NAND boosts Flash memory market in Q2

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

You are now subscribed

Your newsletter sign-up was successful

El Segundo (CA) - Strong demand from makers of consumer-electronics products and mobile phones helped Flash memory makers to increase their sales slightly to $4.1 billion in the second quarter of this year. NAND Flash continues to grab market share and is on track to replace NOR Flash in more and more devices.

The Flash memory market continued its healthy pace of growth in the second quarter of this year. The industry posted slight revenue gains in a period that typically sees flat revenues or even declines sequentially. According to iSuppli, the total market grew 4.0 percent over the prior quarter and landed at $4.13 billion. Year-over-year growth was 2.5 percent.

Growth of the Flash market is split into two segments - with NAND Flash posting strong gains throughout the industry and NOR Flash facing drastic declines in revenues. According to iSuppli, NAND accounted for 55 percent of total worldwide flash-memory revenue in the second quarter of 2005, with NOR taking the remaining 45 percent. In comparison, NAND in the first quarter attained a 52 percent share of overall flash revenue, while NOR took 48 percent. The first quarter marked this first time in the history of the flash memory industry that NAND revenue outstripped NOR on a quarterly basis.

NOR was the first type of Flash and was developed from EPROM and EEPROM chip technologies. Equipped with an SRAM interface, NOR Flash has write and delete speeds that would be considered slow by today's standards, and can handle only a small number of write cycles (about 100,000). It is found in areas where permanently stored data needs to be only infrequently changed. For example, operating systems of digital cameras or mobile phones are stored on NOR Flash units.

NAND had little success until the early 2000s, but offers about ten times the number of write cycles, and higher speeds in both the save and delete processes. Additionally, NAND capacity can be produced at lower price levels due to a smaller cell size of the memory. NAND is used today especially in Flash memory cards and MP3 players and is expected to replace NOR in certain applications, such as cellphones, in the near future.

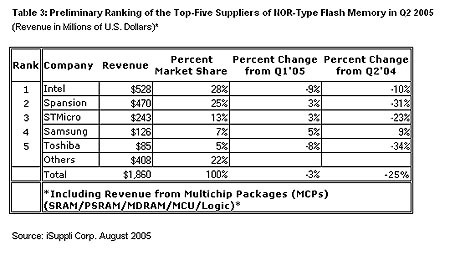

Overall NAND revenues climbed to $2.3 billion, up 10.3 percent from $2.0 billion in the first quarter, and up 46.2 percent from $1.6 billion in the second quarter of 2004. The NAND market is dominated by Samsung, which posted revenue gains of 35 percent and now holds a 55 percent market share. Toshiba is in second place with a 23 percent share and is followed by Hynix (10 percent), which was able to increase its revenues six-fold year-over-year.

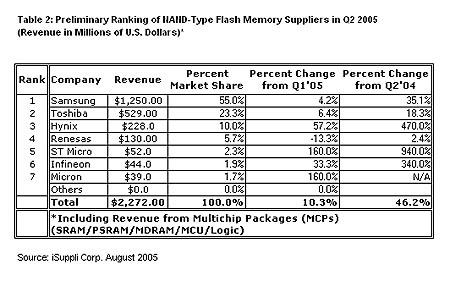

The NOR ranking, on the other hand, displays dramatic declines. Total industry revenues fell 25 percent to $1.9 billion. Intel, the world's largest NOR Flash supplier saw its revenue drop by 10 percent and posted a 28 percent market share. AMD's Spansion unit took a substantial hit with sales dropping 31 percent year over year. Similar developments were seen at ST Micro, which was down 23 percent and Toshiba, which lost 31 percent. Samsung was the only top-5 manufacturer that was able to post a slight revenue gain of nine percent.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Related stories:

NAND Flash revenues surpass NOR for the first time

Wolfgang Gruener is an experienced professional in digital strategy and content, specializing in web strategy, content architecture, user experience, and applying AI in content operations within the insurtech industry. His previous roles include Director, Digital Strategy and Content Experience at American Eagle, Managing Editor at TG Daily, and contributing to publications like Tom's Guide and Tom's Hardware.