Intel Exits 5G Smartphone Modem Business

Intel announced today that it is no longer competing in the 5G modem market for smartphones. The company says it will evaluate the options for the remainder of its 4G and 5G modems in PCs, IoT, and other devices outside of smartphones, but will refocus its 5G efforts on the ‘cloudification’ of the network. This news comes as Apple, by far Intel’s largest modem customer, and Qualcomm settled their multi-year dispute over modem licensing. Intel's 4G discrete modem product line is unaffected.

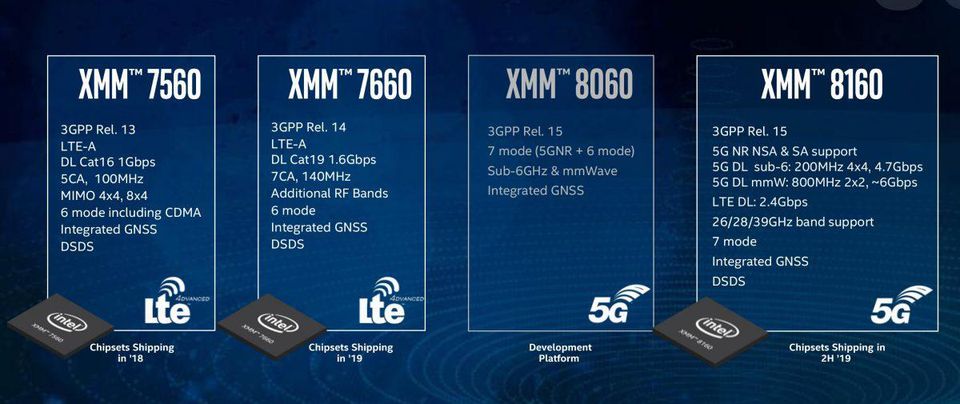

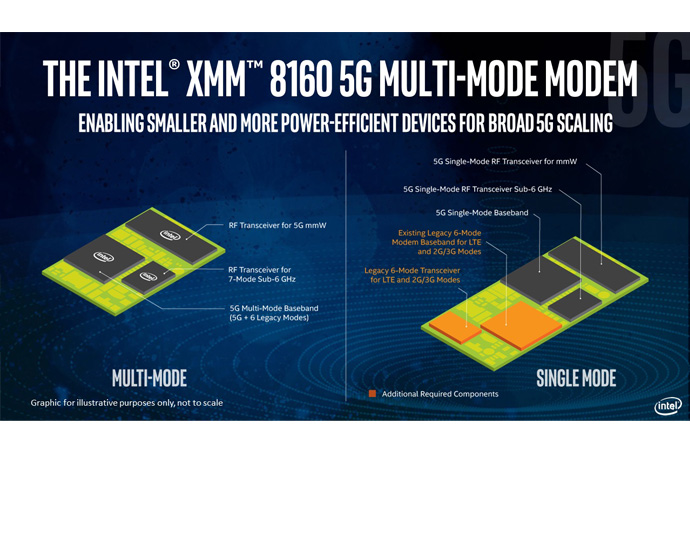

As a result of the decision, Intel stated it would no longer fulfill its previous commitments for 5G modems in the smartphone space that it had planned for 2020. In November, Intel had announced its intention to get 5G into commercial devices in early 2020 with its second-gen XMM 8160 5G modem.

The announcement does not mean that Intel has completely abandoned the 5G modem business or modem development, as Intel specifically referred to the smartphone space. For the time being, Intel said it would assess opportunities to put its discrete modems in other devices. So, what this announcement means for the launch and timeline of the XMM 8160, and whether there will be any Intel 5G product launches in 2020, is unclear. Intel had previously hinted that Project Athena laptops could include 5G connectivity in the future.

In the past, Intel prided itself as being the only company that can provide an end-to-end 5G solution. Instead, Intel will continue to focus on the ‘cloudification’ of the network from the cloud to the network edge. This refers to using standard Xeon Scalable CPUs as the network continues the ongoing transition to network function virtualization (NFV) and software defined networking (SDN). Both terms basically refer to CPUs carrying out the network operations instead of ASICs or ASSPs. Using standard CPUs lowers the cost for communication service providers.

The networking infrastructure market is worth about $20B, which is quite a bit larger than the discrete Apple modem business. Intel had zero market share in this market about half a decade ago, but the company saw significant growth in this market as communication service providers began preparing for 5G, ultimately reaching over 20% market share last year. At CES, Intel announced it was also entering the base station market. Intel expects to capture 40% of that market by 2023 with its 10nm Snow Ridge product.

Summing up this decision, Intel CEO Bob Swan said: “We are very excited about the opportunity in 5G and the ‘cloudification’ of the network, but in the smartphone modem business it has become apparent that there is no clear path to profitability and positive returns. 5G continues to be a strategic priority across Intel, and our team has developed a valuable portfolio of wireless products and intellectual property. We are assessing our options to realize the value we have created, including the opportunities in a wide variety of data-centric platforms and devices in a 5G world.”

Intel stated its 4G portfolio is unaffected by this decision. The company began shipping the XMM 7560 modem last year (its first gigabit LTE modem and also the first modem built on its own in-house 14nm process) that will likely make it into this year’s iPhones. Intel also stated it would provide more details during its earnings call for the first quarter of 2019 (scheduled for April 25).

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Apple And Qualcomm

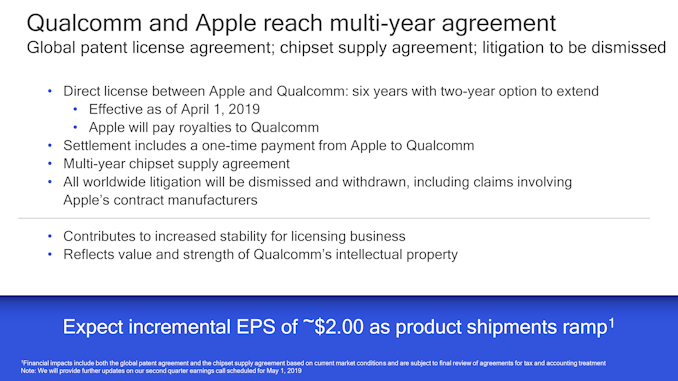

Intel’s announcement came off the back of Qualcomm and Apple settling their 4G licensing dispute, as we reported earlier today.

That settlement included, among other things, an agreement to a multi-year Qualcomm chipset supply agreement with Apple. When that news came in, it become apparent that Intel would lose market share in the iPhone, since it had became the sole modem provider for Apple’s 2018 iPhones. While Qualcomm hadn’t reported any specifics, the information the company provided suggested that it had taken the majority, if not all, of the iPhone modem supply back from Intel. With Intel losing its only major modem customer, it was only a matter of time before it exited that market.

It's unknown if Apple and Qualcomm made this agreement because Intel decided to exit the modem business (in which case Intel will likely stop all 5G modem development), or if Intel was forced to this 'decision' because Apple and Qualcomm reached an agreement.

Intel’s Road To 5G

Intel announced its 5G XMM 8000-series multimode modem portfolio in late 2017, with the XMM 8060 being the first product in the family. At CES last year, Intel announced it would target mid-2019 availability, with both 5G laptops and smartphones launching in the second half of 2019. For the latter market, Intel announced a partnership with Unigroup Spreadtrum to bring 5G to the Chinese smartphone market, but reports emerged earlier this year that the partnership had ended.

However, Intel changed those plans in November 2018. The company made the decision not to commercialize the XMM 8060 (it was rumored to have power consumption and heat issues), relegating it to a development platform. Instead, Intel announced its successor, the XMM 8160, would be available in the second half of 2019 with products in the market in early 2020, representing a pull-in of over half a year. At the time, Intel said those commercial devices would include smartphones, PCs, and broadband access gateways.

As things stand, today’s announcement removes ‘only’ the smartphone category from the portfolio of 5G devices that Intel targets, and not all of its 5G modem efforts. Intel always faced a big hurdle in this market because virtually all players have their own modem IP and have integrated it into their SoCs, hence removing the need for discrete solutions such as Intel's. Apple was a major exception to that; as a result, Intel's modem business' revenue grew to somewhere in the neighborhood of $1B in the last quarter of 2018.

We should learn to what extent Intel is planning to continue (or not) developing its 5G modem family when the company reports its first quarter results later this month.