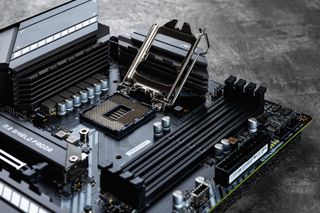

Sales of Motherboards Expected to Drop by 30% in 2022

Hard times are coming.

When demand for PCs began to skyrocket in early 2020 due to work/learn/entertain from home trends, PC brands and Taiwanese motherboard makers made a lot of money. When the crypto mining boom kicked off in H2 2020, they thrived. But by now, demand for client PCs has gotten softer, whereas the crypto mining craze to a large degree ended, which is why many Taiwanese companies are reviewing their prospects for 2022.

Sales of best motherboards from companies like Asus, ASRock, Gigabyte, and MSI will drop by 20% – 30% year-over-year, reports DigiTimes. So far, Asus and Gigabyte have reduced their projected motherboard shipments from 18 million and 9 million units (respectively) to 14 million and 9 million units (respectively). Other makers are also reducing their projections and have to deal with high inventory levels.

Most DIY gaming PCs (and a considerable portion of boutique PCs) use motherboards and graphics cards supplied by Taiwanese manufacturers, such as Asustek, ASRock, Gigabyte, MSI, Leadtek, and PowerColor (Tul Corp.). These companies are among the biggest beneficiaries of gaming PC market growth and the crypto mining craze, so they pinned many hopes for 2022. But slowing demand for consumer PCs will reduce unit shipments to 321.1 million units in 2022, or by 8.2% compared to the previous year (according to IDC), making them revise their forecasts.

Motherboards Shipments Forecasts, According to DigiTimes

| Row 0 - Cell 0 | 2022 Initial Projection | 2022 Revised Projection | 2021 Shipments | 2019 Shipments |

| Asus | 18+ million | 14 million | 18+ million | 16.4 million |

| Gigabyte | ? | 9 million | 13 million | ? |

Big PC brands like Dell, HP, or Lenovo expect to suffer from dropping demand for client computers and hardware. But Taiwanese companies that supply premium motherboards and graphics cards will suffer considerably more. These firms benefited from extremely high prices of graphics cards and significantly raised prices of premium mainboards used by gamers. Now that demand is going to drop because of high inflation rates, geopolitical uncertainties, and the ongoing Russia-Ukraine war, their relative sales drop will be highly significant.

Last week we noted that Apple, AMD, and Nvidia were reducing orders to TSMC ahead of looming product launches. We also pointed out that some financial analysts cut their targets for AMD's client unit shipments. So the information from DigiTimes does not come as a surprise.

On the data center/server side of matters, companies like AMD, Intel, and Nvidia will continue to benefit from solid demand for their products as spending on infrastructure due to ongoing 5G, AI, and HPC megatrends will continue to be strong for quarters or even years ahead. Likewise, ASRock and Gigabyte, which supply various data center products, will continue to thrive.

But when it comes to client PC hardware, brace for impact as the decline will likely get severe.

Stay on the Cutting Edge

Join the experts who read Tom's Hardware for the inside track on enthusiast PC tech news — and have for over 25 years. We'll send breaking news and in-depth reviews of CPUs, GPUs, AI, maker hardware and more straight to your inbox.

Anton Shilov is a Freelance News Writer at Tom’s Hardware US. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

InvalidError A 30% drop would be in line with my expectations of PC sales returning to its historic downward trend after the huge COVID bump: take away the ~15% bump from COVID, add two years of pre-covid 6%/year decline, you get a ~27% total drop if nothing happens to backfill demand.Reply -

2Be_or_Not2Be "Taiwanese companies that supply premium motherboards and graphics cards will suffer considerably more. "Reply

I'm not sure I agree with the writer here. The manufacturers made substantial profits off GPUs & the overall demand for PCs/laptops as work-from-home & crypto-mining took off. That money is in their pockets now. So how exactly are the mfgs suffering if they simply produce less boards now? They aren't going to make the same big profits as a year ago (nor, I'm sure, do they expect to), but they definitely aren't suffering "considerably more." -

InvalidError Reply

If they expanded manufacturing capacity to partially catch up with surge demand, demand returning to its pre-COVID downward trend would hurt: you now have 10-20% extra manufacturing capacity going under-used over the 10-20% spare they may already have had to help ramp up new product output, accommodate seasonal surges, special orders, shifting production between lines for maintenance and other downtime, etc..2Be_or_Not2Be said:So how exactly are the mfgs suffering if they simply produce less boards now? -

2Be_or_Not2Be ReplyInvalidError said:If they expanded manufacturing capacity to partially catch up with surge demand, demand returning to its pre-COVID downward trend would hurt: you now have 10-20% extra manufacturing capacity going under-used over the 10-20% spare they may already have had to help ramp up new product output, accommodate seasonal surges, special orders, shifting production between lines for maintenance and other downtime, etc..

Yeah, that would make sense. However, I don't think any of them increased capacity, largely in part because they couldn't get enough raw supplies to even support an expansion. I think they just took their profits with the big demand & never increased capacity. Indeed, most were/are still struggling to get back to capacity of pre-pandemic times, much less the continued strained supply. -

InvalidError Reply

Many companies invested in new manufacturing outside China and Taiwan to avoid import tariffs and also not get completely screwed should China make a move on Taiwan. Taiwan running into manufacturing issues due to water shortages doesn't help either.2Be_or_Not2Be said:Yeah, that would make sense. However, I don't think any of them increased capacity, largely in part because they couldn't get enough raw supplies to even support an expansion. -

ThatMouse I thought the bump in motherboard sales was due to Windows 11 requiring new hardware.Reply

Most Popular