PC Shipments Will Dip 8.2% in 2022, Analysts Say

Pandemic effects, war and inflation slowing demand for PCs.

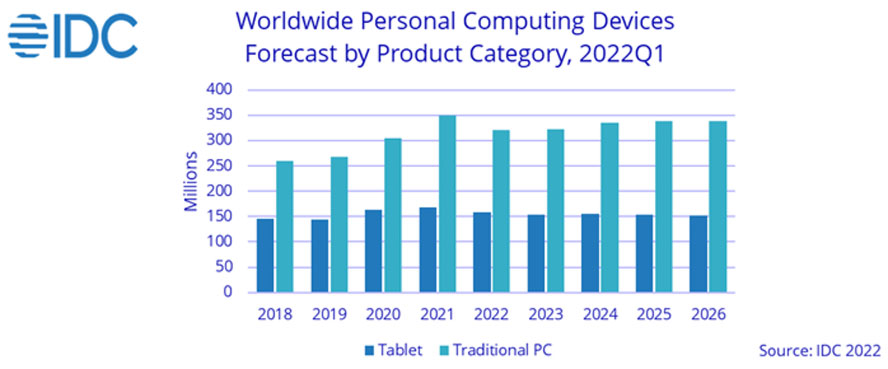

PC shipments in 2022 will decline by 8.2% compared to the previous year, forecast market analysts at IDC. The firm's latest quarterly PC tracker report says this means, by the end of 2022, there will have been 321.2 million PCs shipped worldwide. If the market behaves as it expects, IDC says the PC industry will have a five-year compound annual growth rate (CAGR) of -0.6%. On the positive side of things, 2023 is predicted to see the return of PC shipments growth.

We know that the PC industry was thriving during the lockdowns in the west, with people stuck at home for both work and entertainment. This kind of demand has eased, with adults returning to offices and students returning to schools and colleges. IDC does indeed note that consumer and education markets are the worst affected, in drawing up its expectations of an 8.2% decline for PC shipments in the current year.

Continuing in a negative vein, other pandemic effects, war and inflation are currently slowing demand for PCs. China is still implementing strict lockdowns, which may boost demand for PCs in homes in that country, but the major effect is that supplies of some key components and device assembly are affected – as China is perhaps the most important player in PC component manufacturing and assembly. There are backlogs piling up for some components and finished devices due to pandemic-related Chinese factory issues. IDC expects these issues to be worked through by the end of 2022.

Turning to positives, PC shipments are still above pre-pandemic PC sales levels. 2023 should see a return to PC shipments growth. To attract more high-end consumer sales from upgraders, PC and laptop makers are working to provide devices with larger screens with higher resolutions and the faster CPUs and GPUs required to drive them smoothly. With discrete monitors and laptops there is a trend to make higher resolution panels with faster refresh rates, and wide color gamut technologies like micro LED, QDs, and OLED, available to penetrate the mainstream market.

IDC comments that commercial PC demand remains strong, and emerging markets are still keen to absorb large numbers of PCs. This has helped soften the consumer/education impacts seen as we reach the 2022 half way mark.

In IDC's figures and charts you will also see tablets data. In brief, the decline in tablet sales isn't forecast to be so drastic for the full year 2022 (6.2%). Nevertheless, as tablets are squeezed by thin and light laptops on one side and larger screen smartphones on the other, the segment's chances of recovery aren't as good.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Mark Tyson is a news editor at Tom's Hardware. He enjoys covering the full breadth of PC tech; from business and semiconductor design to products approaching the edge of reason.

-

InvalidError A return to PC growth in 2023? What are those overpaid analysts smoking? The PC market had been on a steady decline at ~6%/year for about a decade prior to COVID. Now that COVID is mostly over, I fully expect PC sales to resume their pre-pandemic declining trajectory.Reply