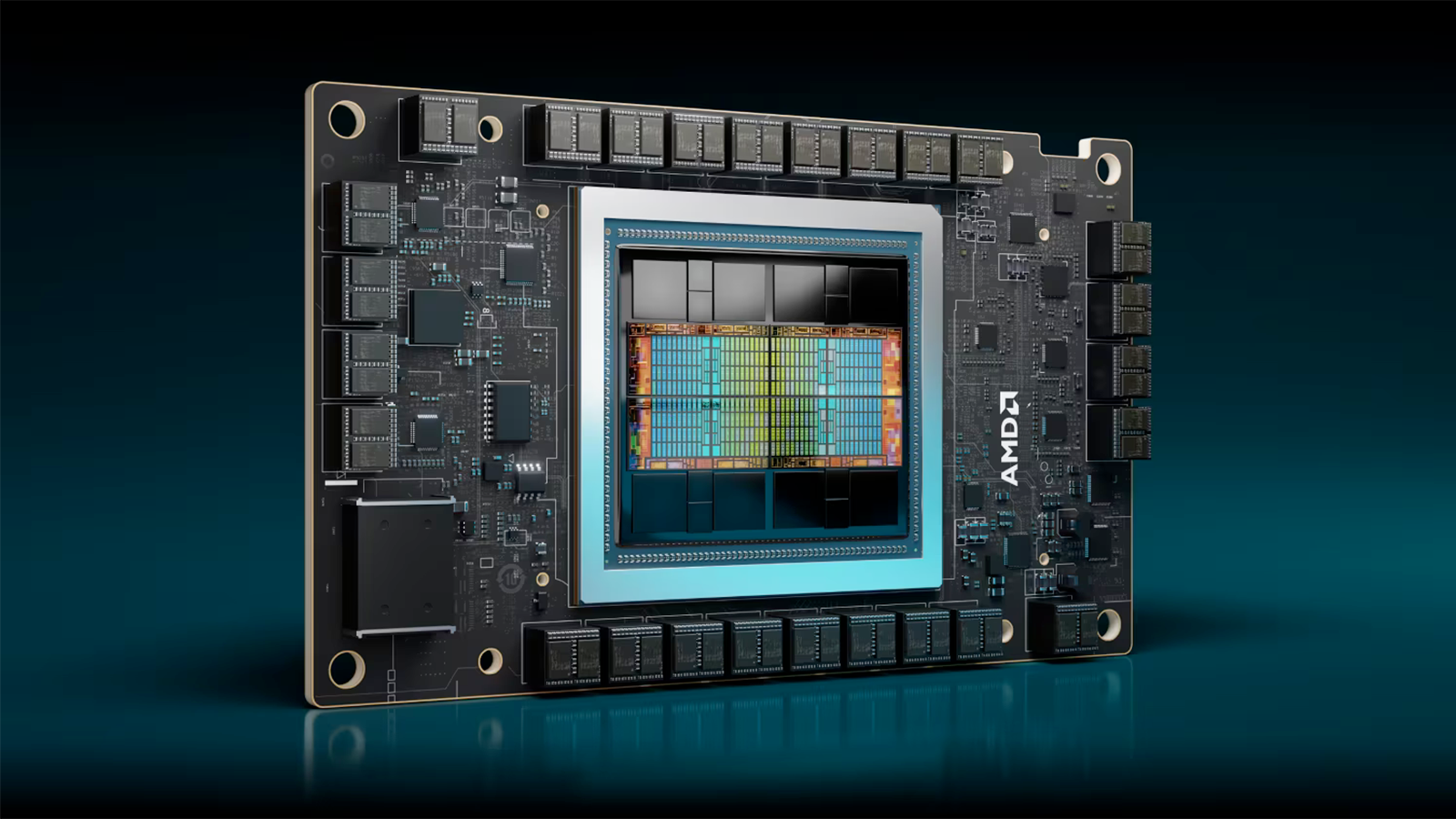

AMD's custom Instinct MI309 GPU for China fails export license test from U.S. government: Report

Still too powerful to sell to sell to Chinese entities.

In a bid not to miss out on China's growing AI and HPC market, AMD has quietly developed its Instinct MI309 processor, a lower-performance processor specifically tailored to meet U.S. export rules that require a license to sell powerful processors to Chinese entities. But apparently, AMD's new product is still too powerful to get an unconditional green light from the U.S. Department of Commerce, and AMD still needs an export license, reports Bloomberg.

In general, AMD is pursuing the AI processor market, but it is pursuing the Chinese market even more aggressively with the launch of its Instinct MI300-series, aiming to compete with Nvidia's processors. The China-specific product, the Instinct MI309, is part of this strategy. The chip's specifications remain unclear.

The U.S. export rules imposed last fall strictly prohibit selling Chinese entities datacenter processors with a Total Processing Performance (TPP, listed processing power multiplied by the length of operation) score of 4800, which means that the maximum AI performance of the processor should not exceed 600 FP8 TFLOPS. It is possible to sell processors with performance slightly lower than 600 FP8 TFLOPS, provided that their performance density (PD, which is TPP divided by the die area measured in square millimeters) is low enough.

AMD's Instinct MI300A has FP8 performance of 1.96 FP8 PFLOPS, so AMD cannot sell it to China-based entities. AMD slowed the chip down — either by lowering clocks, deactivating some stream processors, or removing chiplets from the package — to comply with the U.S. latest export rules. But apparently, it was not enough to meet U.S. export limitations.

As a result, the fate of AMD's Instinct MI309 product remains uncertain: It is unclear if the company will seek the necessary license for sale and, if so, how it plans to limit the performance of its processor for customers in the People's Republic.

It should be noted that pursuing the Chinese AI market will not be an easy ride for AMD as China's Big Tech companies have stockpiled enough Nvidia processors and may not be inclined to buy AMD's offerings right now. Furthermore, China-based companies like Huawei are developing their own Ascend 900-series processors for AI applications. Given that those products are not subject to U.S. export control, many Chinese entities will prefer them over AMD's products.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.

Anton Shilov is a contributing writer at Tom’s Hardware. Over the past couple of decades, he has covered everything from CPUs and GPUs to supercomputers and from modern process technologies and latest fab tools to high-tech industry trends.

-

watzupken To me, this not a setback, but an advantage for AMD and other potential competitors in this space. The reason is because when you cap how powerful your hardware can be in order to be eligible for sale in a very big market, you are pretty much leveling out the playing field. Nvidia for example likely have the most desirable hardware due to performance advantage. When you cap the potential, and for the price that Nvidia charges, it will become a lot less desirable to buyers in China. Why pay more when they perform round about the same?Reply

Ultimately, the long term effect is detrimental to all these technology companies. The cap performance is likely quite a fair bit lower. And once domestic solutions catches up with this performance, there will be no demand for them. -

sygreenblum Yeah, I tend to agree except possibly for different reasons.Reply

China is still able to get high end kit from back channels and black markets for their important projects. This site had an article dated January 28th about a smuggling operation trying to import 53,000 chips in violation of sanctions. Reuters has had several similar articles, one of them dated Jan. 15th.

These stories happen nearly every day large and small. If other smuggling operations are to be used as a comparison, authorities only ever catch a small fraction of these operations. This is evident by the fact that Universities like Harbin Institute of Technology and the University of Electronic Science and Technology of China still able to build super computers and AI systems using Nvidia products. -

FoxtrotMichael-1 I don’t particularly like when companies try to do this anyway. If the spirit of the US trade restrictions on China are to stop the PLA from developing a military advantage in AI (and it is) then trying to develop specialized chips that come in just barely under the terms of the trade restrictions is directly against the spirit of those rules. If these companies want to be “US” companies and receive all the benefits, material and otherwise, of being so then they need to follow the spirit of the US strategic defense objective and not the letter.Reply

I understand that in this global economy we have a tendency to take a “one world” view but nations do still exist and matter. China is a defense risk to the United States. Companies based in the US should respect that.