryptocurrency markets, and evidently, people began to panic.

For all we know, there could be several other factors that caused the sudden lack of trust in Bitcoin, Ethereum, and the like. Such is the nature of the cryptocurrency world. There’s no telling where the markets go from here, but something tells us we’re nowhere near the end for cryptocurrency. Just yesterday, Mark Cuban announced that the Dallas Maverick would accept Bitcoin, Ethereum, and “other tokens” as payment for next NBA season. 2018 is already shaping up to be another roller coaster year for cryptocurrency.

Kevin Carbotte is a contributing writer for Tom's Hardware who primarily covers VR and AR hardware. He has been writing for us for more than four years.

-

InvalidError As more crypto-currencies get dragged into tax evasion, money laundering, fraud, theft, cyber-crime and other similar investigations, expect more governments to crack down on them the only way they can: make it harder to convert country-backed currencies to crypto and back. A crypto-currency is worthless if you can't trade with it or cash it in.Reply -

TJ Hooker Some perspective:Reply

Many major coins have only fallen to the point they were at 1 or 2 months ago. Overall crypto market cap is still well above what it was only a few months ago. This may just be a much needed correction after the crazy growth seen lately.

There has been some sort of 'crash' in the crypto market every Jan since 2015.

https://coinmarketcap.com/charts/

Regarding the cause of this downturn, I've seen some speculation it is related to the newly introduced Bitcoin futures contracts, the first of which expire today. One theory is that a bunch of bitcoin whales shorted bitcoin, and then offloaded a bunch of BTC leading up to the expiry date to drive down the price. The price of major coins often at least somewhat track each other, so other coins dropped too, especially as people panicked upon seeing a sell off.

But who really knows. -

Aspiring techie Hallelulah! Maybe this cryptoboom will finally end and we can buy normally priced graphics cards again!Reply -

bit_user The irony of cryptocurrencies is that blockchain is actually a rather poor replacement for cash. Cash is great for high-volume, small-value transactions, which is exactly where blockchain breaks down. Calling it a currency suggests it will replace cash, which it won't. Perhaps the bubble will deflate as more people come to understand this.Reply

Now, for high-value transactions, it still makes a lot of sense. Especially things like property deeds, where you gain additional value by having the entire ownership history. Smart contracts are another cool feature (e.g. of Ethereum).

-

TJ Hooker @bit_user depends on the crypto currency. There are already some out there that can process hundreds or maybe thousands of transactions per second with zero transaction fees. And there is ongoing development being done to improve scalability, even for existing high value coins like Eth.Reply -

zippyzion I'm afraid that the cryptocurrency market is headed for rough times. For a long while I thought it was a cool thing and applauded those brave enough to make a go at it. Then I read an article somewhere that Doge Coin had made a comeback in a big way, despite being largely abandoned as a dead joke. At that point it hit me that there are probably a huge number of fickle bandwagon jumpers just trying to make a buck, while being utterly uninformed, and I began to really worry. I feel like a crash is coming, most likely not a drop to zero crash of the whole market, but some people are going to lose a LOT of money when things finally balance out.Reply -

hixbot I hope it all crumbless down. I have no problem with de-centralized e-coins. But crypto coins that lead to an ever increasing cloud of mining computers is an environmental disaster. Such an excessive amounts of electricity relative to the real-world work. Crypto for securing online transactions need not be so wasteful on electricity.Reply -

TJ Hooker @hixbot there are already a number cryptocurrencies that use proof of stake (or plan to in the near future) or other consensus schemes that don't require huge amounts of power the way the typical proof of work scheme does.Reply -

Kennyy Evony What do you expect from made up money? It's not tangible to anything but air; perhaps the one escapes from your behind.Reply