Nvidia's Quarterly Revenue Hits All-Time High of $7.1 Billion

Nvidia's revenue grows 50% year-over-year in Q3 FY2022.

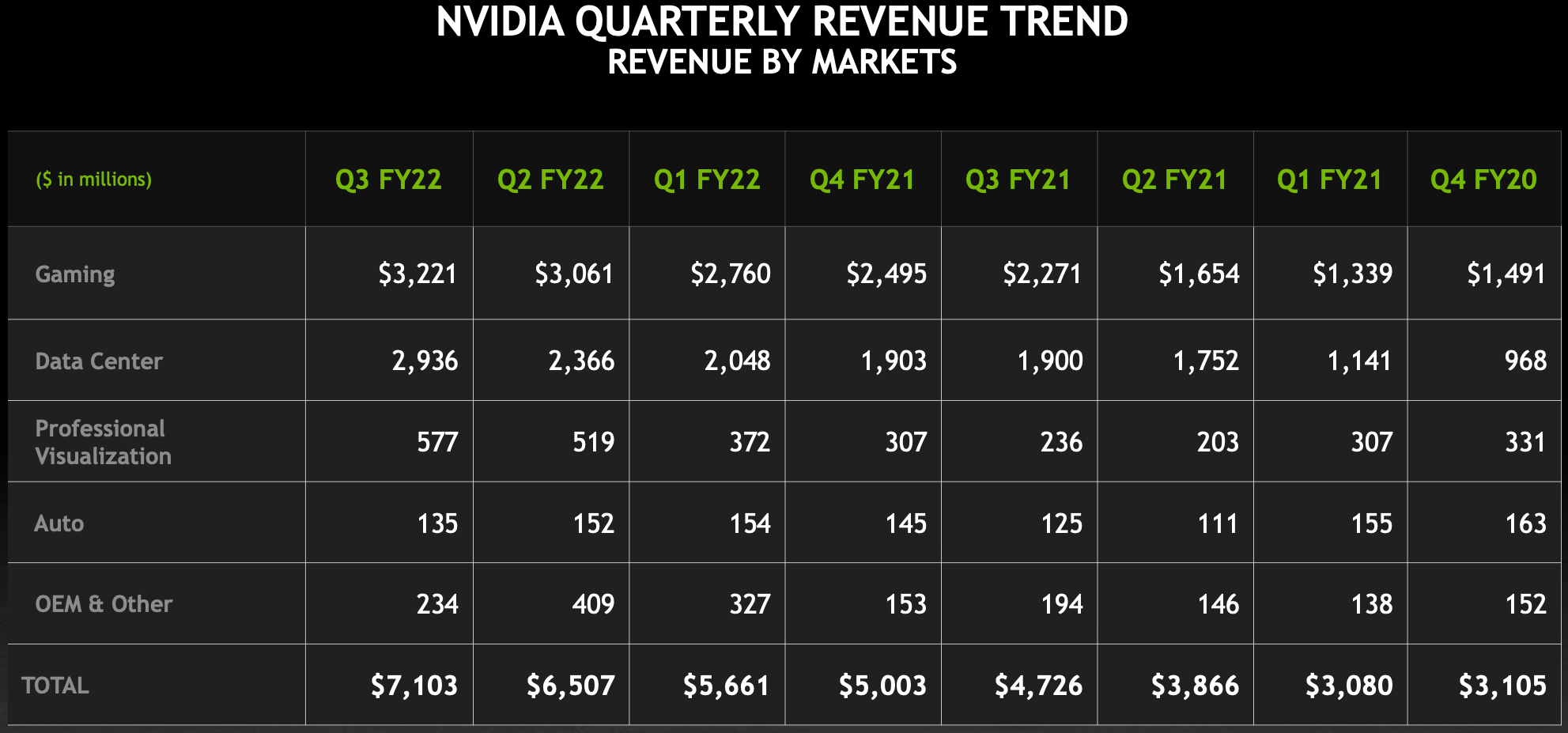

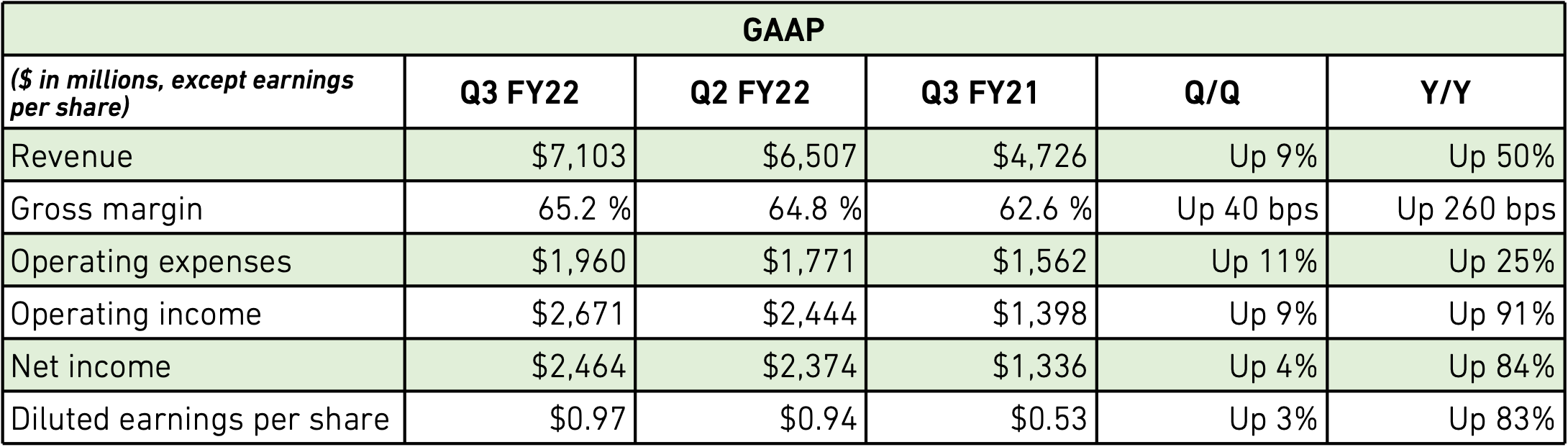

As a result of growing demand for virtually all of its product lines, Nvidia on Wednesday reported its all-time record quarterly revenue for Q3 FY2022. The company's sales reached $7.103 billion for the first time in its history as the company faced unprecedented demand for its high-end gaming, datacenter, and professional visualization (ProViz) products. The company still cannot meet demand for all of its products and to address the issue it had to sign long-term contracts worth about $3.4 billion with its suppliers to secure production capacity.

A New Record

Introduced last year, Nvidia's Ampere architecture for gaming and datacenter GPUs has now reached all product lines and appropriate products have been fully ramped up. As a result, Nvidia can now offer an Ampere-based product for all market segments and virtually all price points. Meanwhile, given that demand for GPUs exceeds supply, the company enjoys very high average selling prices (ASPs) as well as very high margins.

Nvidia's $7.103 billion revenue for the quarter ended on October 31, 2021, was 9% higher compared to the previous quarter and 50% higher compared to the third quarter of its previous fiscal year. In addition to record sales, Nvidia also reported a $2.464 billion net income, an 84% increase over $1.336 billion in Q3 FY2021. The company's gross surged to a record 65.2%, up from 62.6% in the same quarter a year ago.

"The third quarter was outstanding, with record revenue,” said Jensen Huang, chief executive of Nvidia. "Demand for NVIDIA AI is surging, driven by hyperscale and cloud scale-out, and broadening adoption by more than 25,000 companies. Nvidia RTX […] is the ideal upgrade for the large, growing market of gamers and creators, as well as designers and professionals building home workstations."

Gaming, Mining, OEMs

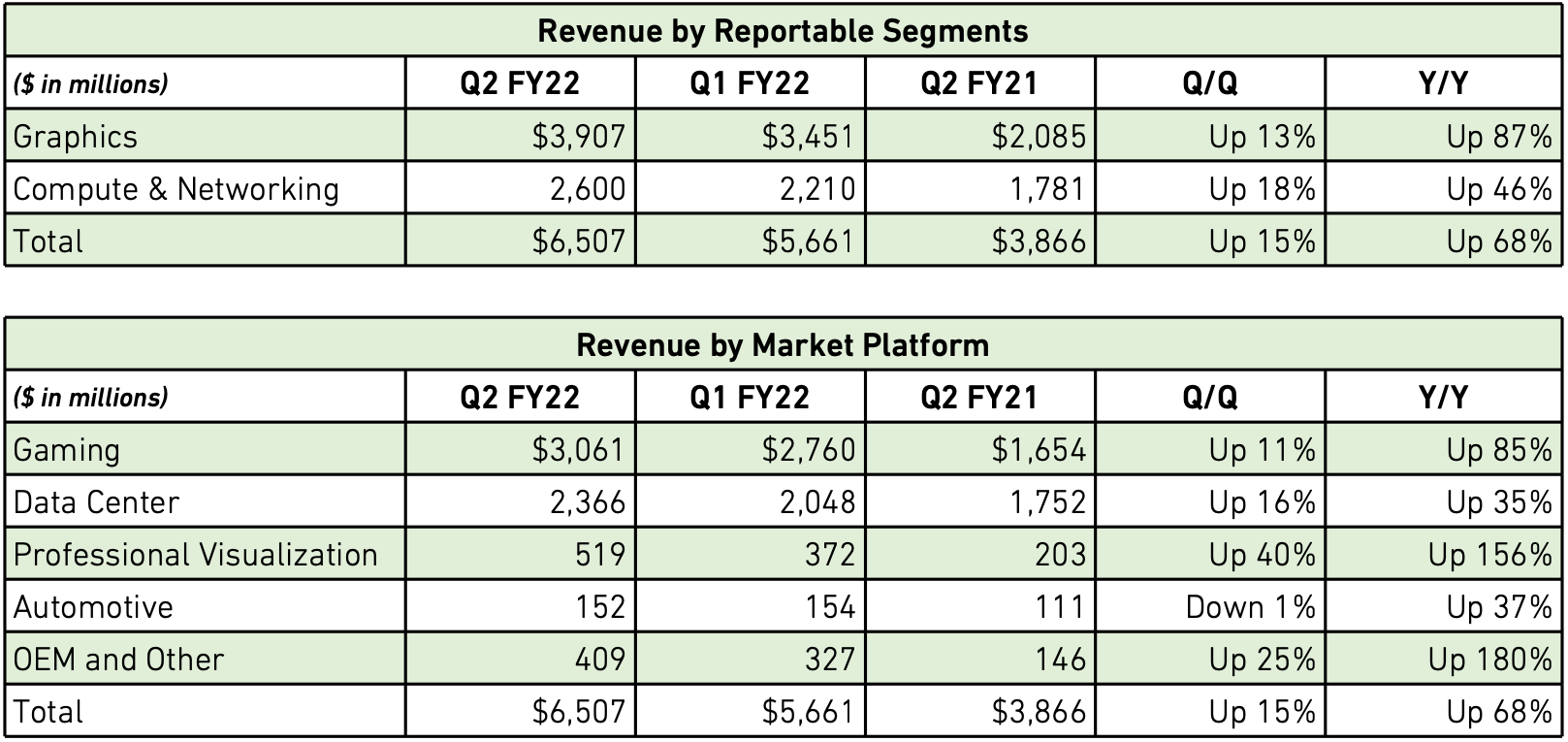

Nvidia's gaming hardware (which includes GeForce GPUs and console SoCs) is traditionally the company's leading business as GeForces are traditionally among the best graphics cards available for purchase. In Q3 FY2022, the company's gaming revenue totaled $3.221 billion, up 5% quarter-over-quarter (QoQ) and 42% year-over-year (YoY). The company says that nearly all of its desktop Ampere-based GeForce RTX GPUs were Lite Hash Rate models not exactly suitable for mining.

During the quarter Nvidia also sold CMP (crypto mining processor) GPUs for mining worth $105 million, down from $266 million in the previous quarter and $150 million in Q1 FY2022, which may indicate that miners did not actively purchase new GPU-based equipment in the third quarter. Nvidia says that it cannot predict future demand for its CMP products lineup since it depends on pricing of Ethereum and other currencies.

Sales of cheap, non-gaming GPUs to OEMs dropped to $129 million as the company focuses on higher-end GeForce products for gamers, whereas low-end standalone GPUs can barely offer tangible advantages over advanced integrated GPUs.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Datacenter

Artificial intelligence (AI) and machine learning (ML) are adopted by various businesses and since Nvidia's Ampere GPUs are tailored for AI and ML, it is not surprising that demand for its compute products is setting records. Also, demand for servers is on the rise, Nvidia's Mellanox products have enjoyed high sales. As a result, the company's datacenter revenue for the quarter reached $2.936 billion, up 24% sequentially and 55% YoY.

Due to the expanding gaming PC market during the pandemic, Nvidia's gaming revenue has been enjoying fast growth since Q2 FY2021, fueled both by demand and high ASPs. The company's datacenter sales have been growing as well, but in Q2 and Q3 FY2022 their growth accelerated significantly (as Ampere-based products reached datacenters) and now shipments of datacenter products are growing faster than sales of gaming products. Nvidia says that its datacenter revenue in the recent quarters was driven by sales of Ampere-based products to hyperscale customers that use it for cloud computing, natural language processing, and things like deep recommender models.

Also, Nvidia's traditional customers from various vertical industries (media and entertainment, healthcare, public sector, automotive.) are buying new hardware both for high-performance computing and for AI/ML workloads.

ProViz

Sales of Nvidia's professional visualization graphics cards (formerly known as Quadro) totaled $577 million during the third quarter, up 11% QoQ and up 144% compared to the same period a year ago. Shipments of professional hardware are driven by multiple factors, including upgrades of existing machines to higher-performing workstations with Ampere inside, a new work-from-home paradigm, and installation of professional GPUs to datacenters to support remote working.

Automotive

Nvidia's automotive business has always been touted as a major future revenue and profit driver, but so far, its results have looked pale compared to Nvidia's success with gaming PCs, workstations, and datacenters. In the third quarter the company's automotive unit earned $135 million in revenue, which is 8% compared to Q3 FY2021, but is an 11% drop from the previous quarter.

Outlook and Prepayments

The company expects demand for its products to continue growing in the fourth quarter and in the future. So, in a bid to better meet demand for its GPUs, it has to make hefty advance payments to its suppliers. This quarter alone the company entered into several long-term supply agreements with undisclosed suppliers and made advance payments of $1.64 billion. In the future, the company will have to pay another $1.79 billion.

"Not only are we procuring for what we need in the fourth quarter, [but for] what we need next year," said Kress. We are planning growth next year, so we have been planning those supply purchases. We are also doing long term supply purchases. These are areas of capacity agreements [with] many of our different suppliers. We made a payment within this quarter of approximately $1.6 billion out of total long-term capacity agreement of about $3.4 billion. So we still have more payments to make, and we will likely continue to be purchasing longer term to support our growth […] for many of those to come."

For the fourth quarter of its fiscal 2022, Nvidia expects its revenue to hit $7.40 billion ±2% and gross margins to be about 65.3%. Traditionally, sales of hardware are down in November – January timeframe (Nvidia's fourth fiscal quarter), but it looks like strong demand for its gaming and datacenter products amid a favorable pricing environment will allow Nvidia to increase its sales despite seasonality.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

sstanic so yeah, it's nvidia selling us graphics cards at 2x the MSRP since the (almost) beginning. they should write a huge thank you christmas card to the scalpers, who pushed them there.Reply -

Jimbojan NVDA growth is purely based on high flying GPU price, but it is just a fad or temporary ( granted it was for more than a year now), when other suppliers, like Intel and AMD and the Chinese supplier coming into the market in the next month or two, latest is in 1Q22, the price of GPU will be normalized, then NVDA's growth will be zero or negative. Intel's HPC graphic, like Pointe Vecchio or Alchemist, is shipping to Argon lab now, should be a killer for NVDA's growth. For a PE of 95+, the analysts are still piling onto NVDA, it is time to be cautious.Reply -

spongiemaster Replysstanic said:so yeah, it's nvidia selling us graphics cards at 2x the MSRP since the (almost) beginning. they should write a huge thank you christmas card to the scalpers, who pushed them there.

How is AMD not currently in the GPU market?Jimbojan said:NVDA growth is purely based on high flying GPU price, but it is just a fad or temporary ( granted it was for more than a year now), when other suppliers, like Intel and AMD and the Chinese supplier coming into the market in the next month or two

AMD Leads Yearly Semiconductor Revenue Growth Forecast by 65%; Intel Shrinks by 1%

Interesting how this just posted news article isn't inundated with people ripping AMD for jacking up prices on everything and completely abandoning the low end market. Their prices have increased even more than Nvidia's. AMD should be renamed Teflon. Doesn't matter what they do, they will be defended at all costs while other companies get trashed for doing the same thing. -

2Be_or_Not2Be @Spongie This article is about Nvidia's profits, not AMD. I don't think people are avoiding AMD here; it's just that they are staying on topic with the subject of the article here - Nvidia.Reply

I also think AMD is sinking all of their low-end efforts into getting more GPUs/SOCs for consoles rather than pushing out < 6600-level products. But that's meandering off-topic here. :) -

spongiemaster Reply

I wasn't talking about this thread. I was talking about the thread I linked to which conspicuously has no one taking shots at AMD for their higher prices like Nvidia took in the first 2 post in this one.2Be_or_Not2Be said:@Spongie This article is about Nvidia's profits, not AMD. I don't think people are avoiding AMD here; it's just that they are staying on topic with the subject of the article here - Nvidia.

-

sstanic well it's a fairly easy answer - it's not the same at all, it's an apples to oranges kind of comparison.Reply

nvidia's GPU segment growth is explained in this article, while in the other article it's not exactly hinted that AMD's projected growth is based on GPUs.

also AMD's growth isn't based on 2x prices, console APUs and their EPYCs and Ryzens are good value products, and are sold at MSRP and use sockets/memory/MBs that are reusable and are not ripping off any category of clients.

so it's growth based on innovation AND good value, while nvidia's GPU segment growth is based on innovation and doubling of the price 'coz they can.

there's more, in the last several months it has also been written - where I don't remember - that AMD has used most of their wafers at TSMC for everything except GPUs, consoles were and are a big deal, EPYC is "the" product for them, now and in the future, and lower end Ryzens weren't made much either. even AMD kind of confessed to it recently if I remember correctly, saying that their GPUs will now finally be available, because for many months since their introduction they weren't available at all, nevermind the price. whether they're selling them at MSRP - I sincerely doubt that - but I just don't know. since the introduction of 3080/90/ti and 6800/900/xt I kind of think nvidia outsold AMD like 29 to 1.

nvidia on the other hand, has more/enough wafers available and a better product, myself I am still hoping to buy a 3080/ti/super? at a more normal price 🤷♂️ -

Eximo Important to note that a lot of the mark-up happens after the tray of GPUs has been sold to a board partner. Then you have the components suppliers (memory being a big one), increased tariffs (in the case of the US), increased shipping costs. People are complaining that the low end GPUs are more expensive, going to be the new normal even after the scalping happens. There isn't any margin left in sub-$300 GPUs at the moment.Reply

Newegg Shuffle is how I got my 3080Ti, FTW3 was one of the more expensive ones, but got it at retail MSRP. Haven't seen many decently priced one since. The new SKUs are all priced a few hundred over that.