AI becomes leading server workload as shipments of other servers drop

AI servers are projected to rise to around 4.5 million by 2029

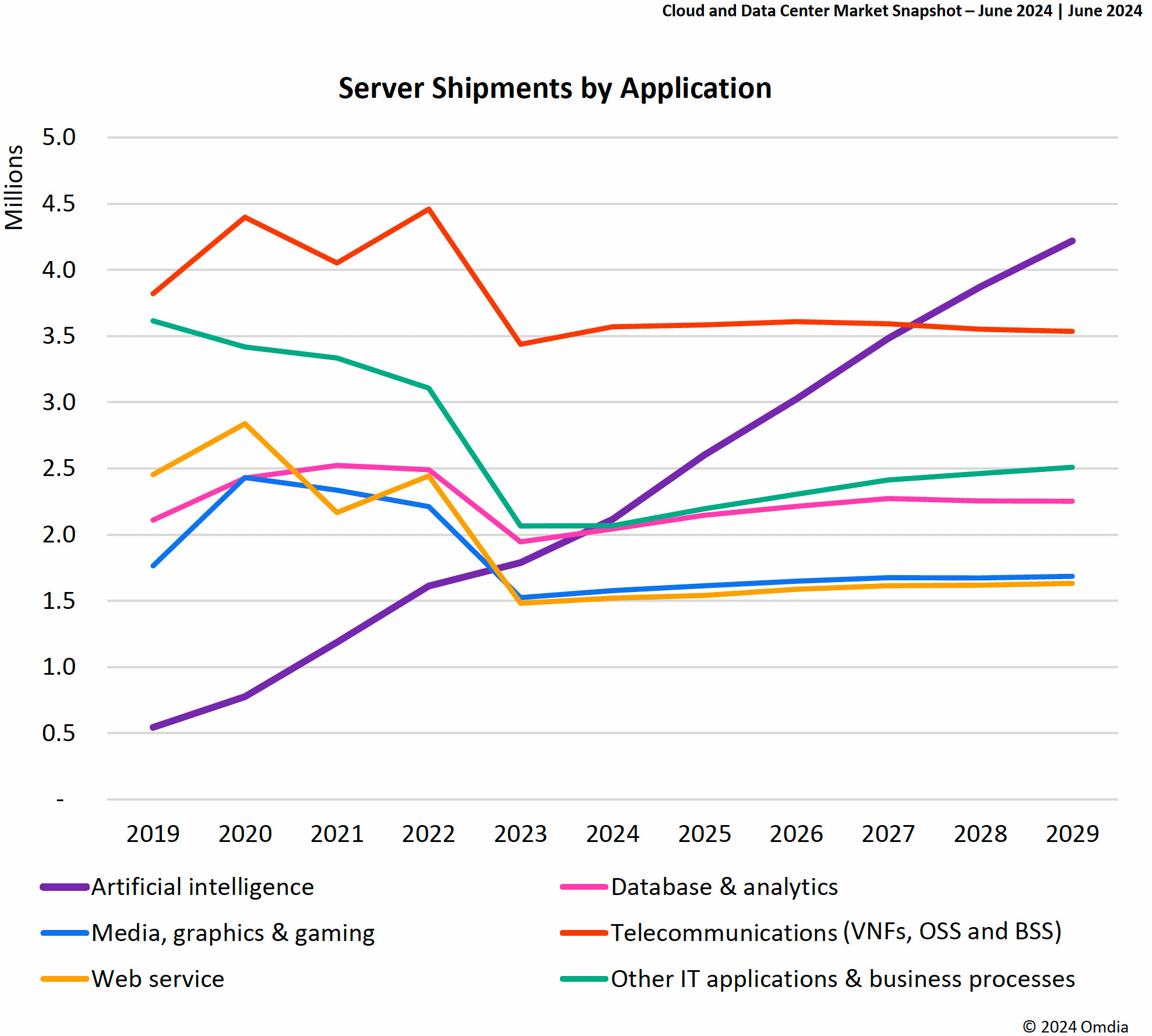

After shipment volumes of all types of servers peaked in 2020 due to the COVID-19 pandemic and working from home, all categories dropped to normal in the following years. All categories, except AI servers, whose shipments volumes headed to the sky in 2020 and showed no signs of slowing down, at least for now, based on data from Omdia.

Shipments of AI servers are projected to rise sharply from about 500,000 in 2019 to approximately 4.5 million by 2029, making AI the leading data center application, according to Omdia's 'Cloud and Data Center Market Snapshot – June 2024' report.

As shown in the graphs by Omdia, AI is poised to become the leading server workload as it expands the wealth of applications that it can address in terms of available trained models (for AI-based models app developers). The number of these models is vast, and so is the number of applicable applications, which is why Omidia expects shipments of AI servers to keep almost skyrocketing through 2029. This is assuming, of course, that these AI servers will make money.

As for other servers, database & analytics servers will grow slightly, from around 2 million in 2019 to 2.5 million by 2029. Media, graphics, and gaming servers will remain stable at about two million. Telecommunications servers have declined significantly from 4 million in 2019 to around two million by 2023, stabilizing after that, perhaps because those machines will consolidate as CPUs gain higher performance (i.e., number of cores) and fewer machines will be needed.

Web service servers have stabilized from 2.5 million in 2019 to 1.5 million by 2023. Shipments of servers for other IT applications and business processes have dropped from 3.5 million in 2019 to 1.5 million by 2023 but are set to rise to about 3 million by 2029. According to Omdia, this reflects a shift towards AI investments and optimizations in other sectors.

Thermal management in data centers will see revenue growth, projected to reach $9.4 billion, up from $7.7 billion in 2023. Additionally, power distribution infrastructure revenue will exceed $4 billion for the first time, driven by investments in components like busways and transformer-based PDUs, according to Omdia.

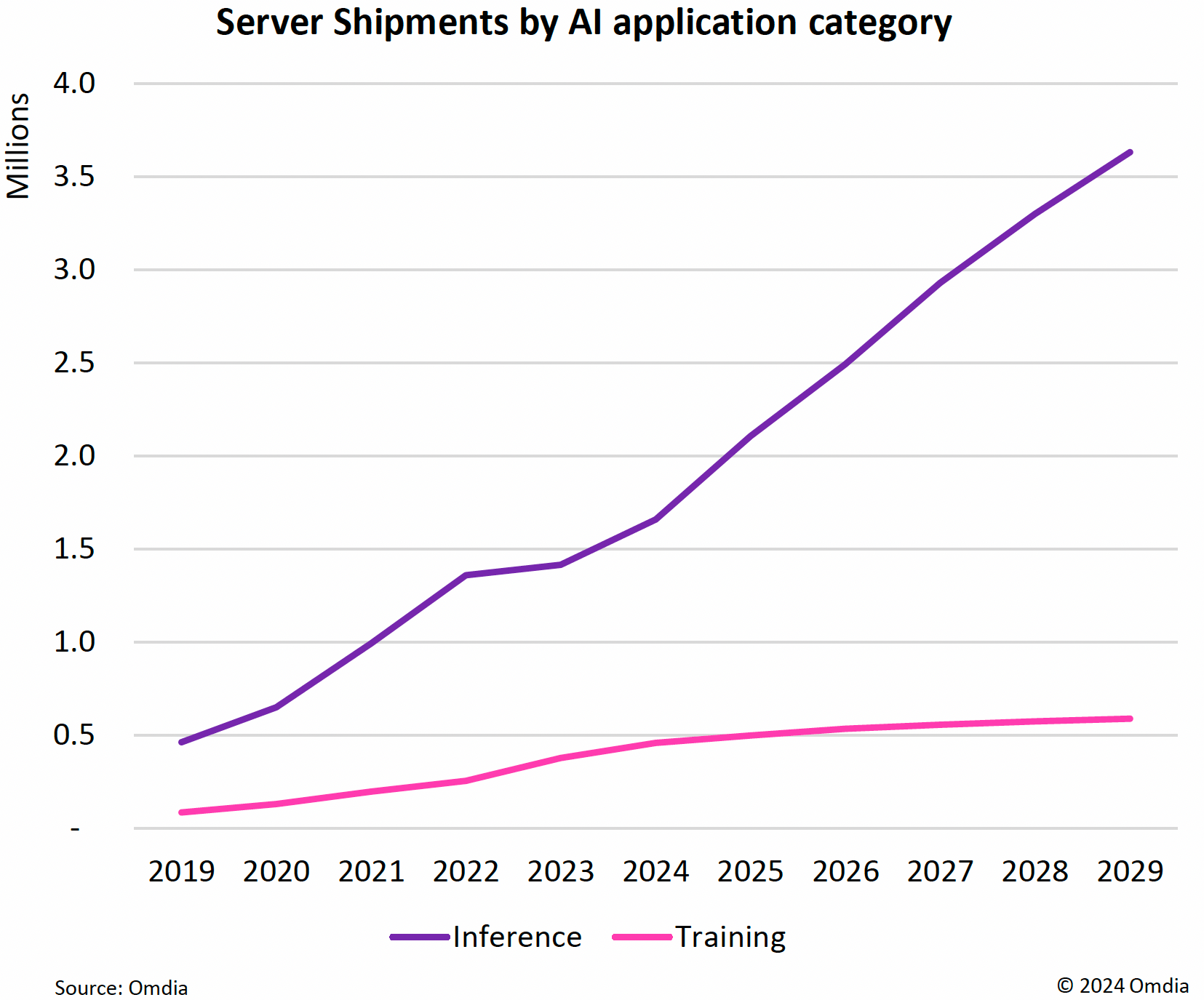

Inference setting to take off

In recent years, AI training has been the main driver for AI servers in general and Nvidia's sales in particular, as the company's A100 and then H100 GPUs with CUDA outperformed rivals significantly. Sales of AI servers for training will keep increasing, but now that many AI models have been trained, it is time to make some money on them. Sales of AI inference servers are set to take off, with growth outpacing the growth of AI training machines.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

AI training servers are expected to grow modestly at a 5% CAGR, increasing from about 0.5 million in 2019 to just under 1 million by 2029. This growth is driven by efficiency improvements in AI GPU/processor performance and R&D budget allocations, and many enterprises are opting for pre-trained models.

In contrast, AI inference servers will see a significant rise, with a 17% CAGR, growing from approximately 500,000 in 2019 to around 4 million by 2029. This reflects the increasing use of AI applications and the corresponding need for more servers to handle the workload.

In general, Omdia believes that sales of AI servers will continue increasing rapidly for the next five years. By contrast, shipments of other types of servers will grow modestly.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.