AMD Comes Roaring Back, Gains Market Share in Laptops, PCs and Server CPUs

AMD gains share amid slow market recovery in Q3 2023.

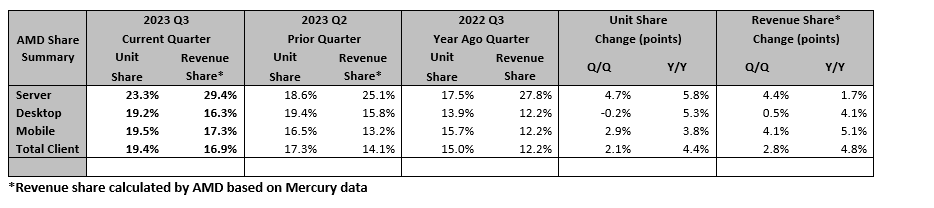

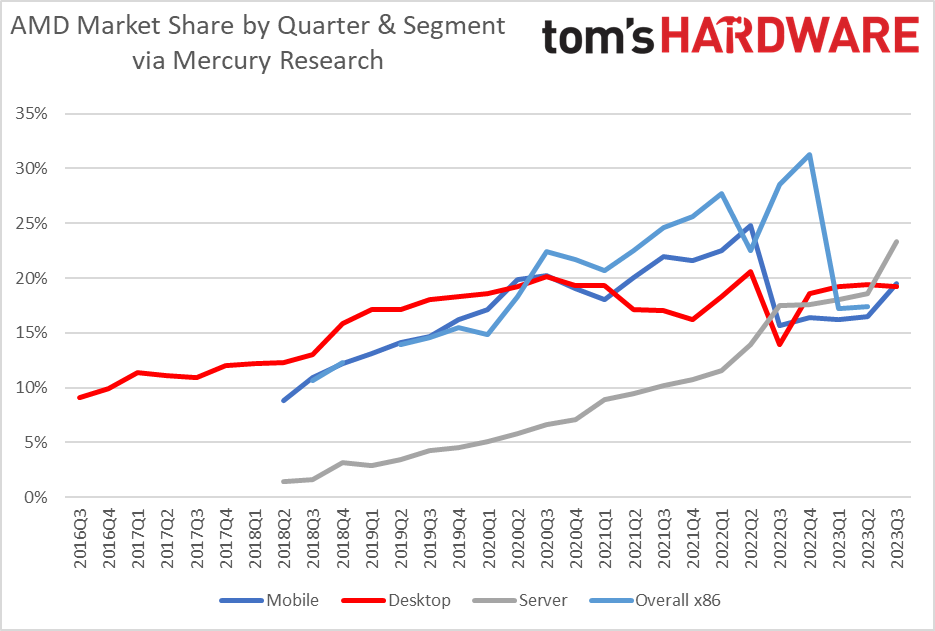

AMD made significant revenue and unit share gains in the server, laptop, and desktop PC markets during the last quarter. Year-over-year, AMD gained 5.8% unit share in desktop PCs, 3.8% in mobile, and 5.8% in servers. Looking at the percentage of the cash AMD gained compared to its rivals (revenue share) year-over-year, AMD gained 4.1% in desktops, 5.1% in notebooks, and 1.7% in servers.

The preceding quarters were challenging both for the consumer PC and server markets as chipmakers and their clients tried to normalize inventory levels and align supply and demand. The situation has largely normalized for the two major CPU suppliers — AMD and Intel — in the third quarter as PC makers started to purchase processors for back-to-school and holiday seasons, whereas server makers ramped up production of machines based on the latest EPYC and Xeon platforms. Overall, AMD was luckier than Intel in Q3 2023 as it gained share, according to Mercury Research.

As it turns out, AMD has gained client and server CPU market share both quarter-over-quarter and year-over-year in the third quarter of 2023, based on data from Mercury Research. The data does not include numbers for Intel and Arm, though, given the dominance of AMD and Intel in client PCs, we can guess that AMD's gains were at Intel's expense.

| Row 0 - Cell 0 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 1Q18 | 4Q17 | 3Q17 | 2Q17 | 1Q17 | 4Q16 | 3Q16 |

| AMD Desktop Unit Share | 19.2% | 19.4% | 19.2% | 18.6% | 13.9% | 20.5% | 18.3% | 16.2% | 17.0% | 17.1% | 19.3% | 19.3% | 20.1% | 19.2% | 18.6% | 18.3% | 18% | 17.1% | 17.1% | 15.8% | 13% | 12.3% | 12.2% | 12.0% | 10.9% | 11.1% | 11.4% | 9.9% | 9.1% |

| Quarter over Quarter / Year over Year (pp) | -0.2 / +0.5 | +0.1 / -1.02 | +0.6 / +0.9 | +4.7 / +2.4 | -6.6 / -3.1 | +2.2 / +3.4 | +2.1 / -1.0 | -0.8 / -3.1 | -0.1 / -3.1 | -2.3 / -2.1 | +0.1 / +0.7 | -0.8 / +1.0 | +0.9 / +2.1 | +0.6 / +2.1 | +0.3 / +1.5 | +0.3 / +2.4 | +0.9 / +5 | Flat / +4.8 | +1.3 / +4.9 | +2.8 / +3.8 | +0.7 / +2.1 | +0.1 / +1.2 | +0.2 / +0.8 | +1.1 / +2.1 | -0.2 / +1.8 | -0.3 / - | +1.5 / - | +0.8 / - | - |

In Desktop PCs, AMD had 19.2% of the unit share in Q3 2023, slightly down from 19.4% in the previous quarter but up significantly from 13.9% in the year-ago quarter, which was an abnormally low quarter for the company. The interesting part is that based on data calculated by AMD based on Mercury Research data, AMD's revenue share increased both QoQ and YoY, suggesting a higher average selling price (ASP) driven by the transition to more expensive AMD Ryzen 7000 parts.

In general, AMD increased its overall consumer CPU market share to 19.4% from 17.3% a quarter ago and from 15% a year ago, which is a significant achievement. The same happened to the company's revenue share, which is an indicator that the company managed to ship more expensive parts in 2023.

| Row 0 - Cell 0 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | Q419 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 |

| AMD Mobile Unit Share | 19.5% | 16.5% | 16.2% | 16.4% | 15.7% | 24.8% | 22.5% | 21.6% | 22.0% | 20.0% | 18.0% | 19% | 20.2% | 19.9% | 17.1% | 16.2% | 14.7% | 14.1% | 13.1% | 12.2% | 10.9% | 8.8% |

| Quarter over Quarter / Year over Year (pp) | 2.9 / 3.8 | 0.3 / -8.3 | -0.2 / -6.3 | +0.8 / -5.1 | -9.1 / -6.4 | +2.3 / +4.8 | +0.9 / +4.4 | -0.4 / +2.6 | +2.0 / +1.8 | +1.9 / +0.01 | -1.0 / +1.1 | -1.2 / +2.8 | +0.3 / +5.5 | +2.9 / +5.8 | +0.9 / +3.2 | +1.5 / +4.0 | +0.7 / +3.8 | +1.0 / +5.3 | +0.9 / ? | Row 2 - Cell 20 | Row 2 - Cell 21 | Row 2 - Cell 22 |

As far as Mobile PC processors are concerned, AMD controlled 19.5% of shipments, up from 16.5% in the previous quarter and up from 15.7% in Q3 2022. That's still significantly less than AMD's peak of 24.8% back in 2022Q2. The updated data suggests that every fifth notebook to be sold in the coming months will be based on an AMD processor. Meanwhile, AMD's revenue share actually demonstrated faster growth in the said periods, which suggests higher ASPs and more competitive Ryzen 7000-series offerings.

| Row 0 - Cell 0 | 3Q23 | 2Q23 | 1Q23 | 4Q22 | 3Q22 | 2Q22 | 1Q22 | 4Q21 | 3Q21 | 2Q21 | 1Q21 | 4Q20 | 3Q20 | 2Q20 | 1Q20 | 4Q19 | 3Q19 | 2Q19 | 1Q2019 | 4Q18 | 3Q18 | 2Q18 | 4Q17 |

| AMD Server Unit Share | 23.3% | 18.6% | 18% | 17.6% | 17.5% | 13.9% | 11.6% | 10.7% | 10.2% | 9.5% | 8.9% | 7.1% | 6.6% | 5.8% | 5.1% | 4.5% | 4.3% | 3.4% | 2.9% | 3.2% | 1.6% | 1.4% | 0.8% |

| Quarter over Quarter / Year over Year (pp) | 4.7 / 5.8 | 0.6 / 4.7 | +0.4 / +6.3 | +0.1 / +6.9 | +3.6 / +7.3 | +2.3 / +4.4 | +0.9 / +2.7 | +0.5% / +3.6 | +0.7 / +3.6 | +0.6 / +3.7 | +1.8 / +3.8 | +0.5 / +2.6 | +0.8 / +2.3 | +0.7 / +2.4 | +0.6 / 2.2 | +0.2 / +1.4 | +0.9 / +2.7 | +0.5 / +2.0 | -0.3 / - | +1.6 / 2.4 | +0.2 / - | Row 2 - Cell 22 | Row 2 - Cell 23 |

AMD has been gradually increasing its Server CPU market share since 2017, but 2022 and 2023 turned out to be breakthrough years for the company as its share gains accelerated rapidly in recent quarters. AMD commanded a 23.3% unit share in Q3 2023, up from 18.6% quarter-over-quarter and 17.5% year-over-year. The revenue share has increased significantly by 4.7% QoQ and 5.8% YoY. Such major increases may be attributed to the high popularity of AMD's latest 4th Generation EPYC processors, which were the most popular data center products from AMD in Q3 as major cloud providers adopted them for internal workloads and public instances.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

In general, AMD has managed to increase both unit and revenue share on the CPU market across all categories, including desktop CPUs, laptop CPUs, and server CPUs, based on data from Mercury Research supplied by AMD. We'll add comments and analysis from Mercury Research's Dean McCarron when they arrive later this week.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

elforeign Good to see AMD continuing to compete and take market share. We need a strong AMD to continue to push Intel in desktop, mobile and HPC/DatacenterReply -

waltc3 It's difficult to understand why anyone would have questioned this rise in share for AMD...;) It's been inevitable. Products speak louder than anything else.Reply -

Jimbojan I am sorry, AMD did not gain any share, just to look at the revenues from Intel and AMD in the last quarter, Intel gains more revenue than AMD, in terms of % or profit, it is not clear your report is correct. As Intel's Meteor Lake laptop chip coming in December, Intel will gain more share from the market (AMD), as it is more power efficient than AMD's with Intel’s 4 vs AMD’s TSMC’s 5nm, it will so in the next 2 years as Intel moves faster than TSMC in the fab technology.Reply -

waltc3 Nope, sorry. You clearly don't know what you're saying. It's not a Tom's Hardware Report. It's Mercury Research's story that Tom's is referencing.Reply

Here's one from Mercury Research way back in February: https://hothardware.com/news/amd-steals-intels-lunch-money-increasing-cpu-market-share

Here's the story today from Mercury Research. https://hothardware.com/news/amd-intel-pc-laptop-server-x86-cpu-market-share

So, feel free to go to Mercury Research and tell them that while they don't know what they are talking about, you do. I'm sure they'd be delighted to change their stories...;) -

Neilbob Reply

Whichever Intel department you work for, I have to say you're making rather a ham-fisted job of it ...Jimbojan said:I am sorry, AMD did not gain any share, just to look at the revenues from Intel and AMD in the last quarter, Intel gains more revenue than AMD, in terms of % or profit, it is not clear your report is correct. As Intel's Meteor Lake laptop chip coming in December, Intel will gain more share from the market (AMD), as it is more power efficient than AMD's with Intel’s 4 vs AMD’s TSMC’s 5nm, it will so in the next 2 years as Intel moves faster than TSMC in the fab technology. -

PEnns ReplyJimbojan said:I am sorry, AMD did not gain any share, just to look at the revenues from Intel and AMD in the last quarter, Intel gains more revenue than AMD, in terms of % or profit, it is not clear your report is correct. As Intel's Meteor Lake laptop chip coming in December, Intel will gain more share from the market (AMD), as it is more power efficient than AMD's with Intel’s 4 vs AMD’s TSMC’s 5nm, it will so in the next 2 years as Intel moves faster than TSMC in the fab technology.

We're deeply sorry the article ruined your day.

I am sure there is some article somewhere that states that AMD was not doing well a few years ago. Feel free to read it and we hope they will cheer you up and restore your happiness.

Cheers. -

dpcxpert Reply

don't you know that AMD is much bigger now? AMD has Xilinx, Pensando, Mipsology and NOD AI!Jimbojan said:I am sorry, AMD did not gain any share, just to look at the revenues from Intel and AMD in the last quarter, Intel gains more revenue than AMD, in terms of % or profit, it is not clear your report is correct. As Intel's Meteor Lake laptop chip coming in December, Intel will gain more share from the market (AMD), as it is more power efficient than AMD's with Intel’s 4 vs AMD’s TSMC’s 5nm, it will so in the next 2 years as Intel moves faster than TSMC in the fab technology. -

spongiemaster Reply

Yup, congrats AMD. The market share gain has you up to 1 CPU sold for every 4 Intel sells. Definitely a death blow to Intel.NeoMorpheus said: -

Freestyle80 Now people here are gonna watch a clickbait AMDware Unboxed video titled "AMD COMES ROARING BACK, IS THIS THE END OF INTEL??"Reply